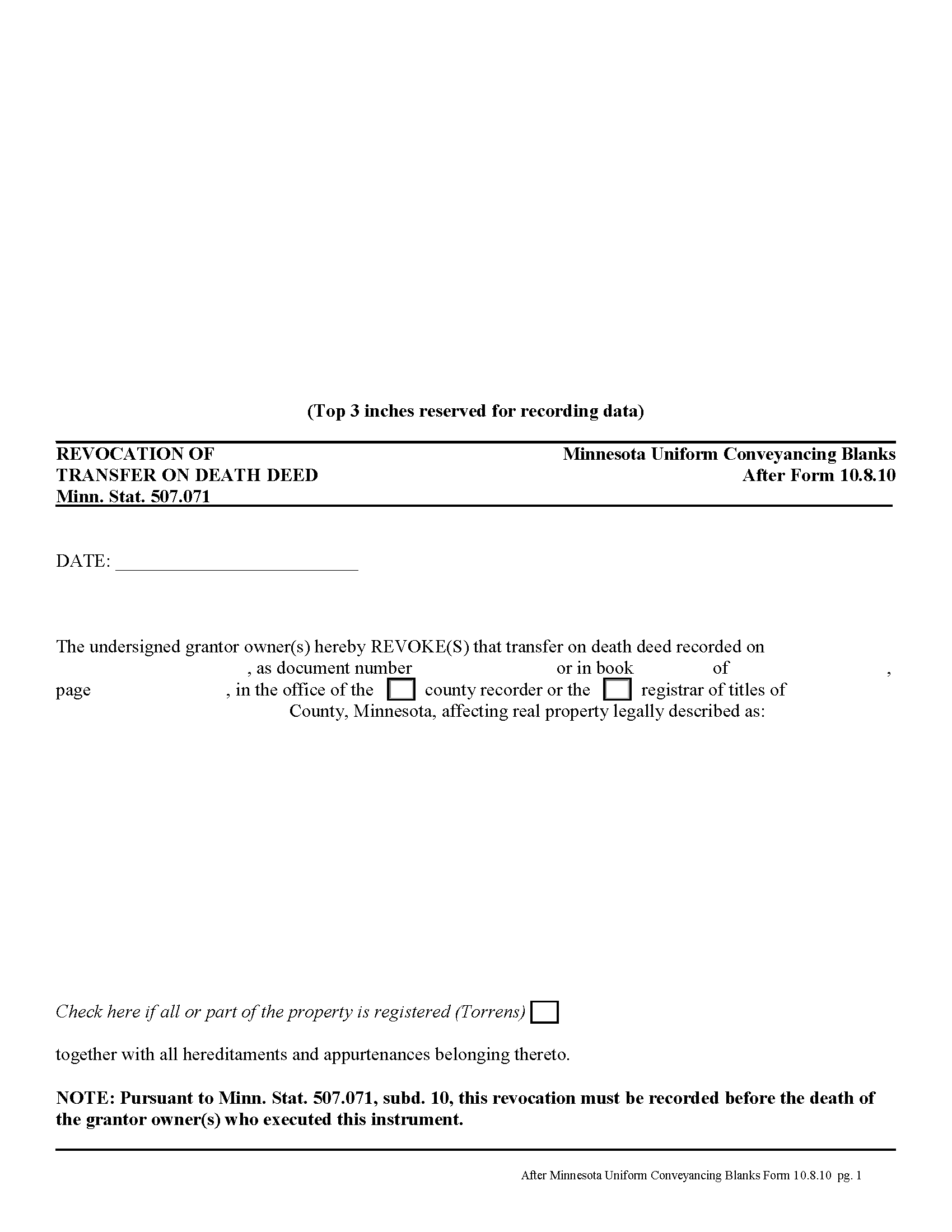

Crow Wing County Transfer on Death Revocation Form

Crow Wing County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

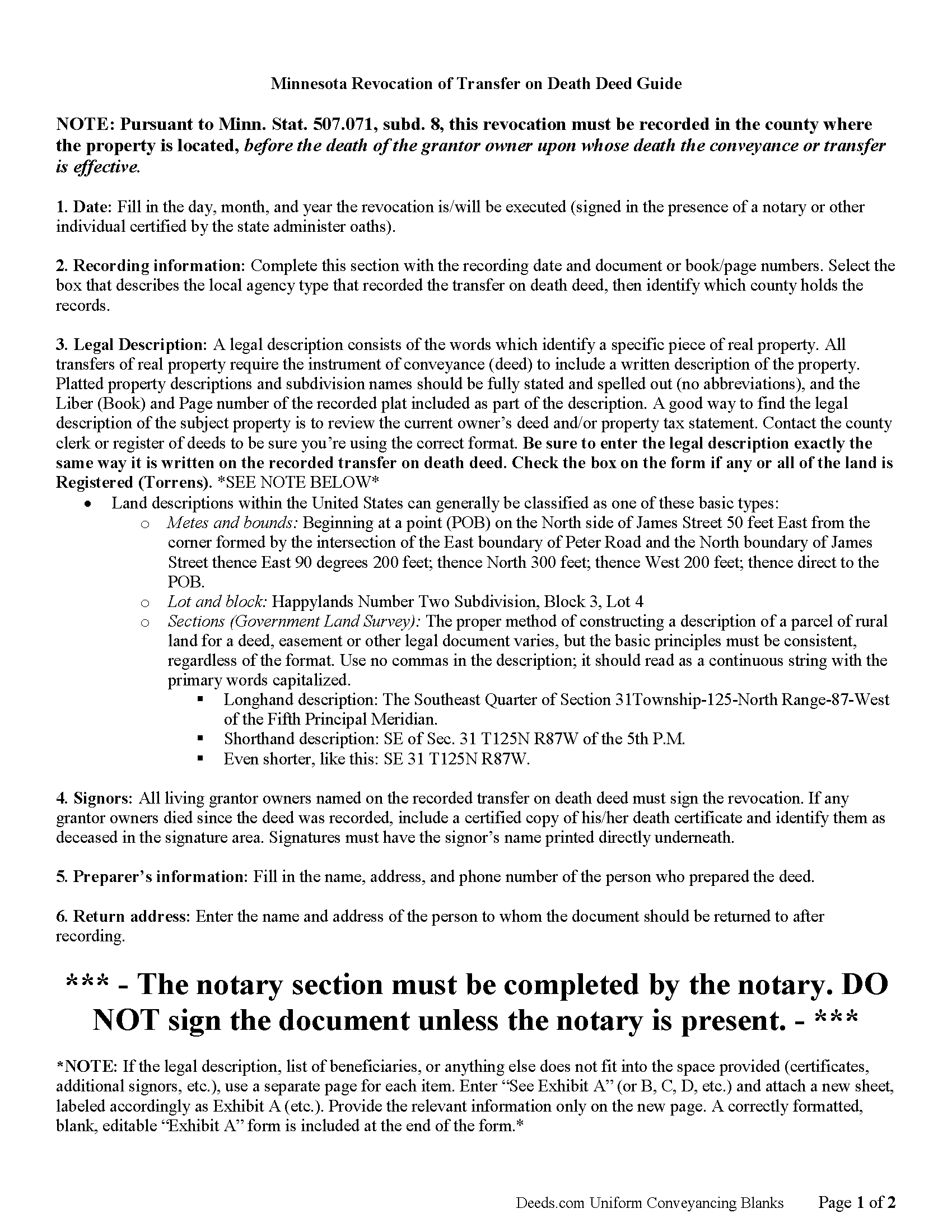

Crow Wing County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

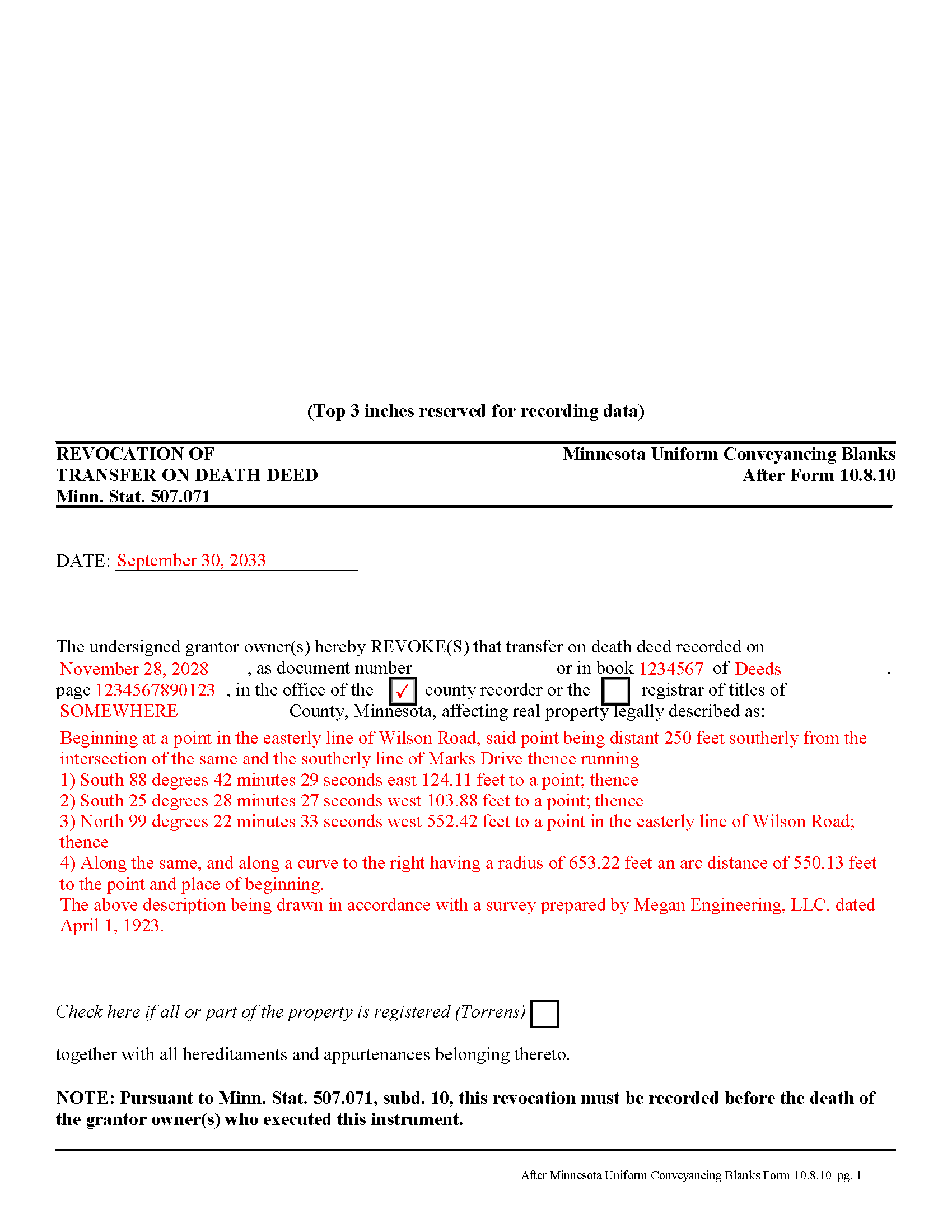

Crow Wing County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Crow Wing County documents included at no extra charge:

Where to Record Your Documents

Crow Wing County Recorder

Brainerd, Minnesota 56401

Hours: 8:00 to 5:00 M-F

Phone: (218) 824-1010

Recording Tips for Crow Wing County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Crow Wing County

Properties in any of these areas use Crow Wing County forms:

- Baxter

- Brainerd

- Crosby

- Crosslake

- Deerwood

- Emily

- Fifty Lakes

- Fort Ripley

- Garrison

- Ironton

- Jenkins

- Lake Hubert

- Merrifield

- Nisswa

- Pequot Lakes

Hours, fees, requirements, and more for Crow Wing County

How do I get my forms?

Forms are available for immediate download after payment. The Crow Wing County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Crow Wing County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Crow Wing County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Crow Wing County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Crow Wing County?

Recording fees in Crow Wing County vary. Contact the recorder's office at (218) 824-1010 for current fees.

Questions answered? Let's get started!

Minnesota's transfer on death deeds are governed by Minn. Stat. 507.071.

Transfer on death deeds offer an excellent alternative for people who wish to designate a beneficiary for their real estate, while remaining outside the complexity of the probate process. Life is unpredictable, however, and the grantor owner of the property might wish to change or revoke the previously recorded transfer on death deed. The same statute covering the deed also includes a section about revoking it (subd. 10).

There are several ways to revoke a transfer on death deed in Minnesota:

1. Complete and record a statutory revocation form (subd. 25). This is the source for the general revocation form. The statute states that a transfer on death deed "may be revoked at any time by the grantor owner or, if there is more than one grantor owner, by any of the grantor owners. To be effective, the revocation must be recorded in the county in which at least a part of the real property is located before the death of the grantor owner or owners who execute the revocation." The revocation is not effective . . . until the revocation is recorded in the county in which the real property is located.

