Nassau County Disclaimer of Interest Form

Nassau County Disclaimer of Interest Form

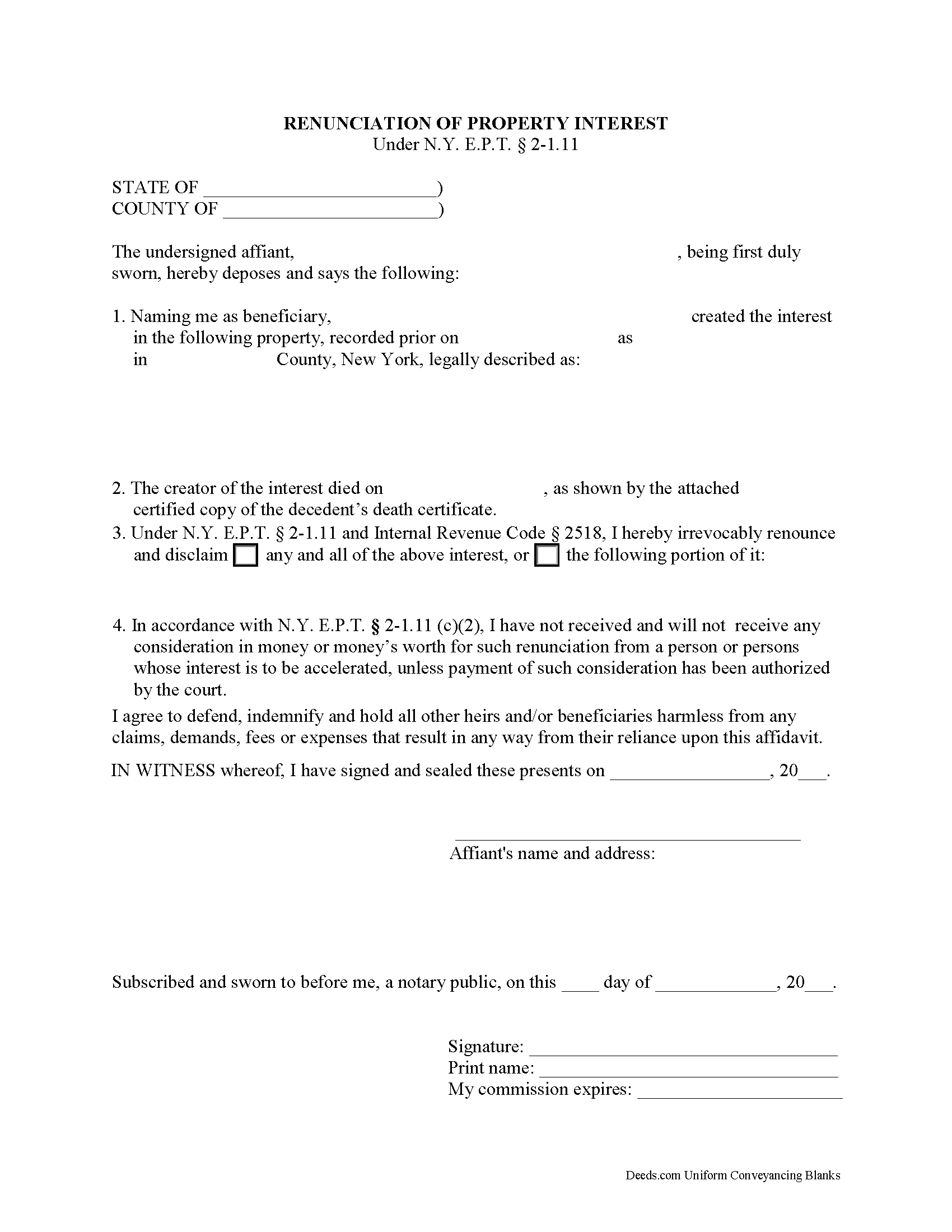

Fill in the blank form formatted to comply with all recording and content requirements.

