Mcdowell County Unconditional Waiver on Progress Payment Form

Mcdowell County Unconditional Waiver on Progress Payment Form

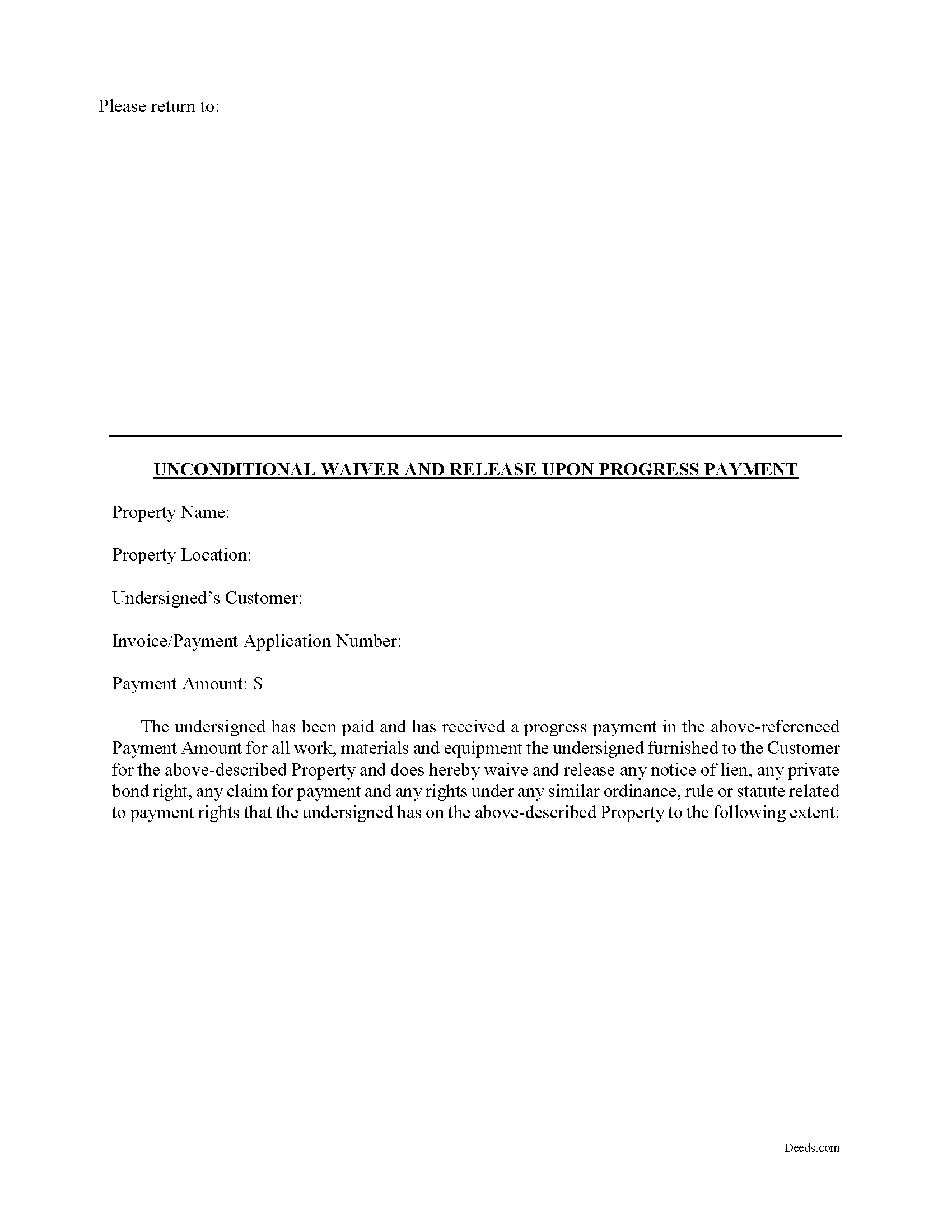

Fill in the blank Unconditional Waiver on Progress Payment form formatted to comply with all North Carolina recording and content requirements.

