Lane County Substitution of Trustee and Deed of Reconveyance (For Deed of Trust / Trust Deed) Form

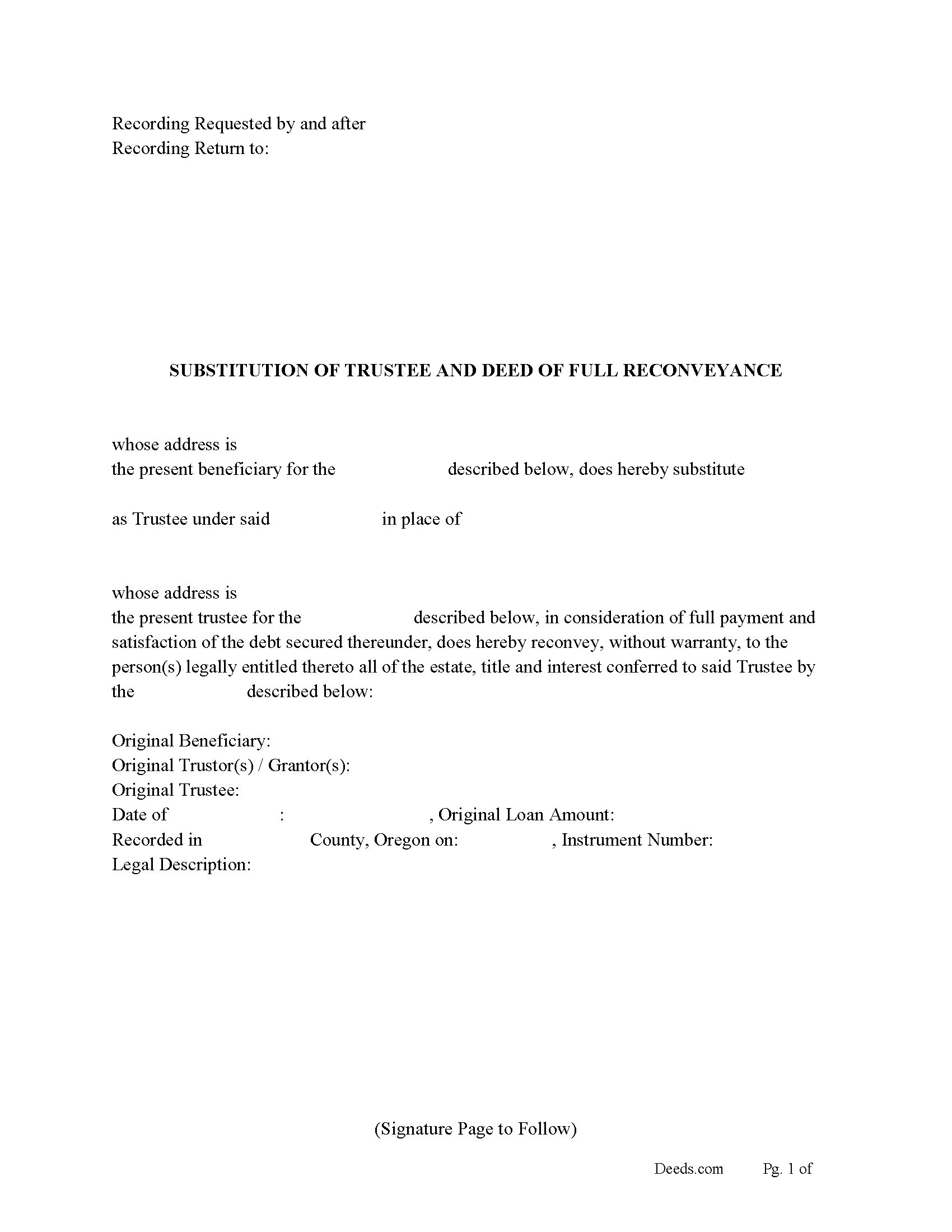

Lane County Substitution of Trustee and Deed of Full Reconveyance

Fill in the blank form formatted to comply with all recording and content requirements.

