Minnesota Correction Deed

County Specific Legal Forms Validated as Recently as July 31, 2025

About the Minnesota Correction Deed

How to Use This Form

- Select your county from the list on the left

- Download the county-specific form

- Fill in the required information

- Have the document notarized if required

- Record with your county recorder's office

What Others Like You Are Saying

“Easy to use website and reasonably priced forms. I recommend it.”

— John S.“Easy to use Website. Quick accurate data reporting. I will use the service in the future.”

— Michael W.“Very informative and helpful Thank you so much”

— Corey G.“Pretty good all in all. I do wish I could download forms to a word doc instead of a .pdf. Word is mo…”

— Tim G.“Quick, easy, thorough, reasonable price. Much better than trying to contact a paralegal (who do not …”

— David D.

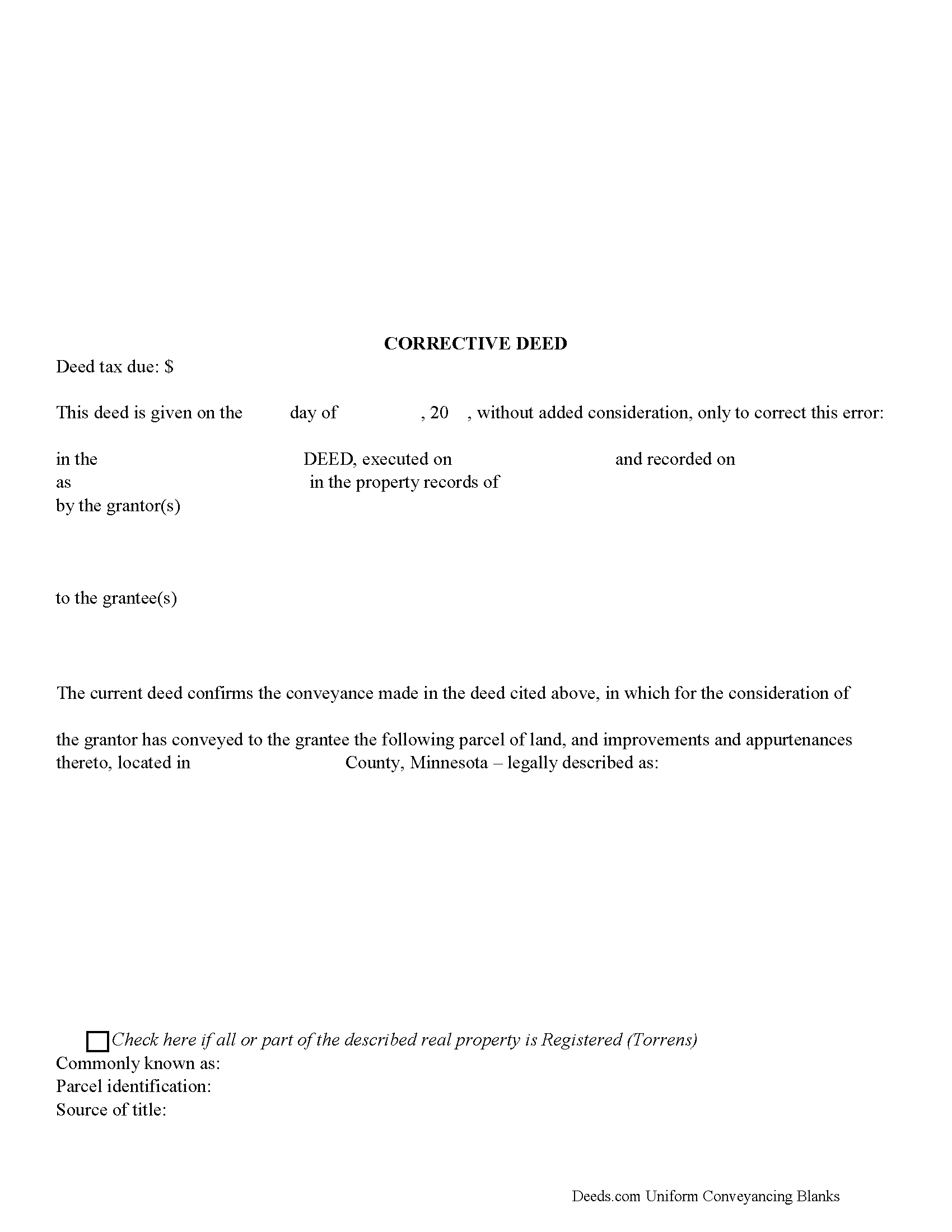

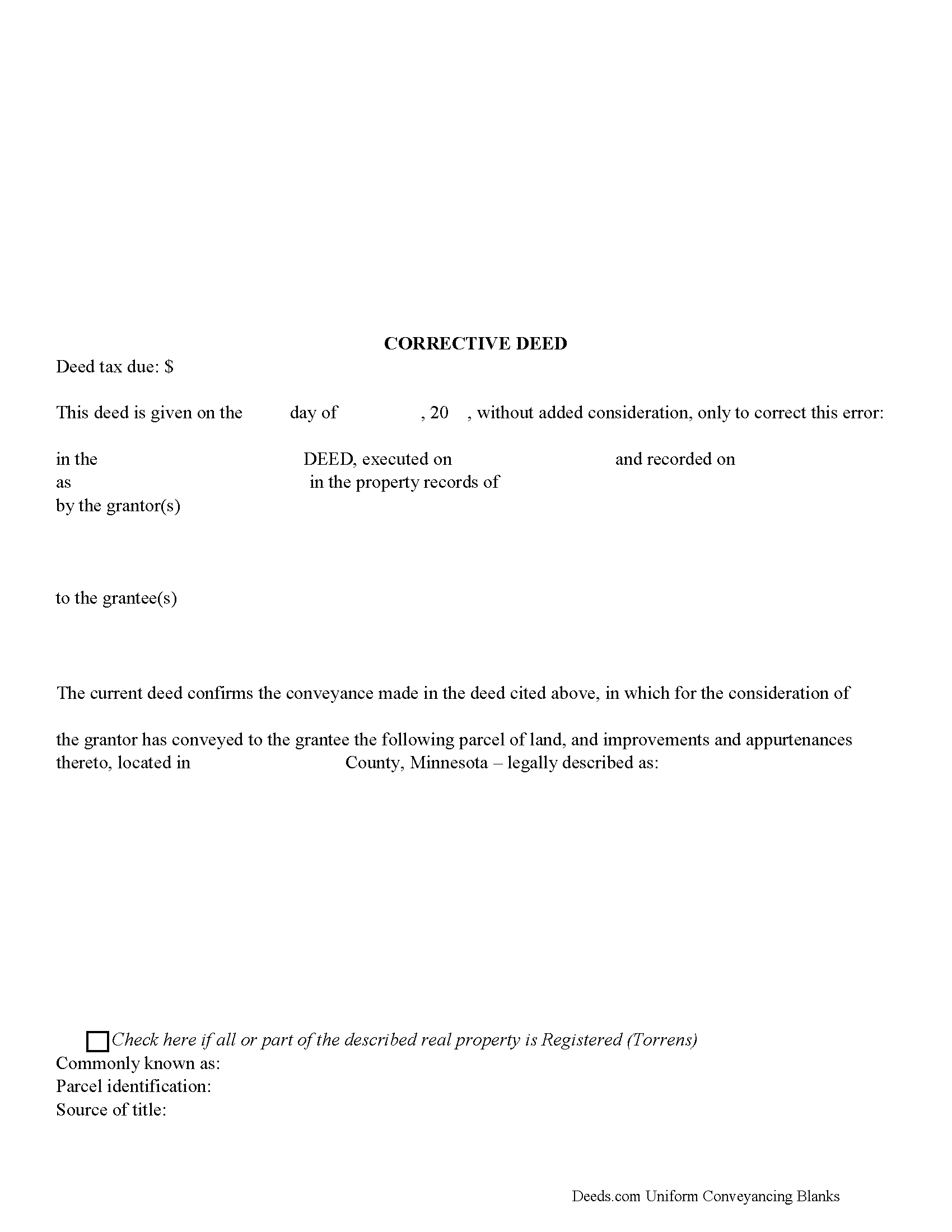

Use the corrective deed to amend a previously recorded deed of conveyance with an error that could affect the title.

In Minnesota, there are two options for correcting a deed, re-recording the corrected original deed and recording a newly drafted corrective deed. When re-recording the original deed, make corrections directly on the document, but keep in mind that legal documents cannot be altered with strikeout, whiteout, line through or correction tape. Check with the county's recording office before choosing this option to verify local requirements regarding title pages, required attachments and how to handle the correcting itself.

A re-recorded document must be re-signed by the original parties and re-acknowledged and contain a correction statement that gives the reason for the re-recording and refers to the prior recording. Keep in mind that adding extra pages for the various required statements and the signatures will increase the overall page count of the re-recording, which may affect recording fees.

The easiest and cleanest option is to record a new corrective deed, which mostly restates the prior deed, but also contains the reason for the correction, reference to the prior deed by date, recording number and title, as well as the actual corrected information. By restating all the information from the earlier deed, the new deed corrects and confirms the previously recorded deed, which remains on record.

