Lawrence County Ohio Limited Power of Attorney for Real Property Form

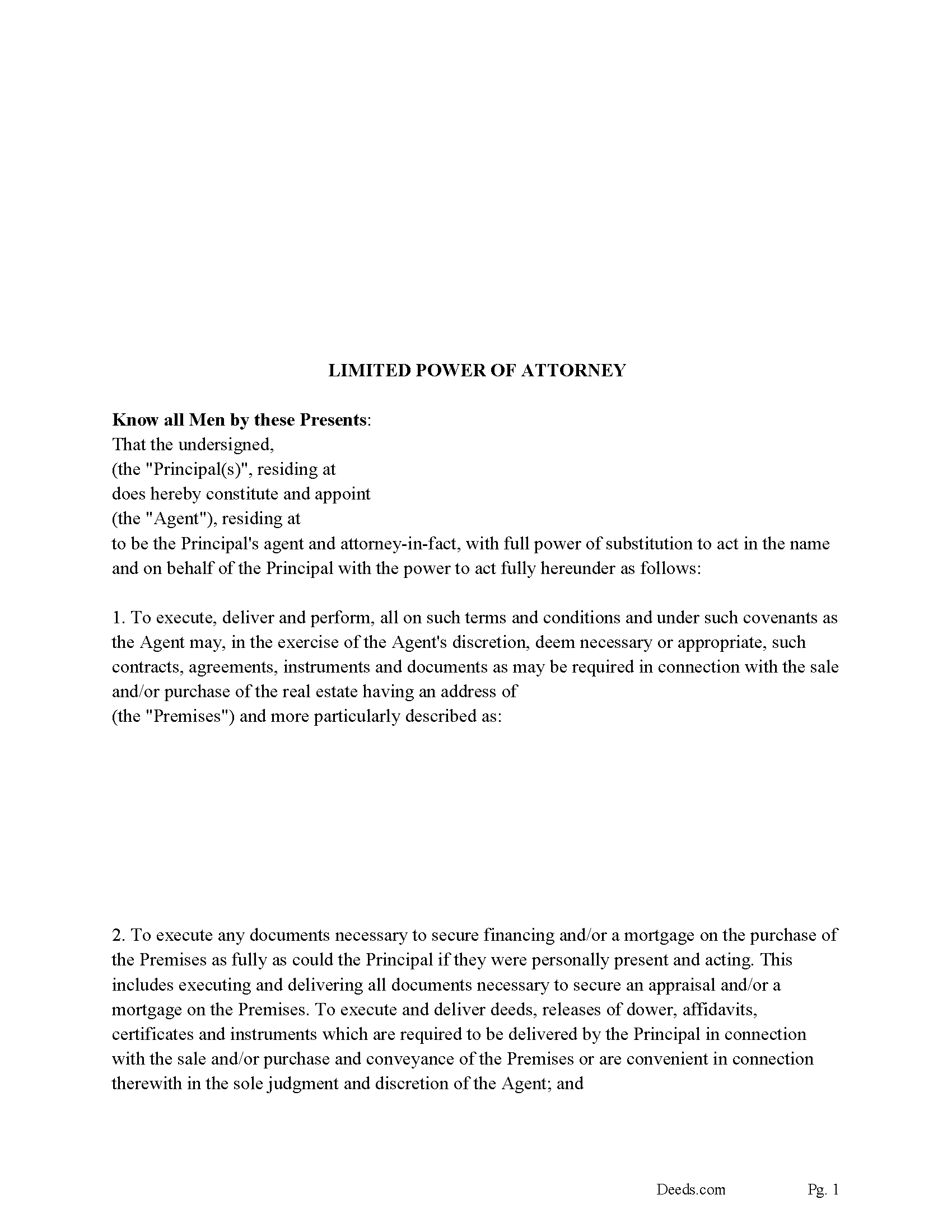

Lawrence County Limited Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