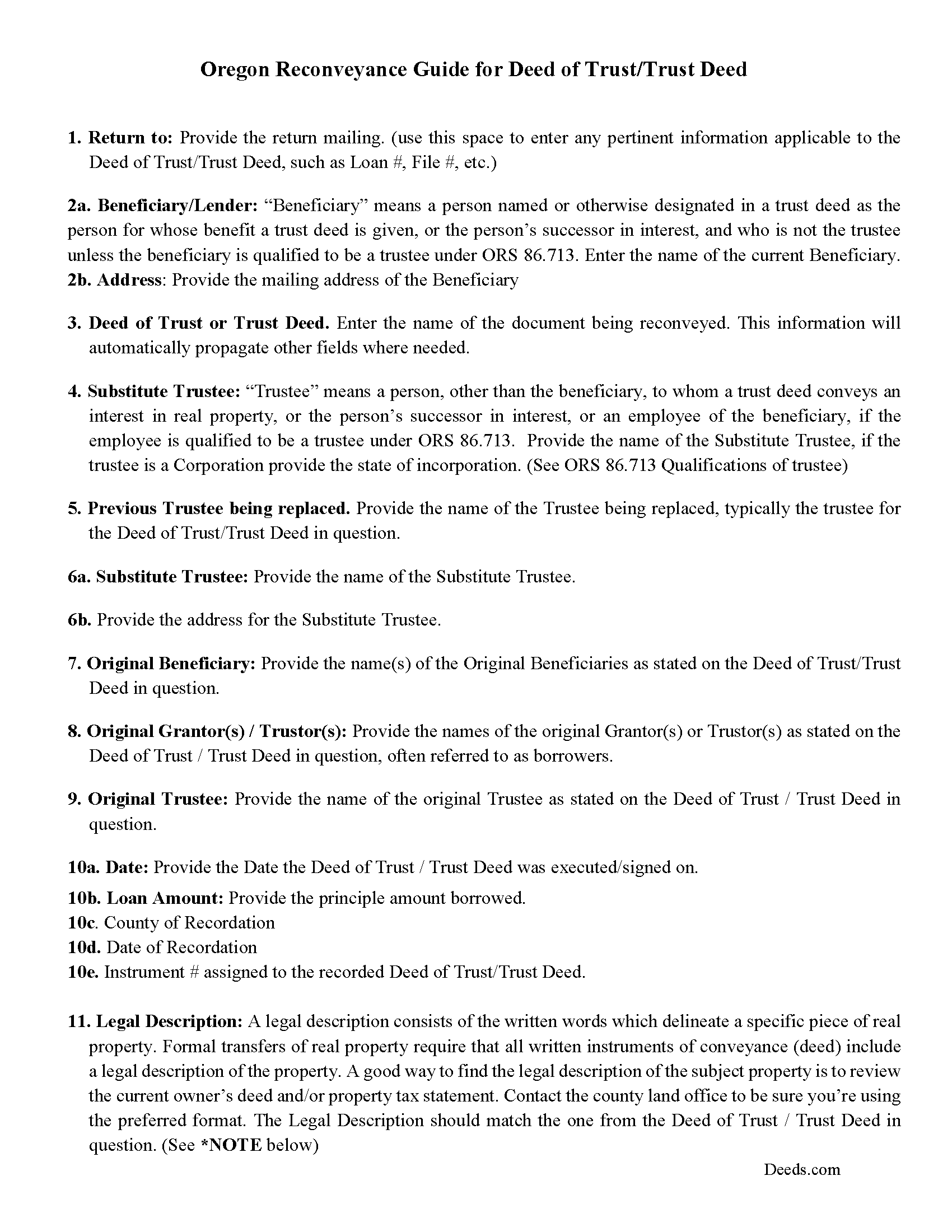

Lane County Substitution of Trustee and Full Reconveyance Guide

Line by line guide explaining every blank on the form.