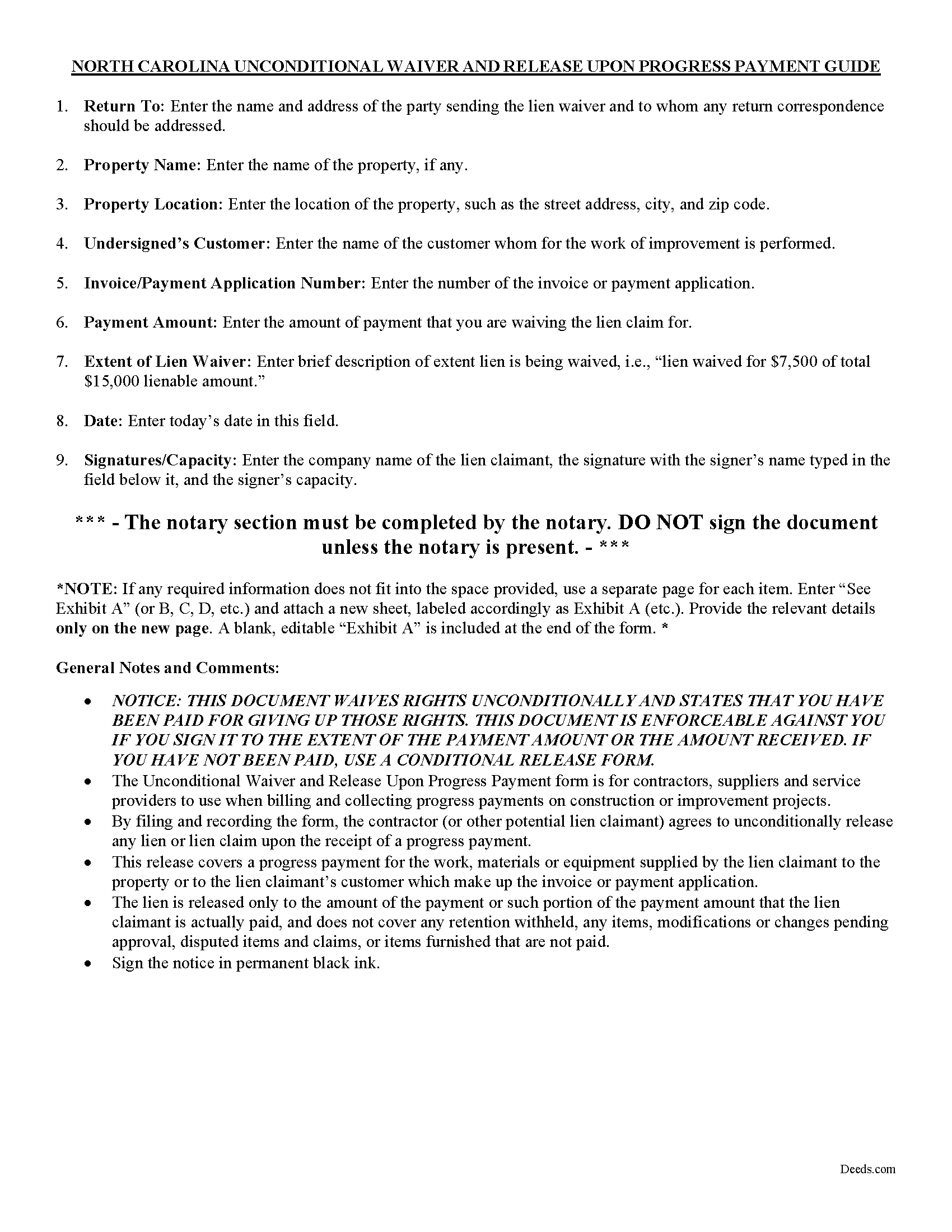

Mcdowell County Unconditional Waiver of Progress Payment Guide

Line by line guide explaining every blank on the form.

