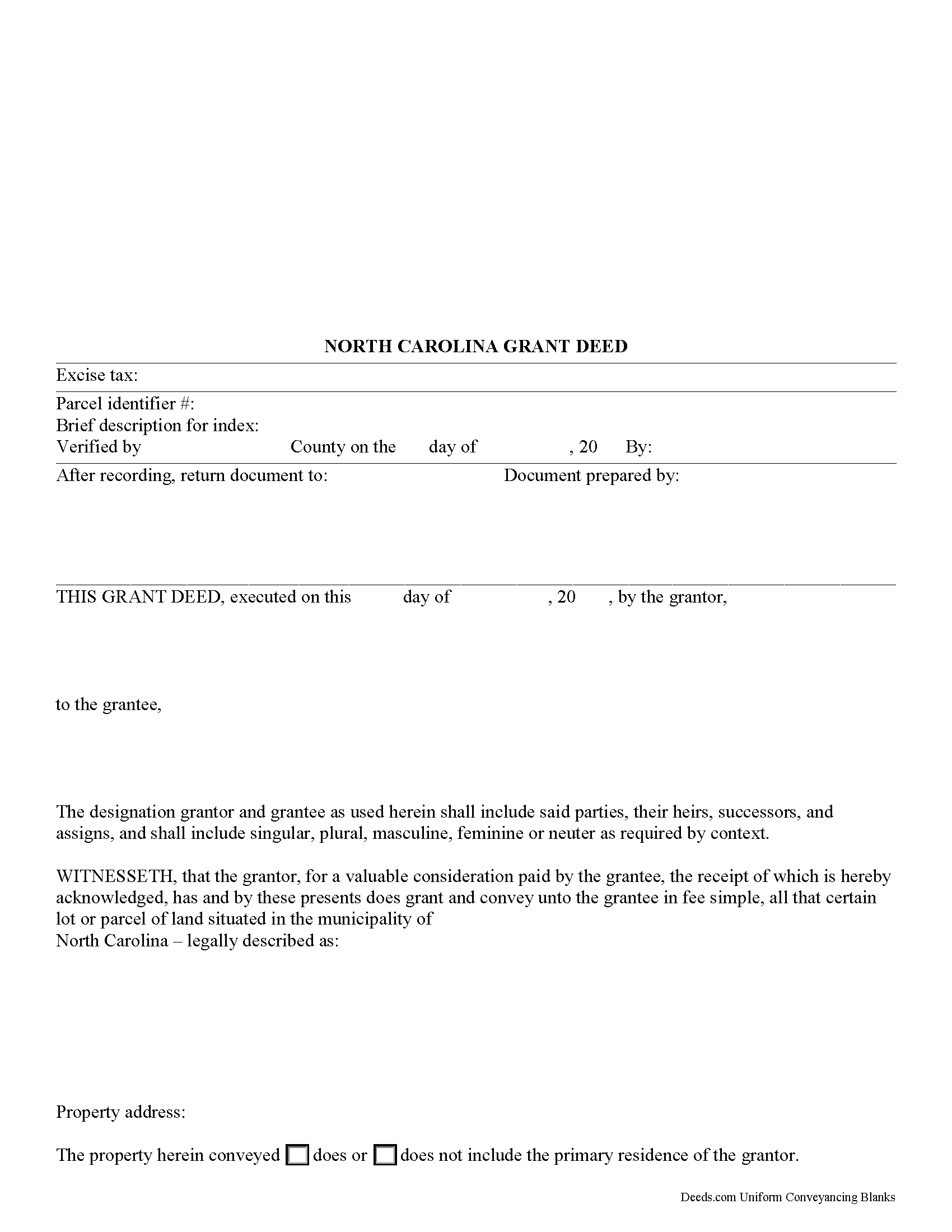

Wake County Grant Deed Form

Wake County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