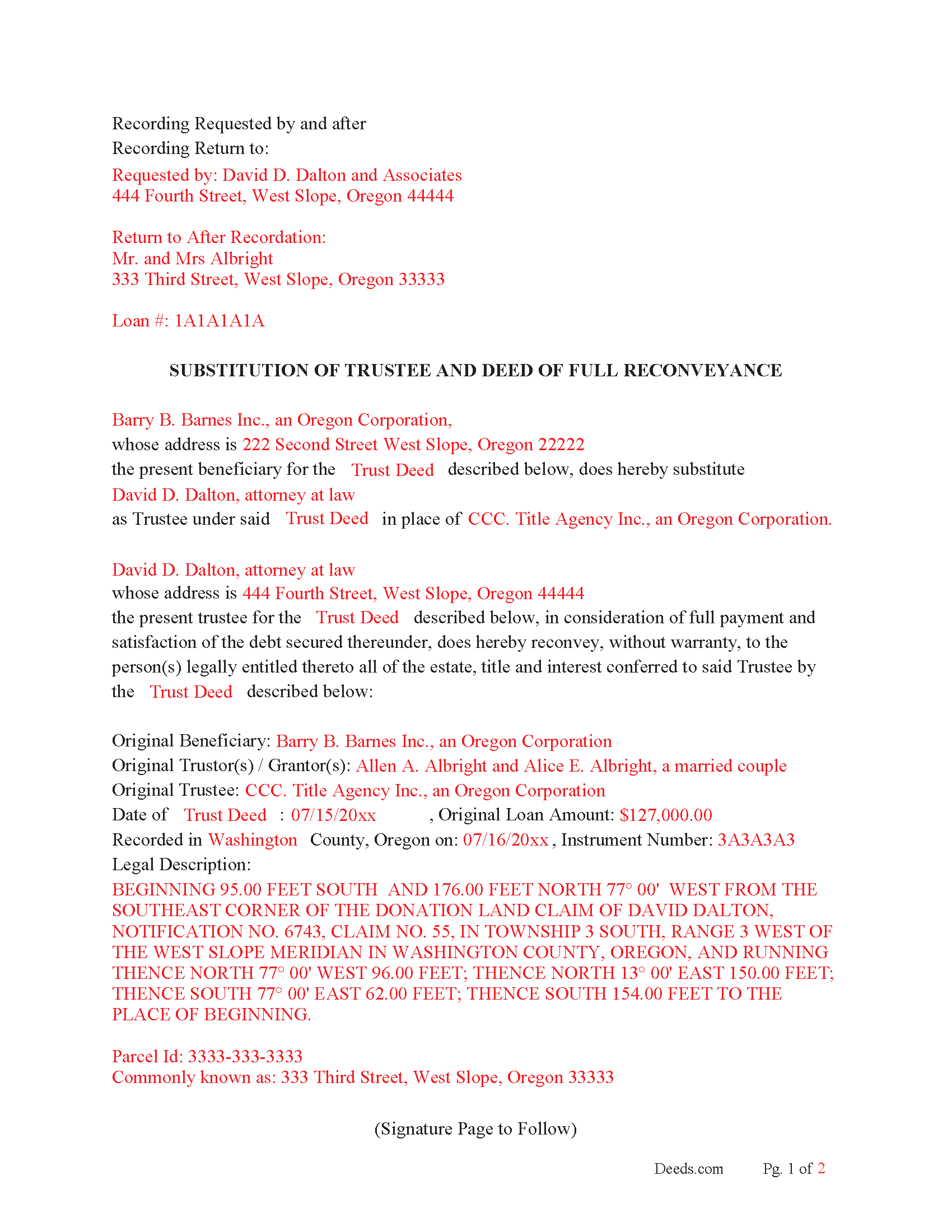

Lane County Completed Example of the Substitution of Trustee and Deed of Full Reconveyance Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Lane County documents included at no extra charge:

Where to Record Your Documents

County Clerk: Deeds & Records

Eugene, Oregon 97401

Hours: 9:00 to 12:00 & 1:00 to 4:00 Mon-Fri / Research: 8:00 to 5:00

Phone: 541-682-3654

Recording Tips for Lane County:

- Documents must be on 8.5 x 11 inch white paper

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Lane County

Properties in any of these areas use Lane County forms:

- Alvadore

- Blachly

- Blue River

- Cheshire

- Cottage Grove

- Creswell

- Culp Creek

- Deadwood

- Dexter

- Dorena

- Elmira

- Eugene

- Fall Creek

- Florence

- Junction City

- Lorane

- Lowell

- Mapleton

- Marcola

- Noti

- Oakridge

- Pleasant Hill

- Saginaw

- Springfield

- Swisshome

- Thurston

- Veneta

- Vida

- Walterville

- Walton

- Westfir

- Westlake

Hours, fees, requirements, and more for Lane County

How do I get my forms?

Forms are available for immediate download after payment. The Lane County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lane County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lane County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lane County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lane County?

Recording fees in Lane County vary. Contact the recorder's office at 541-682-3654 for current fees.

Questions answered? Let's get started!

