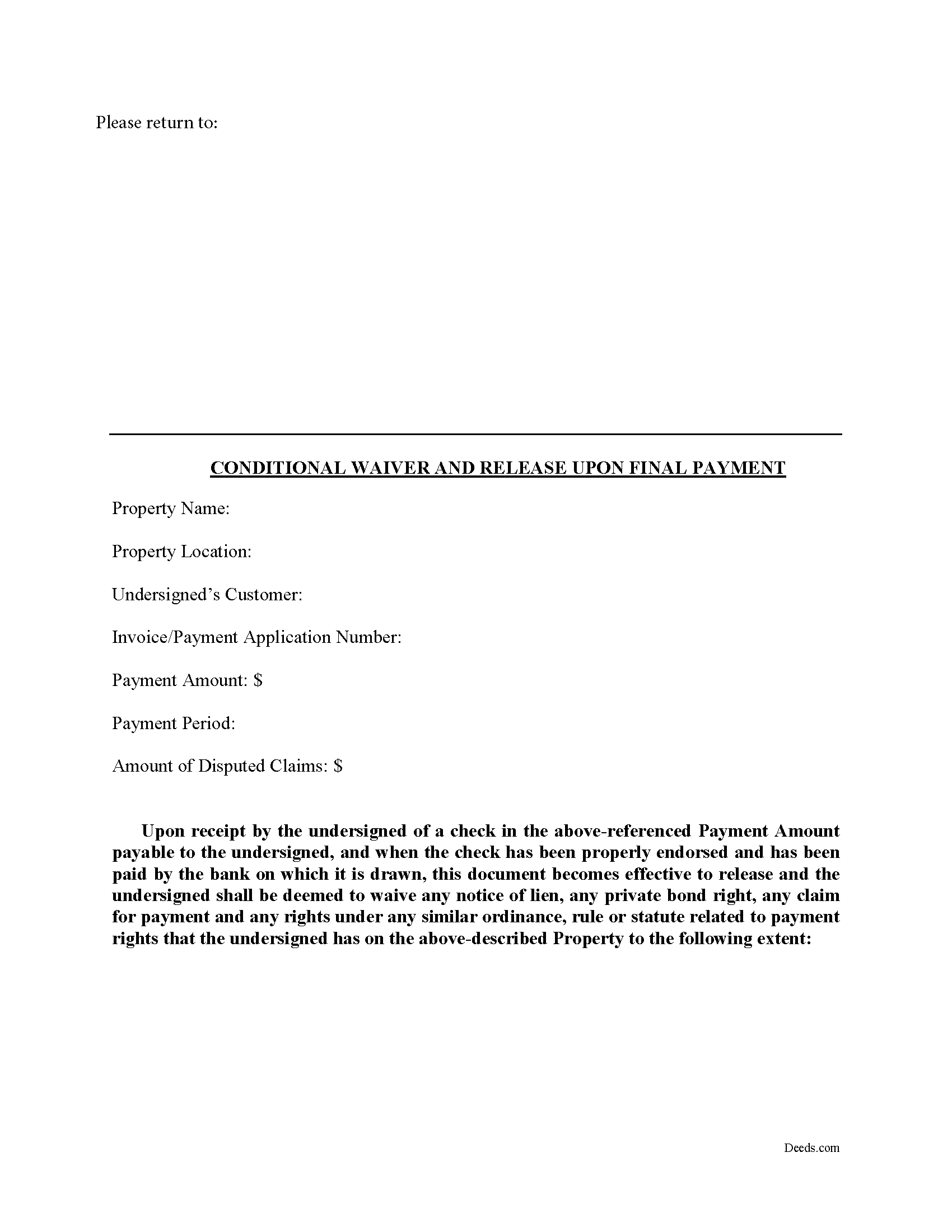

Mcdowell County Conditional Waiver on Final Payment Form

Mcdowell County Conditional Waiver on Final Payment Form

Fill in the blank Conditional Waiver on Final Payment form formatted to comply with all North Carolina recording and content requirements.