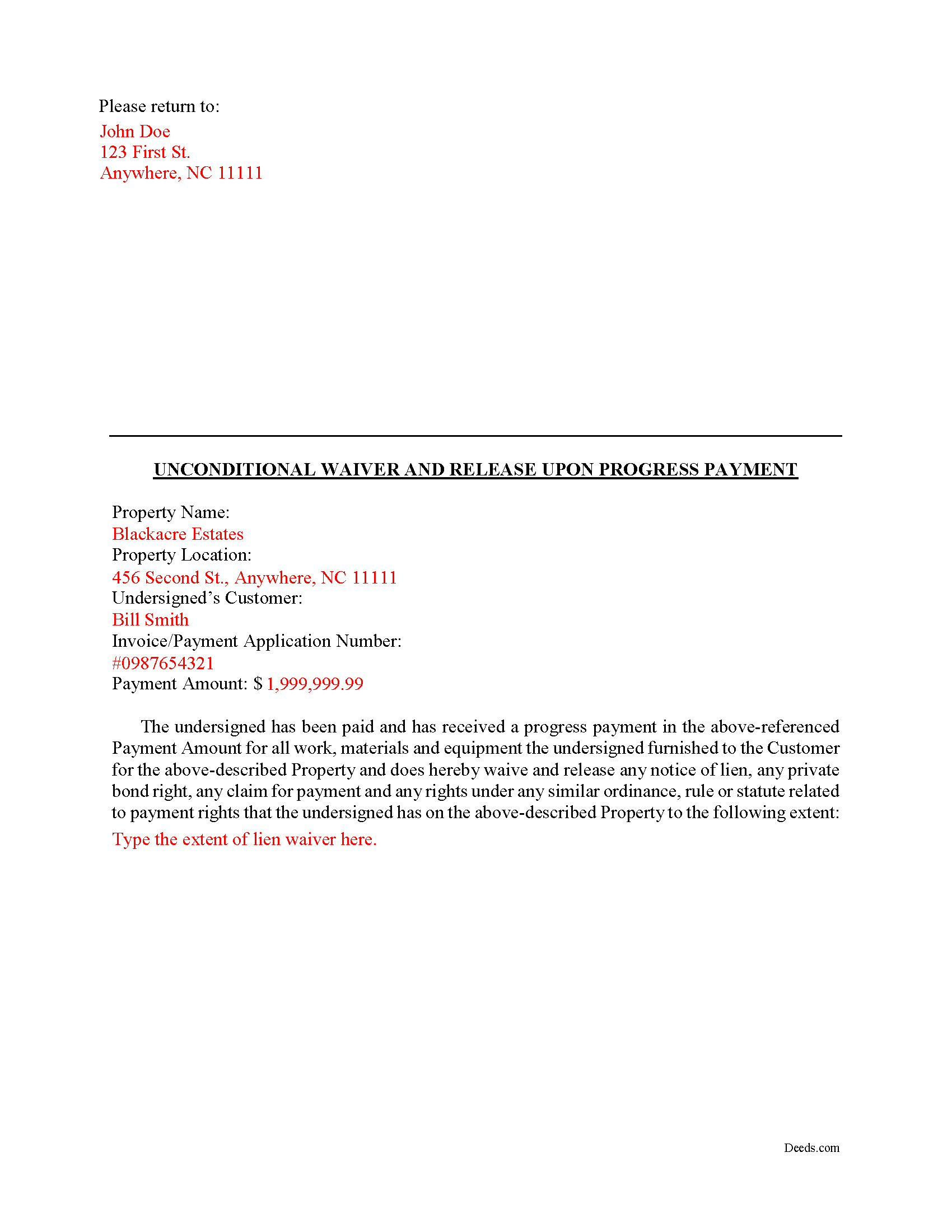

Mcdowell County Completed Example of the Unconditional Waiver on Progress Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Mcdowell County documents included at no extra charge:

Where to Record Your Documents

McDowell County Register of Deeds

Marion, North Carolina 28752

Hours: 8:30am-5:00pm M-F

Phone: (828) 652-4727

Recording Tips for Mcdowell County:

- Double-check legal descriptions match your existing deed

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Mcdowell County

Properties in any of these areas use Mcdowell County forms:

- Glenwood

- Little Switzerland

- Marion

- Nebo

- Old Fort

Hours, fees, requirements, and more for Mcdowell County

How do I get my forms?

Forms are available for immediate download after payment. The Mcdowell County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mcdowell County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mcdowell County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mcdowell County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mcdowell County?

Recording fees in Mcdowell County vary. Contact the recorder's office at (828) 652-4727 for current fees.

Questions answered? Let's get started!

A lien waiver is a document drafted by a potential lien claimant such as a contractor, subcontractor, materials provider, equipment lessor or other party to the construction project (the claimant) that states they have received payment and thereby waive any future lien rights to the owner's property. Simply put, waiving a lien means giving up the right to a future lien in exchange for the payment of the potential lien amount in full or part.

