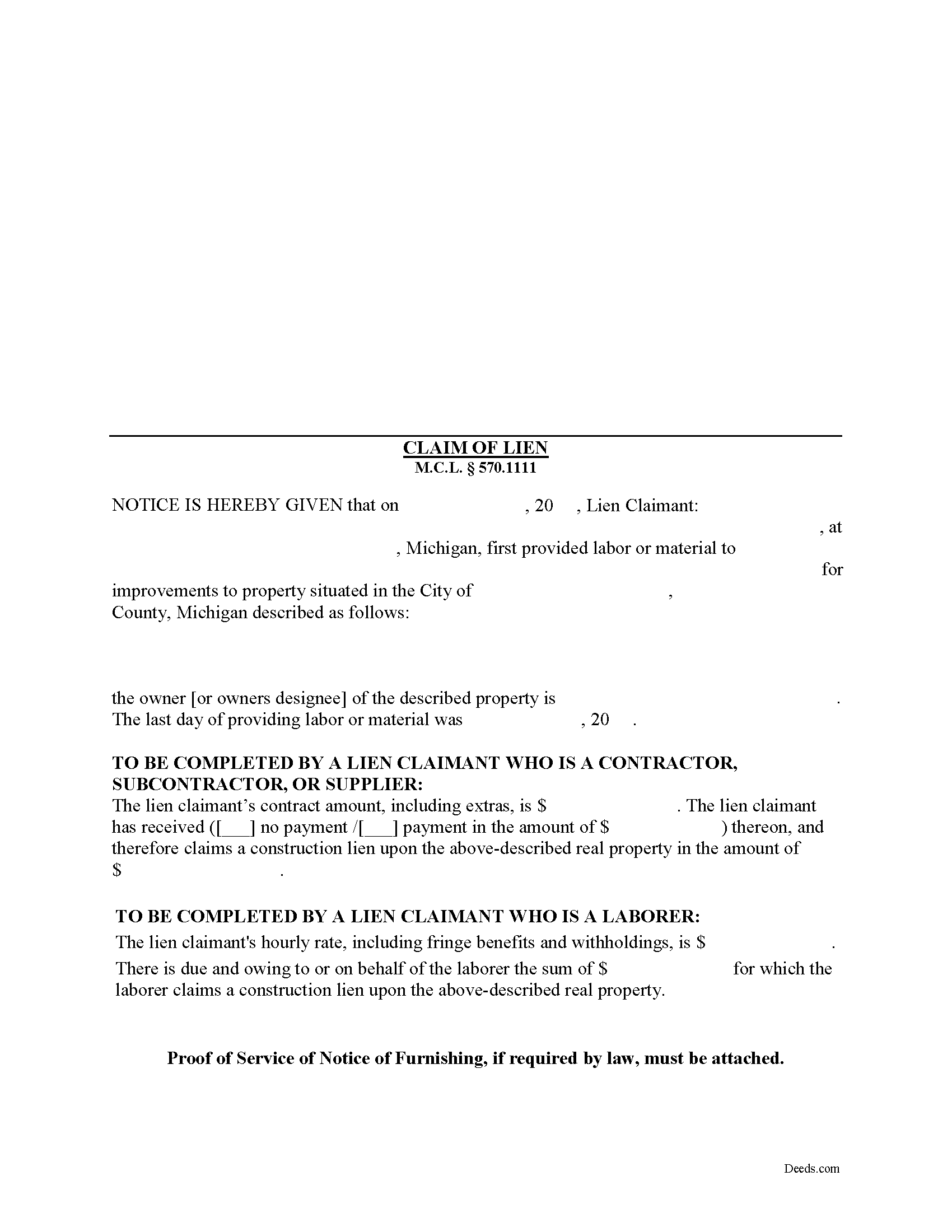

Calhoun County Claim of Lien Form

Calhoun County Claim of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

