Licking County Fiduciary Deed Form

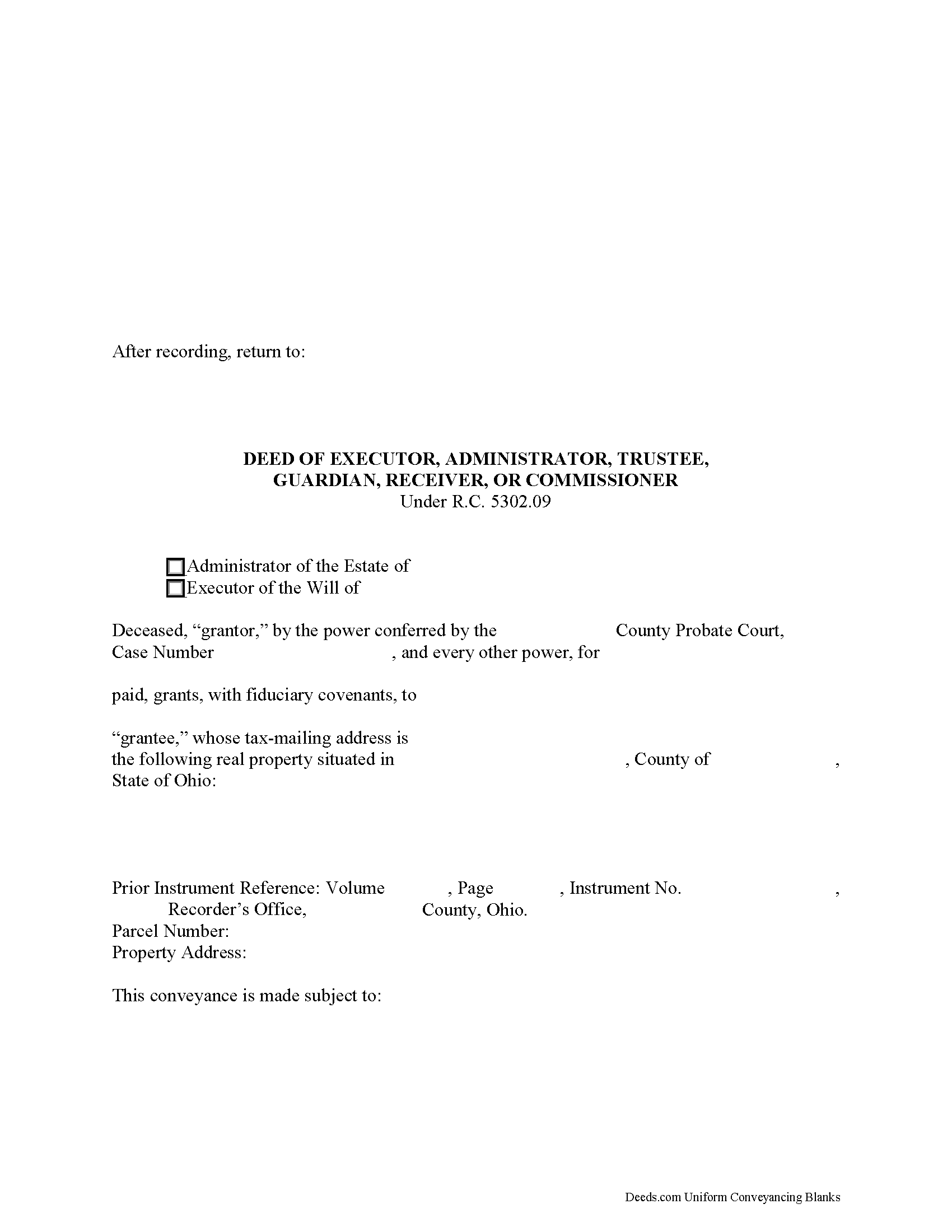

Licking County Fiduciary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

