Warren County Special Power of Attorney for the Sale of Property Form

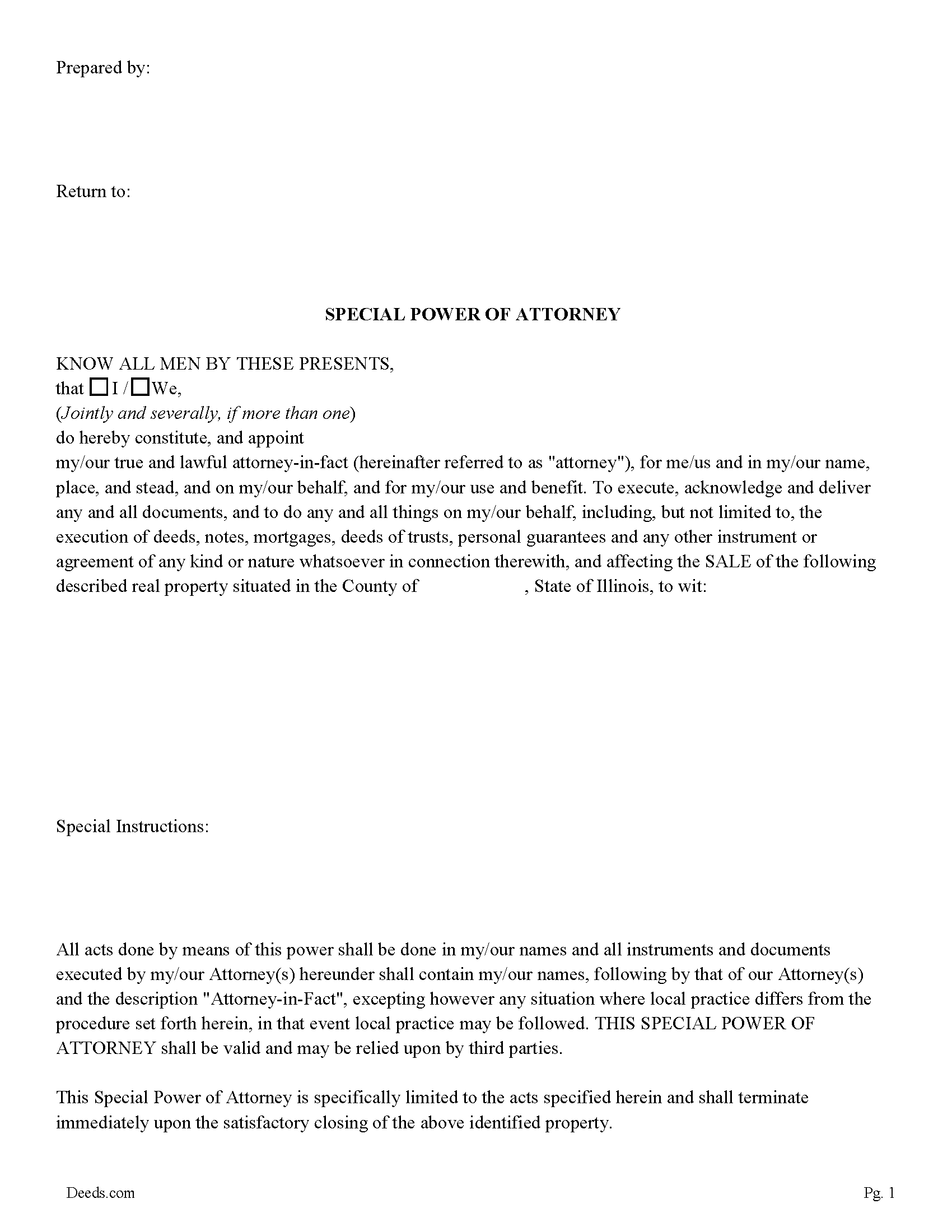

Warren County Special Power of Attorney Form for the Sale of Property

Fill in the blank form formatted to comply with all recording and content requirements.

