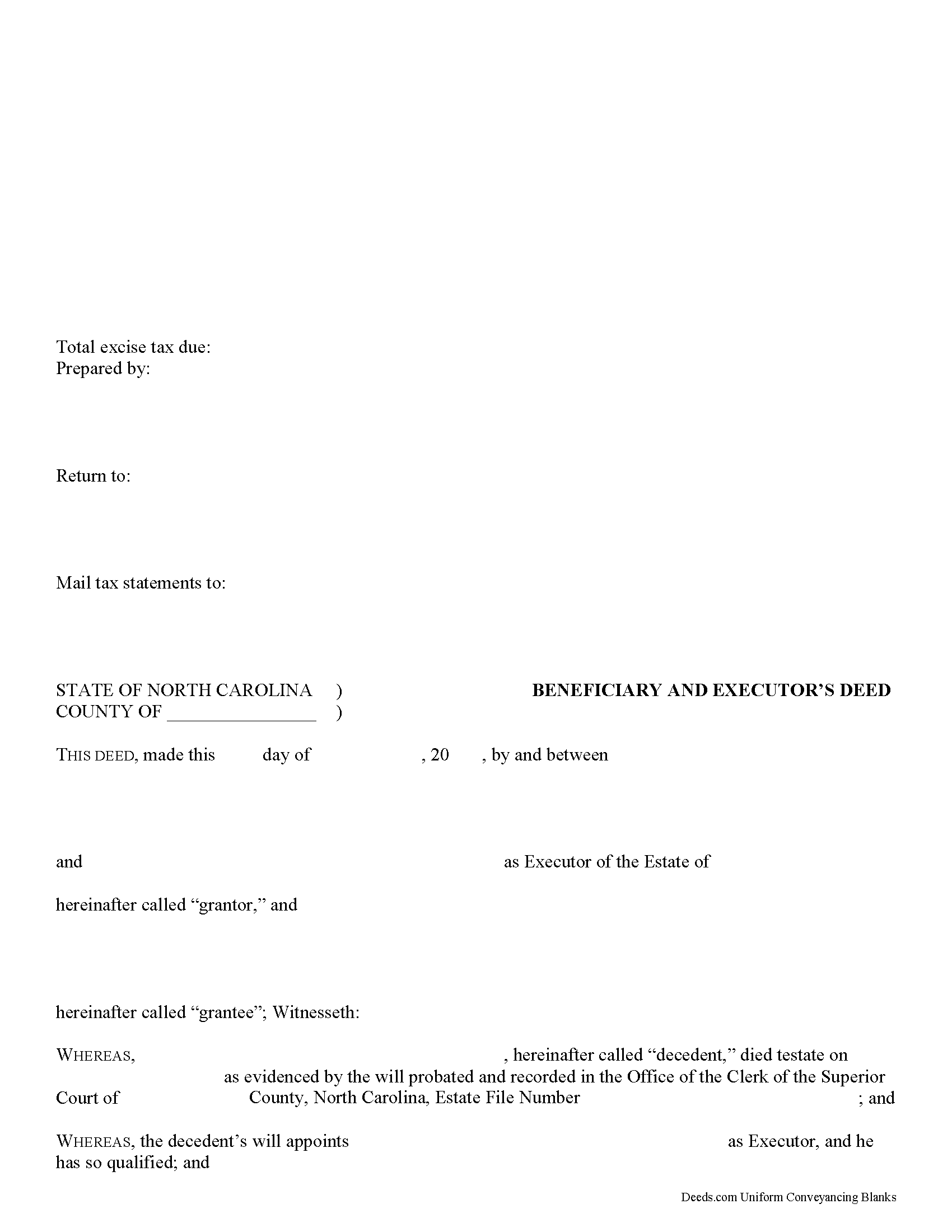

Nash County Beneficiary and Executor Deed Form

Nash County Beneficiary and Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