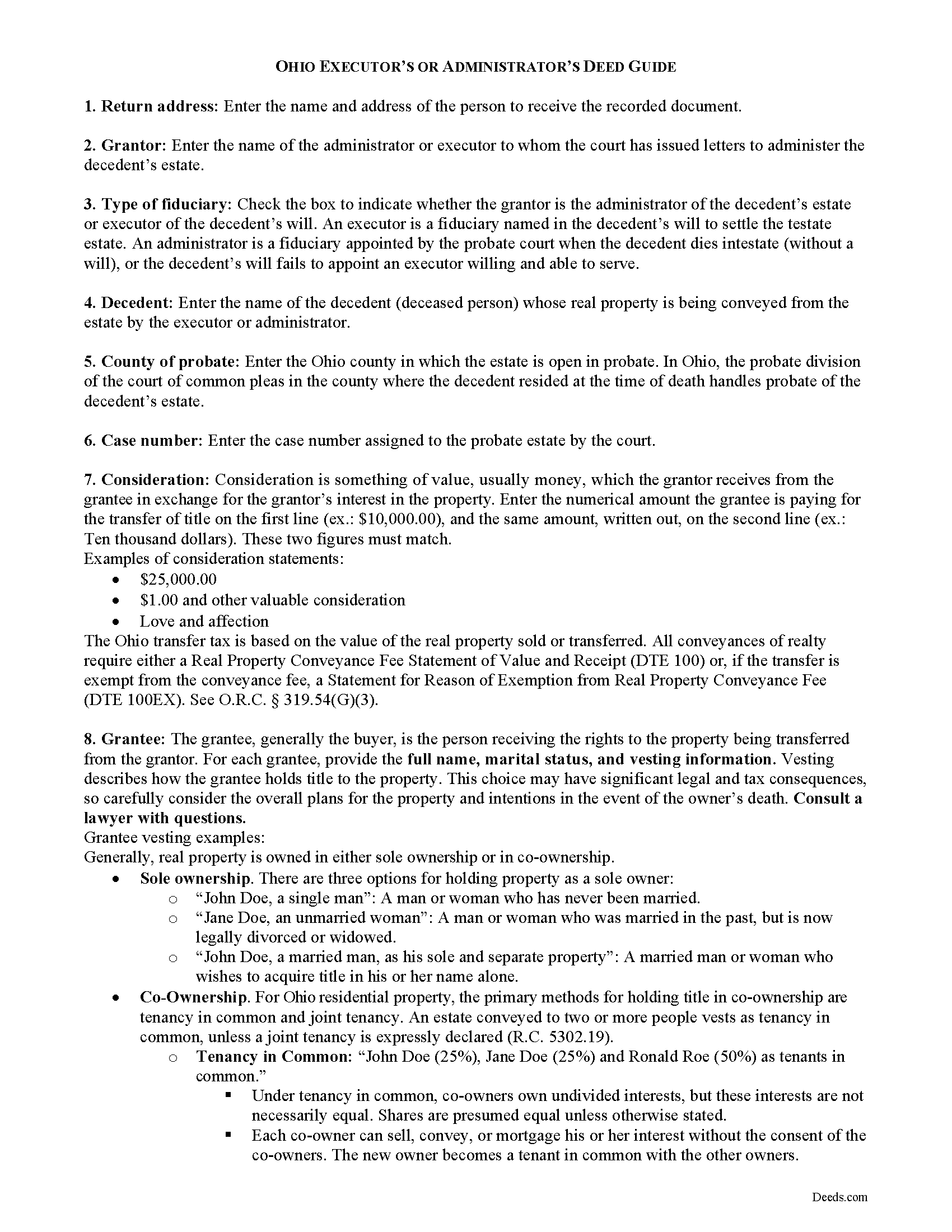

Licking County Fiduciary Deed Guide

Line by line guide explaining every blank on the form.

