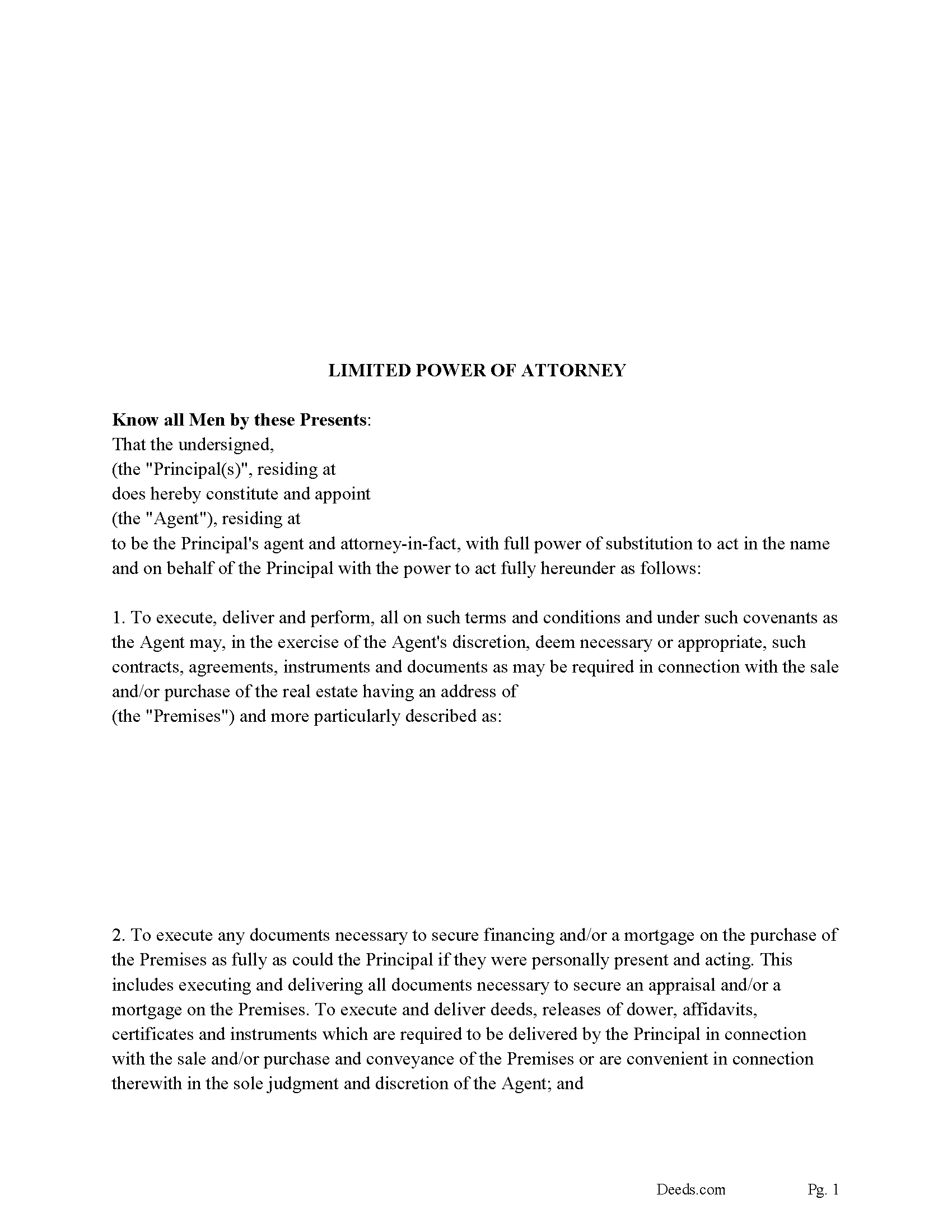

Jefferson County Ohio Limited Power of Attorney for Real Property Form

Jefferson County Limited Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