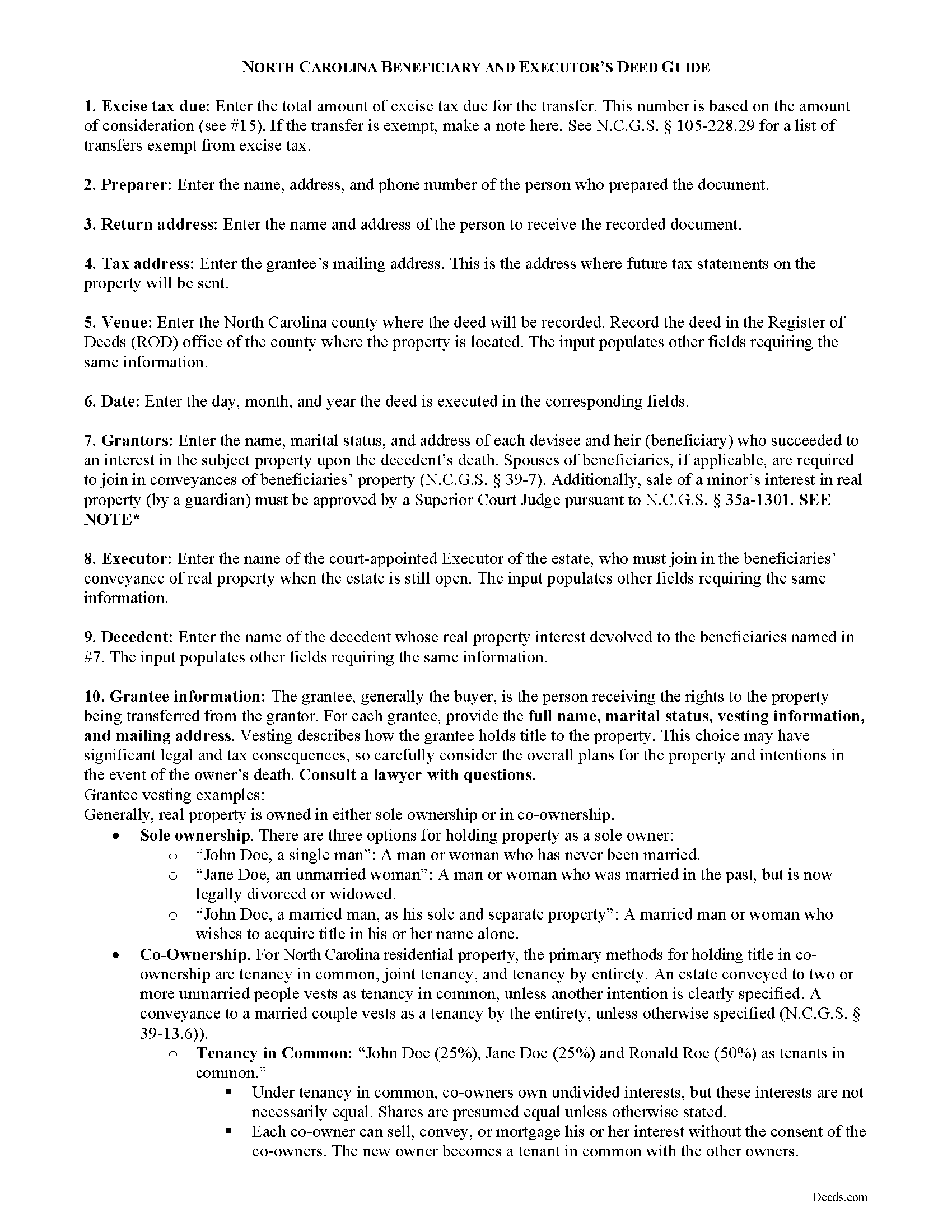

Nash County Beneficiary and Executor Deed Guide

Line by line guide explaining every blank on the form.