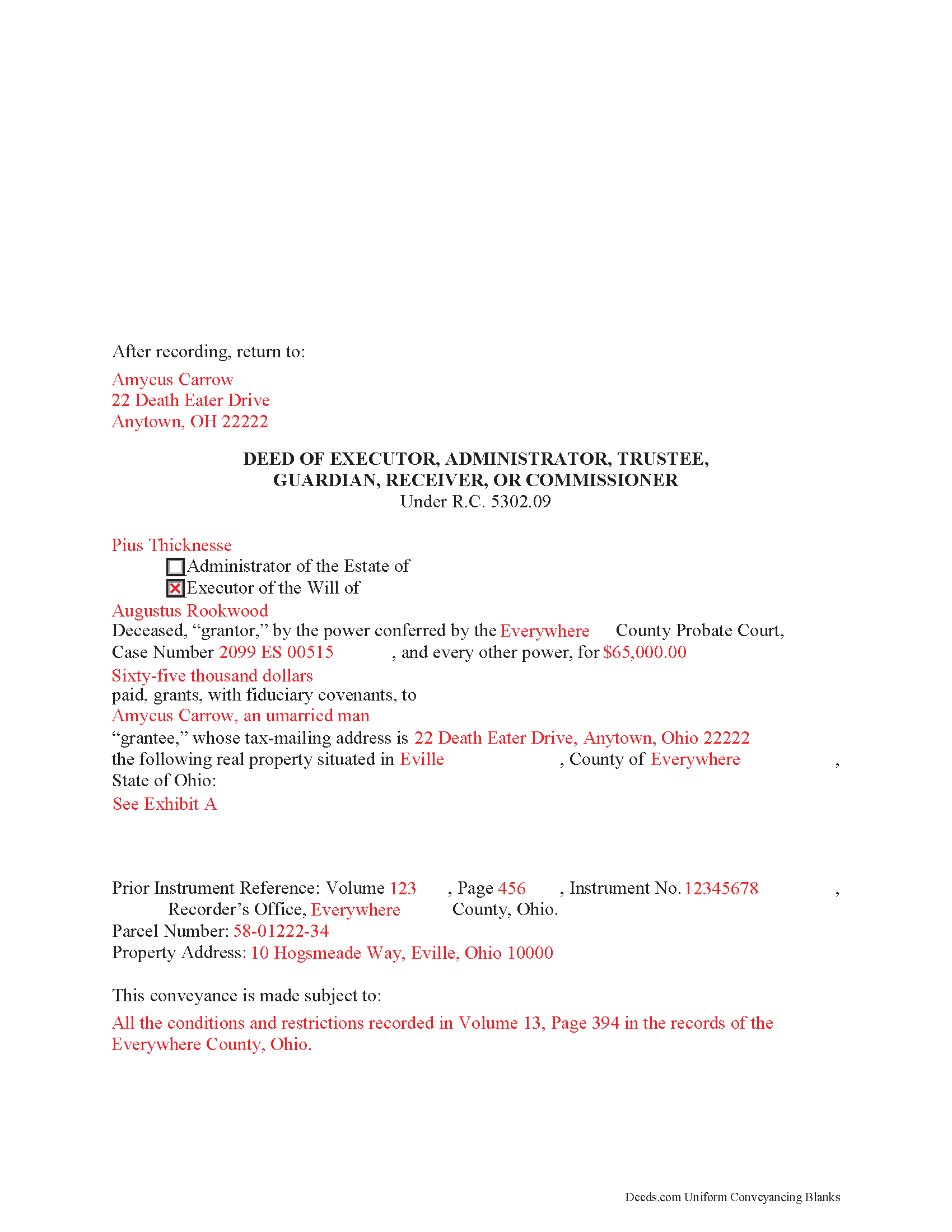

Licking County Completed Example of the Fiduciary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Licking County documents included at no extra charge:

Where to Record Your Documents

Recorder of Deeds

Newark, Ohio 43055

Hours: 8:00 - 4:30 Monday through Friday

Phone: 740-670-5300

Recording Tips for Licking County:

- Ensure all signatures are in blue or black ink

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Licking County

Properties in any of these areas use Licking County forms:

- Alexandria

- Brownsville

- Buckeye Lake

- Croton

- Etna

- Granville

- Gratiot

- Heath

- Hebron

- Homer

- Jacksontown

- Johnstown

- Kirkersville

- Newark

- Pataskala

- Saint Louisville

- Summit Station

- Utica

Hours, fees, requirements, and more for Licking County

How do I get my forms?

Forms are available for immediate download after payment. The Licking County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Licking County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Licking County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Licking County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Licking County?

Recording fees in Licking County vary. Contact the recorder's office at 740-670-5300 for current fees.

Questions answered? Let's get started!

Ohio Fiduciary Deed for Executors and Administrators

Probate is the legal process of settling and distributing a decedent's estate according to the terms of a probated will or laws of intestate succession. In the context of estate administration, a fiduciary is either an executor (when named in a will) or an administrator (when the decedent dies without a will or does not name an executor) assigned by the court of common pleas to administer the decedent's estate.

If the estate's assets are insufficient to pay debts, the fiduciary may need to sell the decedent's property. Fiduciaries must obtain the court's permission to sell assets from the estate, unless authorized or directed by the decedent's will.

In Ohio, executors and administrators use fiduciary deeds to convey real property from an estate to a purchaser pursuant to a court order. A fiduciary deed is a statutory form (R.C. 5302.09) containing fiduciary covenants that the grantor is the duly appointed, qualified, and acting fiduciary, and that he or she is authorized to make the sale and conveyance of the within described real property. Additionally, the grantor covenants with the grantee that in the proceedings of the sale, he or she has complied with statutory requirements (5302.10).