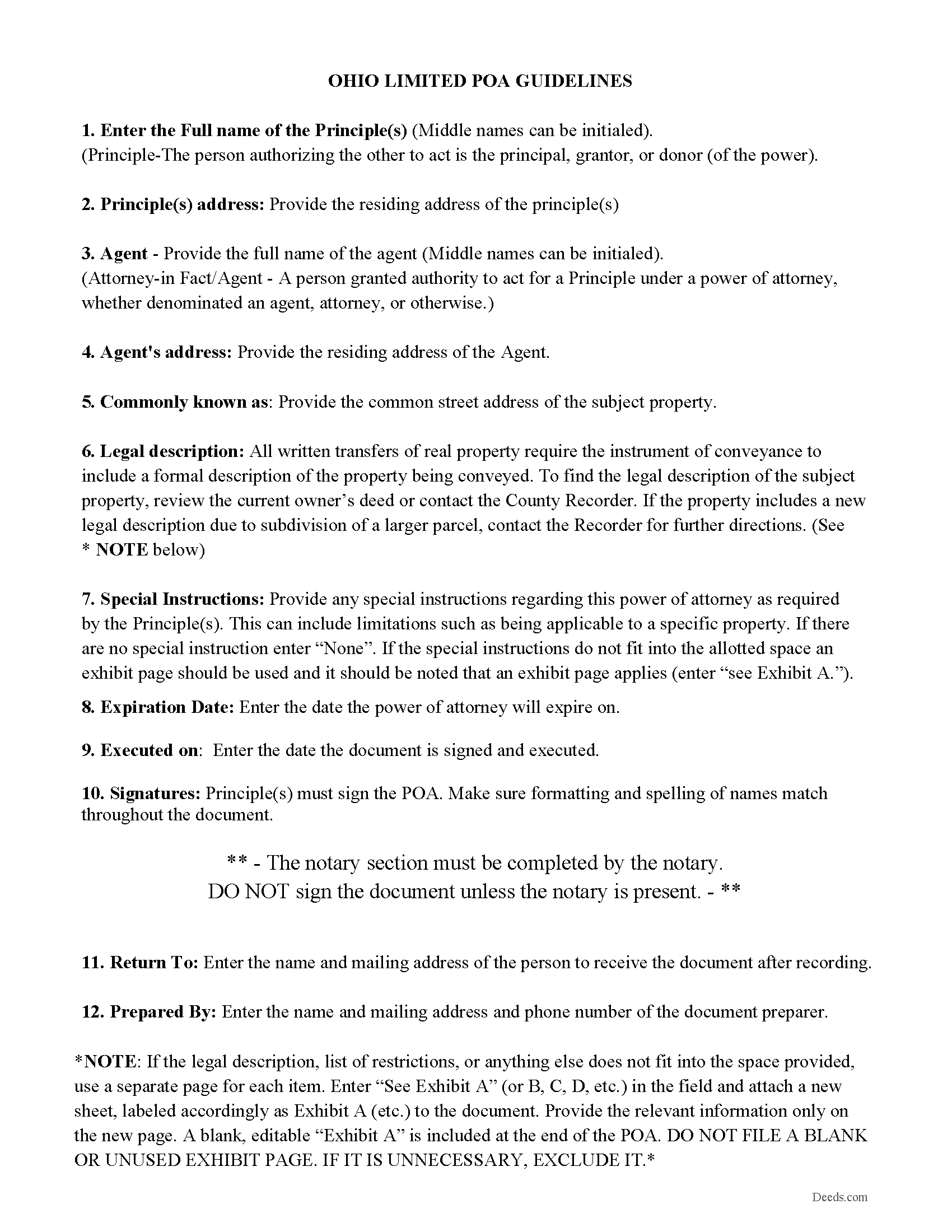

Jefferson County Limited POA Guidelines

Line by line guide explaining every blank on the form.

