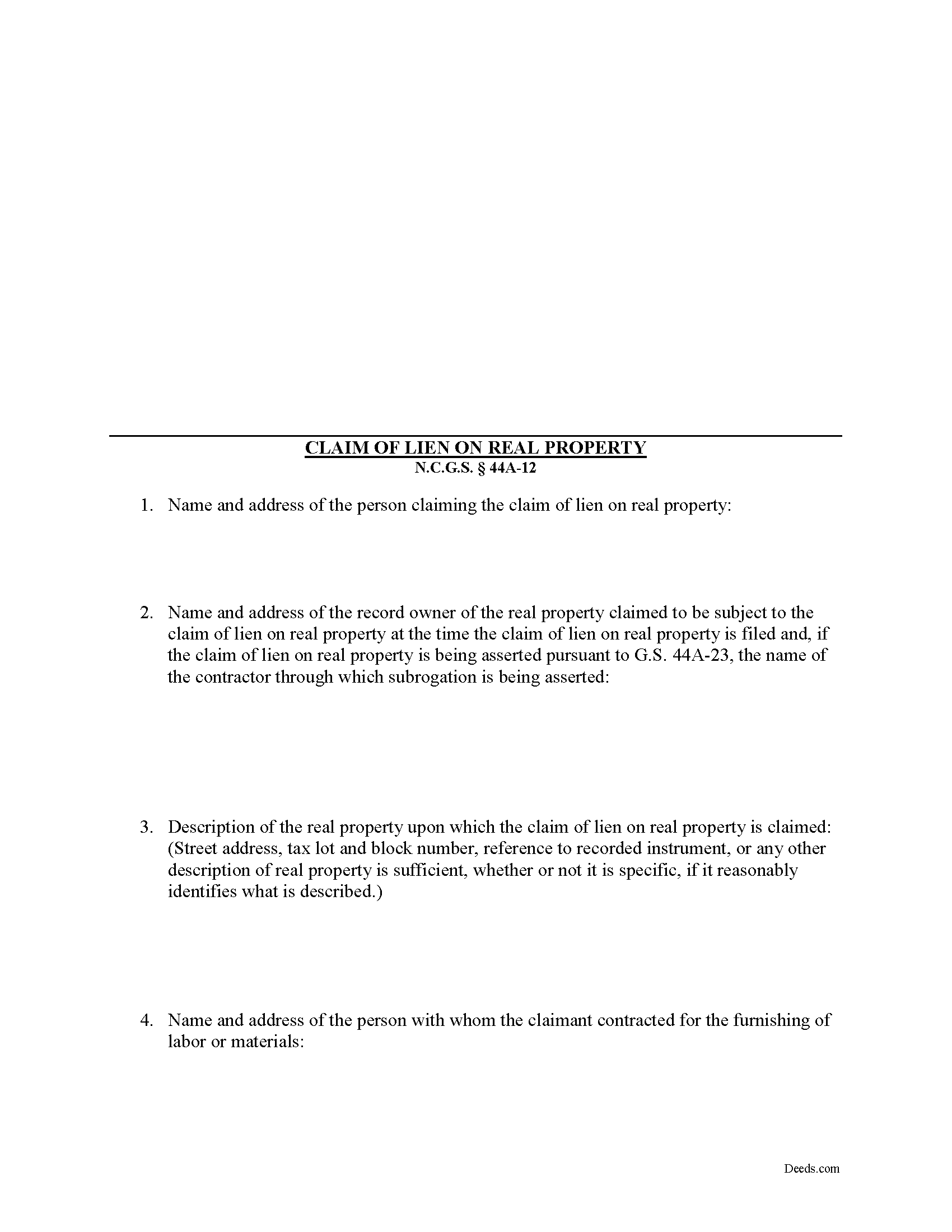

Columbus County Claim of Mechanics Lien Form

Columbus County Claim of Mechanics Lien Form

Fill in the blank Claim of Mechanics Lien form formatted to comply with all North Carolina recording and content requirements.