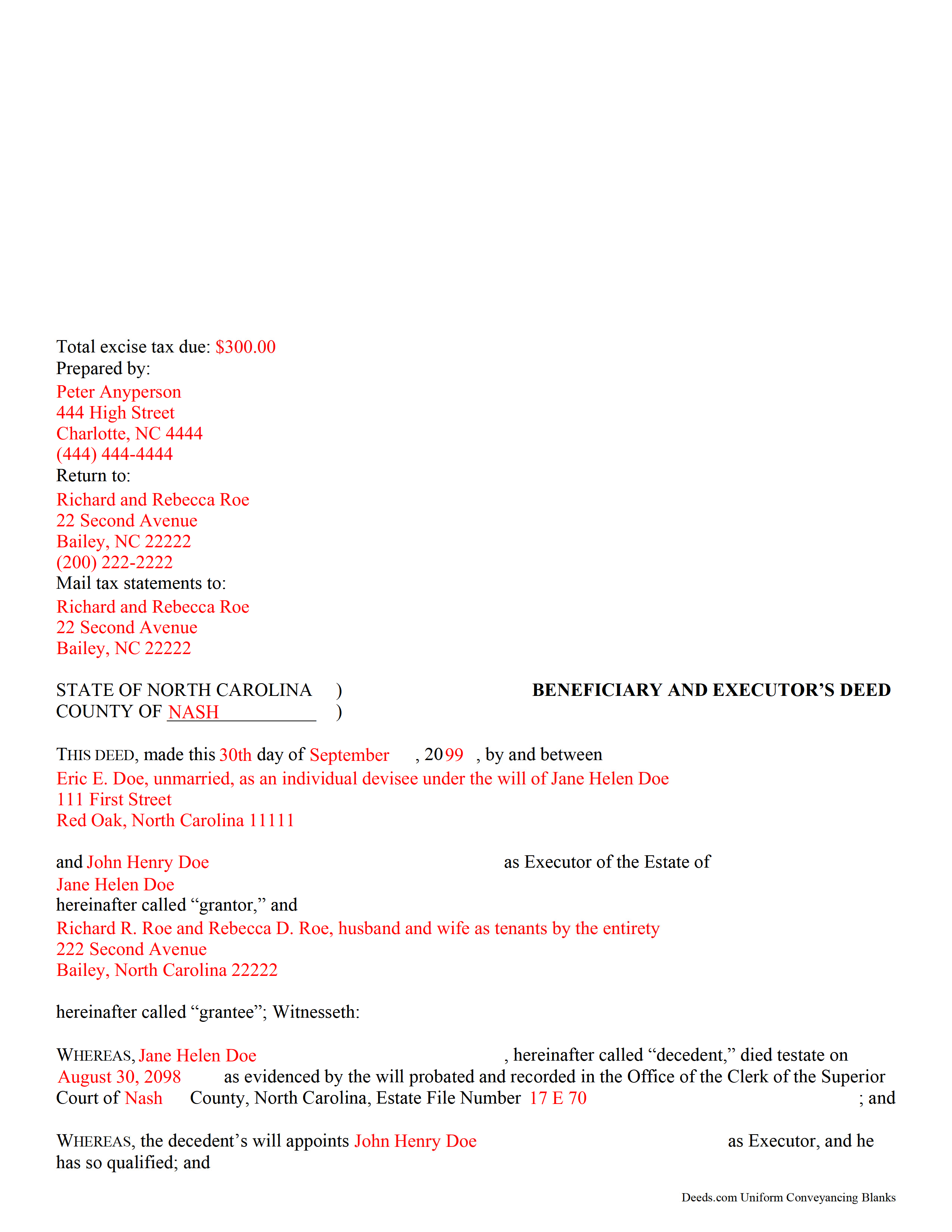

Nash County Completed Example of the Beneficiary and Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Nash County documents included at no extra charge:

Where to Record Your Documents

Nash County Register of Deeds

Nashville, North Carolina 27856

Hours: 8:00 to 5:00 M-F

Phone: (252) 459-9836

Recording Tips for Nash County:

- Request a receipt showing your recording numbers

- Recorded documents become public record - avoid including SSNs

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Nash County

Properties in any of these areas use Nash County forms:

- Bailey

- Castalia

- Middlesex

- Nashville

- Red Oak

- Rocky Mount

- Sharpsburg

- Spring Hope

- Whitakers

Hours, fees, requirements, and more for Nash County

How do I get my forms?

Forms are available for immediate download after payment. The Nash County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Nash County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Nash County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Nash County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Nash County?

Recording fees in Nash County vary. Contact the recorder's office at (252) 459-9836 for current fees.

Questions answered? Let's get started!

Probate is the legal process of proving a decedent's (deceased person's) will, if any, valid and settling his or her estate. An executor is the personal representative named in the decedent's will to administer his or her estate.

When the estate's assets are not sufficient to pay debts, the executor may need to petition the superior court where the estate is open to obtain an order to sell the decedent's real property. In North Carolina, title to real property vests in the decedent's heirs upon death, and a special proceeding is required to bring the property into the estate.

The beneficiary and executor's deed is an instrument executed by a decedent's heirs and joined by the executor of the decedent's will to convey an interest in real property from a testate estate (so called when the decedent leaves a will) to a purchaser.

When the estate is still open in probate, the executor joins in the deed consenting to the sale of the real property described within as required by N.C.G.S. 28A-17-12. By signing the deed, the executor waives the possibility of opening a special proceeding to bring the property back into the estate later.

Unless a) the decedent wills the realty to the executor or directs to the executor to sell the realty with only the proceeds of the sale directed to devisees, or b) the will confers a power of sale upon the executor and devises the property to the estate (and not a devisee), heirs must execute the deed for a valid transfer. Because title is legally vested in them, the executing heirs may make warranties of title, but the executor typically does not. Any warranty language included in the deed is binding on the heirs.

Recitals of a beneficiary and executor's deed include a statement that the decedent died testate and information regarding the probated will, including the date of death, the county of probate, and the file number assigned to the decedent's estate by the clerk of superior court. In addition, the deed contains statements that the executor named within was appointed by the decedent's will and is duly qualified to administer the estate; that a notice to creditors has been given and the estate is still open; and that the executor joins to evidence consent to the sale.