A fiduciary deed names the executing fiduciary's as grantor, and identifies the county and case number in which the decedent's estate is opened in probate. The deed states the amount of consideration the grantee is paying for the transfer of title, and titles the property in the name and manner of vesting of the grantee.

Deeds in Ohio require a recital of the grantor's source of title, including the prior instrument volume and page numbers. A full legal description of the subject parcel is required. Any restrictions on the property should also be noted. The executing fiduciary must sign the deed in the presence of a notary public before recording in the county where the subject property is located.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Ohio with questions regarding fiduciary deeds, as each situation is unique.

(Ohio Fiduciary Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Licking County to use these forms. Documents should be recorded at the office below.

This Fiduciary Deed meets all recording requirements specific to Licking County.

Our Promise

The documents you receive here will meet, or exceed, the Licking County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Licking County Fiduciary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

ROBERET D.

November 18th, 2021

after a poor start was able to get to the forms page and find what I was looking for and every thing worked good. Just getting to the right area was a struggle but we made thanks Bob

Thank you for your feedback. We really appreciate it. Have a great day!

Anthony G.

February 17th, 2021

I have only used the service on one occasion but so far it has been great. Extremely simple to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph S.

November 27th, 2023

THIS IS MY FIRST EXPERIENCE WITH DEEDS.COM. I DLED THE ESTATE DEED FORM THAT I HOPE WILL GO THROUGH OK WITH THE COUNTY. IT WILL BE SOMETIME UNTIL I HAVE IT FILLED IN AND ALL THE NAMES IN, NORARIZED AND FILED. CAN I RECONTACT YOU FOLKS IF THERE IS A PROBLEM? THANK YOU, JOE SEUBERT

We are motivated by your feedback to continue delivering excellence. Thank you!

Judith C.

February 3rd, 2021

very happy so far. Haven't gone to record deeds yet so am in good hopes everything will be in good order. Time saver!!!

Thank you!

Abby H.

September 1st, 2020

Purchased the forms to make a deed. They were available immediately as promised. Easy to use. The guide and example was a big help. Will definitely use again if/when needed. Thanks.

Thank you Abby, we appreciate you. Have a great day!

Daniel F.

March 26th, 2021

We have been very happy with all that Deeds have done very timely and helpful

Thank you!

Annette A.

March 21st, 2019

I requested a property report and it was completed fast and accurately. I would highly recommend this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marianne F.

September 28th, 2020

This serve was very fast and efficient. I was very pleased at how quickly I received my recorded document.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DEBORAH G.

April 1st, 2019

This product is good but the text boxes are not large enough to contain the information required for the form. Even dates do not display with the entry you make.

Thank you for your feedback. We really appreciate it. Have a great day!

Anne S.

June 13th, 2019

Responsive and honest. They were unable to obtain records for me, no fault of theirs, and immediately let me know and credited my account. I give Deeds dot com five stars and would come back. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert F.

January 19th, 2019

Came with all the paperwork that I needed plus a lot more paperwork than what I needed. Covered all the bases! The instructions were a big help. Easy fill in the blanks. Had no problem filing the paperwork afterword at the County Clerks office. Definitely worth the $20.

Thanks Robert. We appreciate you taking the time to give us your feedback. Have a fantastic day!

Terrence R.

January 24th, 2020

So far so good I was able to find the documents I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gail D.

October 22nd, 2024

Very concise and thorough website. Easily navigated and easily affordable.

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

Kristen H.

August 29th, 2019

This was such a money saver. I was told by someone at the courthouse that I had to have a lawyer prepare the paper work for my mom. They stated that family members couldn't prepare the papers. I was hopeful when I found that I could prepare the survivorship affidavit on Deeds. I was able to prepare everything myself and had no issues today when at the courthouse for all the changes. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James J.

December 27th, 2019

Downloaded and used the Ladybird Warranty Deed for a county in Florida with no issues. Cost for the download and subsequent recording fee of the deed totaled less than $40. No reason to pay hundreds. I assume the subsequent transfer upon death will go smoothly, but I of course, will never know. The "example" of a completed form was very beneficial. Also, get a copy of the current deed and make sure legal description of real estate is exactly the same on the new deed.

Thank you for your feedback. We really appreciate it. Have a great day!