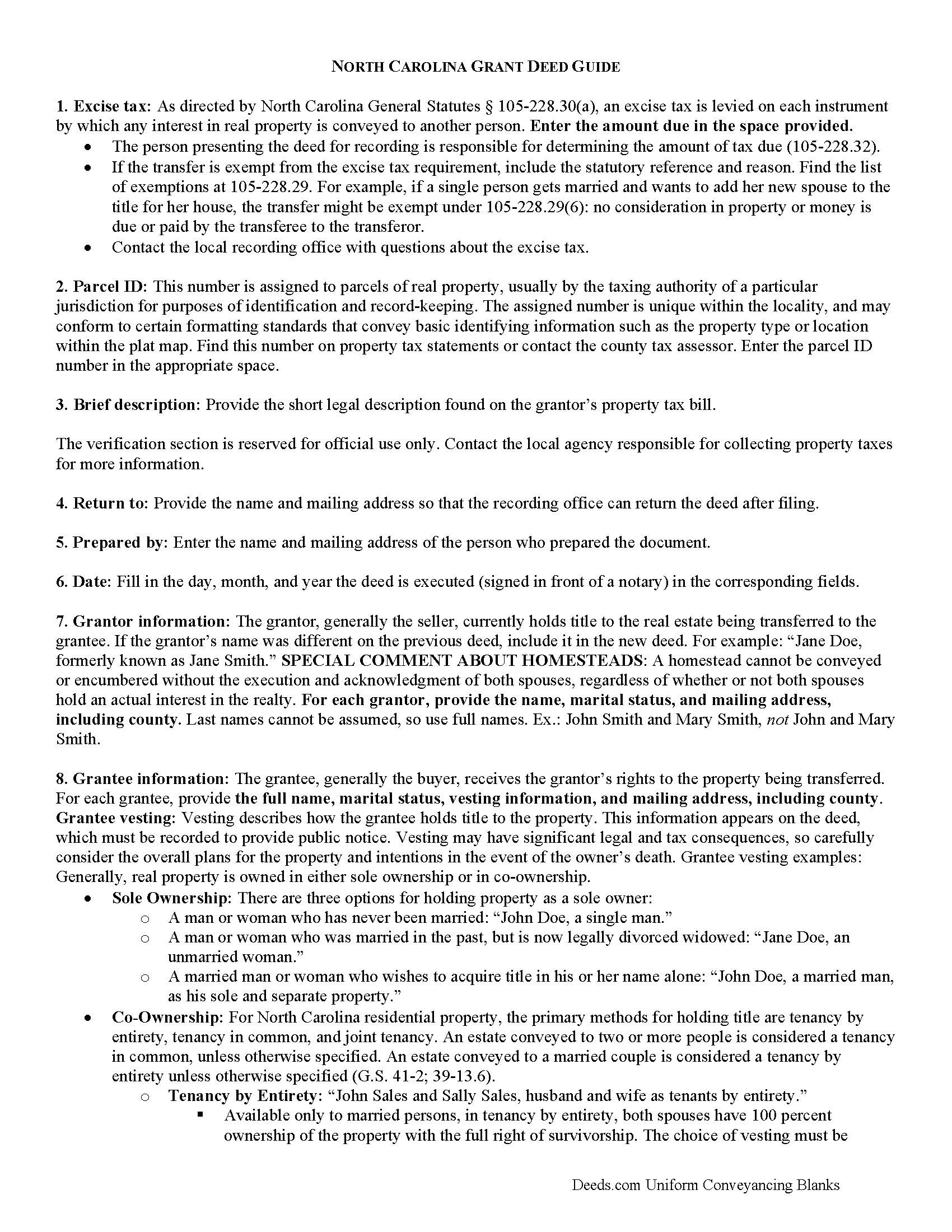

Wake County Grant Deed Guide

Line by line guide explaining every blank on the form.