A lawful deed in North Carolina states the consideration made for the transfer of title, contains an accurate legal description of the subject parcel, recites the grantor's source of title, and indicates whether the property conveyed comprises any part of the primary residence of the grantor. When properly executed and recorded, the beneficiary and executor's deed vests title to the within-described property in the named grantee(s). For a valid beneficiary and executor's deed, the signatures of heirs and their spouses must be present to release homestead rights. Any restrictions to the transfer should be noted in the body of the deed.

Both the heirs' signatures and the executor's signature must be acknowledged in the presence of a notarial official before the deed can be recorded in the county where the subject property is located. An affidavit of consideration or value is required for deeds recorded in Currituck County.

Consult an attorney licensed in the State of North Carolina with questions regarding beneficiary and executor's deeds, as each situation is unique.

(North Carolina B&ED Package includes form, guidelines, and completed example)

Important: Your property must be located in Nash County to use these forms. Documents should be recorded at the office below.

This Beneficiary and Executor Deed meets all recording requirements specific to Nash County.

Our Promise

The documents you receive here will meet, or exceed, the Nash County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Nash County Beneficiary and Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Lynn B.

June 15th, 2022

Their customer service is impressive to say the least. I sent them an email and I received a response that the issue had been resolved in under an hour. They even apologized for the inconvenience. I haven't used the forms I purchased yet but if they are anything like their Customer service, I know I will be extremely satisfied with my purchase. I will definitely return here for ALL my needs they can provide for in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Kari G.

July 15th, 2021

The service was prompt and attentive to my questions. I would've just appreciated a heads up that I also needed to contact the county directly (and provide contact info) to receive a certified copy of the document (Notice of Commencement) in order to submit the certified copy to the Building Department. This was an extra step that I haven't had to complete before using another eRecording service. Even if this extra step is a result of the county's system. I would still have expected a head's up (since there wasn't any info regarding this on the county's site for eRecording).

Thank you for your feedback. We really appreciate it. Have a great day!

Scott S.

November 20th, 2020

This is the best resource I have found for documents related to beneficiary deeds!

Thank you!

Donna G.

April 26th, 2023

Very happy with this service, comprehensive detailed instructions as well as correct forms for my location

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Herman B.

May 19th, 2022

Special Warranty Deed I can't seem to type all my info in the blank spaces. It won't allow me to type any more. Maybe you should consider either allowing typists to type more (leaving more space) or allowing more room to type more.

Thank you!

Rebecca H.

May 22nd, 2021

I thought the forms were reasonably priced, the instructions included in the packet were thorough, and the examples helpful. Thank you for the additional CDR forms too. I contacted the Recorder's office via email with a question and Jennifer Bowser answered promptly. Job well done! However, when I delivered the deed and Real Property Transfer Declaration to the Clerk's office in Lafayette, the clerk was unfamiliar with the Declaration document being submitted and it took some time to convince her to submit the form without charging the recording fee. She even tried to phone the recorder's office for clarification, but no one answered. There then was an additional form at that office that I had to complete called Recording Request/Transmittal Form. I would suggest including that form with instructions in your on-line packet to speed up the process when a Deed is delivered to the County Clerk's satellite office. I do not expect every clerk to know all the particulars of recording requirements but a little knowledge wouldn't hurt.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary Ann H.

May 13th, 2020

Great service! Good documents. Easy to use! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

FREDERICK T C.

November 8th, 2021

simple to follow and easy to use. Thanks

Thank you!

Vera P.

May 14th, 2020

An excellent service!

Thank you!

Margaret T.

May 6th, 2022

Had a difficult time finding my download after purchase. Thankfully I had printed the form and had. However it was read only and I'm not experienced enough to be able to change that. So I went into my word program and typed in the form. I should be able to use it for my purpose. Just glad I was finally able to find it after hours of searching online. I'm in my 70's and not real computer intelligent which may have been part of the problem

Sorry to hear of your struggle Margaret, we will try harder to make our forms easier for everyone.

Janet J.

January 17th, 2020

The download process was quick and efficient. Here's hoping the printing process will be as easy. Appreciate this access to forms so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Joey S.

March 5th, 2022

This is the easiest process ever!

Thank you!

Stephen F.

September 3rd, 2020

Easy to use. Outstanding interface.

Thank you!

Colleen B.

September 20th, 2020

Looks good. We will see how it goes.

Thank you!

Tamica D.

April 22nd, 2020

Exceptional service. Thank you for your assistance.

Thank you!