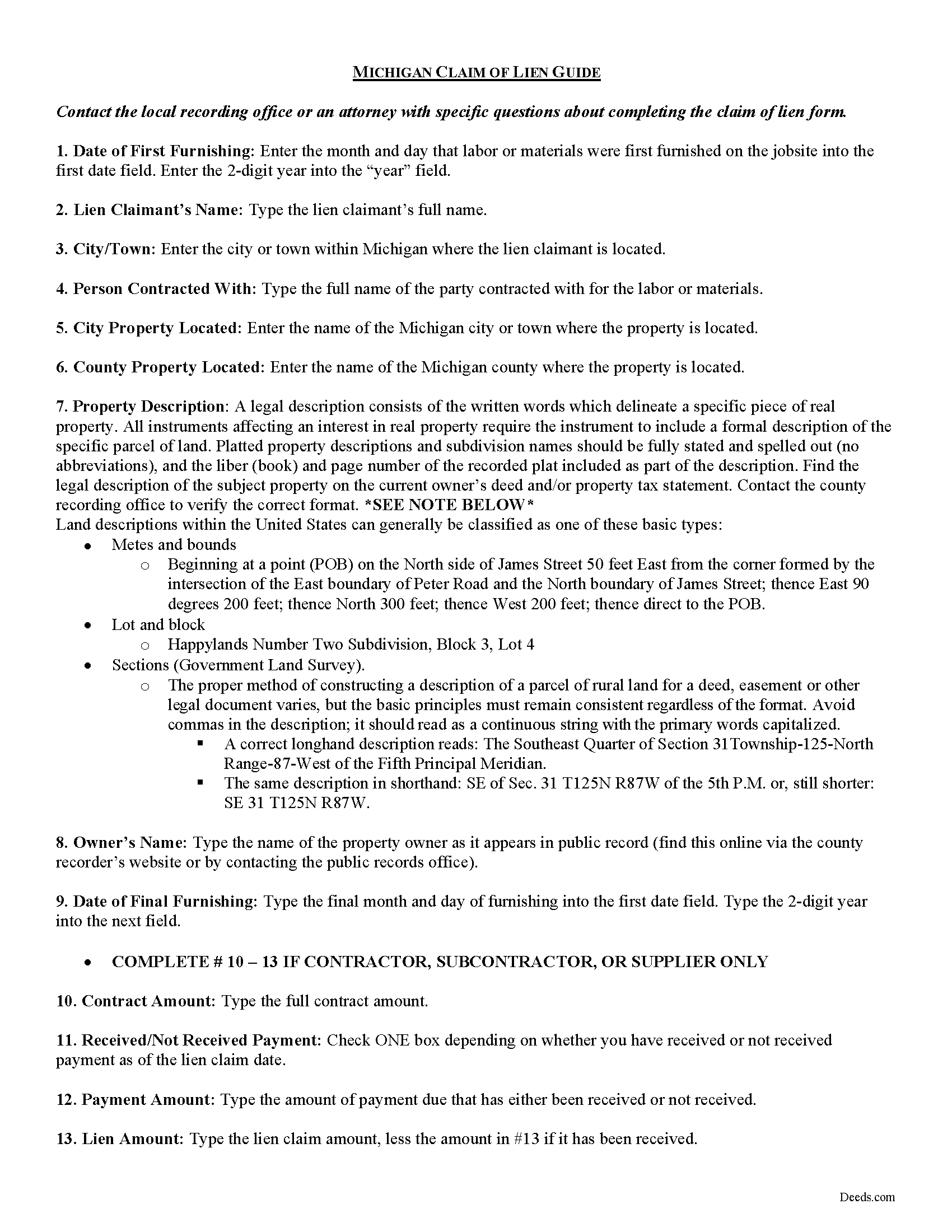

Calhoun County Claim of Lien Guide

Line by line guide explaining every blank on the form.