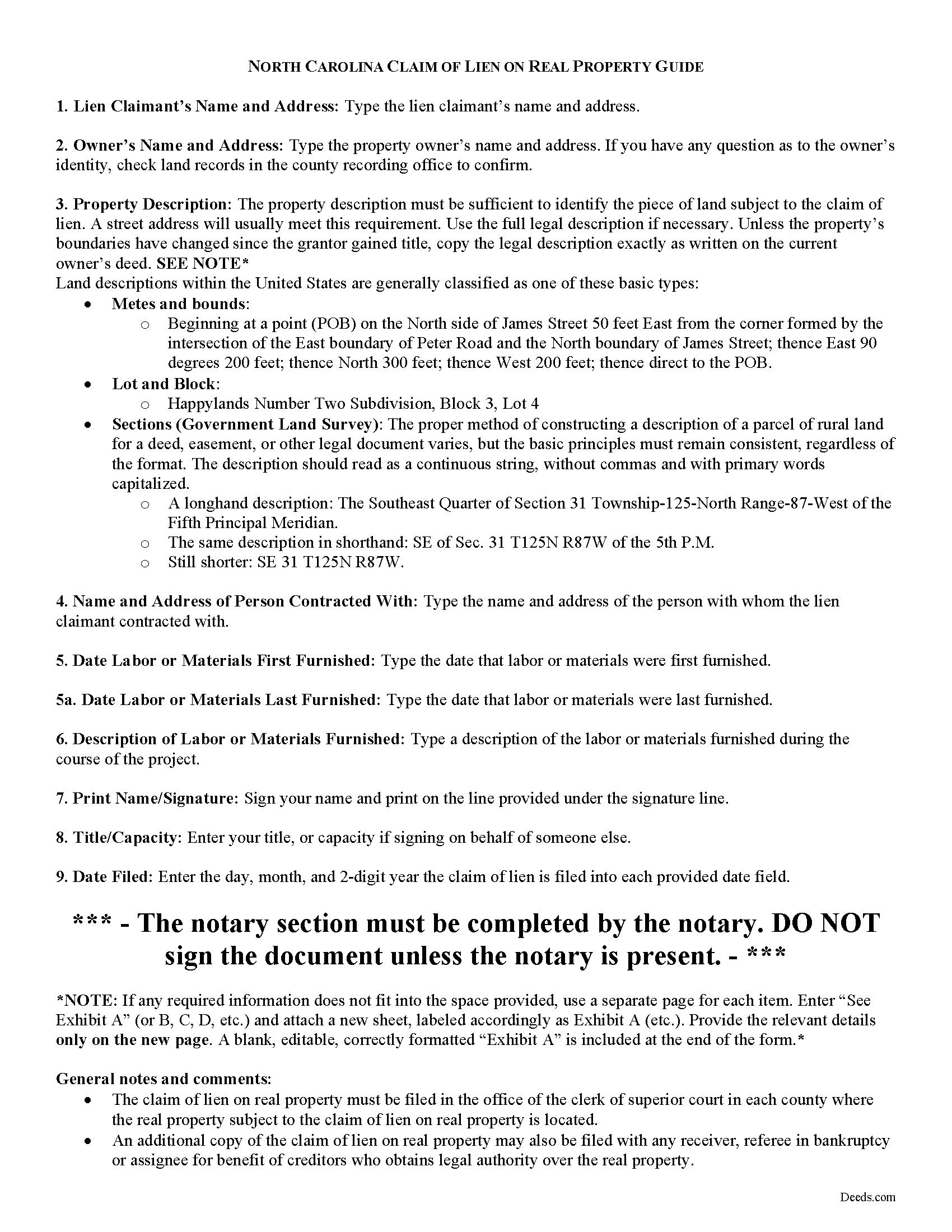

Columbus County Claim of Mechanics Lien Guide

Line by line guide explaining every blank on the form.