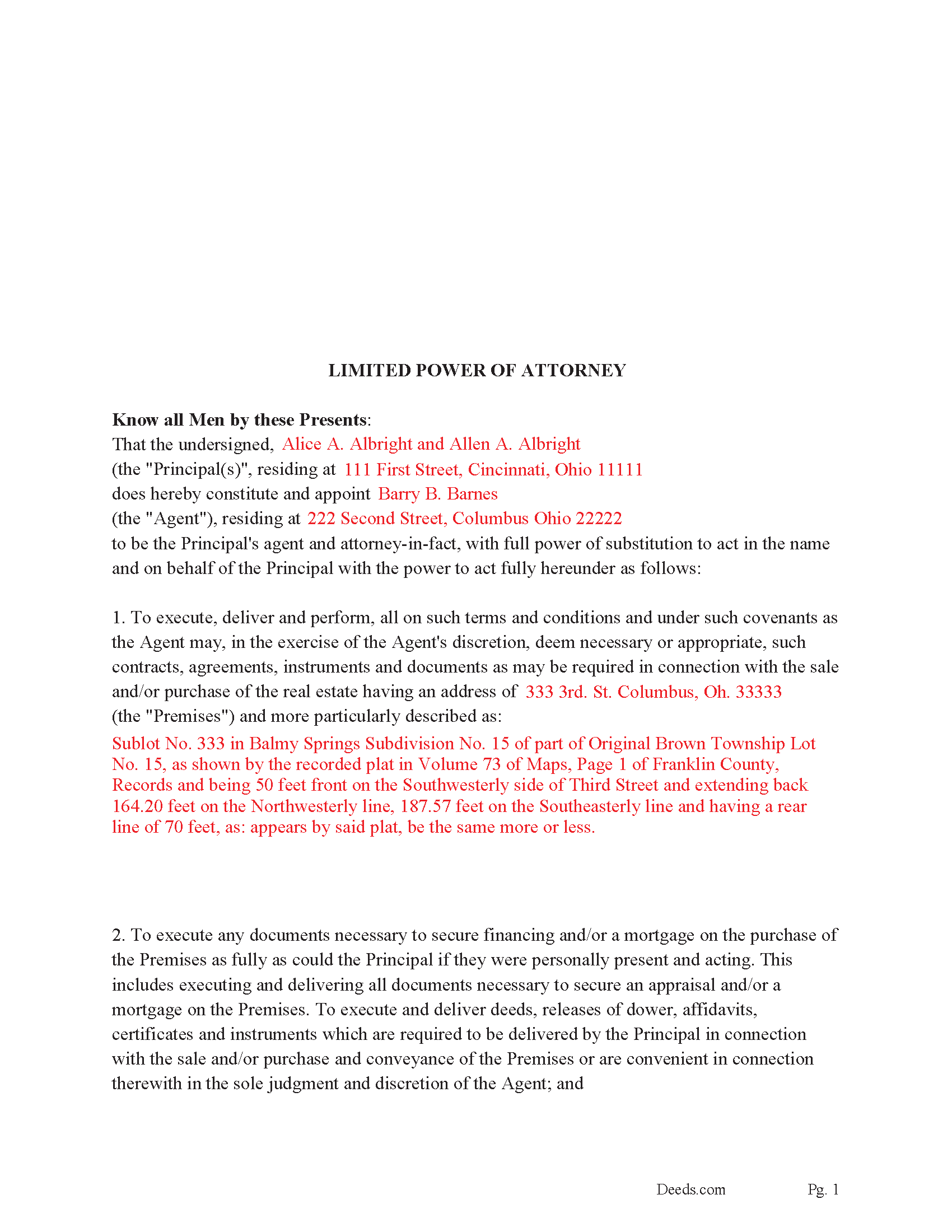

Jefferson County Completed Example of the Limited POA

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Jefferson County documents included at no extra charge:

Where to Record Your Documents

Jefferson County Recorder

Steubenville, Ohio 43952

Hours: 8:30am to 4:30pm Monday through Friday

Phone: 740-283-8566

Recording Tips for Jefferson County:

- Double-check legal descriptions match your existing deed

- Leave recording info boxes blank - the office fills these

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Jefferson County

Properties in any of these areas use Jefferson County forms:

- Adena

- Amsterdam

- Bergholz

- Bloomingdale

- Brilliant

- Dillonvale

- East Springfield

- Empire

- Hammondsville

- Irondale

- Mingo Junction

- Mount Pleasant

- Piney Fork

- Rayland

- Richmond

- Smithfield

- Steubenville

- Stratton

- Tiltonsville

- Toronto

- Wolf Run

- Yorkville

Hours, fees, requirements, and more for Jefferson County

How do I get my forms?