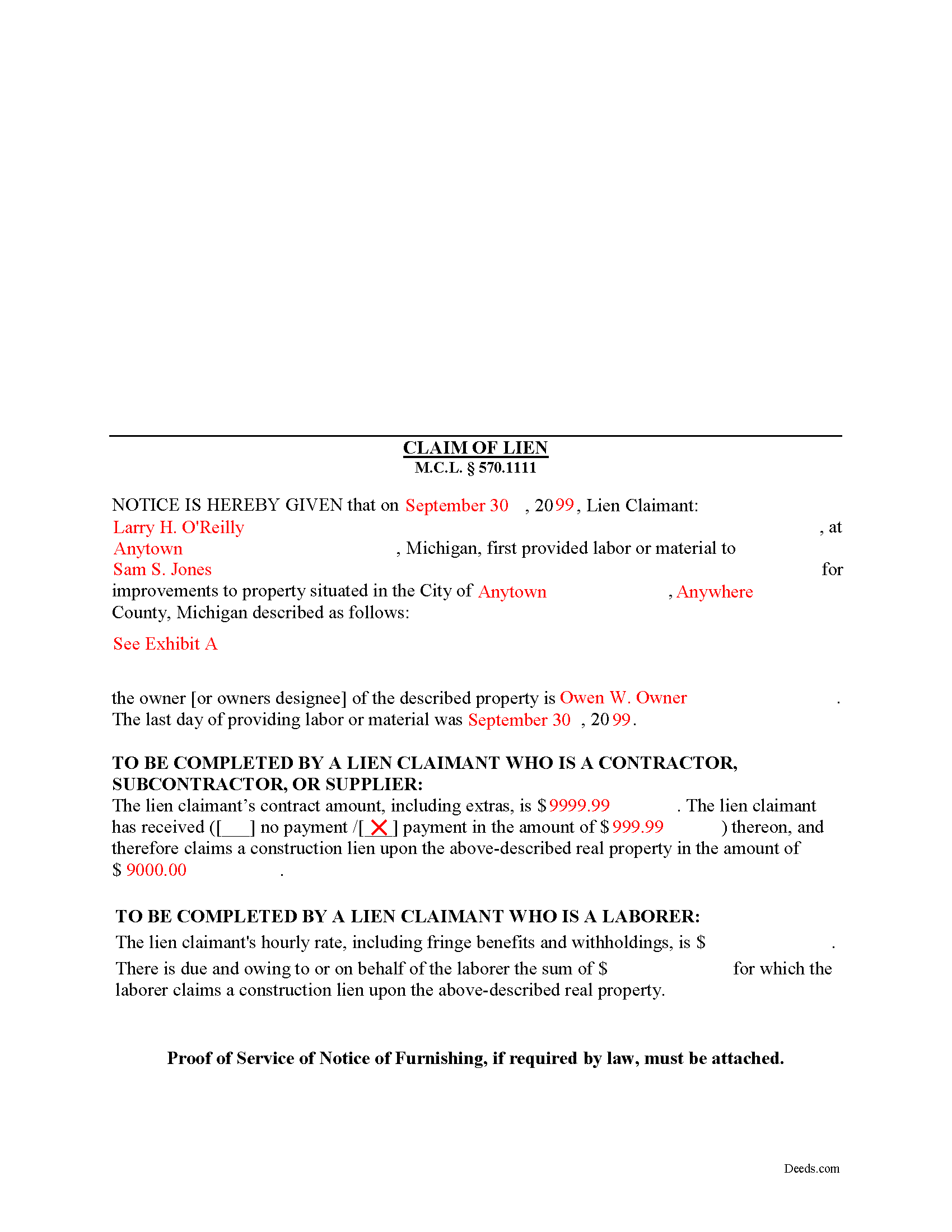

Calhoun County Completed Example of the Claim of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Calhoun County documents included at no extra charge:

Where to Record Your Documents

Calhoun County Register of Deeds

Marshall, Michigan 49068

Hours: 8:00am-5:00pm M-F

Phone: (269) 781-0718

Battle Creek Office

Battle Creek, Michigan 49017

Hours: 8:00am-5:00pm M-F

Phone: 269-969-6908

Recording Tips for Calhoun County:

- Ask if they accept credit cards - many offices are cash/check only

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Calhoun County

Properties in any of these areas use Calhoun County forms:

- Albion

- Athens

- Battle Creek

- Bedford

- Burlington

- Ceresco

- East Leroy

- Homer

- Marshall

- Tekonsha

Hours, fees, requirements, and more for Calhoun County

How do I get my forms?

Forms are available for immediate download after payment. The Calhoun County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Calhoun County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Calhoun County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Calhoun County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Calhoun County?

Recording fees in Calhoun County vary. Contact the recorder's office at (269) 781-0718 for current fees.