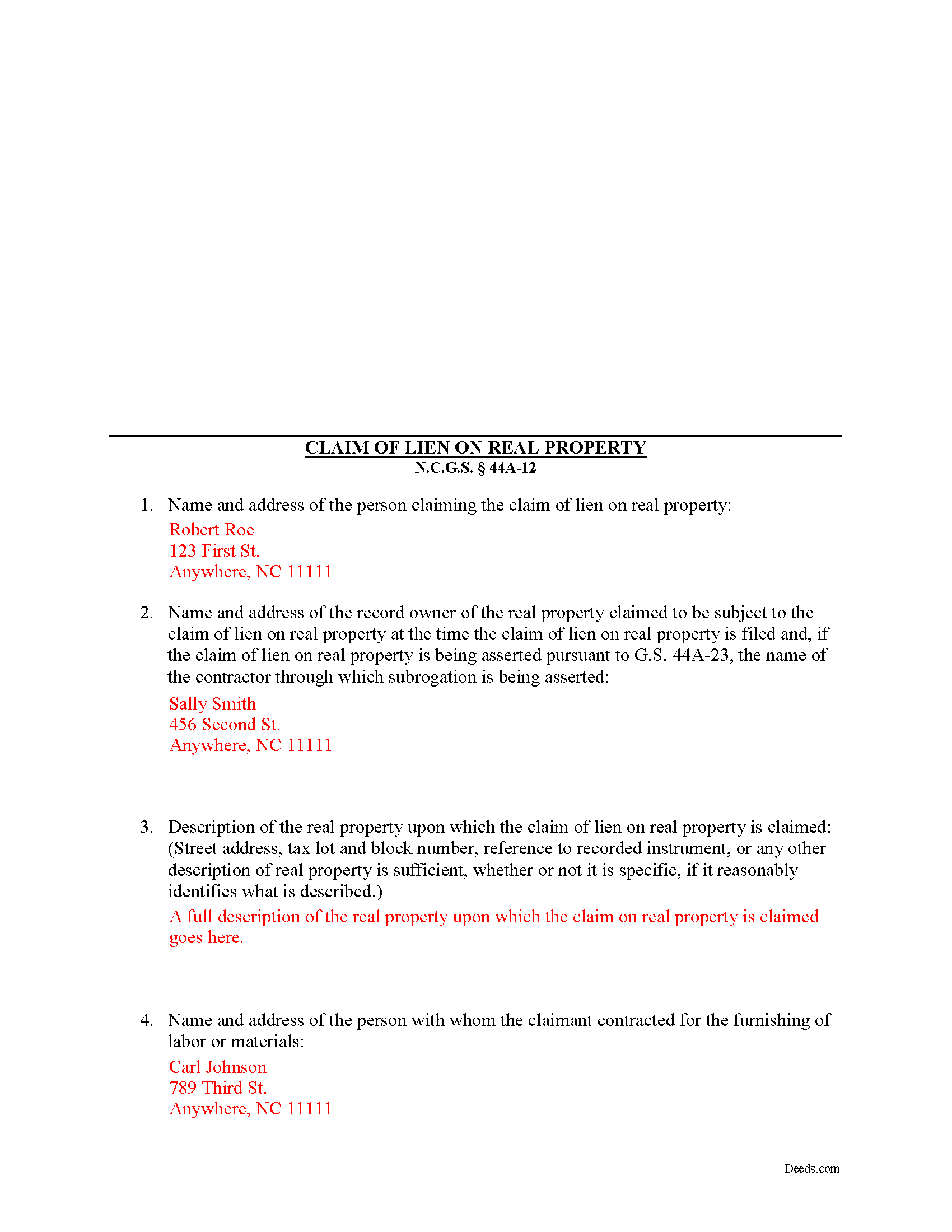

Columbus County Completed Example of the Claim of Mechanics Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Columbus County documents included at no extra charge:

Where to Record Your Documents

Columbus County Register of Deeds

Whiteville, North Carolina 28472

Hours: 8:30 to 5:00 M-F

Phone: (910) 640-6625

Recording Tips for Columbus County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Columbus County

Properties in any of these areas use Columbus County forms:

- Bolton

- Brunswick

- Cerro Gordo

- Chadbourn

- Clarendon

- Delco

- Evergreen

- Fair Bluff

- Hallsboro

- Lake Waccamaw

- Nakina

- Riegelwood

- Tabor City

- Whiteville

Hours, fees, requirements, and more for Columbus County

How do I get my forms?

Forms are available for immediate download after payment. The Columbus County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Columbus County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Columbus County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Columbus County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Columbus County?

Recording fees in Columbus County vary. Contact the recorder's office at (910) 640-6625 for current fees.

Questions answered? Let's get started!

Filing a Mechanic's Lien in North Carolina

Mechanic's liens are used to enforce the terms of payment in a contract when the amount that's owed remains unpaid by the property owner or other contractors in the chain. The lien operates by putting a "block" on the owner's title so that he or she will find it difficult to sell or refinance the property without first resolving the lien. In turn, the lienholder has the power to foreclose, or force a sale on the property to recover money owed. In North Carolina, potential claimants can obtain a mechanic's lien by filing a Claim of Lien on Real Property in accordance with the statutory requirements.

Claims of lien on real property may be filed at any time after the obligation matures, but no later than 120 days after the final furnishing of labor or materials at the site of the improvement by the person claiming the lien. N.C.G.S. 44A-12(b).

Unlike in many states where lien claims are recorded in a land records office, all claims of lien on real property must be filed in the office of the clerk of superior court in each county where the real property subject to the claim of lien on real property is located. N.C.G.S. 44A-12(a). The clerk of superior court shall note the claim of lien on real property on the judgment docket, and index the same under the name of the record owner of the real property at the time the claim of lien on real property is filed. Id. An additional copy of the claim of lien on real property may also be filed with any receiver, referee in bankruptcy or assignee for benefit of creditors who obtains legal authority over the real property. Id.

