Cuyahoga County Mortgage Instrument and Promissory Note Form

Cuyahoga County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Cuyahoga County Mortgage Guidelines

Line by line guide explaining every blank on the form.

Cuyahoga County Completed Example of the Mortgage Document

Example of a properly completed form for reference.

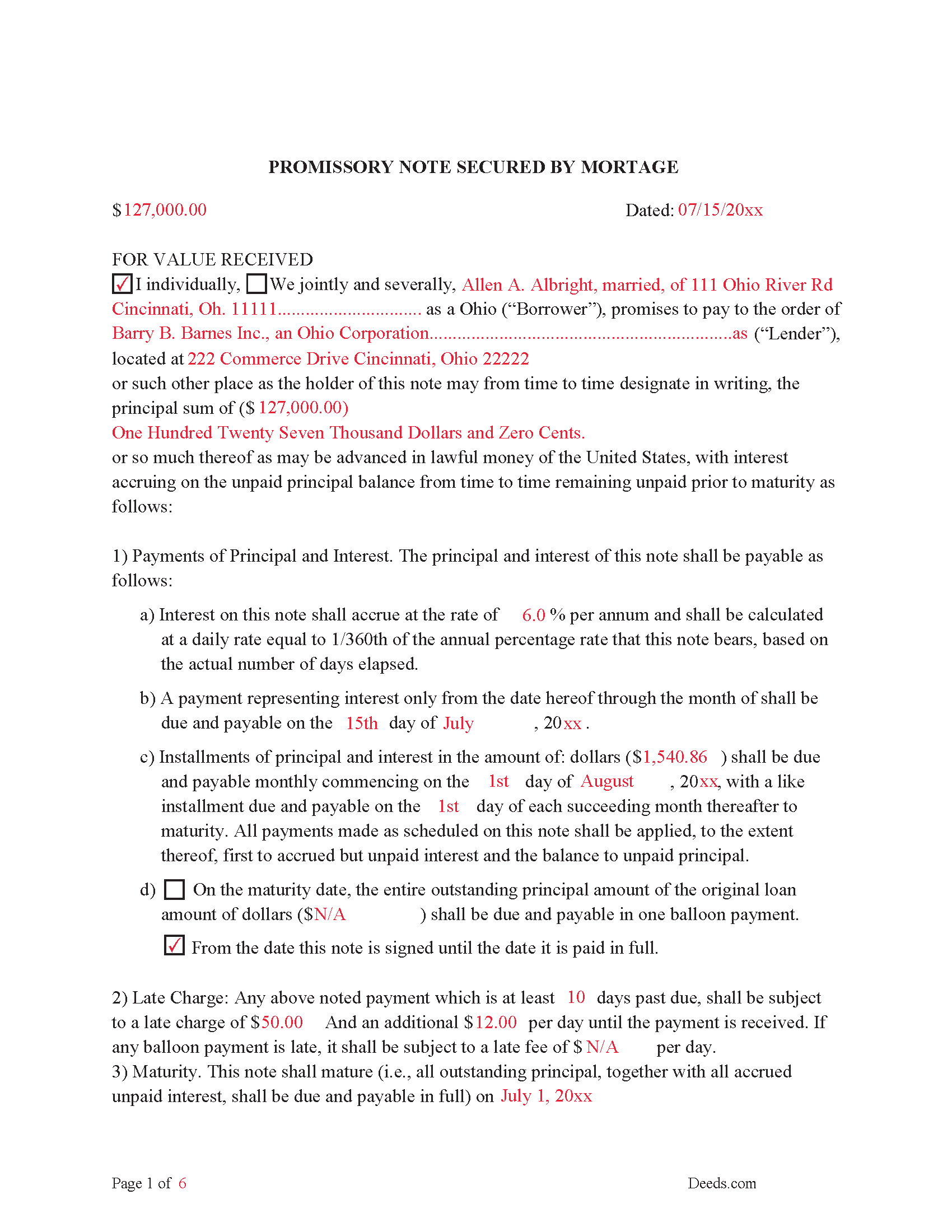

Cuyahoga County Promissory Note Form

Promissory Note secured by Mortgage Agreement.