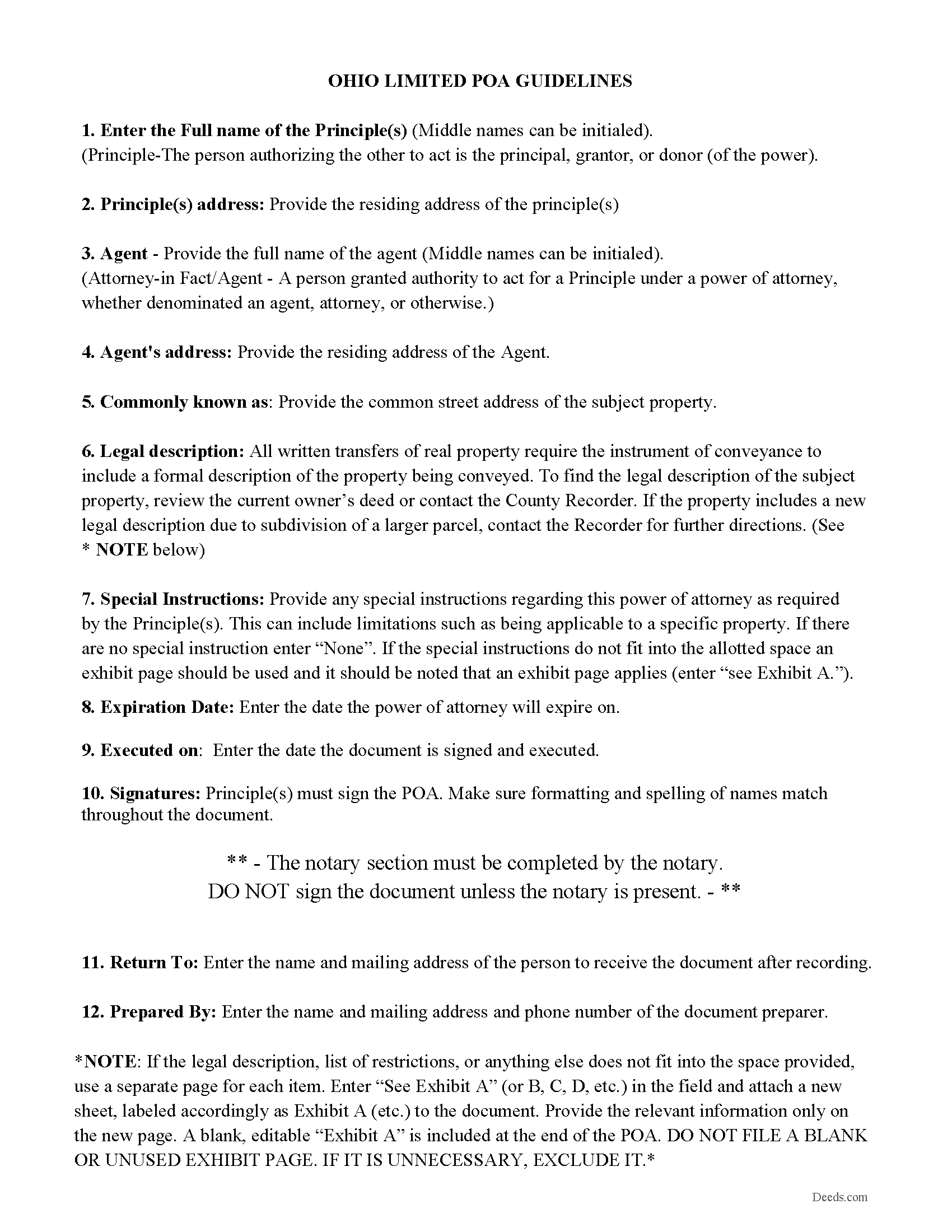

Lawrence County Limited POA Guidelines

Line by line guide explaining every blank on the form.

