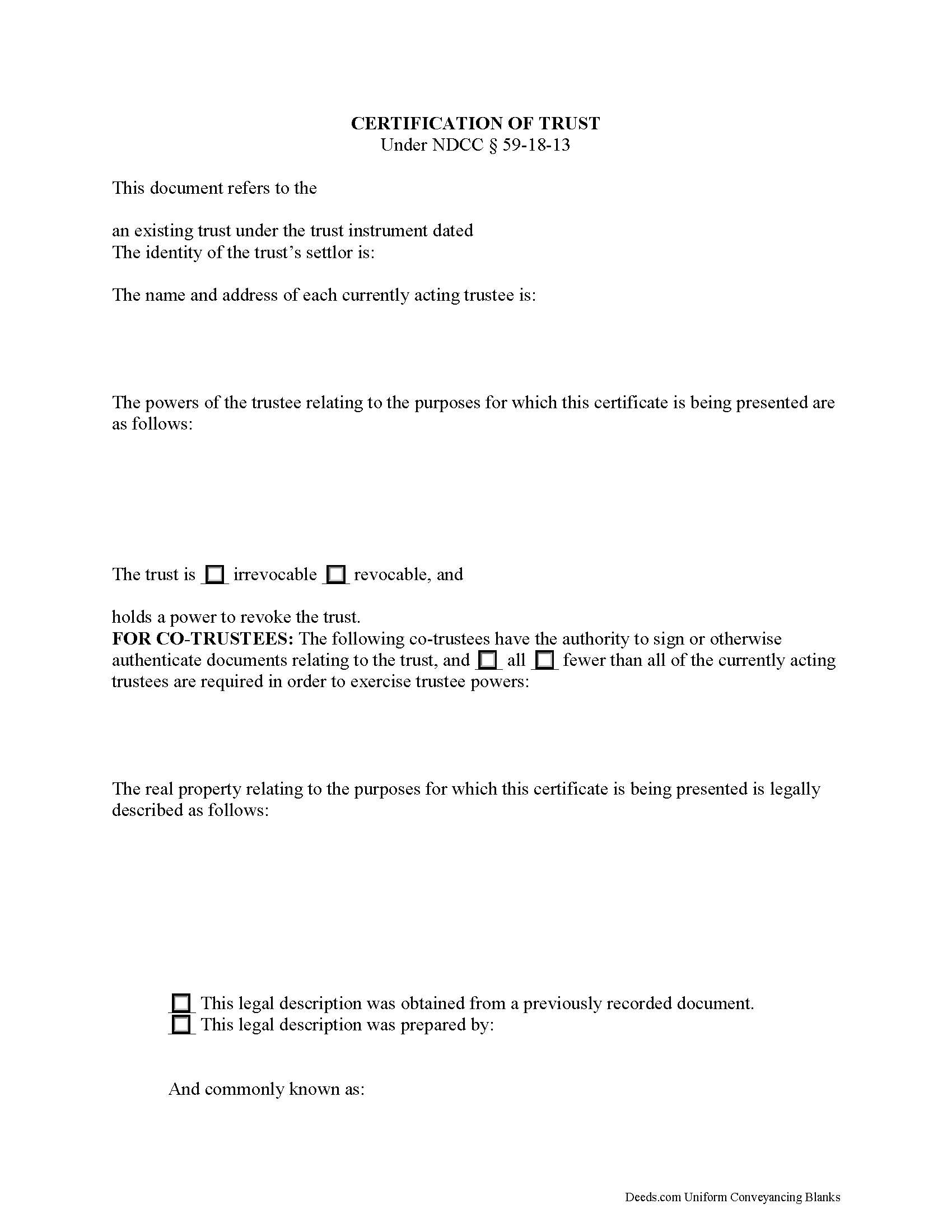

Traill County Certificate of Trust Form

Traill County Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