Lien waivers generally fall into two categories: conditional and unconditional. A conditional waiver is effective only upon the triggering of a specific event, such as the payment check clearing. An unconditional waiver is an absolute abandonment of the claimant's right to a future lien whether or not payment is ever made to the possible claimant. North Carolina does not provide for lien waivers by statute, although waivers are still permissible and will be recognized by a state court under the principles of contract law.

An unconditional waiver upon progress payment releases all claimant rights through a specific date unconditionally (meaning that the release of rights is not dependent upon the payment clearing the bank). Because this is an unconditional waiver, only use it after a progress payment has actually been made and received.

By filing the form, the lien claimant represents that he or she either has already paid or will use the money he or she receives from this progress payment in order to make prompt payment in full to all his or her laborers, subcontractors, materialmen and suppliers for all work, materials or equipment that are the subject of this waiver and release.

Getting a lien waiver also allows property owners to shield the title to their property from the general contractor, material suppliers and subcontractors involved with a project. With a partial lien release upon a progress payment, the property owner works toward regaining clear title and the ability to obtain financing or sell the property.

The property owner should require lien and labor waivers to be submitted with the contractor's invoices and should not authorize payment of any invoice without properly signed lien and labor waivers. Proper lien waivers can protect the property owner from liens filed by the contractor's subcontractors, suppliers and laborers who might record a lien if they are not paid by the contractor.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of a legal professional. Please contact an attorney with questions about using lien waivers, or for any other issues related to liens in North Carolina.

Important: Your property must be located in Mcdowell County to use these forms. Documents should be recorded at the office below.

This Unconditional Waiver on Progress Payment meets all recording requirements specific to Mcdowell County.

Our Promise

The documents you receive here will meet, or exceed, the Mcdowell County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mcdowell County Unconditional Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

DONALD L P.

January 15th, 2019

HAD WRONG PASSWORD; PROGRAM MADE CHANGE EASY.

Thank you!

Patricia J.

January 10th, 2019

So simple. Thank you.

Thank you Patricia.

Wes C.

March 26th, 2022

The forms are easy to use and the examples and guidance are easy to understand and follow.

Thank you for your feedback. We really appreciate it. Have a great day!

Joshua A.

May 13th, 2020

It was fast, secure, and reliable, and for the cost it saved me time, and driving four hours to the courthouse and back. It really saved me. Thank You.

Thank you Joshua, glad we could help.

KELLY S.

June 12th, 2021

very happy. I will use you for all my needed documents thanks for being here

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

janitza g.

July 31st, 2020

It was easy!!! The example for completing a quickclaim deed form was very helpful!!

Thank you!

Greg S.

August 19th, 2022

The Beneficiary Deed is easy to fill out, expecially with the examples/explanations provided. The only recommendation I would make is to state that the Parcel ID and the Assessor's ID are one in the same. I looked everywhere for something that mentions "Assessor's ID" in my paperwork to no avail. Upon calling the Maricopa Assessor's number in Maricopa I was told that they are the same.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael W.

April 15th, 2020

I am generally pleased with your products. However, I found it difficult to return to the package after accessing one selected document. One other comment: Your Trustee's Deed package should include a Certificate of Trust form.

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce S.

August 5th, 2019

Download very easy. Forms are just what I need. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Leslie C.

September 13th, 2023

I recently purchased online DIY legal forms, and I must say I was thoroughly impressed. The documents provided were accurate, comprehensive, and precisely what I needed. The accompanying guide was clear, instructive, and really bridged the gap for someone like me who isn't well-versed in legal jargon. What stood out the most, however, was the inclusion of the example. It served as a practical reference and made the entire process so much more approachable. Being able to see a filled-out sample made all the difference. Overall, this product has been invaluable in helping me navigate legal processes on my own.

Thank you for your feedback. We really appreciate it. Have a great day!

Leesa N.

December 29th, 2022

Easy, Fast, Inexpensive and Responsive!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

frederic m.

January 1st, 2021

surprisingly good, gave me all the info I needed to prepare a deed and necessary attachments for recording.

Thank you!

Wayne R.

February 22nd, 2021

Couldn't believe how simple it was to do such a very important family support task and the price was right! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Margaret S.

March 16th, 2020

Great experience, quick and easy, thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas W.

September 15th, 2019

A great way to access form knowledge

Thank you!