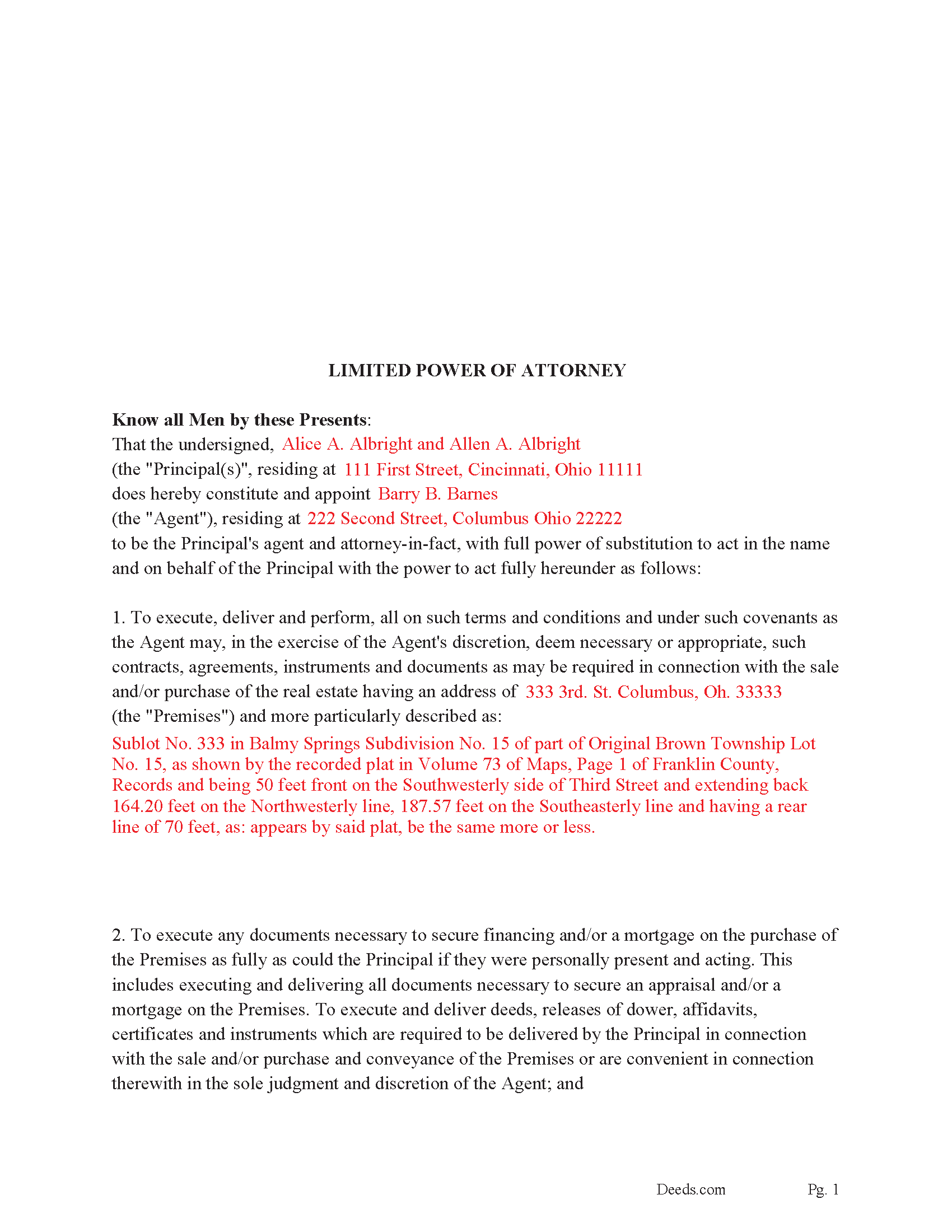

Lawrence County Completed Example of the Limited POA

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Lawrence County documents included at no extra charge:

Where to Record Your Documents

Lawrence County Recorder

Ironton, Ohio 45638

Hours: 8:00 a.m. - 4:00 p.m. Monday - Friday

Phone: (740) 533-4314

Recording Tips for Lawrence County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Lawrence County

Properties in any of these areas use Lawrence County forms:

- Chesapeake

- Ironton

- Kitts Hill

- Pedro

- Proctorville

- Rock Camp

- Scottown

- South Point

- Waterloo

- Willow Wood

Hours, fees, requirements, and more for Lawrence County

How do I get my forms?

Forms are available for immediate download after payment. The Lawrence County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lawrence County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lawrence County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lawrence County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lawrence County?

