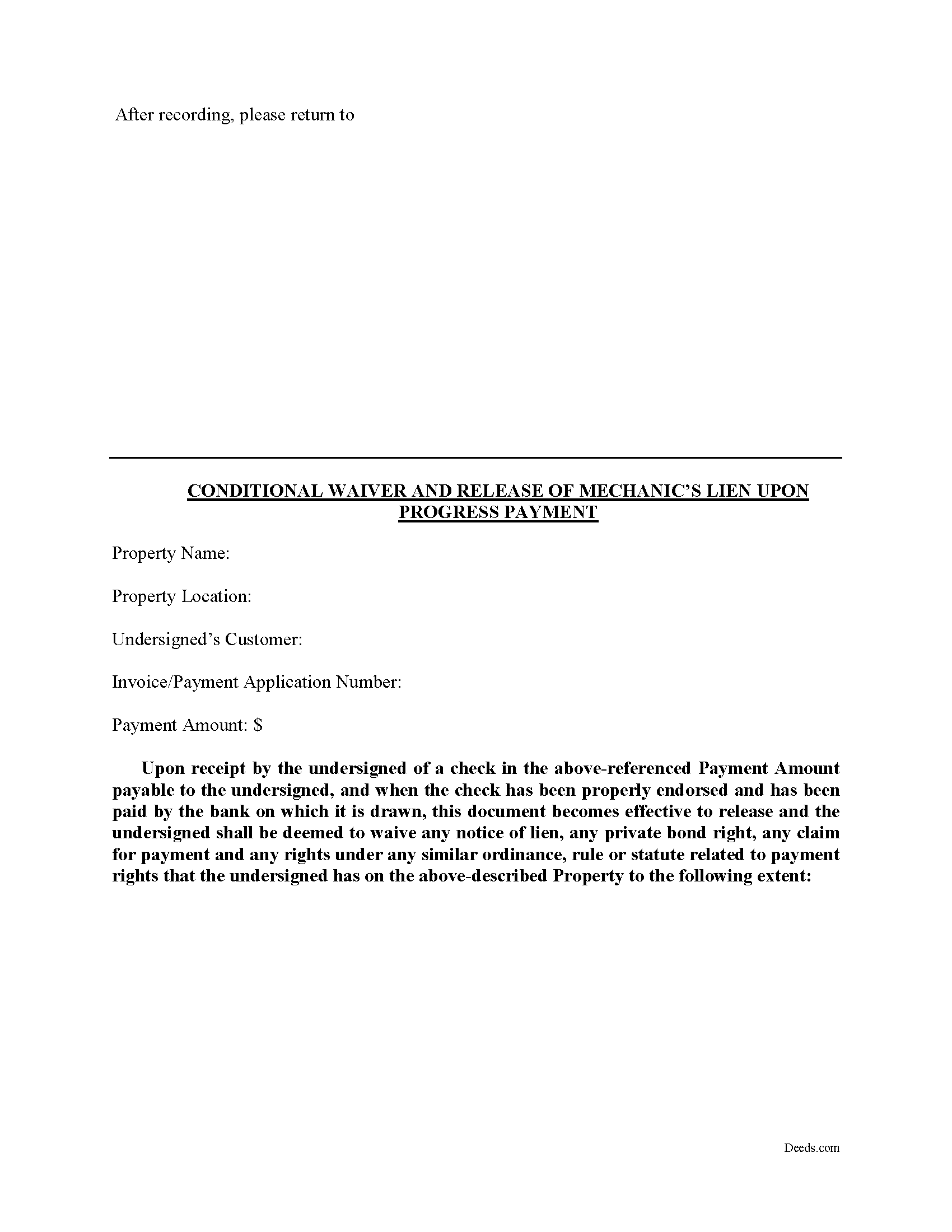

Gates County Conditional Lien Waiver on Progress Payment Form

Gates County Conditional Lien Waiver on Progress Payment Form

Fill in the blank Conditional Lien Waiver on Progress Payment form formatted to comply with all North Carolina recording and content requirements.