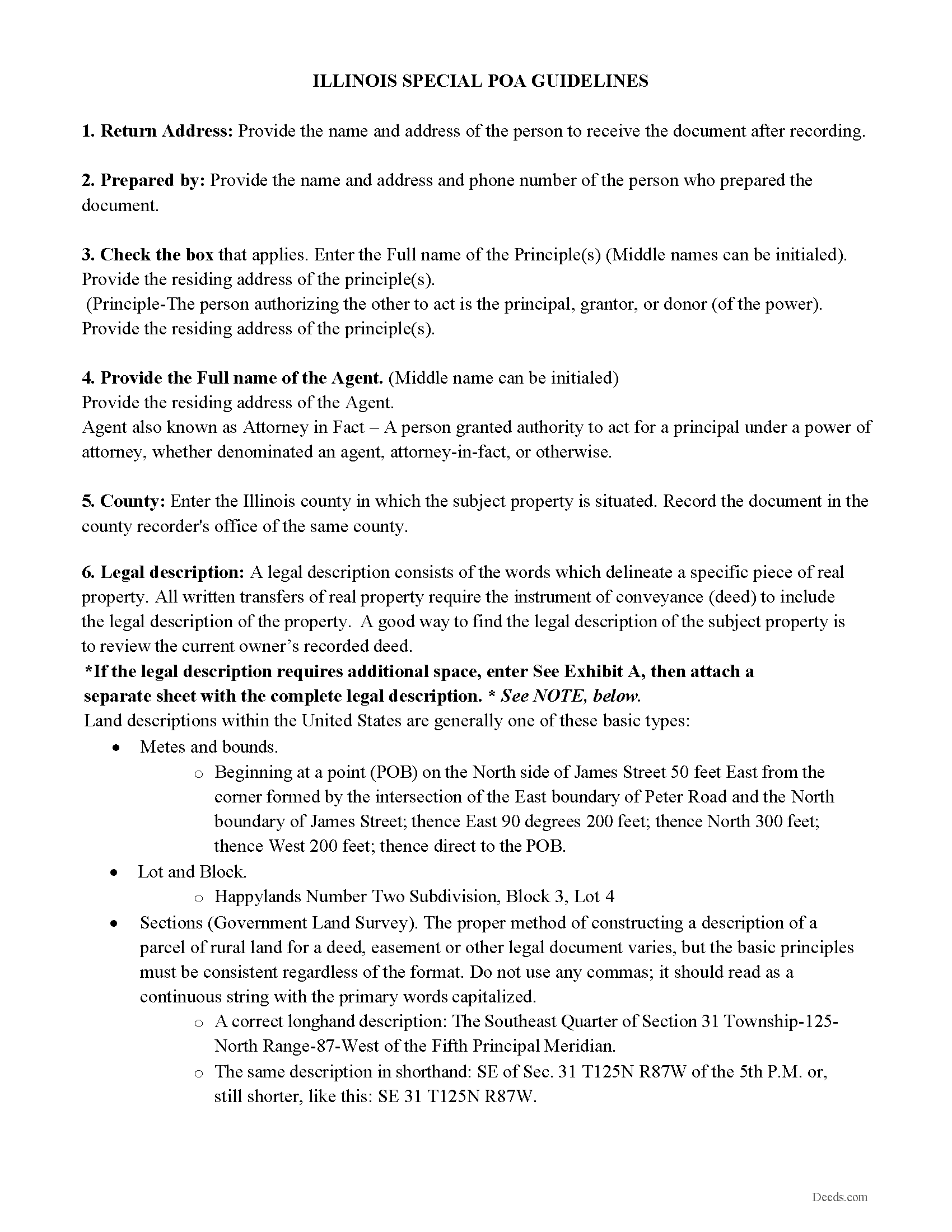

Warren County Special Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

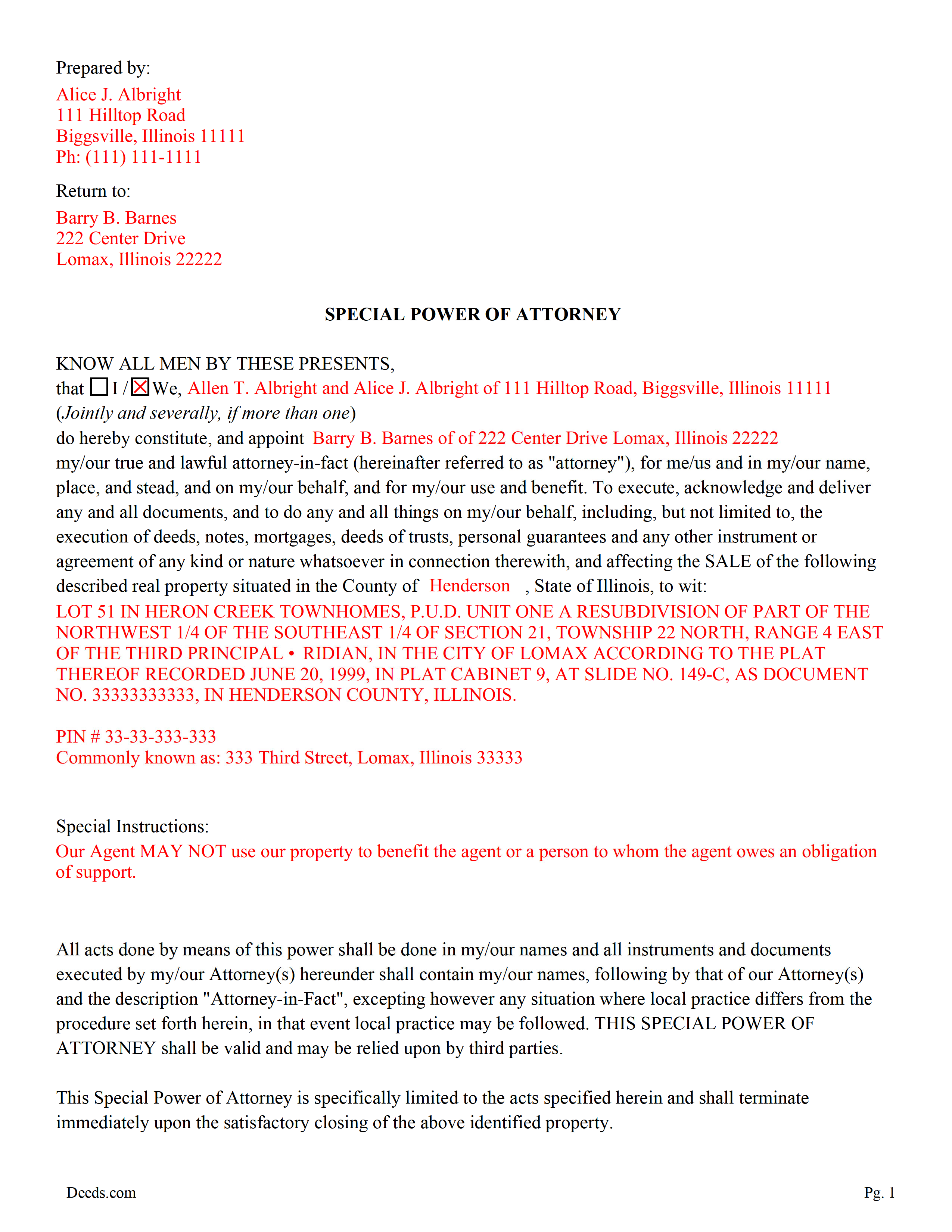

Warren County Completed Example of the Special Power of Attorney Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Warren County documents included at no extra charge:

Where to Record Your Documents

Warren County Clerk / Recorder

Monmouth, Illinois 61462

Hours: 8:00am to 4:30pm M-F

Phone: (309) 734-8592

Recording Tips for Warren County:

- Double-check legal descriptions match your existing deed

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Warren County

Properties in any of these areas use Warren County forms:

- Berwick

- Cameron

- Gerlaw

- Kirkwood

- Little York

- Monmouth

- Roseville

- Smithshire

Hours, fees, requirements, and more for Warren County

How do I get my forms?

Forms are available for immediate download after payment. The Warren County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Warren County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Warren County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Warren County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Warren County?

Recording fees in Warren County vary. Contact the recorder's office at (309) 734-8592 for current fees.

Questions answered? Let's get started!

This form is used for the SALE of real property. The principle designates an agent and empowers him/her to act in all necessary legal documents and instruments for the sale of a specific property and terminates immediately upon the satisfactory closing of the specified property. It includes a "special instructions" section where the principle can limit or further define actions taken by the agent.

For use in Illinois Only.

(Illinois Special POA-Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Warren County to use these forms. Documents should be recorded at the office below.

This Special Power of Attorney for the Sale of Property meets all recording requirements specific to Warren County.

Our Promise

The documents you receive here will meet, or exceed, the Warren County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Warren County Special Power of Attorney for the Sale of Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

William J. T.

July 9th, 2019

Satisfied with downloaded documents.

Thank you!

Nancy R.

October 25th, 2024

Deeds.com is very precise, helpful and friendly. I found the form I needed without any effort and everything worked perfect and smooth. I recommend it 100%. Thank you.

We are delighted to have been of service. Thank you for the positive review!

Bob B.

September 14th, 2021

Good so far. Will be great if you get the deed recorded.

Thank you!

Russell B.

March 15th, 2023

