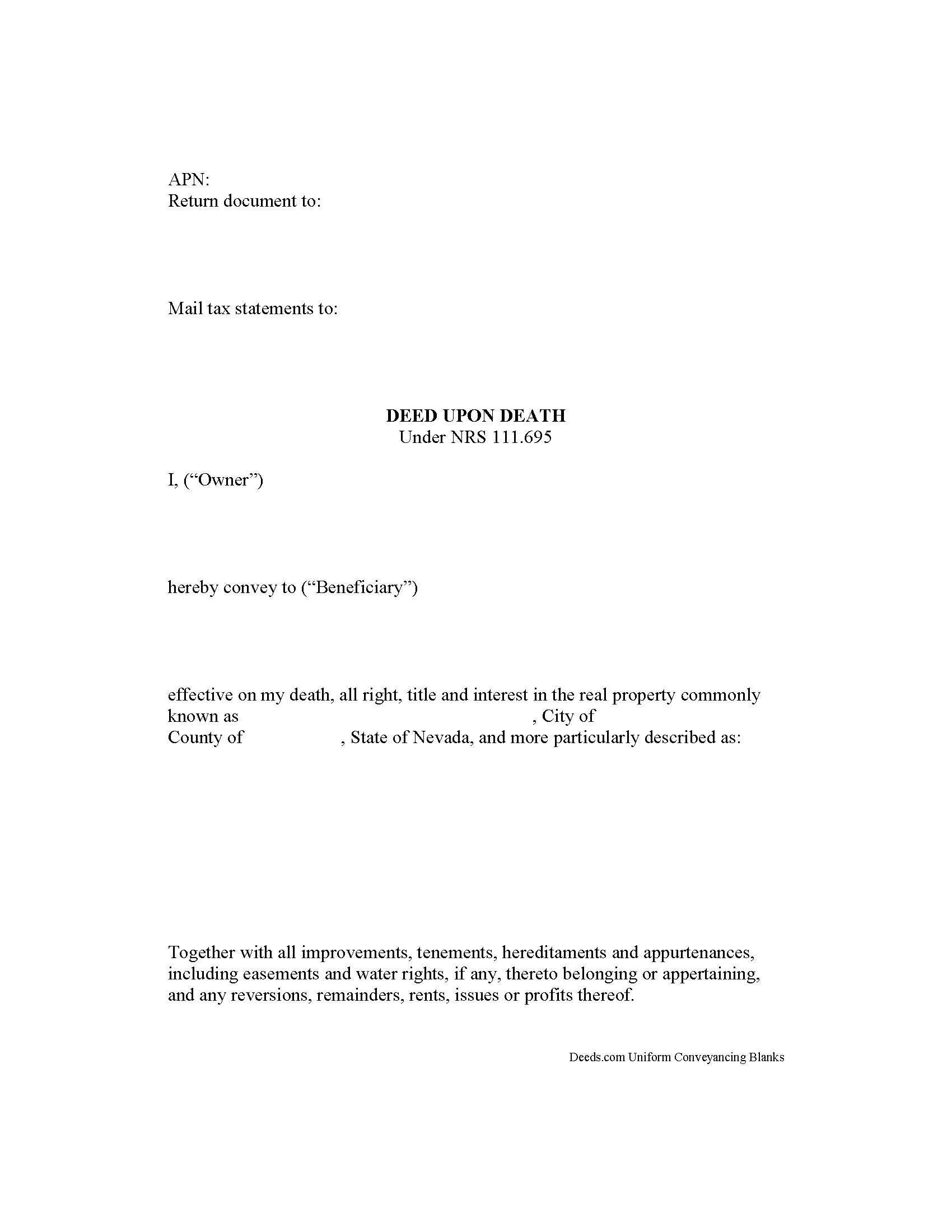

Washoe County Transfer on Death Deed Form

Washoe County Transfer on Death Deed

Fill in the blank form formatted to comply with all recording and content requirements.