In this form the beneficiary/lender changes the trustee (independent third party) then the new trustee reconveys the Deed of Trust or Trust Deed.

((1) Within 30 days after performance of the obligation secured by the trust deed, the beneficiary shall deliver a written request to the trustee to reconvey the estate of real property described in the trust deed to the grantor. Within 30 days after the beneficiary delivers the written request to reconvey to the trustee, the trustee shall reconvey the estate of real property described in the trust deed to the grantor. In the event the obligation is performed and the beneficiary refuses to request reconveyance or the trustee refuses to reconvey the property, the beneficiary or trustee so refusing shall be liable as provided by ORS 86.140 (Liability of mortgagee for failure to discharge mortgage) in the case of refusal to execute a discharge or satisfaction of a mortgage on real property. The trustee may charge a reasonable fee for all services involved in the preparation, execution and recordation of any reconveyance executed pursuant to this section.)

(ORS 86.720 Reconveyance upon performance)

Who can be a Trustee? Under ORS 86.713 Qualifications of trustee

(A) An attorney who is an active member of the Oregon State Bar or a law practice that includes an attorney who is an active member of the Oregon State Bar;

(B) A financial institution or trust company, as defined in ORS 706.008 (Additional definitions for Bank Act), that is authorized to do business under the laws of Oregon or the United States;

(C) A title insurance company or a subsidiary, affiliate, insurance producer or branch of the title insurance company that is authorized to insure title to real property in this state;

(D) The United States or any agency of the United States; or

(E) An escrow agent that is licensed under ORS 696.505 (Definitions for ORS 696.505 to 696.590) to 696.590 (Penalty amounts).

(Oregon SOT&DOR Package includes form, guidelines, and completed example)

Important: Your property must be located in Lane County to use these forms. Documents should be recorded at the office below.

This Substitution of Trustee and Deed of Reconveyance (For Deed of Trust / Trust Deed) meets all recording requirements specific to Lane County.

Our Promise

The documents you receive here will meet, or exceed, the Lane County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lane County Substitution of Trustee and Deed of Reconveyance (For Deed of Trust / Trust Deed) form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Eileen D.

August 5th, 2020

Very easy to use. The example form was a big help in making sure I had the forms filled out correctly.

Thank you!

Klint D.

October 2nd, 2020

Quick and easy

Thank you!

Caroline E.

June 28th, 2024

Very easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Griselle M.

April 9th, 2020

Great service - it was my first time using the service and really recommend it. Due to COVID-19, my County Recorder's Office is closed and I was able to create the document using their vast templates, notarize it, and upload it into the system. The recording process took about 7 working days which is not bad considering that most people are working remotely. I will share this website and its many resources with my relatives and friends.

Thank you Griselle, glad we could help.

Ray L.

February 17th, 2021

This was my first time using Deeds.com It was very easy to understand and use. I was pleasantly suprised.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

michael o.

July 17th, 2019

After trying to get help locally I found your website. Very easy

Thank you for your feedback. We really appreciate it. Have a great day!

Hilda R.

January 16th, 2019

It very convenient and fast. Thank you Hilda Reyes

Thanks so much Hilda, have a great day!

Leon S.

June 26th, 2023

I am happy that I found Deeds.com. It provided me with all the information I needed to prepare a quit claim deed, and at a reasonable cost.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ed d.

December 23rd, 2020

Fast efficient hassle free

Thank you for your feedback. We really appreciate it. Have a great day!

BILL G.

October 22nd, 2019

Slick

Thank you!

Sherri S.

March 30th, 2021

Easy to access forms, and reasonably priced. I'll definitely use again in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary K.

March 2nd, 2025

I love this site already! Even though I have not executed my downloads, the documents are so professionally written, and the extras are great. I am impressed with Deeds. Thank you! I will continue to use Deeds as a source for my business and personal needs.

Thank you for your positive words! We’re thrilled to hear about your experience.

Robert F.

December 1st, 2021

Great, quick and easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

leila m.

January 30th, 2021

Very good service, friendly customer service I absolutely will use the service again

Thank you!

Thomas E.

December 18th, 2018

Great, immediate access to everything I needed to assist my client! This is truly a great resource for a Notary Public! I will surely keep my account open, and will refer others as well!

Thank you for the Kind words Thomas. We really appreciate you! Have a great day.