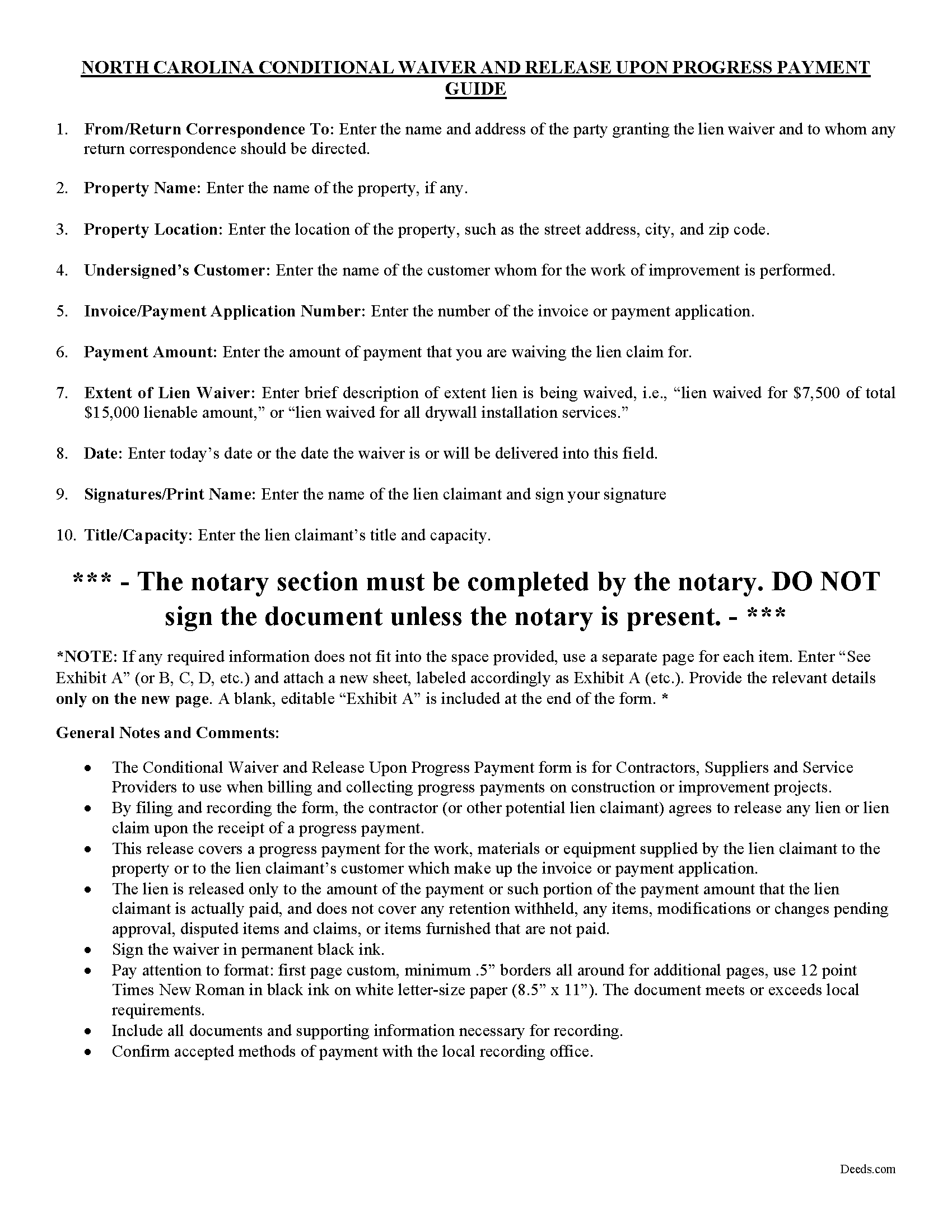

Gates County Conditional Lien Waiver on Progress Payment Guide

Line by line guide explaining every blank on the form.