Washoe County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

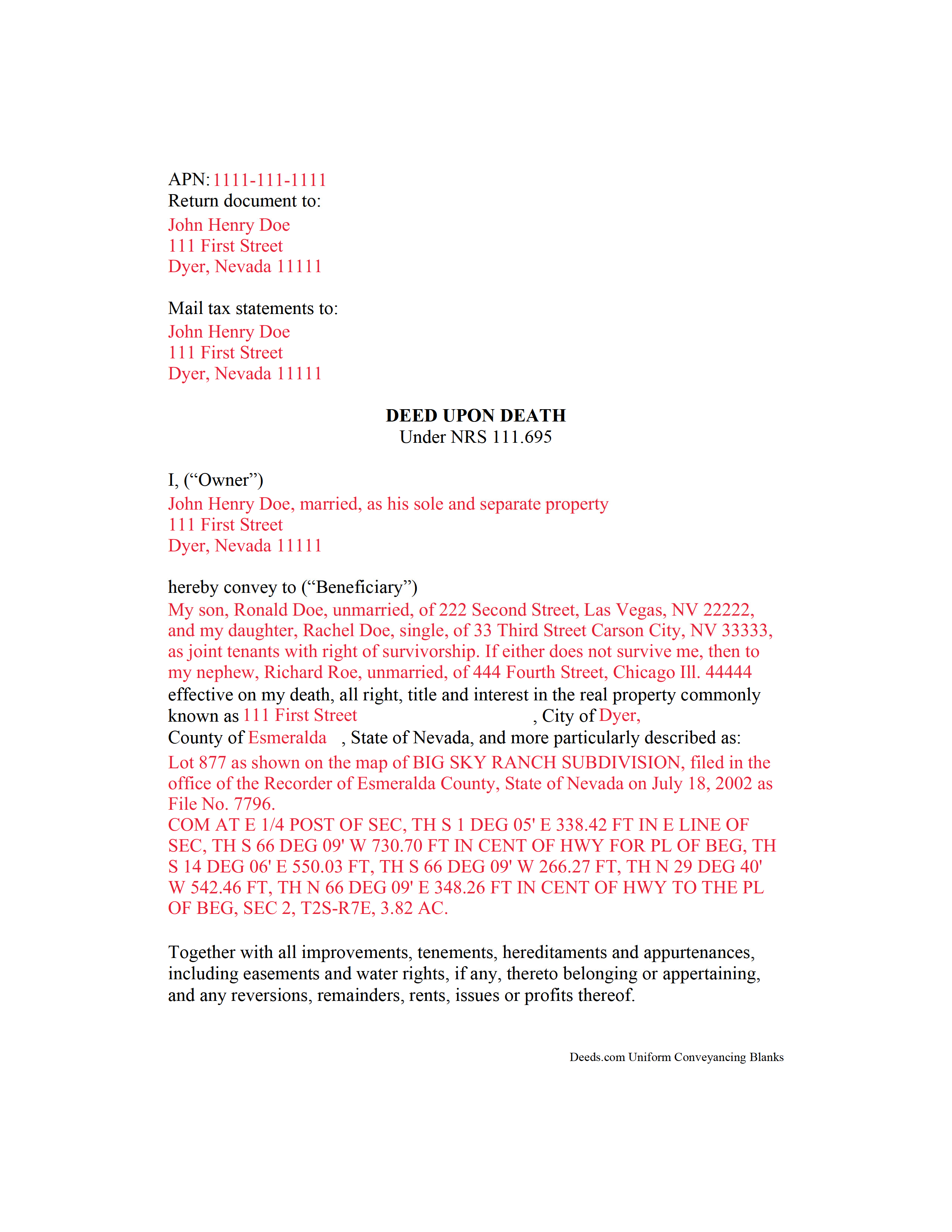

Washoe County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Washoe County documents included at no extra charge:

Where to Record Your Documents

Washoe County Recorder

Reno, Nevada 89512

Hours: 8:00 to 5:00 M-F

Phone: (775) 328-3661

Recording Tips for Washoe County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Documents must be on 8.5 x 11 inch white paper

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Washoe County

Properties in any of these areas use Washoe County forms:

- Crystal Bay

- Empire

- Gerlach

- Incline Village

- Nixon

- Reno

- Sparks

- Sun Valley

- Verdi

- Wadsworth

- Washoe Valley

Hours, fees, requirements, and more for Washoe County

How do I get my forms?

Forms are available for immediate download after payment. The Washoe County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Washoe County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Washoe County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Washoe County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Washoe County?

Recording fees in Washoe County vary. Contact the recorder's office at (775) 328-3661 for current fees.

