Calhoun County Correction Deed Form

Calhoun County Correction Deed Form

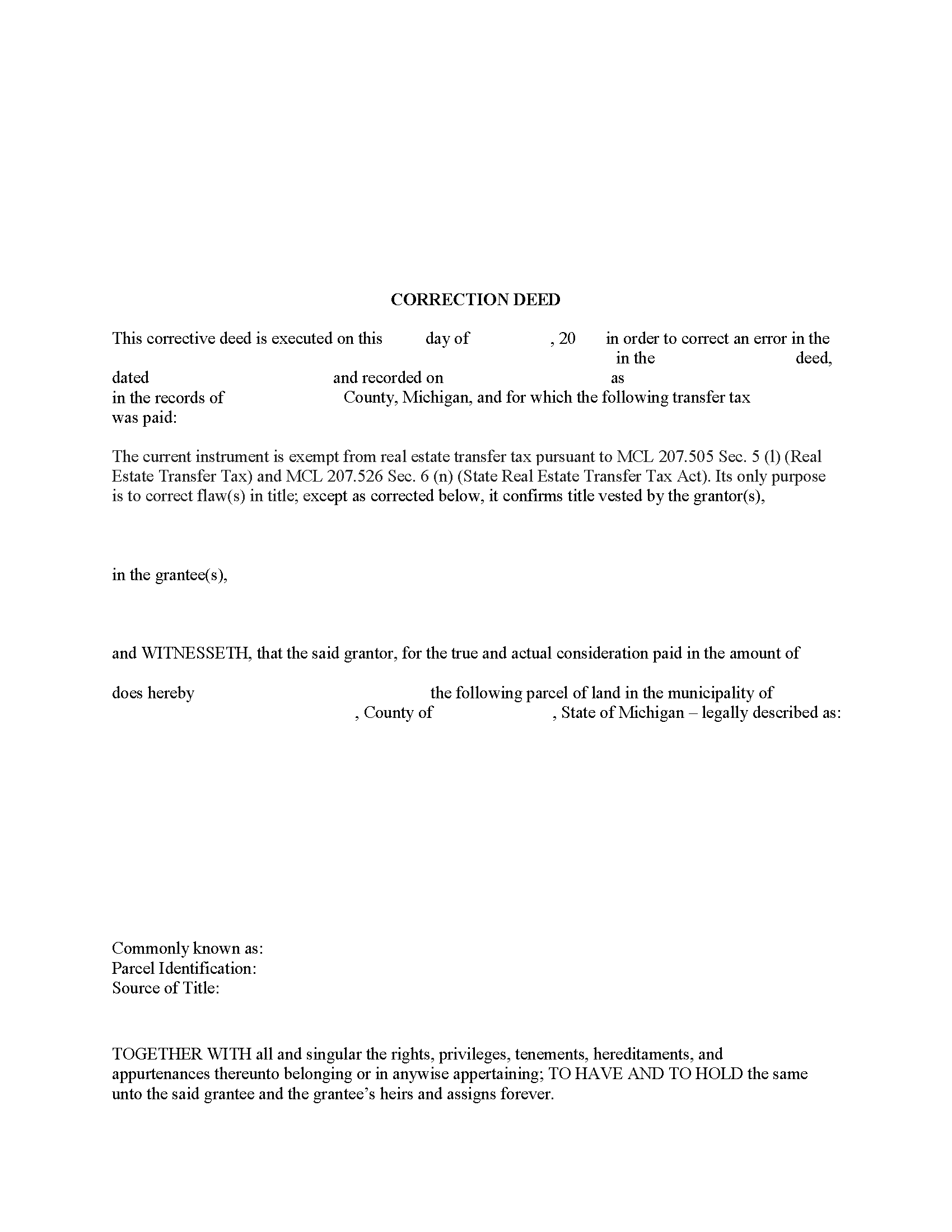

Fill in the blank form formatted to comply with all recording and content requirements.