complete package as promised at a very reasonable cost. Easy forms to complete. Thank you. Definitely 5 stars!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Dave W.

November 7th, 2023

Very handy when clueless about filling out a form. Saved hours of research.

Your appreciative words mean the world to us. Thank you and we look forward to serving you again!

Heather M.

January 9th, 2019

Great service, convenient, fast and easy to use. Thumbs Up!!!!w

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Monty H.

November 6th, 2019

Perfection. The filled-out form was especially helpful and I appreciate not having to share personal/financial information over the Internet, as required by so many other legal form service providers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah P.

June 7th, 2021

Very good information. Easy access and easy to download. All the forms needed for TOD to be notarized and recorded with the county office. Much better than working with a Trust and the expense of lawyers, especially when several parties are involved and the owner of said property knows exactly to whom the property should go. Having forms and instructions available for the public to have their wishes recorded and confirmed makes handling final planning much easier and prevents family members from having the unnecessary task of going through court to solve property distribution issues. Thank you for this site and the forms you provide. I will recommend Deeds.com to those I know who are making final plans.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gloria R.

September 12th, 2023

The website was easy.

Thank you!

Laura D.

February 4th, 2023

Great forms - I got several property deeds and really appreciated that they came with the required state forms (for NY). the sample completed form is also really helpful. Attorney wanted hundreds- with this form it is the same amount of work but I can file myself for the cost of lunch!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chase J.

June 2nd, 2022

This is the best service. It has made my life so easy when I have to record things with the county! Thanks so much for such a streamlined no hassle process.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles Z.

February 23rd, 2021

I am very happy with the service and would use again. Super fast, efficient, and very helpful friendly staff. I would recommend and would use again.

Thank you for your feedback. We really appreciate it. Have a great day!

Fred B.

May 19th, 2020

Great site and very easy to use. I will be using this for all of my search and form requirements.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael W.

February 7th, 2025

Excellent product. I am so happy I found Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Lori M.

March 6th, 2021

So easy to use. The directions are very clear.

Thank you!