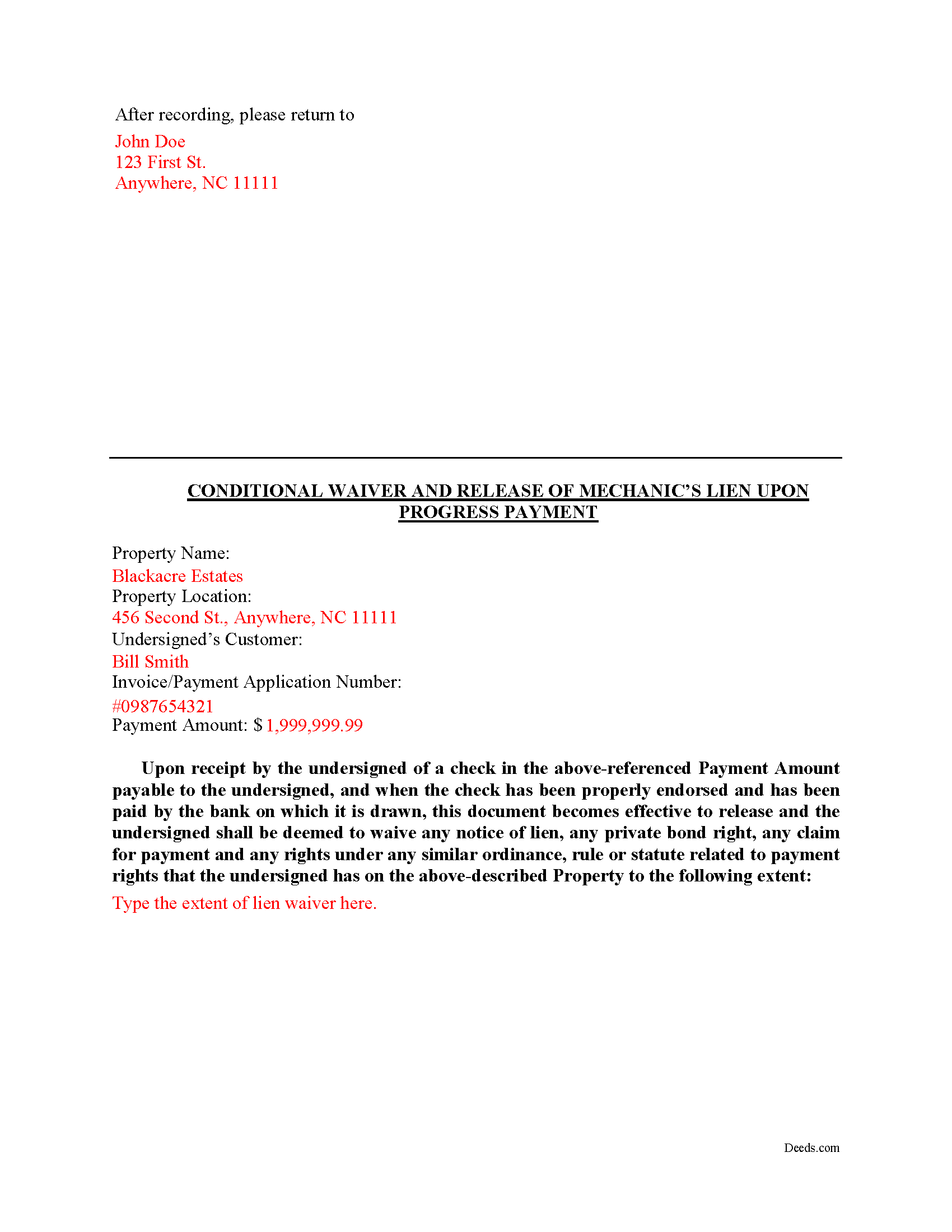

Gates County Completed Example of the Conditional Lien Waiver on Progress Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Gates County documents included at no extra charge:

Where to Record Your Documents

Gates County Register of Deeds

Gatesville, North Carolina 27938

Hours: 9:00am - 5:00 pm Monday through Friday

Phone: (252) 357-0850

Recording Tips for Gates County:

- Recording fees may differ from what's posted online - verify current rates

- Ask about their eRecording option for future transactions

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Gates County

Properties in any of these areas use Gates County forms:

- Corapeake

- Eure

- Gates

- Gatesville

- Hobbsville

- Roduco

- Sunbury

Hours, fees, requirements, and more for Gates County

How do I get my forms?

Forms are available for immediate download after payment. The Gates County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Gates County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gates County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Gates County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Gates County?

Recording fees in Gates County vary. Contact the recorder's office at (252) 357-0850 for current fees.

Questions answered? Let's get started!

A lien waiver is a document drafted by a potential lien claimant such as a contractor, subcontractor, materials provider, equipment lessor or other party to the construction project (the claimant) that states they have received payment and thereby waive any future lien rights to the owner's property. Simply put, waiving a lien means giving up the right to a future lien in exchange for the payment of the potential lien amount in full or part.