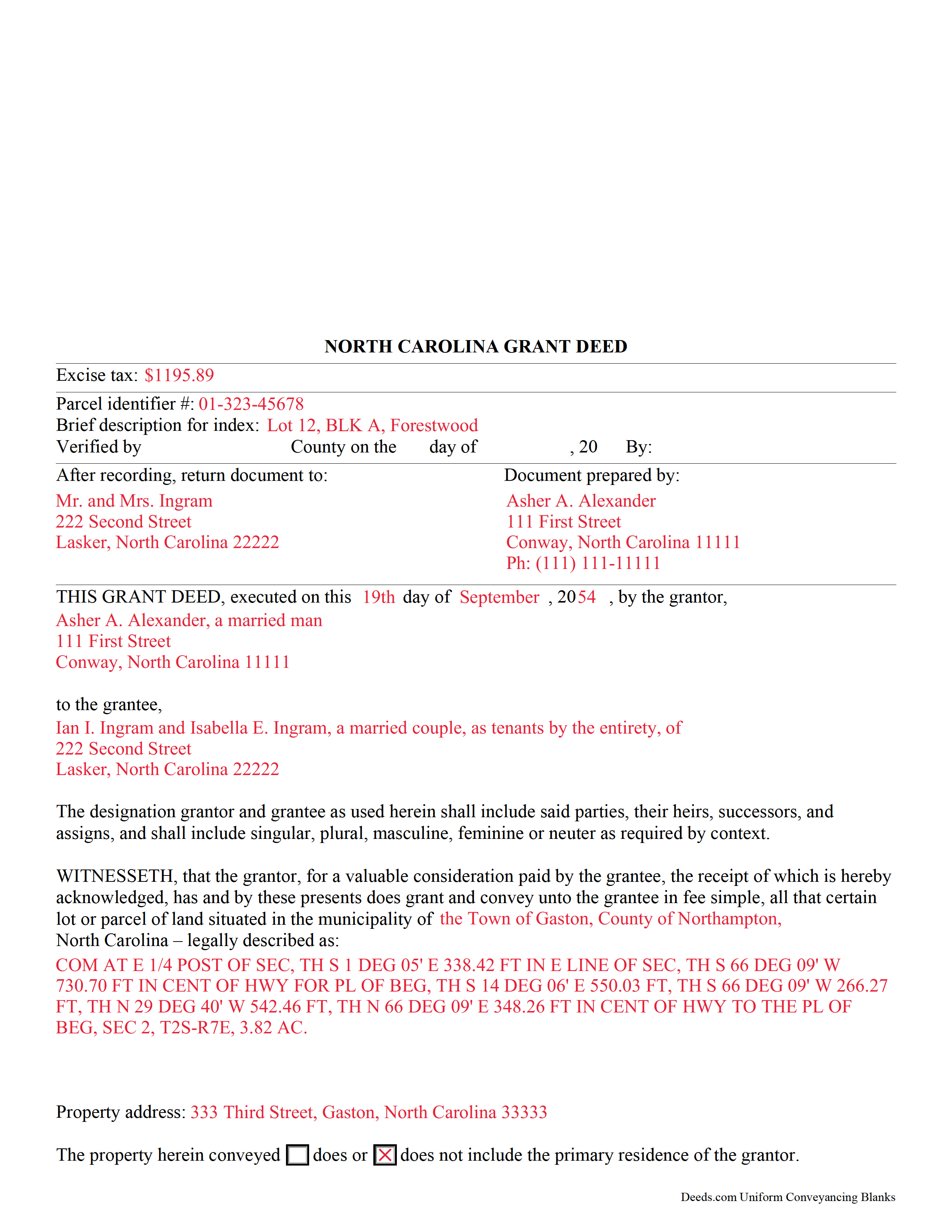

Wake County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Wake County documents included at no extra charge:

Where to Record Your Documents

Wake County Register of Deeds

Raleigh, North Carolina 27601

Hours: 8:30 to 4:45

Phone: (919) 856-5460

Mailing Address

Raleigh, North Carolina 27602

Hours: N/A

Phone: N/A

Recording Tips for Wake County:

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

- Make copies of your documents before recording - keep originals safe

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Wake County

Properties in any of these areas use Wake County forms:

- Apex

- Cary

- Fuquay Varina

- Garner

- Holly Springs

- Knightdale

- Morrisville

- New Hill

- Raleigh

- Rolesville

- Wake Forest

- Wendell

- Willow Spring

- Zebulon

Hours, fees, requirements, and more for Wake County

How do I get my forms?

Forms are available for immediate download after payment. The Wake County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wake County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wake County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wake County?

Recording fees in Wake County vary. Contact the recorder's office at (919) 856-5460 for current fees.

Questions answered? Let's get started!

A grant deed can be used in North Carolina to transfer title to real property. This type of deed falls between a warranty deed and a quitclaim deed.

In a grant deed, the seller (grantor) warrants that the property is free from any encumbrances except those that have been previously disclosed to the buyer (grantee). The seller also guarantees that he does in fact hold title to the property and has the right to convey it to the buyer.