Forms are available for immediate download after payment. The Jefferson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jefferson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jefferson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jefferson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jefferson County?

Recording fees in Jefferson County vary. Contact the recorder's office at 740-283-8566 for current fees.

Questions answered? Let's get started!

This is a LIMITED power of attorney for real property. What is a limited power of attorney? A "limited power of attorney" gives the agent authority to conduct a specific act. For example, a person might use a limited power of attorney to sell and/or purchase a home in another state by delegating authority to another person to handle the transaction locally. Such a power could be "limited" to selling and/or purchasing a home/property or to other specified acts. This form includes a "Special Instructions" section where the principal can further define or limit the Agent's powers.

When the Agent is authorized to transfer interest in real property by (a power of attorney), it (shall be signed, acknowledged, and certified as provided in section 5301.01 of the Revised Code.) (1337.01)

(No deed executed by a person acting for another, under a power of attorney, acknowledged, and recorded, is invalid or defective because he, instead of his principal, is named in such deed as such attorney as grantor; nor because his name, as such attorney, is subscribed to such deed, instead of the name of his principal; nor because the certificate of acknowledgment, instead of setting forth that the deed was acknowledged by the principal, by his attorney, sets forth that it was acknowledged by the person who executed it, as such attorney. All such deeds shall be as valid and effectual, in all respects, within the authority conferred by such powers of attorney, as if they had been executed by the principals of such attorneys, in person.) (1337.03)

(A power of attorney for the conveyance, mortgage, or lease of an interest in real property must be recorded in the office of the county recorder of the county in which such property is situated, previous to the recording of a deed, mortgage, or lease by virtue of such power of attorney.) (1337.04)

(Ohio Limited POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Jefferson County to use these forms. Documents should be recorded at the office below.

This Ohio Limited Power of Attorney for Real Property meets all recording requirements specific to Jefferson County.

Our Promise

The documents you receive here will meet, or exceed, the Jefferson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jefferson County Ohio Limited Power of Attorney for Real Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Kenneth K.

October 8th, 2019

It was fast and easy to use.

Thank you!

JoAnn T.

October 7th, 2022

Very happy! This was a very easy to use web site, the form came with directions and an example, both were very helpful. I will absolutely use Deeds.com in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Betty A.

March 2nd, 2022

You've made it very easy to download the form I needed. Thank you.

Thank you!

John L.

February 26th, 2023

excellent...exactly what i need....

Thank you!

Frank W.

November 15th, 2022

would be nice to be able to see what I am purchasing before I paid

Thank you!

Clint E.

September 3rd, 2020

Good value. I like not only getting the forms, but also the instructions and examples the forms came with

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gregory N.

September 10th, 2020

Good information guiding through filling out the product. Would like form to be more flexible in terms of spacing, but otherwise excellent.

Thank you for your feedback. We really appreciate it. Have a great day!

RICHARD M.

May 12th, 2020

After a little glitch due to heavy volume at the County Recorder, my document was recorded. County Recorder was closed to public access at the office (due to the coronavirus issues) so all documents were either mailed to them or sent in electronically. Deeds.com was very efficient at their end with very quick responses to my questions and concerns. I would definitely use their services again.

Thank you for your feedback. We really appreciate it. Have a great day!

Tami C.

May 11th, 2021

Excellent service, easy to follow instructions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott M.

August 8th, 2024

Very straightforward. Only issue was it took a few times for the mineral deed form to show up. The first few times it instead showed a mineral rights transfer between operators.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Carol O.

April 3rd, 2023

Easy process as I had an example of my other property deeds to work from plus my most current Real Estate Tax forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eric L.

June 28th, 2021

Great service, but still needs some knowledge to complete. Also missing Michigan right to farm paragraph.

Thank you!

Pat G.

May 12th, 2020

Found correct form right away, easy to download and print. Thank you!

Thank you!

Patrick N.

August 15th, 2019

I was very satisfied with your service. Prompt, and thorough. Price was reasonable. Will use your service again when needed.

Thank you for your feedback. We really appreciate it. Have a great day!

SHIRLEY R.

August 22nd, 2019

This was Awesome!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!