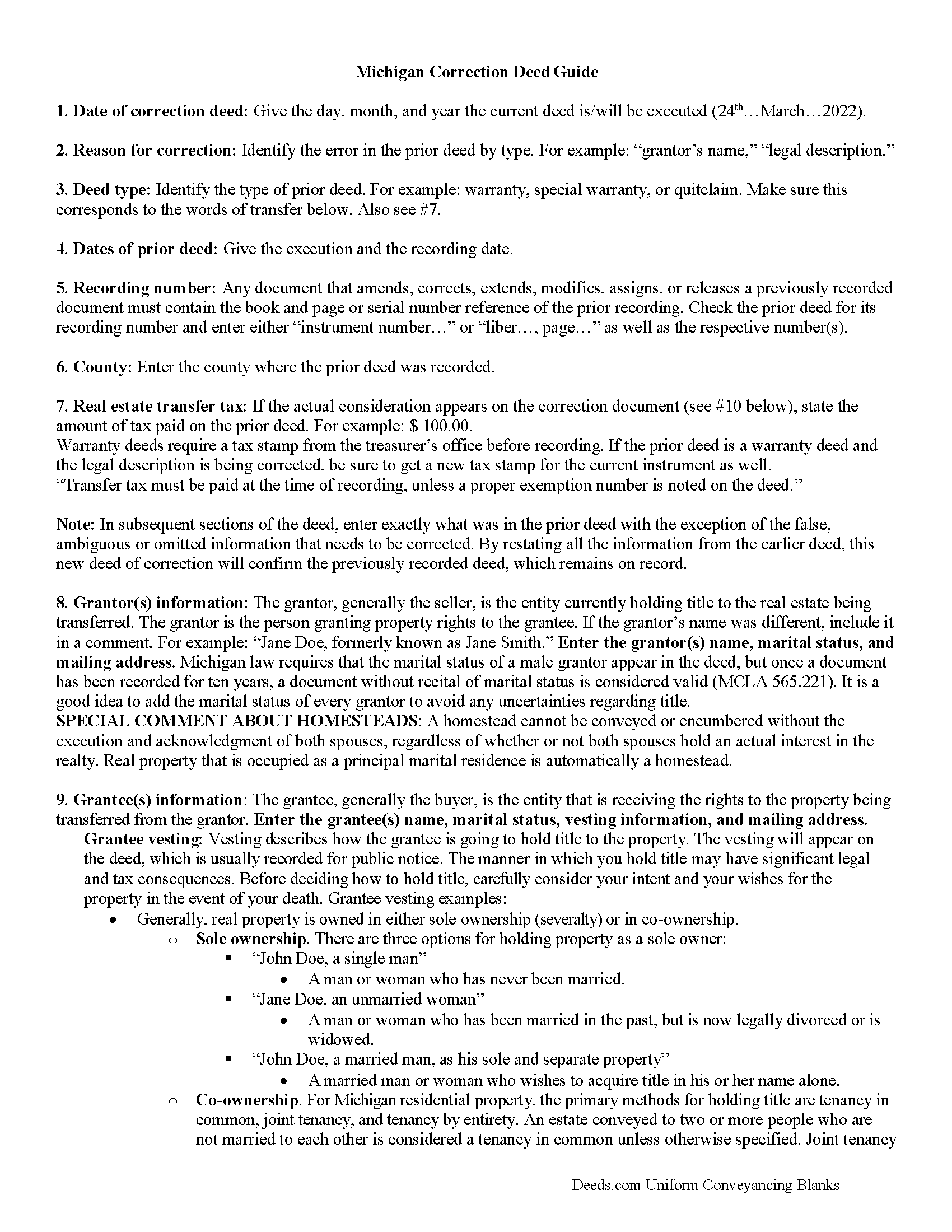

Calhoun County Correction Deed Guide

Line by line guide explaining every blank on the form.