Recording fees in Lawrence County vary. Contact the recorder's office at (740) 533-4314 for current fees.

Questions answered? Let's get started!

This is a LIMITED power of attorney for real property. What is a limited power of attorney? A "limited power of attorney" gives the agent authority to conduct a specific act. For example, a person might use a limited power of attorney to sell and/or purchase a home in another state by delegating authority to another person to handle the transaction locally. Such a power could be "limited" to selling and/or purchasing a home/property or to other specified acts. This form includes a "Special Instructions" section where the principal can further define or limit the Agent's powers.

When the Agent is authorized to transfer interest in real property by (a power of attorney), it (shall be signed, acknowledged, and certified as provided in section 5301.01 of the Revised Code.) (1337.01)

(No deed executed by a person acting for another, under a power of attorney, acknowledged, and recorded, is invalid or defective because he, instead of his principal, is named in such deed as such attorney as grantor; nor because his name, as such attorney, is subscribed to such deed, instead of the name of his principal; nor because the certificate of acknowledgment, instead of setting forth that the deed was acknowledged by the principal, by his attorney, sets forth that it was acknowledged by the person who executed it, as such attorney. All such deeds shall be as valid and effectual, in all respects, within the authority conferred by such powers of attorney, as if they had been executed by the principals of such attorneys, in person.) (1337.03)

(A power of attorney for the conveyance, mortgage, or lease of an interest in real property must be recorded in the office of the county recorder of the county in which such property is situated, previous to the recording of a deed, mortgage, or lease by virtue of such power of attorney.) (1337.04)

(Ohio Limited POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Lawrence County to use these forms. Documents should be recorded at the office below.

This Ohio Limited Power of Attorney for Real Property meets all recording requirements specific to Lawrence County.

Our Promise

The documents you receive here will meet, or exceed, the Lawrence County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lawrence County Ohio Limited Power of Attorney for Real Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Lorie C.

April 15th, 2023

Easy and effective...surely saved hundreds by avoiding a lawyer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hans K.

November 7th, 2020

The deeds.com site provides clarifying useful information for the do-it-yourself type of person.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Moving Forward V.

October 13th, 2023

Great Service!

Thank you!

Linda W.

June 24th, 2019

Very easy to use. They had the exact document I was looking for.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joe S.

July 6th, 2020

Easy to use, reasonable price and excellent customer service! I would not hesitate to use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa D.

December 7th, 2022

Had the correct forms I needed with guides and examples to follow on filling them out. Very easy to use. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry A.

December 17th, 2021

Provided exactly the form I was looking for at a reasonable price. Easy to do as well.

Thank you!

RONDA S.

March 18th, 2021

I just love this site!

Thank you!

leslie w.

June 23rd, 2020

Easy to use! Thanks for saving the time and expense of an attorney!

Thank you for your feedback. We really appreciate it. Have a great day!

joseph p.

December 23rd, 2019

As i am not very computer ready,i had one heck of a time filling,printing,and copying this document.But with your patience and understanding of older ways,WE DID IT SUCCESSFULLY.Thank you for your time.I will recommend this site to all that inquire

Thank you for your feedback. We really appreciate it. Have a great day!

Randy B.

February 3rd, 2019

The form was exactly what we needed and the directions were spot on and perfectly clear. Filling out government forms can be an experience filled with anxiety but deeds.com made it easy and practically worry free.

Thanks Randy, we really appreciate your feedback.

Margaret J.

July 27th, 2022

Forms were clear and understandable

Thank you!

susanne y.

July 13th, 2020

wonderful service, docs recorded with no issues.

Thank you for your feedback. We really appreciate it. Have a great day!

Christopher S.

October 5th, 2024

very easy to use, and comprehensive...I like the e-recording package

We are grateful for your feedback and looking forward to serving you again. Thank you!

Morgan K.

August 24th, 2021

When I brought this deed to the county assessor, they were so impressed that I had done it correctly on my first try, and said they wished everyone would do such a good job on their paperwork.

Thank you for your feedback. We really appreciate it. Have a great day!