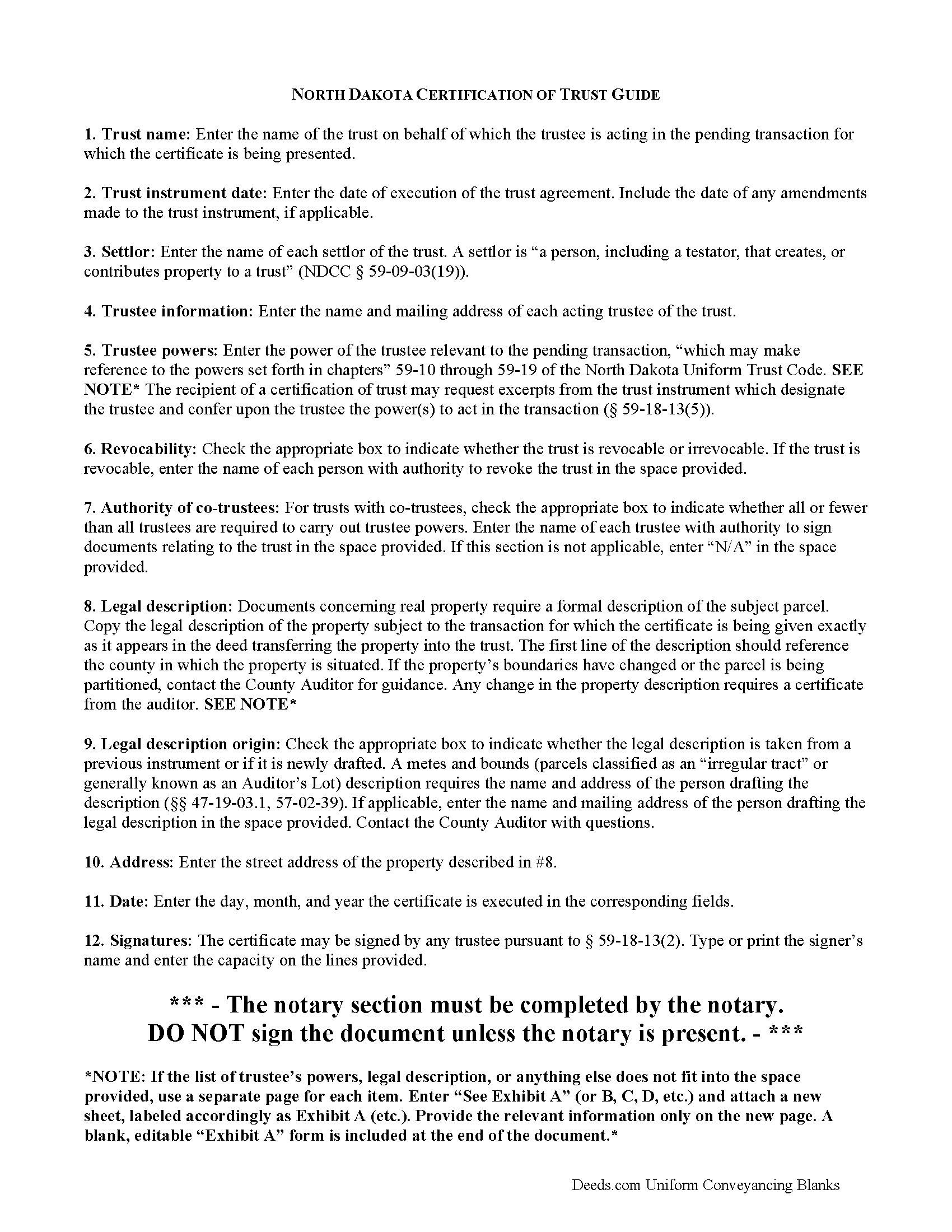

Traill County Certificate of Trust Guide

Line by line guide explaining every blank on the form.