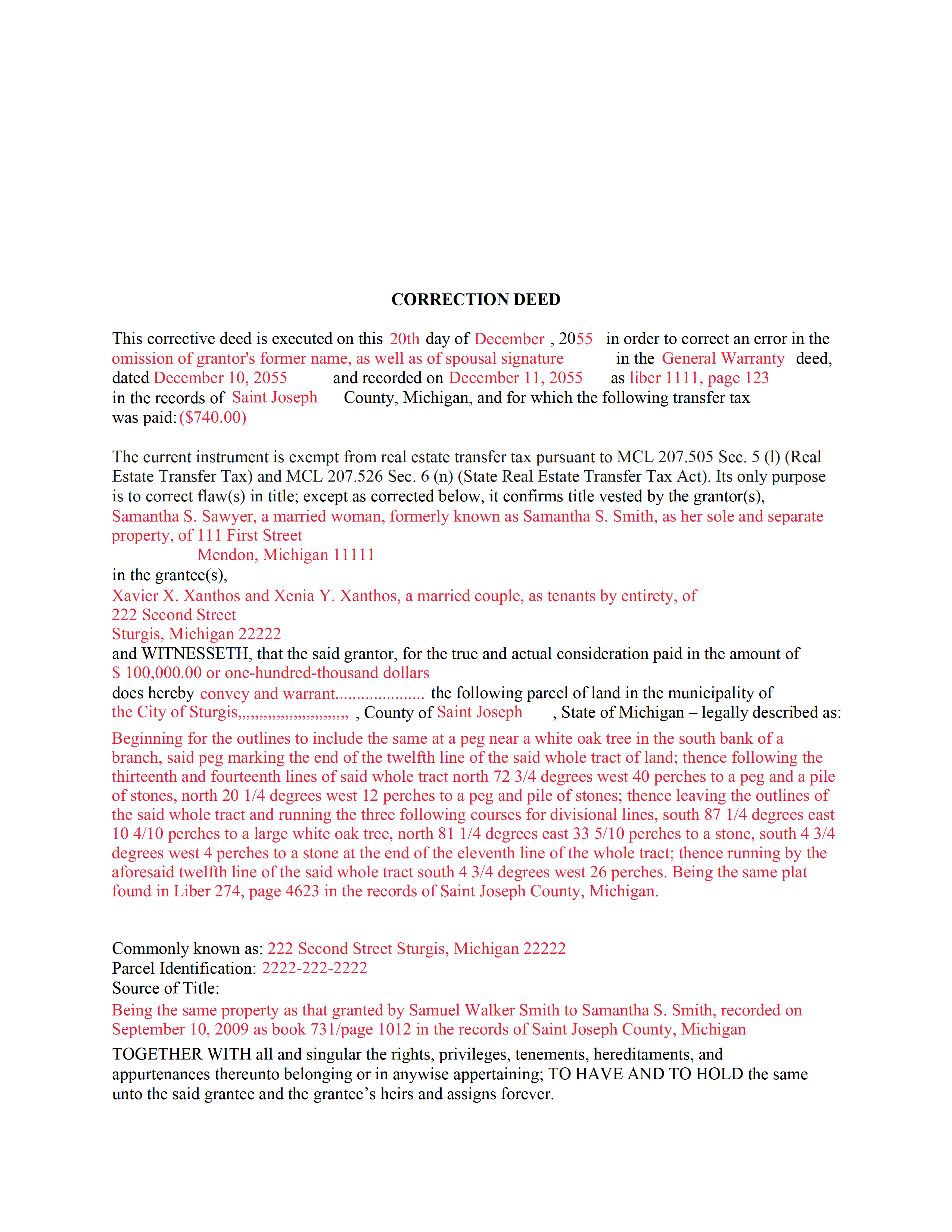

Calhoun County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Calhoun County documents included at no extra charge:

Where to Record Your Documents

Calhoun County Register of Deeds

Marshall, Michigan 49068

Hours: 8:00am-5:00pm M-F

Phone: (269) 781-0718

Battle Creek Office

Battle Creek, Michigan 49017

Hours: 8:00am-5:00pm M-F

Phone: 269-969-6908

Recording Tips for Calhoun County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Leave recording info boxes blank - the office fills these

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Calhoun County

Properties in any of these areas use Calhoun County forms:

- Albion

- Athens

- Battle Creek

- Bedford

- Burlington

- Ceresco

- East Leroy

- Homer

- Marshall

- Tekonsha

Hours, fees, requirements, and more for Calhoun County

How do I get my forms?