A grant deed must be signed and properly acknowledged by the grantor before an officer authorized by the state to take acknowledgments of deeds. Section 47-38 of the North Carolina General Statutes provides an individual form for acknowledgement by a grantor. If a deed has been executed and acknowledged in a state other than North Carolina, the deed must conform to North Carolina law in order to be recorded in this state. Grant deeds must be executed and acknowledged in strict compliance with the North Carolina acknowledgment provisions in order to be recorded and to provide constructive notice.

North Carolina has a pure race recording statute. No conveyance of land in this state will be valid to pass any property interest as against lien creditors or purchasers for a valuable consideration from the donor, bargainer, or lesser but from the time it is registered in the county where the land lies, or if the land is in more than one county, until the conveyance is registered in each such county. Unless it is otherwise stated on the grant deed or on a separate registered instrument executed by the party whose priority interest is adversely affected, instruments registered in the office of the register of deeds will have priority based on the order of registration as determined by the time of registration. If instruments are registered simultaneously, then priority is determined by the earliest document number set forth on the registered instrument or the sequential book and page number (47 18).

(North Carolina Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Wake County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Wake County.

Our Promise

The documents you receive here will meet, or exceed, the Wake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wake County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

David T.

May 4th, 2025

Deeds.com made the experience of filing an Affidavit of Heirship in the public records of Logan County, Arkansas painless. Their process was easy to navigate, and they provided clear and immediate communication at every step. Highly recommended.

Thank you, David, for your kind words and thoughtful review! We’re so glad to hear that your experience filing an Affidavit of Heirship in Logan County, Arkansas, was smooth and stress-free. Our goal is to make these important processes as easy and transparent as possible, and it’s great to know our communication and platform met your expectations. We truly appreciate your recommendation and are here if you ever need assistance again.

Rod G.

August 7th, 2020

You guys have it DOWN!! You made it easy to navigate your site and services. You explained things effectively. You are helpful and fast. NO WAY would even entertain using a different deed/ document recording service. I'll be back! Thank you. Rod

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jeffrey G.

April 21st, 2021

The documents requested were perfect! Very helpful, with instructions on how to complete and submit and unique to the county. They provided additional helpful documents that I would not have thought to ask for. Great job!

Thank you!

MARY LACEY M.

April 17th, 2025

Deeds.com consistently provides excellent service at a fair price, and we rely and are thankful them for assisting with our recording needs.

Thank you, Mary! We truly appreciate your kind words and continued trust in Deeds.com. It means a lot to us to be part of your recording process, and we’re always here to help whenever you need us.

Greg F.

October 14th, 2022

Sorry that this a little late. I'm VERY HAPPY with everything. The deeds paperwork was just what I was looking for. It was very to fill out, it was different than n the folks used years ago. I called the county clerk, and they were very helpful. Thank you for the paperwork it was easy to use and understand.

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer A.

May 20th, 2020

Great site

Thank you!

SUSAN B.

September 16th, 2024

THE PROCEDURE IN GETTING THIS MECHANICS LIEN PROCESSED HAS SO FAR BEEN RELATIVELY SIMPLY - BETTER THAN HAVING TO WAIT ON MAIL OR GO IN PERSON TO GET RECORDED

We are delighted to have been of service. Thank you for the positive review!

Anna P.

April 15th, 2021

Deeds.com was a life saver! I was able to have a document recorded the very same day of my request. Thank you for taking care of this! Top notch service.

Thank you!

ROBERTA G K.

May 21st, 2023

I have looked and finally found a reliable source of updated legal documents that are current with local and state law that I can be readily downloaded for review, reference and use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

CYNTHIA Z.

April 26th, 2021

So easy to use and fast.

Thank you!

HELEN F.

September 1st, 2019

Process was easy... paperwork was on point... process took less then one day...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David S.

September 2nd, 2020

It was as I suspected. Very useful.

Thank you for your feedback. We really appreciate it. Have a great day!

Diana L.

June 19th, 2020

Easy to use but need to go through the courthouse to do what I need to do.

Thank you!

SHARON R.

September 12th, 2019

Excellent Service! Please note that form Realty Transfer Tax Statement of Value does not print completely. Part of the pages are cut off. Otherwise, excellent service.

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia S.

September 22nd, 2022

I am an attorney assisting my son with some simple legal docs & this service saved me a lot of time and is user friendly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!