Questions answered? Let's get started!

Claiming a Mechanic's Lien in Michigan

A mechanic's lien (sometimes called a construction or contractor's lien) is a remedy available to contractors, subcontractors, laborers, and material suppliers to help recover money due, but unpaid, for services or materials on a construction job. In many ways, a lien is a property interest like a mortgage. In Michigan, the Construction Lien Act (Act 497 of 1980) governs the procedure for obtaining this kind of lien.

In order to preserve the right of a contractor, subcontractor, laborer, or supplier to a construction lien, the contractor (or other claimant) must record a claim of lien within 90 days after the last furnishing of labor or material for the improvement, in the office of the register of deeds for each county where the real property to which the improvement was made is located. M.C.L. 570.1111(1).

A claim of lien is valid only as to the real property described in the claim of lien and located within the county where the claim of lien has been recorded. Id. It must contain the following information: (1) the date of first furnishing; (2) lien claimant's name; (3) name of person contracted with; (4) description of the subject property; (5) owner's name; (6) date of final furnishing; and (7) contract and payment amounts (if contractor) or hourly rate and sum due (if laborer). M.C.L. 570.1111(2). Attach proof of service of a Notice of Furnishing to a lien claim filed by a subcontractor, supplier, or laborer. M.C.L. 570.1111(5).

The lien claim must also be served after recording. Service refers to giving all interested parties notice of the action and an opportunity to be heard. Each contractor, subcontractor, supplier, laborer, or agent of a group of laborers who record a claim of lien must, within 15 days after the date of the recording, serve on the designee personally or by certified mail, return receipt requested, at the address shown on the notice of commencement, a copy of the claim of lien and a copy of any proof of service recorded in connection with the claim of lien. Id.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. If you have any questions about filing a claim of lien, or any other issues involving mechanic's liens, please consult with a Michigan-licensed attorney.

Important: Your property must be located in Calhoun County to use these forms. Documents should be recorded at the office below.

This Claim of Lien meets all recording requirements specific to Calhoun County.

Our Promise

The documents you receive here will meet, or exceed, the Calhoun County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Calhoun County Claim of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Steve R.

June 17th, 2023

Hopefully filling out and filing the paperwork is as easy as this was.

Thank you for your feedback. We really appreciate it. Have a great day!

James J.

October 4th, 2021

I couldn't be more pleased or more impressed with the e-recording services I received from deeds.com and from my service representative, KVH. I was able to record documents in approximately half a dozen different counties easily and seamlessly, with a minimum of fuss. The turn around time was incredibly fast. The pricing was incredibly reasonable. I know I have alternatives because, in the past, I have used a competitor service for my recording needs. I won't do that again -- this was an exceptional experience. Thank you for your help!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jan David F.

January 5th, 2019

Your data doesn't go deep enough in time to be useful to me. I needed deeds from 1911 to 1966.

Thank you for your feedback Jan. It does look like staff canceled your order after discussing your needs with you.

Tracy E.

December 19th, 2020

This is so convenient. Thank you.

Thank you!

Robert S.

December 21st, 2018

Were unable to help me because of the recorders office but credited my account promptly

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa C.

July 2nd, 2020

Great. Thank you. Received information quickly. Helped out a lot.

Thank you!

Wayne A.

June 10th, 2021

good service but pricey.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

April 2nd, 2019

Excellent, easy to operate, saved $$$ by doing this TOD deed myself. WILL BUY AGAIN!!

Thank you Robert. Have a fantastic day!

Therese L.

September 20th, 2019

Good instructions and example

Thank you!

Kermit S.

October 12th, 2020

Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth B.

October 26th, 2023

Your site provided all I needed. Thank you!

It was a pleasure serving you. Thank you for the positive feedback!

Sally F.

January 22nd, 2020

Amazing forms, thanks so much for making these available.

Thank you!

Charles G.

June 22nd, 2022

I downloaded your Transfer on Death Deed Forms on Monday and registered the deed on Wednesday. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel D.

February 9th, 2020

Well done. A little pricy.

Thank you!

Shawn H.

April 16th, 2019

The site provided exactly what I needed when I needed it.

Thank you for your feedback. We really appreciate it. Have a great day!