Cuyahoga County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Cuyahoga County Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

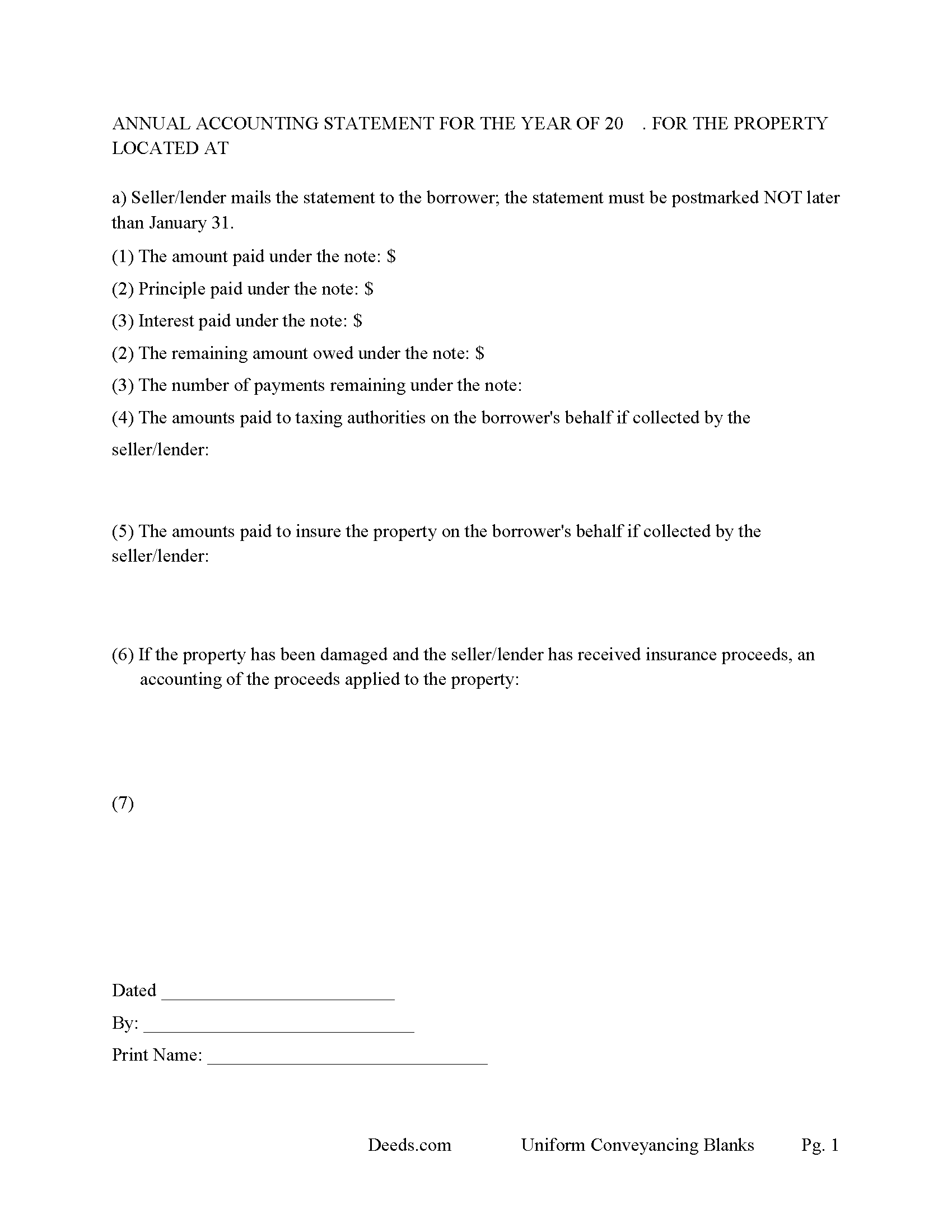

Cuyahoga County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Cuyahoga County documents included at no extra charge:

