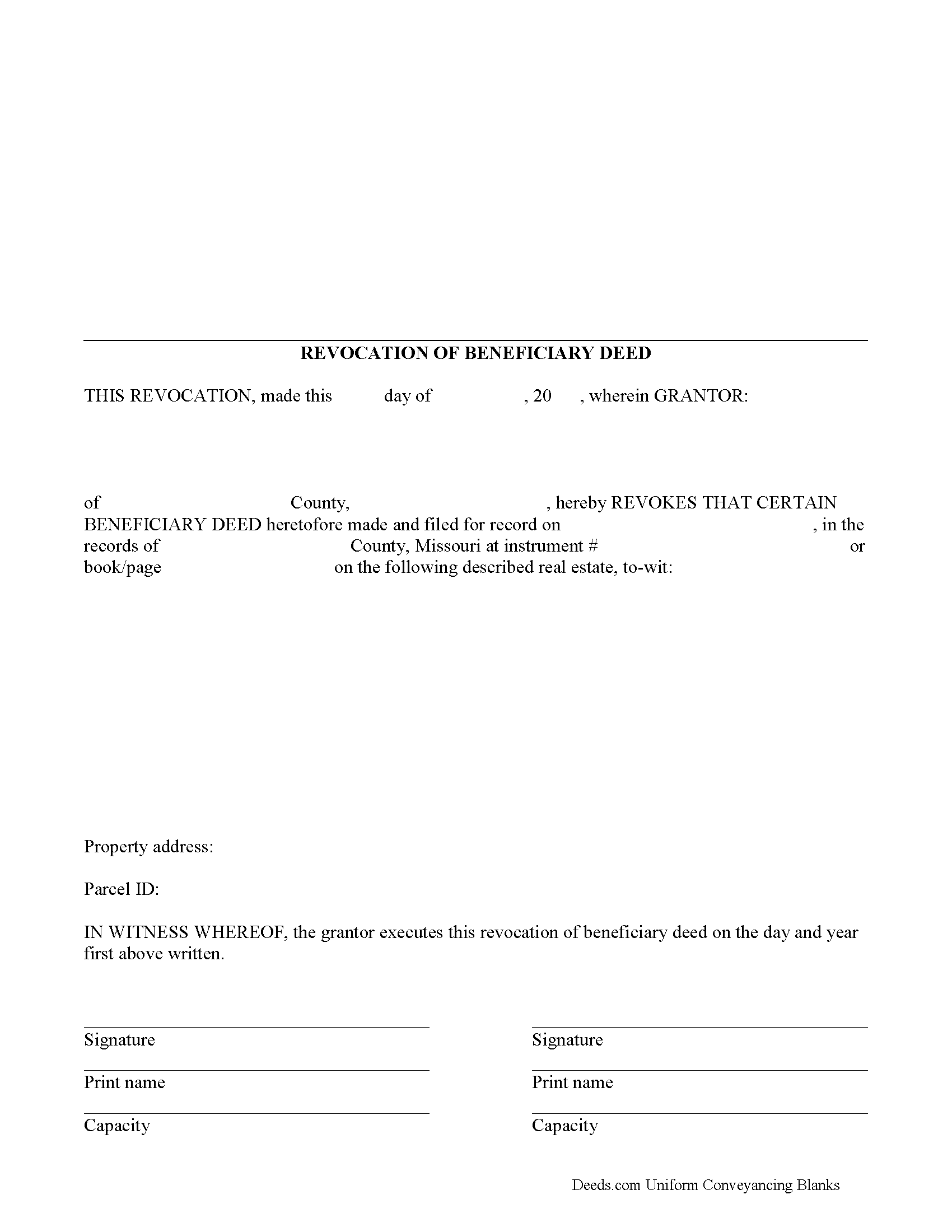

Saline County Revocation of Beneficiary Deed Form

Saline County Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

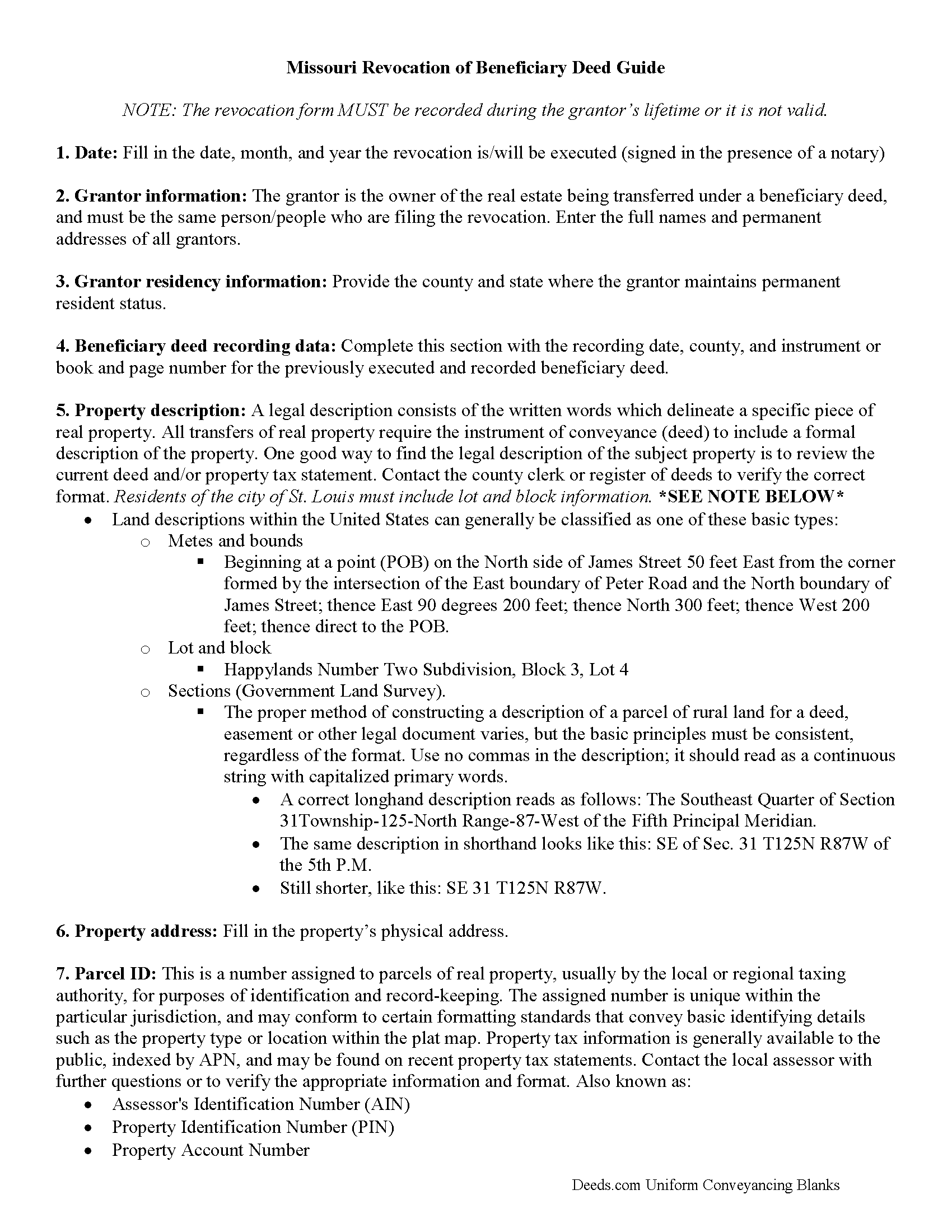

Saline County Revocation of Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

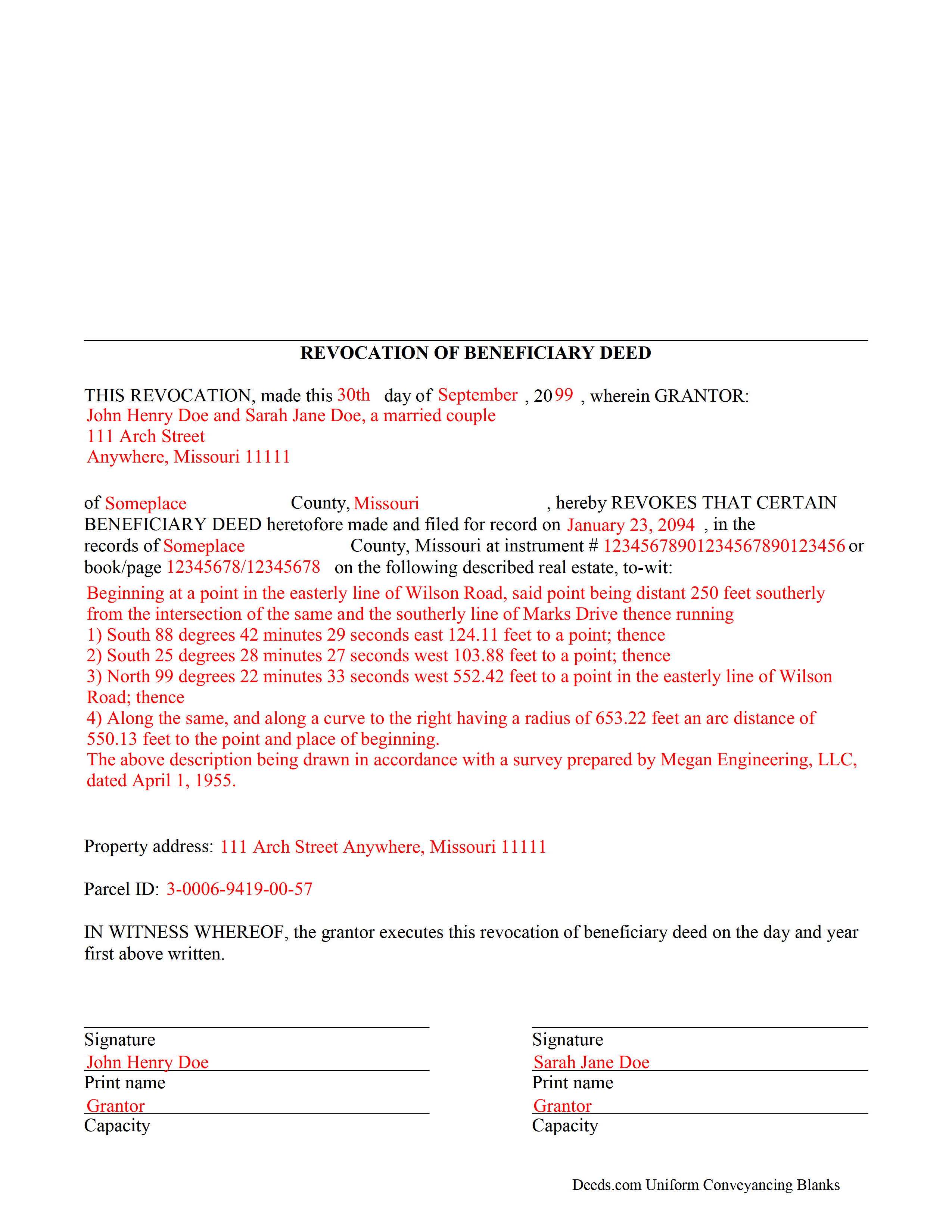

Saline County Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Saline County documents included at no extra charge:

Where to Record Your Documents

Saline County Recorder of Deed

Marshall, Missouri 65340

Hours: 8:00 to 12:00 & 1:00 to 4:30 M-F

Phone: (660) 886-2677

Recording Tips for Saline County:

- Documents must be on 8.5 x 11 inch white paper

- Request a receipt showing your recording numbers

- Recording fees may differ from what's posted online - verify current rates

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Saline County

Properties in any of these areas use Saline County forms:

- Arrow Rock

- Blackburn

- Gilliam

- Malta Bend

- Marshall

- Miami

- Nelson

- Slater

- Sweet Springs

Hours, fees, requirements, and more for Saline County

How do I get my forms?

Forms are available for immediate download after payment. The Saline County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Saline County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saline County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Saline County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Saline County?

Recording fees in Saline County vary. Contact the recorder's office at (660) 886-2677 for current fees.

Questions answered? Let's get started!