Take advantage of the statutorily defined right to have a corrective instrument inspected by the county attorney, who, "on finding that such deed is given for the purpose of correcting a defect in the title, or on account of a technical error in a prior conveyance," will certify those findings so that the deed can be recorded even if "there are unpaid taxes or assessments upon such land." (Minn. Stat. 272.15) As far as deed tax is concerned, corrective deeds in Minnesota are generally subject to minimum deed tax. Contact the county recorder or review the county website to ensure that the correct amount is included and sent to the required location.

(Minnesota CD Package includes form, guidelines, and completed example)

Important: County-Specific Forms

Our correction deed forms are specifically formatted for each county in Minnesota.

After selecting your county, you'll receive forms that meet all local recording requirements, ensuring your documents will be accepted without delays or rejection fees.

How to Use This Form

- Select your county from the list above

- Download the county-specific form

- Fill in the required information

- Have the document notarized if required

- Record with your county recorder's office

What Others Like You Are Saying

“Easy to use website and reasonably priced forms. I recommend it.”

— John S.“Easy to use Website. Quick accurate data reporting. I will use the service in the future.”

— Michael W.“Very informative and helpful Thank you so much”

— Corey G.“Pretty good all in all. I do wish I could download forms to a word doc instead of a .pdf. Word is mo…”

— Tim G.“Quick, easy, thorough, reasonable price. Much better than trying to contact a paralegal (who do not …”

— David D.Common Uses for Correction Deed

- Transfer property between family members

- Add or remove names from property titles

- Transfer property into or out of trusts

- Correct errors in previously recorded deeds

- Gift property to others