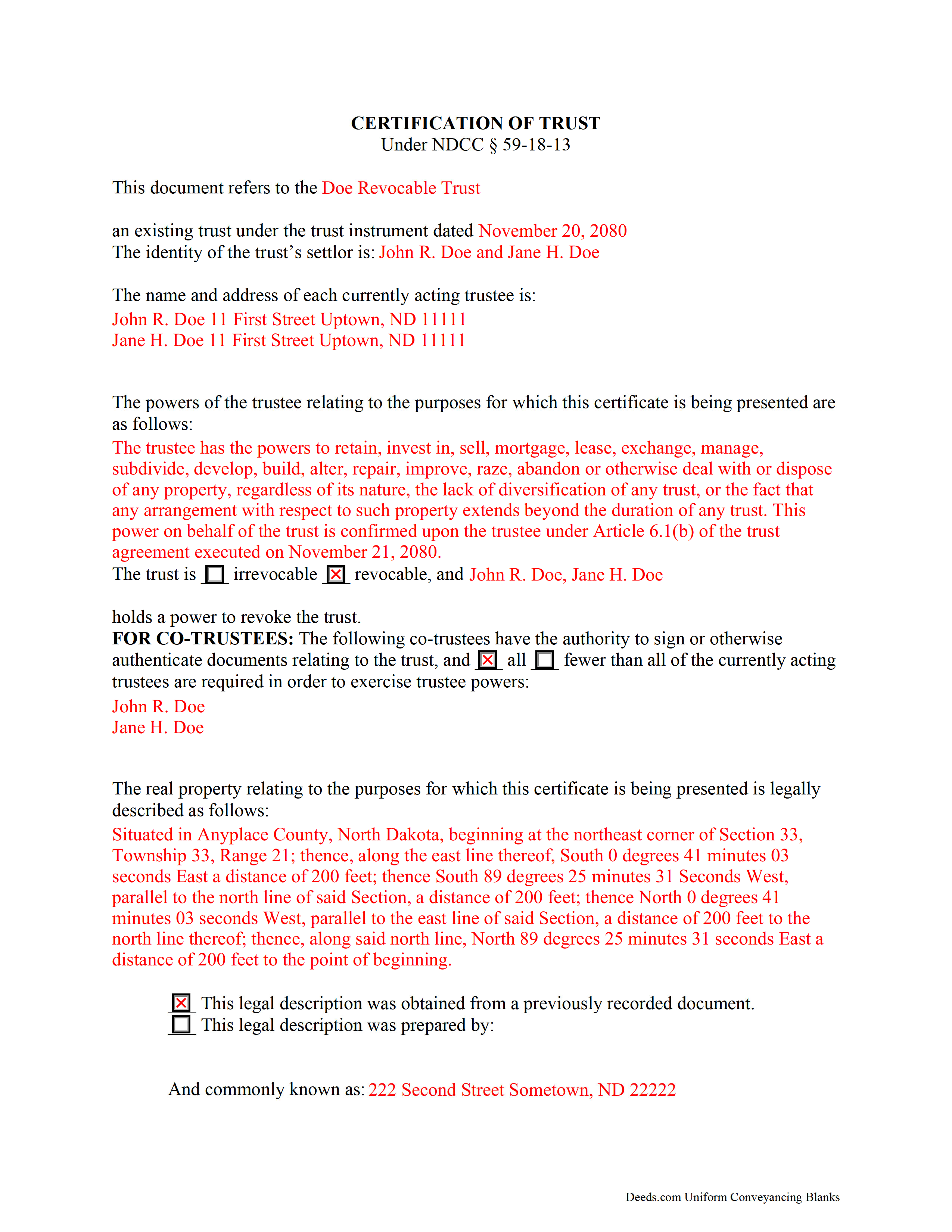

Traill County Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Traill County documents included at no extra charge:

Where to Record Your Documents

Traill County Recorder

Hillsboro, North Dakota 58045

Hours: 8:00 to 12:00 & 12:30 to 4:30 M-F

Phone: (701) 636-4457

Recording Tips for Traill County:

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Verify all names are spelled correctly before recording

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Traill County

Properties in any of these areas use Traill County forms:

- Blanchard

- Buxton

- Caledonia

- Clifford

- Cummings

- Galesburg

- Hatton

- Hillsboro

- Mayville

- Portland

Hours, fees, requirements, and more for Traill County

How do I get my forms?

Forms are available for immediate download after payment. The Traill County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Traill County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Traill County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Traill County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Traill County?

Recording fees in Traill County vary. Contact the recorder's office at (701) 636-4457 for current fees.

Questions answered? Let's get started!

Codified at N. D. Cent. Code 59-18-13 as part of the North Dakota Uniform Trust Code, the certification of trust is a document containing essential information about a trust. A trustee can present a certificate when entering transactions on behalf of a trust. As the name suggests, the form certifies the trust's existence and the trustee's authority to conduct business in the trust's name, and its recipient may rely upon the facts contained within it without further inquiry ( 59-18-13(6)).