One of the many useful aspects of the Nonprobate Transfers Law of Missouri (RSMo Sections 461.003 to 461.081) is the option to revoke a previously recorded beneficiary deed. Revocation is specifically addressed in RSMo 431.033. The option to revoke is possible for several reasons: the grantor is not required to notify the beneficiary of the potential future interest; there is no consideration given in exchange for property rights; and the transfer of ownership is not completed until the grantor or grantors have all died. As a result, the named beneficiary has no actual interest in the real estate.

A grantor on a beneficiary deed may change or revoke beneficiary designations at will, and with no obligation to the individuals named as beneficiaries on the deed. To accomplish this, the original grantor (or grantors) may record a signed, notarized notice of revocation with the same office that accepted the original beneficiary deed. While effective, real estate that is not re-conveyed under a new beneficiary deed reverts back to the grantor's estate at his/her death, and is then distributed via the probate process. Alternately, the grantor may execute a new beneficiary deed, designating someone else as the beneficiary. Recording the new deed removes the prior beneficiary's name and replaces it, identifying the current beneficiary's information.

Note that any change in beneficiary designation must be executed and submitted for recordation during the grantor's lifetime.

(Missouri Revocation of BD Package includes form, guidelines, and completed example)

Important: Your property must be located in Saline County to use these forms. Documents should be recorded at the office below.

This Revocation of Beneficiary Deed meets all recording requirements specific to Saline County.

Our Promise

The documents you receive here will meet, or exceed, the Saline County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saline County Revocation of Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Alison B.

March 17th, 2021

The Deed of trust form was fine but the promissory note was less user friendly since I needed to change a few things that were fixed in the template. I ended up using white-out after I got no response when I emailed the help site that was provided in one of your emails, so it looks a little odd but should be usable

Thank you for your feedback. We really appreciate it. Have a great day!

Judith O.

January 13th, 2019

Unfortunately, it wasn't the information I needed. I wanted something that could remove my husbands name on our deed, because he passed away last month.

Sorry to hear about your situation Judith. The document you selected is one that would need to be used during the grantor's lifetime. Under the circumstances, we have canceled your order and refunded your payment.

Justin S.

September 2nd, 2022

Very useful information

Thank you!

Michael T.

October 17th, 2019

Good site. Two things to note. 1. The Documentary Transfer Tax Exemption sheet, the word "computer" is used when I think it should be "computed" Error in state form? 2. The California Trust Guide could have a watermark which is less distracting. Kind of hard to read the print with the DEEDS.COM logo so prominent.

Thank you for your feedback. We really appreciate it. Have a great day!

Khadija K.

March 2nd, 2023

Great Service. Not only the required form, but also the state guidelines. Thank you for making it easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark E.

April 25th, 2024

This was easy to use and only contained one glaring error-where to send the completed form to finish the process. I’ve completed the form, does this mean I get the amended deed sent to me? I think not.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Terri A B.

July 17th, 2025

The process was easy and cost was reasonable. My only suggestion is to allow user the ability to shorten the space between the county and state and the space after the month. I needed to draw a line at the courthouse before they would file it.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Theresa M.

August 12th, 2023

Simple and quick service!!

Thank you!

james h.

June 15th, 2020

Service was quick and easy to use. I got not only the necessary forms, but instructions and sample forms filled out. Highly recommended.

Thank you!

Gerlinde H.

June 18th, 2019

This was fantastic. I downloaded the document, filled it out, printed it, had it notarized and drove to the recorders office and had it recorded within less than 15 minutes. Instructions are precise and easy to understand. You saved me hundreds of dollars a lawyer would have charged for the same work.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JJ G.

September 18th, 2020

Was very easy and helpful. No going down to the courthouse

Thank you!

Sarah A.

August 3rd, 2020

Uploading the document was simple, and it was recorded much faster than I thought! Deeds.com makes the process incredibly easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sylvia H.

December 20th, 2023

I appreciated the fact that all the forms I needed were available, and even some I don't need right now but will need in the future (homestead exemption) were also available. And the price is very good. Thank you

Your kind words have brightened our teams day! Thank you for the positive feedback.

Armando R.

February 17th, 2021

Great service, quick and affordable. Thank you!

Thank you!

Howard K.

October 19th, 2020

Great products, quick downloads, the "guides" are extremely helpful. Overall 5 stars!

Thank you!