Shelby County Transfer on Death Revocation Form

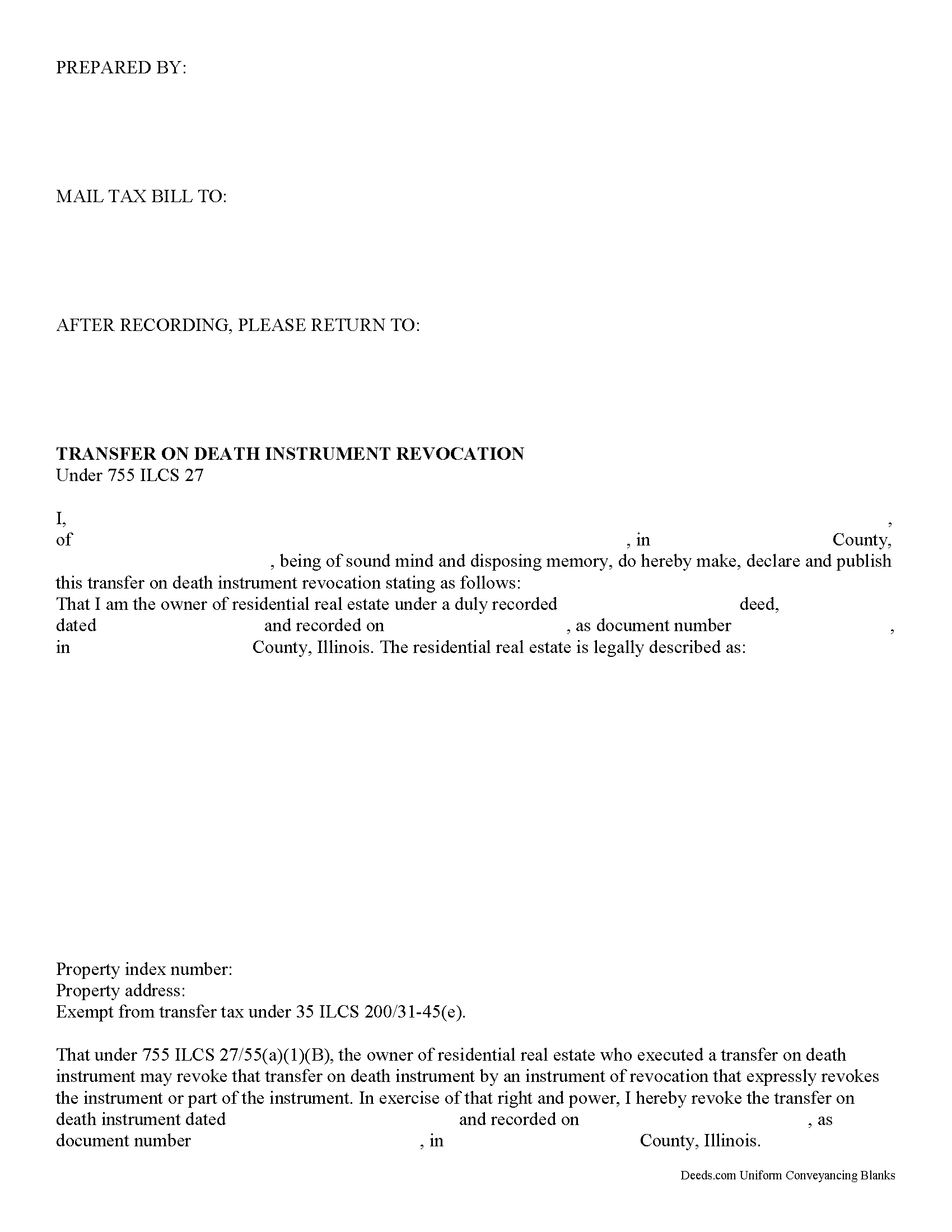

Shelby County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

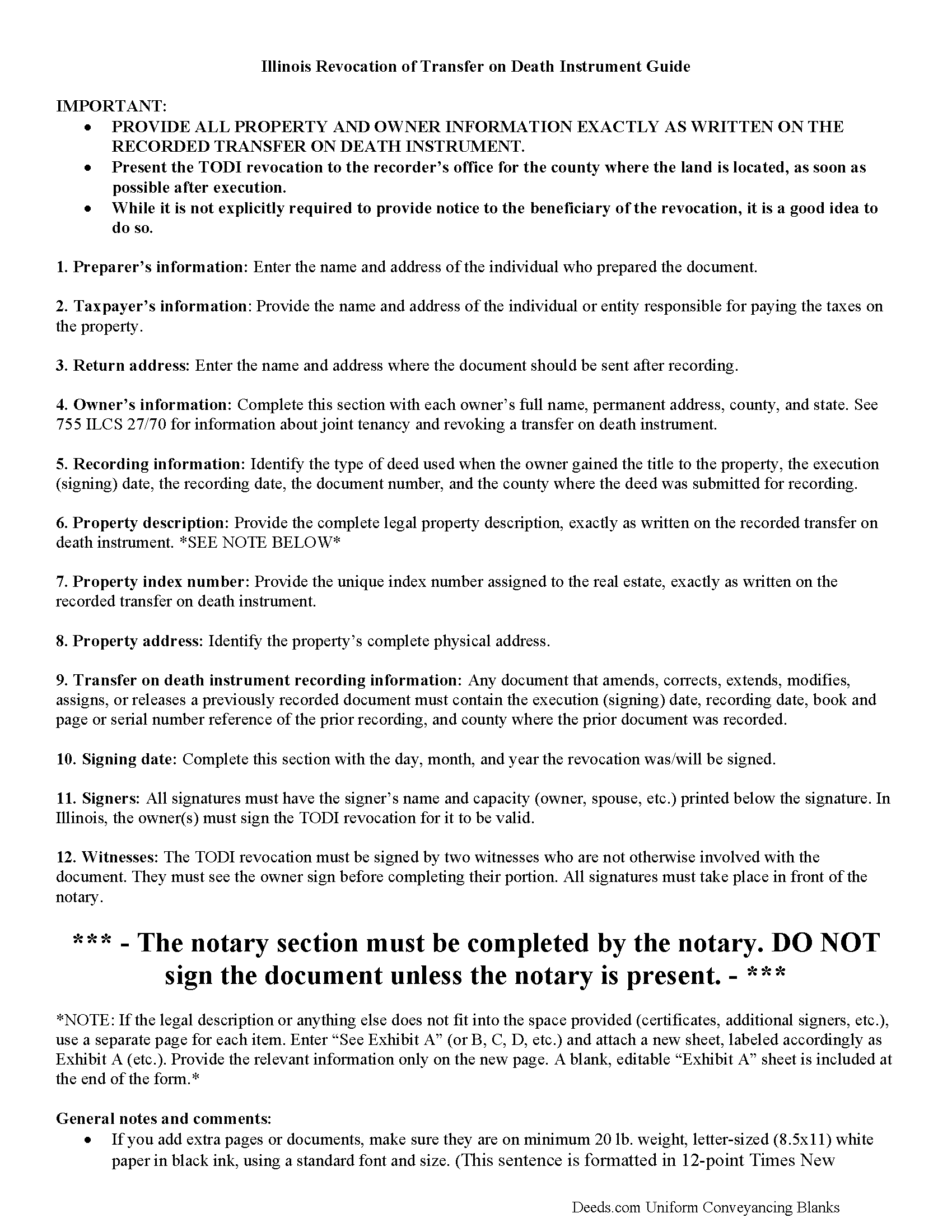

Shelby County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

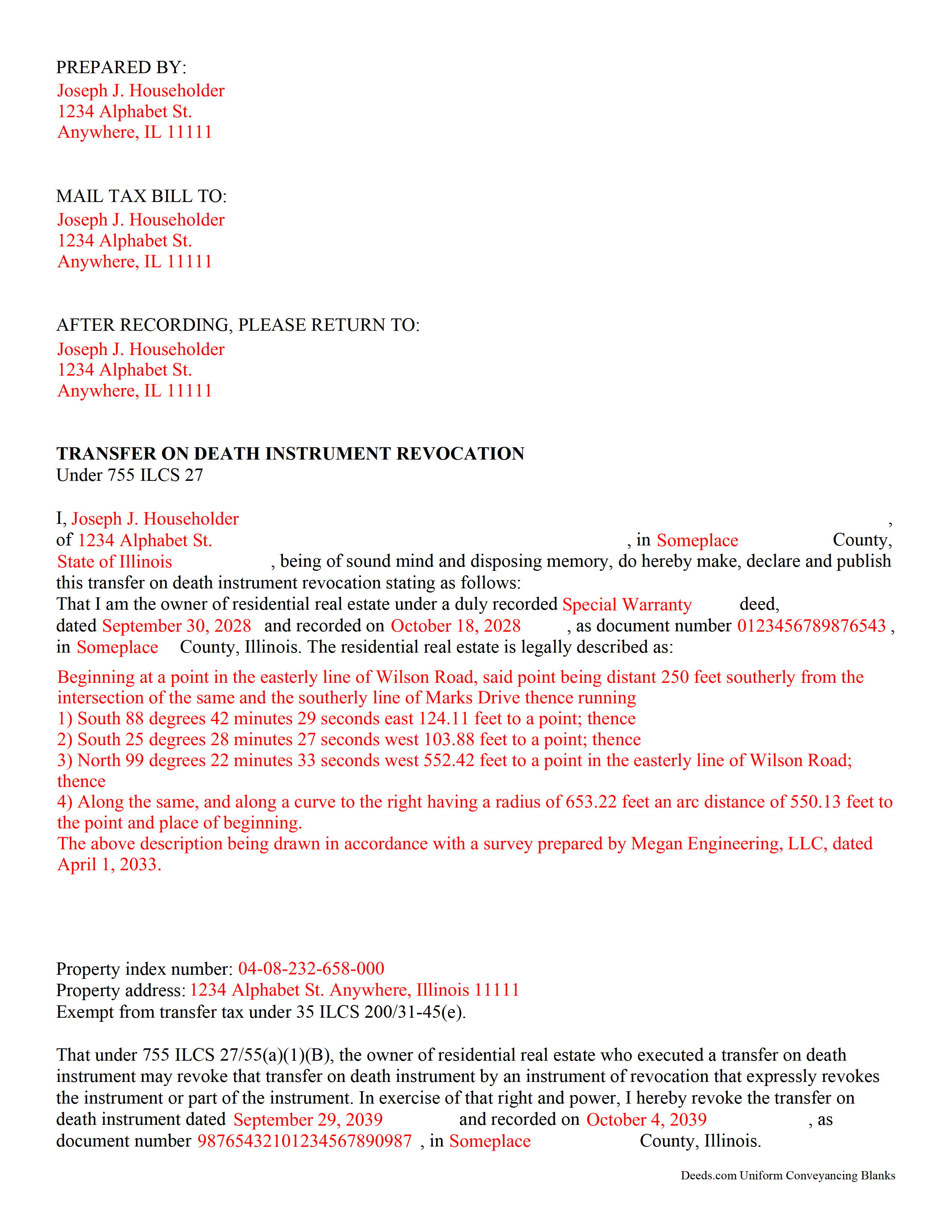

Shelby County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Shelby County documents included at no extra charge:

Where to Record Your Documents

Shelby County Clerk/ Recorder

Shelbyville, Illinois 62565

Hours: 8:00 to 4:00 M-F

Phone: (217) 774-4421

Recording Tips for Shelby County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Shelby County

Properties in any of these areas use Shelby County forms:

- Cowden

- Findlay

- Herrick

- Lakewood

- Mode

- Oconee

- Shelbyville

- Sigel

- Stewardson

- Strasburg

- Tower Hill

- Windsor

Hours, fees, requirements, and more for Shelby County

How do I get my forms?

Forms are available for immediate download after payment. The Shelby County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Shelby County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Shelby County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Shelby County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Shelby County?