A trust is an arrangement whereby a settlor (or grantor) transfers property to another person (trustee) to be held for the benefit of third (beneficiary). The trust is governed by the terms expressed in the trust instrument, a (generally) unrecorded document that designates the trustee, contains the scope of the trust's assets, and identifies the trust's beneficiaries. Some types of trust take effect during the settlor's lifetime (inter vivos trust), and others take effect upon the death of the settlor (testator), as provided for by a will (testamentary trust).

In North Dakota, the certification states that the trust exists and provides the trust's name and effective date of the trust instrument. In addition, it identifies each person who has contributed property to the trust as a settlor and gives the name and address of the currently acting trustee. The trustee's powers relevant to the pending transaction are enumerated; reference may be made to the statutory trustee powers codified at chapters 59-09 through 59-19 of the North Dakota Uniform Trust Code. The recipient of a certification of trust can request copies of excerpts from the trust instrument designating the trustee and conferring the power to act in the business at hand ( 59-18-13(5)).

The certificate also defines the trust as either irrevocable or revocable, and names who, if any, holds a power to revoke the trust. If the trust has co-trustees, the certificate states whether or not all trustees are required in order to carry out trustee powers. It also specifies, by name, which trustees can authorize trust documents. Finally, the document contains a statement that the trust has not been revoked, modified, or amended in any way that would falsify the statements made within.

Generally, it is unnecessary to provide a certificate of trust alongside conveyances of property from trustees in North Dakota, as the "trustee of a trust that holds title to real property is presumed to have the power to sell, convey, and encumber the real property unless restrictions on that power appear in the records of the county recorder" ( 47-10-26).

However, some situations may warrant an accompanying certificate, such as when a trustee is incorrectly identified on the deed into trust, or the trustee named on the current deed has been replaced [1]. When property deeded into a trust is erroneously titled in the name of the trust rather than the trustee of the trust, the subsequent conveyance out of the trust may be validated if the trustee's identity "is reasonably ascertainable from the conveyance or from other information of public record," such as a certification of trust ( 47-19-42.1). When used in transactions involving real property, the certificate should provide a legal description of the subject property.

The certificate must be signed by a trustee in the presence of a notary public. If recording is applicable to the situation, the certificate may be recorded through the recorder's office. Consult a lawyer with any questions.

(North Dakota COT Package includes form, guidelines, and completed example)

Important: Your property must be located in Traill County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust meets all recording requirements specific to Traill County.

Our Promise

The documents you receive here will meet, or exceed, the Traill County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Traill County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Richard O.

February 18th, 2025

It has an easy-to-use interface and well-formatted, detailed forms. Consider adding AI agents to assist in completing these forms from data provided or available from public sources. Overall, I am very satisfied!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Janet B.

July 28th, 2020

Review: Very user friendly and that is very important to me. Quick, easy and clear instructions. I would highly recommend deeds.com for your online filing services.

Thank you for your feedback. We really appreciate it. Have a great day!

John G.

July 25th, 2022

I was actually quite pleased with the ease of use of this site. I really, really liked the step by step instructions and examples of the finished product !!

Thank you!

Vera P.

May 14th, 2020

An excellent service!

Thank you!

lorali V.

February 12th, 2020

Not easy to fill in and the finished product looked awful when printed.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine B.

September 15th, 2020

Trying to get a hold of someone in the office is very difficult. This made it so much easier, thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Roy K.

February 15th, 2019

Just what we were looking for. Very easy to fill out. Thanks

Thank you Roy. We appreciate your feedback.

Arthur H.

March 17th, 2022

Deeds.com was informative, quick, and complete. Found everything I needed complete with instructions and examples. Easy to use and understand. And VERY reasonably priced.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Timothy B.

May 17th, 2023

Information was very helpful and straight forward, Thankyou!

Thank you!

Sandrs T.

August 27th, 2020

It would be good to be able to print several documents at 1 time by highlighting them in the list without having to do one document at a time.

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer M.

April 3rd, 2024

Consistent and quick. This site saves me so much time away from my desk. It's a great resource for my small business!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Omid B.

January 14th, 2021

Super efficient, extremely responsive , and above all quick turnaround. Thank you! Will definitely use your services again!

Thank you!

Robert B.

April 5th, 2019

Everything worked Fine. I wish there was an John Doe type of an example for the Tax form.

Thank you!

Justin S.

September 2nd, 2022

Very useful information

Thank you!

Jane B.

December 20th, 2020

Easy to use,thanks

Thank you!