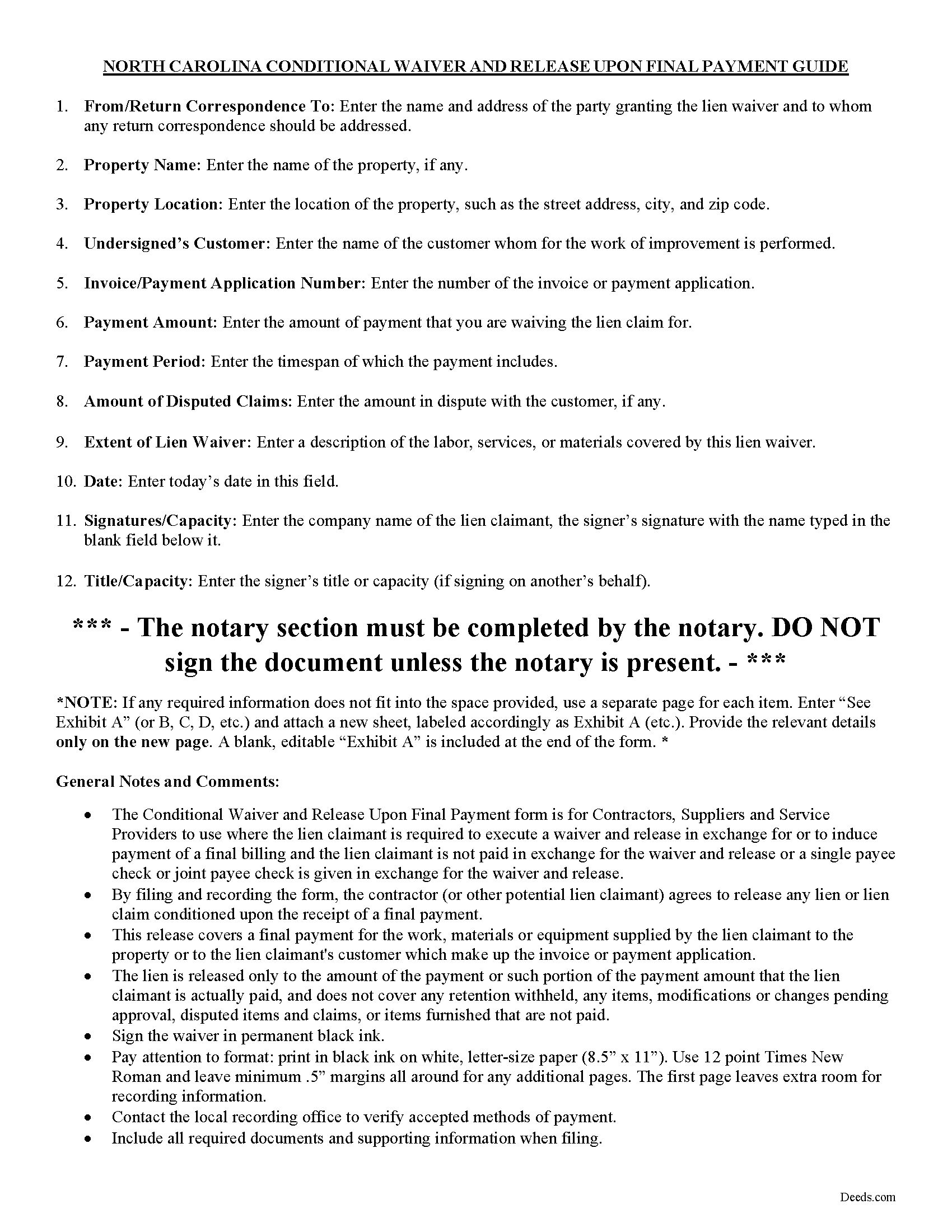

Mcdowell County Conditional Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

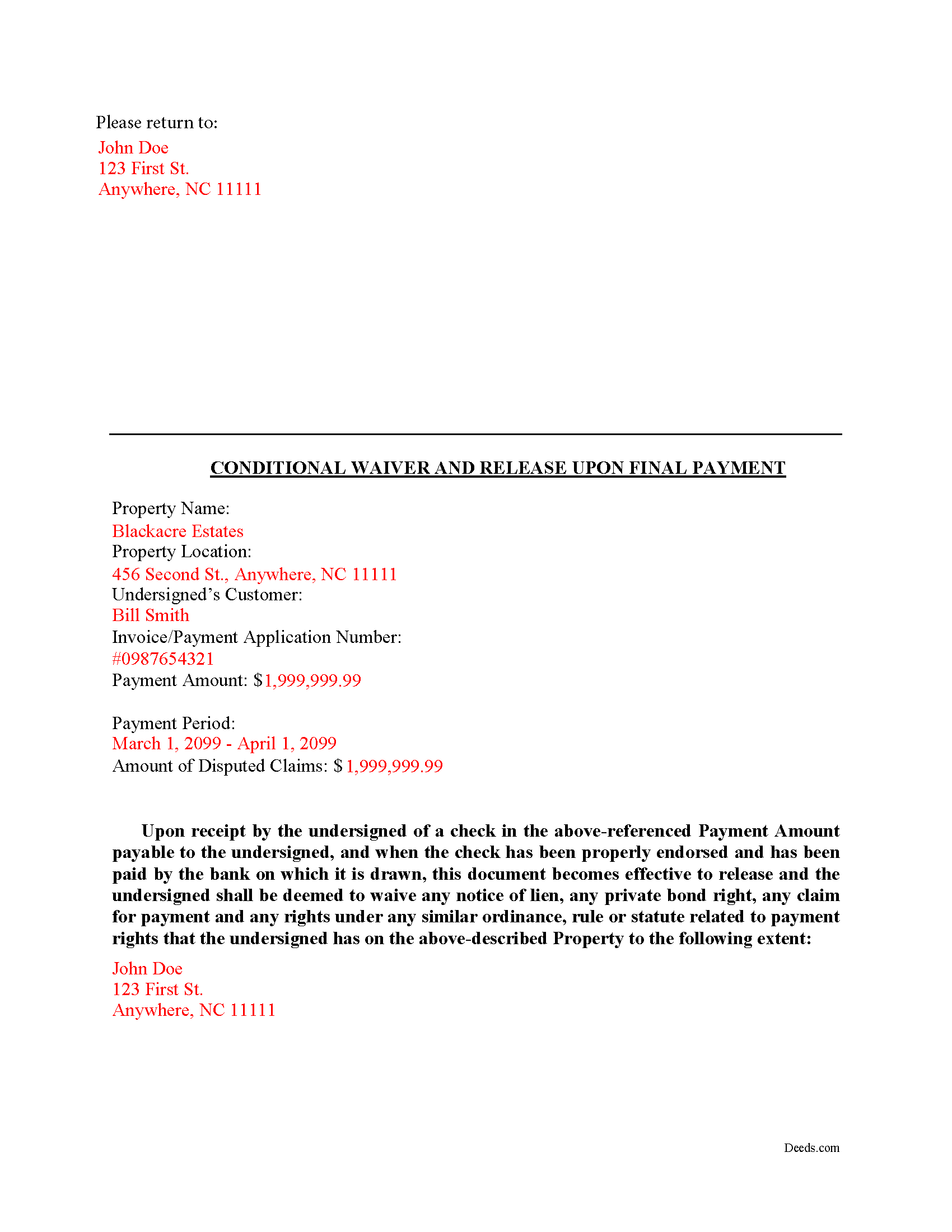

Mcdowell County Completed Example of the Conditional Waiver on Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Mcdowell County documents included at no extra charge:

Where to Record Your Documents

McDowell County Register of Deeds

Marion, North Carolina 28752

Hours: 8:30am-5:00pm M-F

Phone: (828) 652-4727

Recording Tips for Mcdowell County:

- Verify all names are spelled correctly before recording

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Ask about accepted payment methods when you call ahead

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Mcdowell County

Properties in any of these areas use Mcdowell County forms:

- Glenwood

- Little Switzerland

- Marion

- Nebo

- Old Fort

Hours, fees, requirements, and more for Mcdowell County

How do I get my forms?

Forms are available for immediate download after payment. The Mcdowell County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mcdowell County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mcdowell County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mcdowell County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mcdowell County?

Recording fees in Mcdowell County vary. Contact the recorder's office at (828) 652-4727 for current fees.

Questions answered? Let's get started!

A lien waiver is a document drafted by a potential lien claimant such as a contractor, subcontractor, materials provider, equipment lessor or other party to the construction project (the claimant) that states they have received payment and thereby waive any future lien rights to the owner's property. Simply put, waiving a lien means giving up the right to a future lien in exchange for the payment of the potential lien amount in full or part.