The Claim of Lien form must contain the following information about the contracting parties and the subject property: (1) the name and address of the person claiming the claim of lien; (2) the name and address of the record owner of the real property subject to the claim of lien at the time, and, if the claim of lien on real property is being asserted pursuant to G.S. 44A-23 (subcontractor's claims), the name of the contractor through which subrogation is being asserted; (3) a description of the real property for which the claim of lien on real property is claimed (street address, tax lot and block number, reference to recorded instrument, or any other description of real property is sufficient if it reasonably identifies what is described); (4) the name and address of the person with whom the claimant contracted for the furnishing of labor or materials; (5) the date labor or materials were first furnished upon the property by the claimant; (5a) the date labor or materials were last furnished upon the property by the claimant; and (6) a general description of the labor performed or materials furnished and the amount claimed. N.C.G.S. 44A-12(c).

Be careful when completing the form, because a claim of lien on real property may not be amended. N.C.G.S. 44A-12(e). It can, however, be cancelled by a claimant or the claimant's agent or attorney, and a new claim of lien on the real property can be substituted if it's filed within the time provided for the original filing. Id.

Once the lien is in place, it must be enforced within the provided time or it will expire. A lien is enforced by foreclosing on the property to recover the amount owed. An action to enforce a claim of lien on real property may be commenced in any county where venue is otherwise proper. N.C.G.S. 44A-13(a). No such action may be commenced more than 180 days after the last furnishing of labor or materials at the site of the improvement by the person claiming the claim of lien on real property. Id. A judgment enforcing a lien may be entered for the principal amount due which cannot exceed the principal amount stated in the claim of lien. N.C.G.S. 44A-13(c). The judgment then forces a sale of the real property subject to the lien. Id.

Liens grow old and expire, so claimants must pay attention to significant dates. If a lien claimant fails to file a suit to enforce the lien or fails to file an answer in a pending suit to enforce a lien within 30 days after a properly served written demand of the owner, lienee, or other authorized agent, the lien will be extinguished. N.C.G.S. 44A-24.10. Liens must also be released when the underlying obligation has been satisfied. If a claim for a lien has been filed with the clerk of superior court and the claim has been paid in full, or if the lien claimant fails to institute a suit to enforce the lien within the time as provided by law, the lien claimant must acknowledge satisfaction or release of the lien in writing upon written demand of the owner promptly, and in no event more than 30 days after the demand. N.C.G.S. 44A-24.11.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of a legal professional. Please contact a North Carolina attorney with any questions about filing a claim of lien on real property.

Important: Your property must be located in Columbus County to use these forms. Documents should be recorded at the office below.

This Claim of Mechanics Lien meets all recording requirements specific to Columbus County.

Our Promise

The documents you receive here will meet, or exceed, the Columbus County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Columbus County Claim of Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Mark E.

March 12th, 2019

Thank you for your Swift response. Have docs I was looking for!

Thank you for your feedback. We really appreciate it. Have a great day!

Jana C H.

July 29th, 2019

Form was the one I needed and the instructions along with a sample form was all I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Muriel S.

October 5th, 2023

The three people we dealt with were courteous and helpful.

Thank you!

Martin E.

February 16th, 2021

documents and guidance need to properly comply with court

Thank you!

James I.

March 3rd, 2023

It worked out very well. Got the form(s) with clear instructions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

pete k.

February 11th, 2021

Excellent service and quick turnaround time.I ordered a copy of my property deed and I received a downloadable digital copy in about 10 to 15 minutes. Very impressed. Thank You

Thank you for your feedback. We really appreciate it. Have a great day!

Connie H.

January 18th, 2019

I really appreciated the detailed instructions provided with the document. The instructions made it easy to fill it out correctly. Filed the document with the courthouse the next day and have received confirmation that it has been filed.

Thanks Connie! Have a great day!

LINDA S.

November 11th, 2020

This was SO much easier than having to go down to the county recorder's office. I would definitely use this company again!

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce K.

June 21st, 2019

I was very happy with this site. It included all the papers I needed, instructions, and even an example sheet to work from. The papers are now filed and done with ease. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

ray r.

July 17th, 2020

excellent service

Thank you!

Joshua P.

July 27th, 2022

Easy fill in the blanks form. Just FYI make sure you have a copy of whatever deed you are changing and the tax records. You will want the language to be identical.

Thank you for your feedback. We really appreciate it. Have a great day!

Colleen N.

March 30th, 2021

The instruction were very clear and the sample was also very helpful.

Thank you!

Barbara K.

June 10th, 2023

Found what I needed quickly, easy website to maneuver. Like having a sample to look at along with instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

marion v.

March 26th, 2023

Phenomenal website !

Thank you!

Jennifer M.

April 3rd, 2024

Consistent and quick. This site saves me so much time away from my desk. It's a great resource for my small business!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!