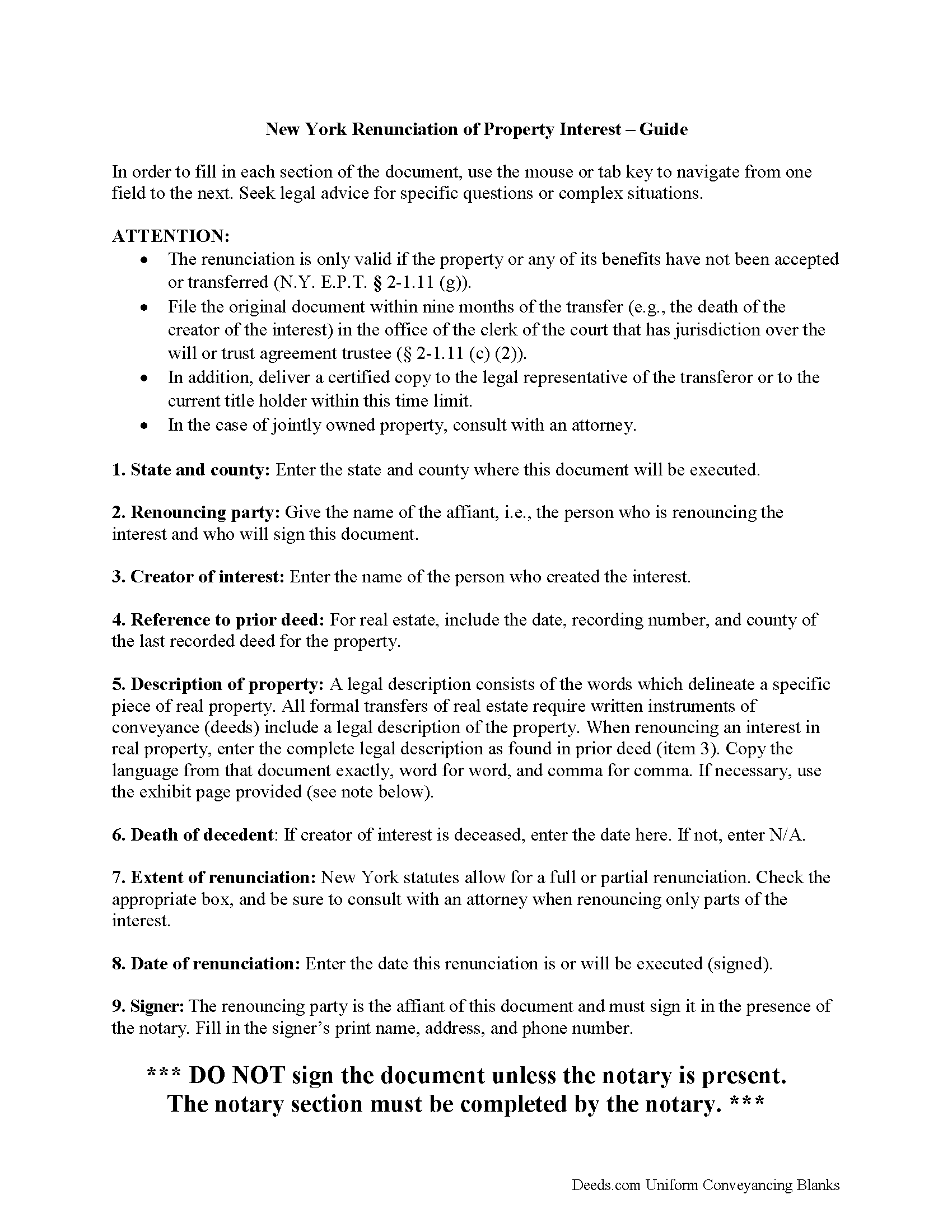

Nassau County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

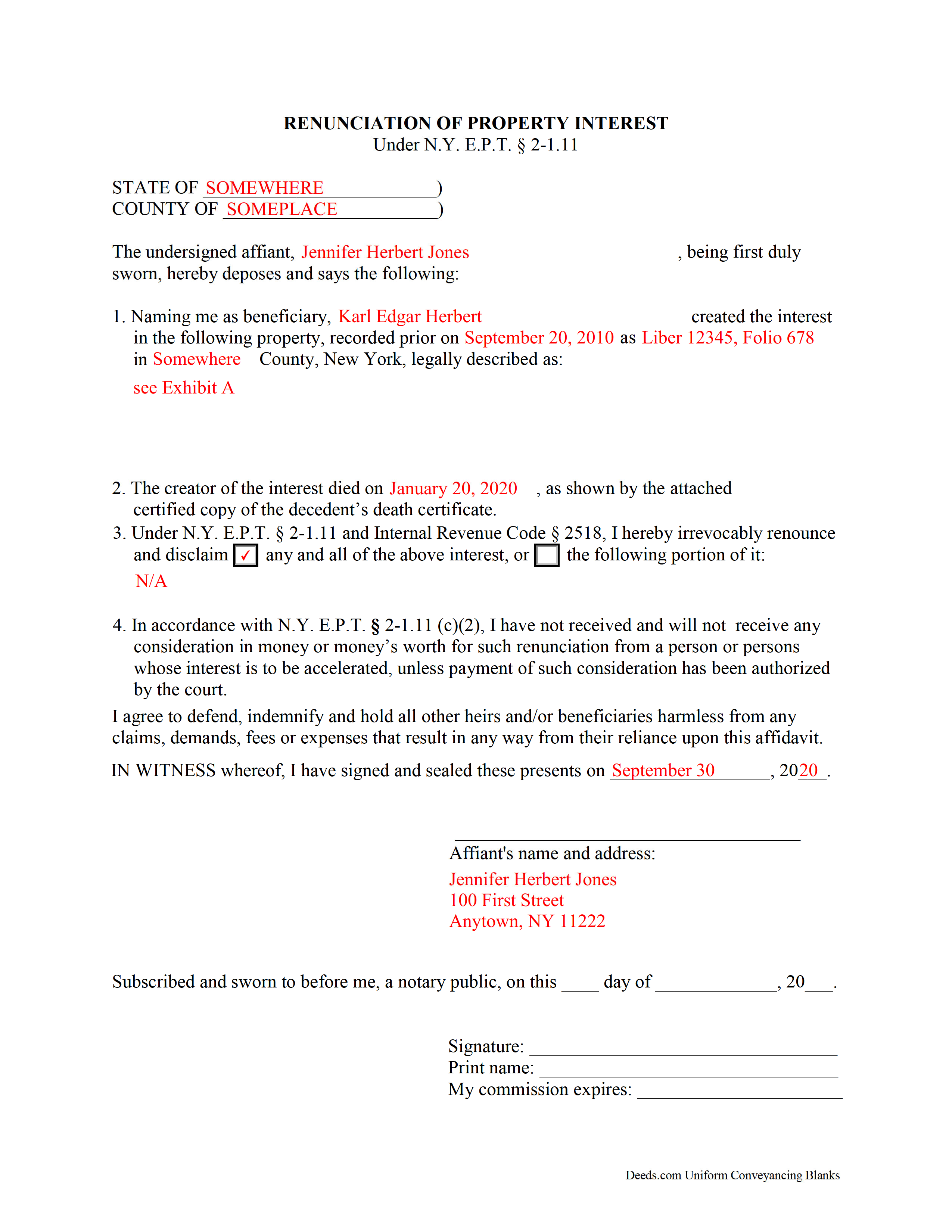

Nassau County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Nassau County documents included at no extra charge:

Where to Record Your Documents

Nassau County Clerk

Mineola, New York 11501

Hours: Mon - Fri 9:00am to 5:00pm / Tue until 7:00pm

Phone: (516) 571-2660

Recording Tips for Nassau County:

- Double-check legal descriptions match your existing deed

- Documents must be on 8.5 x 11 inch white paper

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Nassau County

Properties in any of these areas use Nassau County forms:

- Albertson

- Atlantic Beach

- Baldwin

- Bayville

- Bellmore

- Bethpage

- Carle Place

- Cedarhurst

- East Meadow

- East Norwich

- East Rockaway

- Elmont

- Farmingdale

- Floral Park

- Franklin Square

- Freeport

- Garden City

- Glen Cove

- Glen Head

- Glenwood Landing

- Great Neck

- Greenvale

- Hempstead

- Hewlett

- Hicksville

- Inwood

- Island Park

- Jericho

- Lawrence

- Levittown

- Locust Valley

- Long Beach

- Lynbrook

- Malverne

- Manhasset

- Massapequa

- Massapequa Park

- Merrick

- Mill Neck

- Mineola

- New Hyde Park

- Oceanside

- Old Bethpage

- Old Westbury

- Oyster Bay

- Plainview

- Point Lookout

- Port Washington

- Rockville Centre

- Roosevelt

- Roslyn

- Roslyn Heights

- Sea Cliff

- Seaford

- Syosset

- Uniondale

- Valley Stream

- Wantagh

- West Hempstead

- Westbury

- Williston Park

- Woodbury

- Woodmere

Hours, fees, requirements, and more for Nassau County

How do I get my forms?

Forms are available for immediate download after payment. The Nassau County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Nassau County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Nassau County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Nassau County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Nassau County?

Recording fees in Nassau County vary. Contact the recorder's office at (516) 571-2660 for current fees.

Questions answered? Let's get started!