Lien waivers generally fall into two categories: conditional and unconditional. A conditional waiver is effective only upon the triggering of a specific event, such as the payment check clearing. An unconditional waiver is an absolute abandonment of the claimant's right to a future lien whether or not payment is ever made to the possible claimant. North Carolina does not provide for lien waivers by statute, although waivers are still permissible and will be recognized by a state court under the principles of contract law.

A conditional waiver upon final payment releases all claimant rights to file a mechanics lien if they have actually been paid to date (and that includes no return or stopped payment checks). Waivers should identify the parties, location of the job or project, relevant dates, costs, and payments, and any other details as needed.

By filing the form, the lien claimant represents that he or she either has already paid or will use the money he or she receives from this payment in order to make prompt payment in full to all his or her laborers, subcontractors, materialmen and suppliers for all work, materials or equipment that are the subject of this waiver and release.

Getting a lien waiver also allows property owners to shield the title to their property from the general contractor, material suppliers, and subcontractors involved with a project. With a lien release upon a final payment, the property owner restores clear title and can obtain financing or sell the property.

The property owner should require lien and labor waivers to be submitted with the contractor's invoices and should not authorize payment of any invoice without properly signed lien and labor waivers. Proper lien waivers can protect the property owner from liens filed by the contractor's subcontractors, suppliers and laborers who might record a lien if they are not paid by the contractor.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of a legal professional. Please contact an attorney with questions about using lien waivers, or for any other issues related to liens in North Carolina.

Important: Your property must be located in Mcdowell County to use these forms. Documents should be recorded at the office below.

This Conditional Waiver on Final Payment meets all recording requirements specific to Mcdowell County.

Our Promise

The documents you receive here will meet, or exceed, the Mcdowell County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mcdowell County Conditional Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Lawrence D.

March 14th, 2019

My first time using it; very fast service. I am an estate planning attorney (44 years). None of my old title company contacts are around anymore to provide deed copies, so this is a great source. I will be using it again.

Thank you Lawrence, we appreciate your feedback. Have a fantastic day!

Thomas N.

May 9th, 2019

TODD Form would not print surveyor degrees character (superscript "o") in Exhibit A. It also would not print the "Return Address" or "Prepared By" entries with my middle name as your example showed.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie C.

July 21st, 2020

The process worked great! It's a great solution for recording documents at the county during the pandemic and in the future if you don't want to leave home!!

Thank you!

Daniel L.

April 27th, 2019

Very good. The right forms and instructions . Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

June 15th, 2020

Excellent Service I was looking for a copy of deeds on a few properties. Researched online and ended up at Deeds.com. I signed up for a new account, entered the pertinent information, paid a nominal fee and received all deeds within 40 minutes. Seamless and very impressed! Bob

Thank you!

Silvana M.

April 10th, 2020

This is a great service, I was worried about my NOC and Liens being filed in this terrible time!!! Happy I have this service Deeds.com!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Shelly S.

January 20th, 2021

Was able to sell a property with the information obtained from your website without using an attorney! Extremely happy.

Thank you!

Ralph H.

May 8th, 2019

Your documents resolved my problem. Thanks.

Thank you Ralph, we appreciate your feedback.

Jane N.

February 17th, 2022

Good morning, It seems to be easy to navigate and print out the form I needed. Great!!! Jane

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Evelia G.

January 4th, 2019

I love this guide. Thank you for having this available.

Thanks so much for your feedback Evelia, have a fantastic day!

Jacqueline T.

June 17th, 2021

Worth it for the time saved as the supplemental forms required were included the purchase. First time user, easy peasy. 5 stars from me.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George D.

August 23rd, 2020

The TODD form has been notarized and registered with my county Register of Deeds office, so it works just fine. My only quibble is that when I printed it out, it missed part of the last line of the notary's info and the fine print in the bottom corners. When I printed it at 90% scale, it included those things.

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory G.

April 4th, 2019

Quick and Easy/Immediate Access after payment. Now seeking other forms needed ASAP! Thanks!

Thank you!

Kimberly M.

February 14th, 2019

Great service. Very helpful and quick. Love Deeds.com and will be using their services again.

Thank you for your feedback Kimberly, we really appreciate it!

Kyle K.

June 10th, 2020

Very quick and simple process! Will be using this service much more.

Thank you!