Lien waivers generally fall into two categories: conditional and unconditional. A conditional waiver is effective only upon the triggering of a specific event, such as the payment check clearing. An unconditional waiver is an absolute abandonment of the claimant's right to a future lien whether or not payment is ever made to the possible claimant. North Carolina does not provide for lien waivers by statute, although waivers are still permissible and will be recognized by a state court under the principles of contract law.

The Conditional Waiver upon Progress Payment offers the most protection for lien claimants because it states that if the claimant(s) have actually been paid to date (including no return or stopped payment checks) the waiver serves as effective proof against any lien claim on the property. The lien is "conditioned" on receiving payment and is only waived if the claimant actually receives the payment.

Waivers should identify the parties, location of the job or project, relevant dates, costs, and payments, and any other details as needed.

By filing the form, the lien claimant represents that he or she either has already paid or will use the money he or she receives from this progress payment in order to make prompt payment in full to all his or her laborers, subcontractors, materialmen and suppliers for all work, materials or equipment that are the subject of this waiver and release.

Lien waivers also allow property owners to shield the title to their property from the general contractor, material suppliers, and subcontractors involved with a project. With a lien release upon a progress payment, the property owner moves toward clear title and the ability to obtain financing or sell the property. Proper lien waivers can also protect the property owner from liens filed by the contractor's subcontractors, suppliers and laborers who might record a lien if they are not paid by the contractor.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of a legal professional. Please contact an attorney with questions about using lien waivers, or for any other issues related to liens in North Carolina.

Important: Your property must be located in Gates County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver on Progress Payment meets all recording requirements specific to Gates County.

Our Promise

The documents you receive here will meet, or exceed, the Gates County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gates County Conditional Lien Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

David C.

March 16th, 2022

I was able to use your website for the purpose I was looking for. I was able to conclude the transactions I needed without having to use an attorney.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patrick N.

August 15th, 2019

I was very satisfied with your service. Prompt, and thorough. Price was reasonable. Will use your service again when needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Melody L.

November 8th, 2020

Beware, you cannot save the information you typed and change it later. It will be a PDF upon saving. So if you need corrections...you have to start all over!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael F.

February 22nd, 2024

This service wasn't helpful at all.

We're sorry the records you were looking for were not available Michael. We understand how frustrating that can be. Thank you for taking the time to share your thoughts. We're continually working to expand our database and hope to better serve your needs in the future.

Bernice L.

August 18th, 2022

Finally able to print out the forms after a few tries. Honestly, I think it could have been designed a little better. I am almost 80; however, very computer savvy, but finally managed to get what I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

February 7th, 2021

I found it pretty easy to navigate, all worked well. Need a better example of excise tax. Lastly, your link in the email to get to this page doesn't work :)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles R.

December 18th, 2018

No review provided.

Thank you for your review. Have a fantastic day!

Edward B.

May 13th, 2020

Thank you for the rapid response. I shall persevere in my search using other public records. I shall keep your website handy for other such searches in the future.

Thank you!

Jacqueline G.

October 10th, 2019

Great site, user friendly. Exactly what we needed and the detailed instructions/completed sample were a nice touch.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janet M.

February 9th, 2024

Deed.com is an amazing site. After calling many places and going on many websites to figure out what I needed to submit (most counties cannot help with questions and the place I needed to turn the documents into could not help either, they are not allowed to give legal advice) I came across Deeds.com. It has been so helpful and I was able to research what documents I needed. I purchased one document and after more research I realized I needed a different document. Deed.com refunded my first purchase. I then purchased an Affidavit of Death and a Deed for the county and state I needed them for. Both the example and guide were very helpful and I will be submitting my documents after I have them notarized. I give five stars

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Ardith S.

February 14th, 2021

Very informative and user friendly. Was able to get all information and forms needed without any problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

L. Candace H.

April 29th, 2021

So far it's been good & informative. I have not chosen forms for download but I like the site. Thanks

Thank you!

Terri L.

January 31st, 2022

Great Tool! Very easy to complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elbert M.

July 19th, 2021

I found The blank documents easy to use and the instructions informative and simple to follow. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

SueAnn V.

July 22nd, 2021

Thanks so much for the TOD Beneficiary Deed with the explanation, supplementary forms and great example! I just filed it today for the state of Colorado, in my county and it was accepted by the Clerk/Recorder. I really appreciate the thorough work that Deeds.com does. I definitely will use this site again and also recommend it to family and friends. Thanks again.

Thank you for your feedback. We really appreciate it. Have a great day!