Renouncing Inherited Property in New York

A beneficiary of an interest in property in New York can disclaim a bequeathed asset or power (New York State Code, Estates, Powers, and Trusts, Article 2, 1.11). Such a renunciation, which must be in writing and signed by the beneficiary or a legally authorized representative, allows that beneficiary to disclaim his or her interest in the property, either in full or partially (1.11 (c) (1), 1.11 (f)).

The renunciation is only valid if the beneficiary has not indicated acceptance of the property, for example, through transfer or encumbrance, acceptance of any payment, or other actions (1.11 (g)). It must be acknowledged by a notary and accompanied by an affidavit stating that the beneficiary is not receiving monetary consideration in exchange for the renunciation (1.11 (c) (2)).

The statutes provide a nine-month window, to be extended at the discretion of the court, during which the beneficiary must file the renunciation document with the surrogate court in the county where the will or estate is being administered. The document must also be delivered to the fiduciary or administrator of the estate, or to the person holding legal title to the property (1.11 (c) (2)).

A renunciation is irrevocable (1.11 (h)) and has the same effect as though the beneficiary "had predeceased the creator or the decedent" (1.11 (e)). So, consult an attorney when in doubt about the drawbacks and benefits of renouncing inherited property.

(New York DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Nassau County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Nassau County.

Our Promise

The documents you receive here will meet, or exceed, the Nassau County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Nassau County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Elliot M V.

July 28th, 2021

Easy to use

Thank you!

Martin P.

April 6th, 2019

The DEEDs website is very easy to navigate and find the required documents. I have not yet had an opportunity to review the documents I purchased and downloaded. That is the reason I have assigned a rating of four stars. I fully hope that can raise my rating to five stars after I've used those documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles C.

November 2nd, 2020

I found this site to be very easy to use . I found and printed what I needed in just a few minutes after getting on the sit . Good work setting up this site . Thank you .

Thank you!

Cleatous S.

December 9th, 2020

The deed form is hard to fill in. There is no way to fill in the county in the "reviewed by" section. Also, there is no place for the Grantee's address on the form. I had to include it in the fill-in space for the legal description.

Thank you!

Clint J.

March 23rd, 2021

Deeds.com is a great way for people that are unfamiliar with legal documents to get things done. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joy N.

February 22nd, 2024

As a real estate professional, I've had the opportunity to use various legal form providers over the years, but none have matched the quality and user-friendliness of Deeds.com's real estate legal forms. The forms themselves are comprehensive, up-to-date, and in line with current real estate laws and regulations, which is paramount in our field. The clarity and thoroughness of the documentation ensured that I could complete with confidence, knowing that every detail was covered. I wholeheartedly recommend their services and look forward to continuing our partnership.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Sherry P.

November 24th, 2020

It would be helpful to have a frequently asked questions section. That would make it easier to know I have the correct form. Sherry

Thank you for your feedback. We really appreciate it. Have a great day!

Joey S.

March 5th, 2022

This is the easiest process ever!

Thank you!

Jeffrey B.

August 1st, 2021

Love Deeds.com! I was a little confused as to how to go about Quitclaiming, but you made it very easy! Thank you SO much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nora B.

April 15th, 2019

VERY NICE SERVICE

Thank you for your feedback. We really appreciate it. Have a great day!

Erik H.

July 16th, 2020

tl;dr - Bookmarked and anticipating using this site for years to come. My justification for rating 5/5 1. Provide intuitive method for requesting property records. 2. Cost for records *seems reasonable. 3. They clearly state that interested parties could gather these records at more affordable costs through the county (which was more confusing for an inexperienced person such as myself). I mean, I appreciate and respect this level of honesty. *I didn't shop around too much because it was difficult for me to find other services that could deliver CA property records.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brenda B.

January 6th, 2019

Excellent transaction.

Thank you Brenda.

Travis S.

May 6th, 2023

I couldn't even look for a deed because the website said that deed/title searching wasn't available. Very disappointed about it.

I'm sorry to hear that you had a disappointing experience with the website's deed/title searching feature. It can be frustrating when a feature you were hoping to use isn't available.

We do hope that you found what you were looking for elsewhere.

Tommie G.

March 11th, 2021

I saved 225.00 with this purchase.Make sure you have an updated property description from your county tax collectors' office.In Bay county,Florida the tax office will email you an updated property description.I attached the email to the the deed.I had to change the date and they accepted a white out and ink correction on your form.

Thank you for your feedback. We really appreciate it. Have a great day!

Marvin C.

December 23rd, 2023

My client needed to provide a statutory Oklahoma Memorandum of Trust. I was able to provide her with the form quickly and inexpensively.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!