Recording fees in Shelby County vary. Contact the recorder's office at (217) 774-4421 for current fees.

Questions answered? Let's get started!

Revoking an Illinois transfer on death instrument is governed by 755 ILCS 27.

One of the many useful aspects of the Illinois transfer on death instrument (TODI) is the ability to revoke it with no penalty to the owner and no obligation to the beneficiary. If the owner, who already executed and recorded a TODI, decides, for any reason, to cancel the future transfer, completing, executing, and recording a revocation will negate the prior document and prevent the former beneficiary from gaining ownership of the residential real property covered by the TODI.

Complete, sign, and record this form to revoke a previously executed and recorded transfer on death instrument for residential real property in the state of Illinois.

Note that the requirements for executing a revocation are similar to those of the TODI. The owner must sign the revocation in the presence of two adult witnesses who are not otherwise involved with the transaction. Additionally, a notary public or other individual who is authorized by the courts to administer oaths must be present to certify the identities and signatures of the owner and the witnesses.

(Illinois Transfer on Death Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Shelby County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Shelby County.

Our Promise

The documents you receive here will meet, or exceed, the Shelby County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Shelby County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

David D.

January 28th, 2021

Forms were quick to receive and appear to be what I need to complete our task.

Thank you for your feedback. We really appreciate it. Have a great day!

John Z.

November 5th, 2021

Very easy to use. Straight forward. Am glad I found the tools to process an important document of property ownership. Thanks much. Will recommend to friends and family.

Thank you!

Alain L.

June 15th, 2021

deeds.com was able to turnaround my document in a matter of hours. I was also surprised at how easy their website was to navigate, considering other websites that offered the same service were so convoluted. Thank you again for the quick turnaround.

Thank you!

Tracy B.

March 20th, 2020

I was happy with the way this worked and the quick responses. Unfortunately, my documents could not be pulled. I will use this service again in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Stacey S.

January 27th, 2022

The system was easy to use and download my documents but the way the packages are set up it was confusing and I wish there was a way to delete an item from a package if you make a mistake.

Thank you for your feedback. We really appreciate it. Have a great day!

Sarah H.

December 11th, 2020

Very helpful and great price

Thank you!

Rebecca V.

May 18th, 2023

The staff is Great to work with, Thank You

Thank you!

Elizabeth B.

February 3rd, 2020

Excellent product! Easy to fill out, complete directions. I highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

heather i.

December 5th, 2022

I don't pay very close attention to what I'm doing all the time which leads to mistakes. Deeds.com was helpful in correcting my error and getting me on my way.

Thank you!

Scotty A.

October 2nd, 2021

A great time and money saver that also has a money back guarantee. I received all the pertinent forms and instructions for less than a family eating a fast food dinner.

Thank you!

DONNA P.

July 21st, 2020

Deeds.com was quick, efficient, and cost effective. Deeds.com works with individuals where I found other companies only offer services to title companies, settlement companies, etc. Thank you Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret T.

May 6th, 2022

Had a difficult time finding my download after purchase. Thankfully I had printed the form and had. However it was read only and I'm not experienced enough to be able to change that. So I went into my word program and typed in the form. I should be able to use it for my purpose. Just glad I was finally able to find it after hours of searching online. I'm in my 70's and not real computer intelligent which may have been part of the problem

Sorry to hear of your struggle Margaret, we will try harder to make our forms easier for everyone.

Esfir K.

October 3rd, 2022

I had to call 3 times, two calls were hanged up on me. Thank you to 3rd representative, who helped me with my question. Unfortunately, I do not know her name. She was very patient, kind, professional. I am very thankful for her help.

Thank you!

Molly S.

November 13th, 2020

I used deeds.com to record a deed because the recording office closed due to Covid 19. It was easy to sign up and upload the documents I needed recorded and within 24 hours possibly even less, the deeds were recorded. I am very happy with the service and the $15 fee was affordable and worth every penny to get it done so quickly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Madline J.

June 25th, 2020

amazing job!!

Thank you!