Forms are available for immediate download after payment. The Calhoun County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Calhoun County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Calhoun County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Calhoun County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Calhoun County?

Recording fees in Calhoun County vary. Contact the recorder's office at (269) 781-0718 for current fees.

Questions answered? Let's get started!

Use this correction deed to correct an error in a previously executed and recorded deed.

Correction deeds are used to adjust the earlier deed when that document contains minor errors of omission or typographical errors, sometimes called scrivener's mistakes. For example, a misspelled name, an omitted or wrong middle initial, a minor error in the property description, or an omitted execution date. Do not us the correction deed for more substantial changes, such as the removal of a name from a deed. Such alterations are better handled through a quit claim deed.

The correction deed, also called corrective deed, must state that its sole purpose is to correct a specific error, which is usually identified by type. For example: an error in the grantor's name, or an error in the grantor's marital status. It also must clearly reference the type of document it is correcting and state the execution and recording date of that prior document, as well as the number under which it was recorded, either referred to as instrument number or liber (book) and page number.

In subsequent sections, the correction deed repeats the information that was in the prior deed with the exception of the false, ambiguous or omitted information that needs to be corrected. By restating all the information from the earlier deed, this new deed of correction will confirm the previously recorded deed, which remains on record as is.

Warranty deeds require a tax stamp from the treasurer's office before recording. If the prior deed is a warranty deed and the legal description is being corrected, be sure to get a new tax stamp for the current instrument as well. In some counties, any deed that contains the word "warrant" must be checked by the treasurer's office first regardless of the type of correction.

(Michigan CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Calhoun County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Calhoun County.

Our Promise

The documents you receive here will meet, or exceed, the Calhoun County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Calhoun County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Ernest S.

July 30th, 2019

Took it to the Courthouse and the Register of Deeds said,"well Done" Thanks you so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

TERRY E.

August 19th, 2020

VERY EASY TO USE !

Thank you!

Valerie I.

November 19th, 2020

Quick and easy! Had my document submitted to the county and back in one day. Good rates as well!

Thank you!

Michael S.

March 12th, 2021

Well designed easy to use system. Provided all instructions and updates required, as well as catching an extra form required by our county.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin F.

November 9th, 2022

Very Convenient and easy to use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gregory J.

March 6th, 2019

Ordered two separate forms for two separate states at two differnt times and couldn't be happier with my purchase. When compared to the cost of having two different attorneys prepare the forms I needed, the value of deeds.com couldn't be beat!

Thank you Gregory. We appreciate you taking the time to leave your feedback. Have a great day!

Thomas W.

February 9th, 2021

Found what I needed, thanks.

Thank you!

Traci K.

April 29th, 2021

Thk u for the forms I needed so badly I really appreciate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John C.

February 26th, 2024

Ease and speed of recording are remarkable. This is especially true of deeds with problems: I often get feedback within minutes and can correct problems immediately and still complete the filing in the same day. I wish more counties accepted electronic filing! It would be helpful to list counties that do/do not accept electronic filing so I would not have to upload documents to find out my effort was fruitless.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Stephanie B.

May 28th, 2020

Really great, relevant and straight forward forms. Deeds.com is excellent and helps you avoid costly errors on documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

August 14th, 2021

The forms were easy to download and fill.

Thank you!

Lori N.

August 16th, 2022

I ordered the document I needed and it was available for download within a half hour. Very pleased, thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra B.

February 15th, 2022

Easy to navigate through. Documents were in orderly fashion. Highly recommend. Step by step instructions

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jessica B.

September 23rd, 2021

Amazing service. Immediate responses at all hours of the day and prevent late in the evening! Patient and friendly. I will say that Adobe scan did not work well for me. Notes app for IOS has a scan feature and that seemed to work best.

Thank you for your feedback. We really appreciate it. Have a great day!

Rhonda P.

February 23rd, 2021

Very quick and easy! Didn't even have to leave the house and I didn't have to send via USPS which is nice since we are in a pandemic. The convenience of this site is worth the extra money. Would definitely use this site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!