Questions answered? Let's get started!

Nevada's statutory transfer on death instrument for real property is called a deed upon death. It is governed by NRS 111.655-111.699 (2013), inclusive, and incorporates the Uniform Real Property Transfer on Death Act into its text. Like other transfer on death deeds, THE EXECUTED DEED, AS WELL AS ANY CHANGES OR REVOCATIONS, MUST BE RECORDED IN THE COUNTY WHERE THE LAND IS LOCATED, DURING THE OWNER'S NATURAL LIFE.

Transfer on death deeds/deeds upon death make it possible for owners of real estate in Nevada to convey their land to one or more designated beneficiaries after their death, with no need to subject the property to probate distribution. Significantly, transfers included in deeds upon death are not affected by directions included in wills. As such, these deeds comprise only one part of a regularly updated overall estate plan.

When correctly executed and recorded, a deed upon death only contains a potential future interest in the property, so there is no requirement to pay consideration or to give notice to any named beneficiary. In addition, the owner retains absolute control over the property, including the right to change beneficiary designations, revoke the deed, sign sales, rental, or mortgage agreements, and use the land in any other lawful way without penalty.

After the owner's death, the surviving beneficiary claims the property by recording an affidavit of death of grantor, along with an official copy of the owner's death certificate. Alternately, if the beneficiary is unable or unwilling to accept the transfer, the statutes provide a method to disclaim it.

Overall, Nevada's deed upon death offers a flexible tool for estate planning. Because each circumstance is unique, take the time to fully understand the benefits and drawbacks that accompany these documents, including the potential impact on taxes, benefit eligibility and repayment, and other financial concerns. Contact a local attorney with specific questions or for complex situations.

(Nevada TOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Washoe County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Washoe County.

Our Promise

The documents you receive here will meet, or exceed, the Washoe County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Washoe County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Anne G.

April 6th, 2020

I used deeds.com's services for the first time while the Stay at Home Order is in effect and found it to be very user friendly and seamless. I am very impressed.

Thank you Anne, glad we could help.

Kristopher K.

October 22nd, 2021

Process is easy but system would not accept 3 different credit cards on first day. No phone number to call. Sent message and response was all 3 cards must have been declined. However, next day one of those cards went through with no problem.

Thank you for your feedback. Unfortunately we have no control over which payment get approved or declined.

Valerie C.

May 1st, 2022

Thanks

Thank you!

Roland P.

December 28th, 2021

The website is easy to navigate. Unfortunately, you were not able to record the deed. However, I appreciate the fast response.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy A.

April 24th, 2024

This is an excellent resource. I was surprised because the price is so low I thought the products might be inferior. Not only were were the requested documents high quality, additional unrequested documents were added to my order that I didn't realize I would need until I read them. I especially appreciate that all the documents were specific to my county. I highly recommend using deeds.com.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

TIFFANY C.

May 20th, 2020

It would be nice if the notary State was fillable, we are having to notarize in another State. Also, need more room to add 2 beneficiaries with two different addresses.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael S.

July 11th, 2019

So far, I'm happy with my experience. I'm still reviewing the guide for the docs I downloaded. Including the guide for the docs is indeed a plus.

Thank you Michael, we really appreciate your feedback.

Joy Lynn W.

December 31st, 2020

Timely response and helpful....good job!

Thank you!

Cynthia D.

May 22nd, 2021

It turned out I didn't need the information was taken care of by my husband. Thank you.

Thank you!

Virginia S.

October 24th, 2021

Very quick process and forms were downloaded. I am very pleased with the detailed information for filling out the forms. Would use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terry S.

March 23rd, 2022

Worked well for us except for not being able to edit. Got it completed and recorded with the county clerk! Having the instructions and example made it easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Troy B.

July 8th, 2020

Very pleased with website very simple to navigate through

Thank you for your feedback. We really appreciate it. Have a great day!

Debra K.

January 16th, 2019

Very happy with forms downloaded. Well worth the price. Could not find them anywhere else on the web. Also had easy to understand instructions and a demo form as a guide

Thank you Debra, we appreciate your feedback. Have a wonderful day!

Kathleen H.

August 10th, 2019

EASY!!

Thank you!

Jerome K.

July 2nd, 2021

Very Fast and simple process for finding documents and downloading

Thank you!