2. Minnesota transfer on death deeds allow grantor owners full use of and control over the property to be conveyed. If the grantor owner who executed and recorded a transfer on death deed decides to convey the same property to a third party using anything "other than a transfer on death deed, all or a part of such grantor owner's interest in the property described in the transfer on death deed, no transfer of the conveyed interest shall occur on such grantor owner's death and the transfer on death deed shall be ineffective as to the conveyed or transferred interests, but the transfer on death deed remains effective with respect to the conveyance or transfer on death of any other interests described in the transfer on death deed owned by the grantor owner at the time of the grantor owner's death."

3. "If a grantor owner executes and records more than one transfer on death deed conveying the same interest in real property or a greater interest in the real property, the transfer on death deed that has the latest acknowledgment date and that is recorded before the death of the grantor owner upon whose death the conveyance or transfer is conditioned is the effective transfer on death deed and all other transfer on death deeds, if any, executed by the grantor owner or the grantor owners are ineffective to transfer any interest and are void." (subd. 13)

NOTE: a correctly executed, acknowledged, and recorded transfer on death deed cannot be revoked by a will. (subd. 19)

To summarize, once a transfer on death deed is recorded, there are three primary ways to revoke it: a revocation form, conveying the property to a third party by another kind of deed (warranty, quitclaim, etc.), or by executing and recording a new transfer on death deed with a different beneficiary. They may also be invalidated as part of a final divorce decree, but that is part of a different process. To maintain the most clarity in the chain of title (ownership history), however, it makes sense to record a revocation before changing anything else about the status of real estate covered by a transfer on death deed.

Remember that the revocation must be recorded, DURING THE GRANTOR OWNER'S LIFE, in the county where the property is located.

(Minnesota TOD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Crow Wing County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Crow Wing County.

Our Promise

The documents you receive here will meet, or exceed, the Crow Wing County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Crow Wing County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Gary S.

January 9th, 2022

Easy to use. Very helpful

Thank you!

Lucus S.

May 19th, 2022

I tried to do it myself by copying an old deed and ended up with a bunch of headaches (expensive ones) wish I would have used these documents first. Live and learn.

Thank you!

Frank S.

December 21st, 2022

Pretty easy to register. Menu layout is too follow.

Thank you!

Raj J.

December 2nd, 2020

Perfect, thanks

Thank you!

Jeffery H.

October 18th, 2023

Very easy to use. Thanks for your quick response on my document submissions and follow up and guidance on specific questions.

Thank you for your positive words! We’re thrilled to hear about your experience.

Rebecca M.

May 3rd, 2025

EASY DOWNLOAD AND PRINT AND / OR SAVE TO YOU PC WHICH SHOULD BE DONE BEFORE FILLING OUT. AFTER I actually use them I'll let you know if its all good, Thanks

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Todd B.

October 9th, 2020

very quick and easy

Thank you!

Tracey T.

July 19th, 2019

Lots of great information. Might need to view it again but found it very helpful!

Thank you!

Philip C.

July 2nd, 2019

The product I purchased looks great and I added Adobe to be able to copy it, but for some reason I can't,so I will delete Adobe and then try again to copy what i paid for. I have all the PDFS' and my computer and printer are fairly new (windows 10),I should have tried to copy it first, I'll get it! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Melanie K.

December 27th, 2019

Great service! Super easy to use! I used the service to download a deed notice to do a TOD on a property in Fairfax County, VA. Just a heads up that Fairfax County required me to add the last deed book and page # onto the deed notice but otherwise all was just as they required!

Thank you!

james h.

June 15th, 2020

Service was quick and easy to use. I got not only the necessary forms, but instructions and sample forms filled out. Highly recommended.

Thank you!

Monica U.

January 23rd, 2021

Thank You. Good Service. Questions were answered.

Thank you for your feedback. We really appreciate it. Have a great day!

Alex Q.

July 26th, 2023

The best people to work with! Thank you for all you do. We send documents from all states to Deeds.com to record for us. They are professional, keep us updated and always notify us if there is an issue with one of our documents prior to sending to recording and that saves us money and time! Thank you!!

Thanks for the kind words Alex. We appreciate you!

Andrew H.

November 11th, 2020

Very efficient does what it says on the box.

Thank you!

Jon G.

June 26th, 2021

Excellent service and professionalism

Thank you!