Where to Record Your Documents

Cuyahoga County Fiscal Office: Transfer and Recording Department

Cleveland, Ohio 44115

Hours: 8:30 to 4:30 M-F

Phone: 216-443-7020

Recording Tips for Cuyahoga County:

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Cuyahoga County

Properties in any of these areas use Cuyahoga County forms:

- Bay Village

- Beachwood

- Bedford

- Berea

- Brecksville

- Broadview Heights

- Brook Park

- Chagrin Falls

- Cleveland

- Euclid

- Gates Mills

- Independence

- Lakewood

- Maple Heights

- North Olmsted

- North Royalton

- Olmsted Falls

- Rocky River

- Solon

- Strongsville

- Westlake

Hours, fees, requirements, and more for Cuyahoga County

How do I get my forms?

Forms are available for immediate download after payment. The Cuyahoga County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cuyahoga County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cuyahoga County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cuyahoga County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cuyahoga County?

Recording fees in Cuyahoga County vary. Contact the recorder's office at 216-443-7020 for current fees.

Questions answered? Let's get started!

These forms are used for financing residential property, condominiums, rental units, small commercial, vacant land, and planned unit developments. They include special provisions and exhibit pages making them adaptable and flexible for unique situations. Ohio recognizes dower rights, which means that if a married man or woman owns an interest in real property, his or her spouse holds a 1/3 interest in the property, Review Oh. statute 2103.02. Dower rights can become problematic when it comes to mortgages. Oftentimes, banks require a release of dower if only one spouse is on the promissory note. Otherwise, if the paying spouse defaults, a spouse may be able to enforce their dower rights if the spouse is not on the deed. This mortgage can release rights of dower if applicable to the situation. These forms have stringent default terms, typical uses - lender who is financing investment property, owner financing, etc.

(Ohio Mortgage Package includes forms, guidelines, and completed examples) For use in Ohio only.

Important: Your property must be located in Cuyahoga County to use these forms. Documents should be recorded at the office below.

This Mortgage Instrument and Promissory Note meets all recording requirements specific to Cuyahoga County.

Our Promise

The documents you receive here will meet, or exceed, the Cuyahoga County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cuyahoga County Mortgage Instrument and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Bobette B.

September 26th, 2019

Worked well with clear guide!

Thank you!

Sarah A.

August 3rd, 2020

Uploading the document was simple, and it was recorded much faster than I thought! Deeds.com makes the process incredibly easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Clifford J.

July 4th, 2022

a lil pricey but i was able to knock out what needed to be done within 2 hours and not all day.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen H.

July 21st, 2020

Very disappointed that the Recording Information section did not state where to get the information required.

Sorry to hear that we failed you Kathleen.

RONDA S.

March 18th, 2021

I just love this site!

Thank you!

Barbara D.

October 9th, 2019

Appreciate this service!

Thank you!

Rosemary S.

July 25th, 2020

It was quick and so very easy. Very detailed information. Love the app.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Caville B.

February 10th, 2019

Received the documents, but the explanation and process is not as straightforward as I would have liked. The Instructions and Sample document were not always easy to follow. I may just have a real estate lawyer perform the task.

Thank you for your feedback. We really appreciate it. Have a great day!

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

William B.

May 29th, 2021

The website works just as described. I couldn't ask for anything more helpful in drafting an easement and all at a very reasonable price. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Djala C.

November 18th, 2019

my experience was excellent.

Thank you!

Thomas C.

July 31st, 2021

This platform made electronic filing of a lien easy and quick. I was able to accomplish everything from my laptop and phone, and the fees were reasonable. I would recommend deeds.com for efiling property related documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DIANA S.

August 19th, 2019

Five star rating. I requested a copy of the deed to my house and it arrived very quickly and for a fraction of the cost that it would have cost me on other sites. Great company. Will do business again. Five stars.

Thank you!

Johannah H.

May 20th, 2022

Deeds.com made my experience recording a Deed in Weld County, CO so easy! The representative went above and beyond by assisting me with the preparation of a high-quality digital document for recording. Highly Recommend!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!