Mercer County Disclaimer of Interest Form

Mercer County Disclaimer of Interest Form

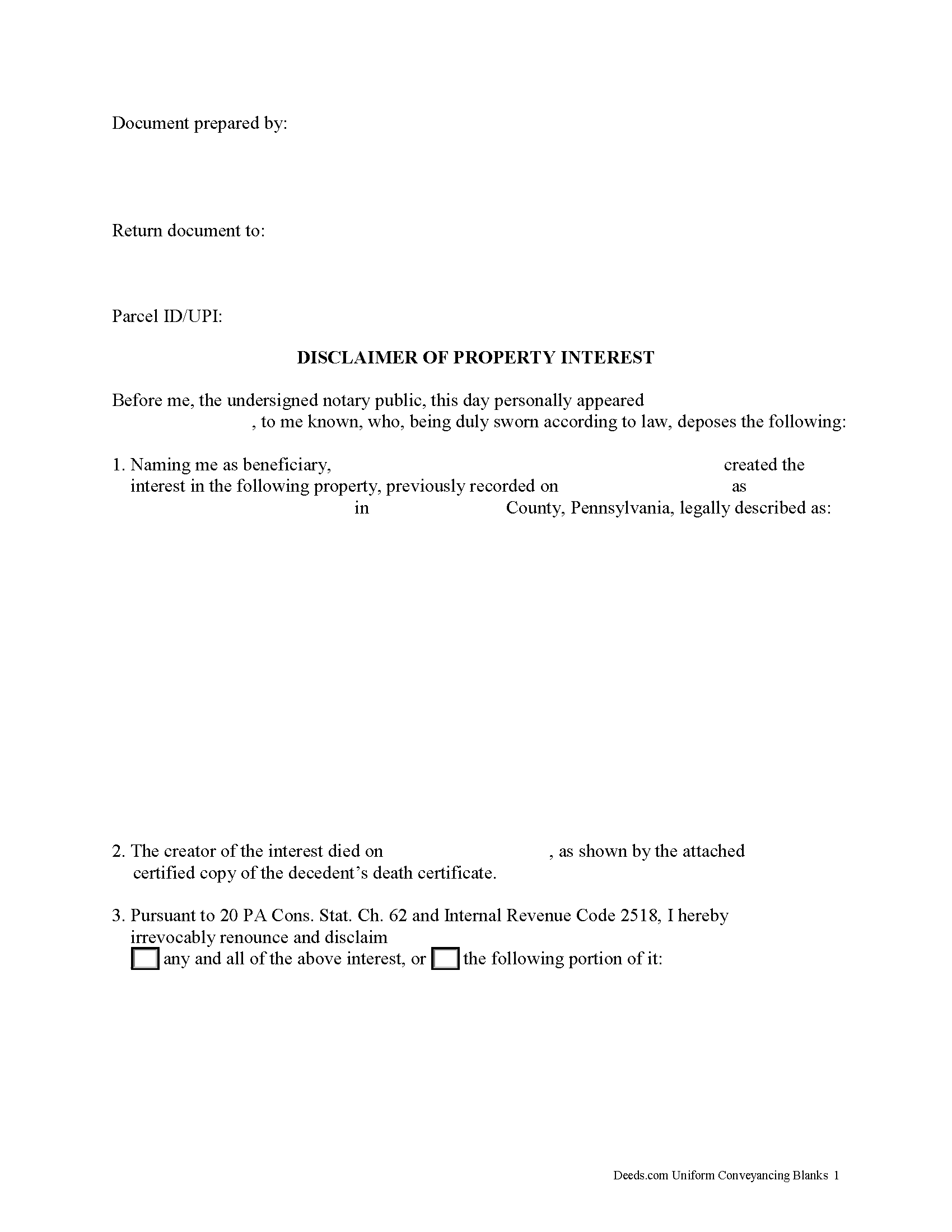

Fill in the blank form formatted to comply with all recording and content requirements.

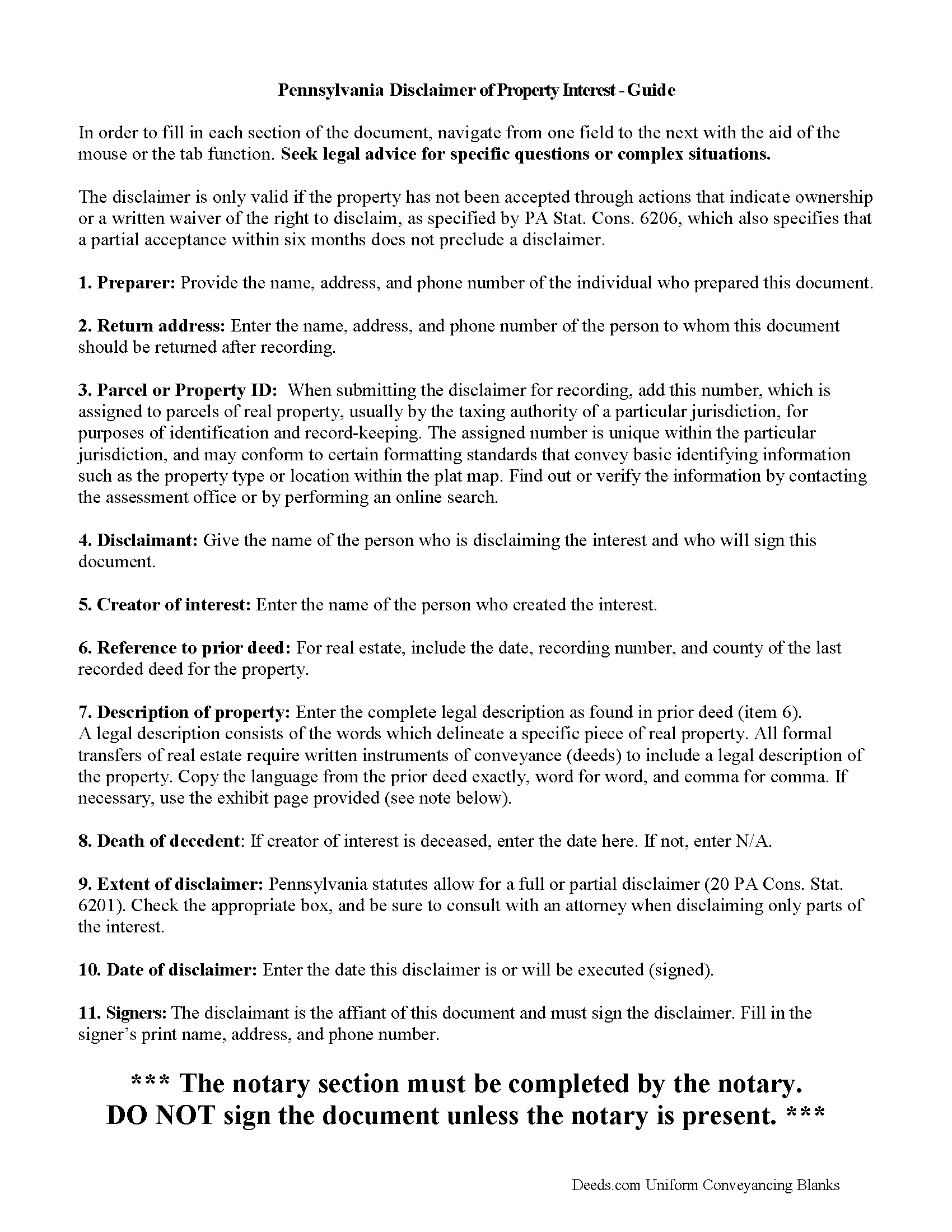

Mercer County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

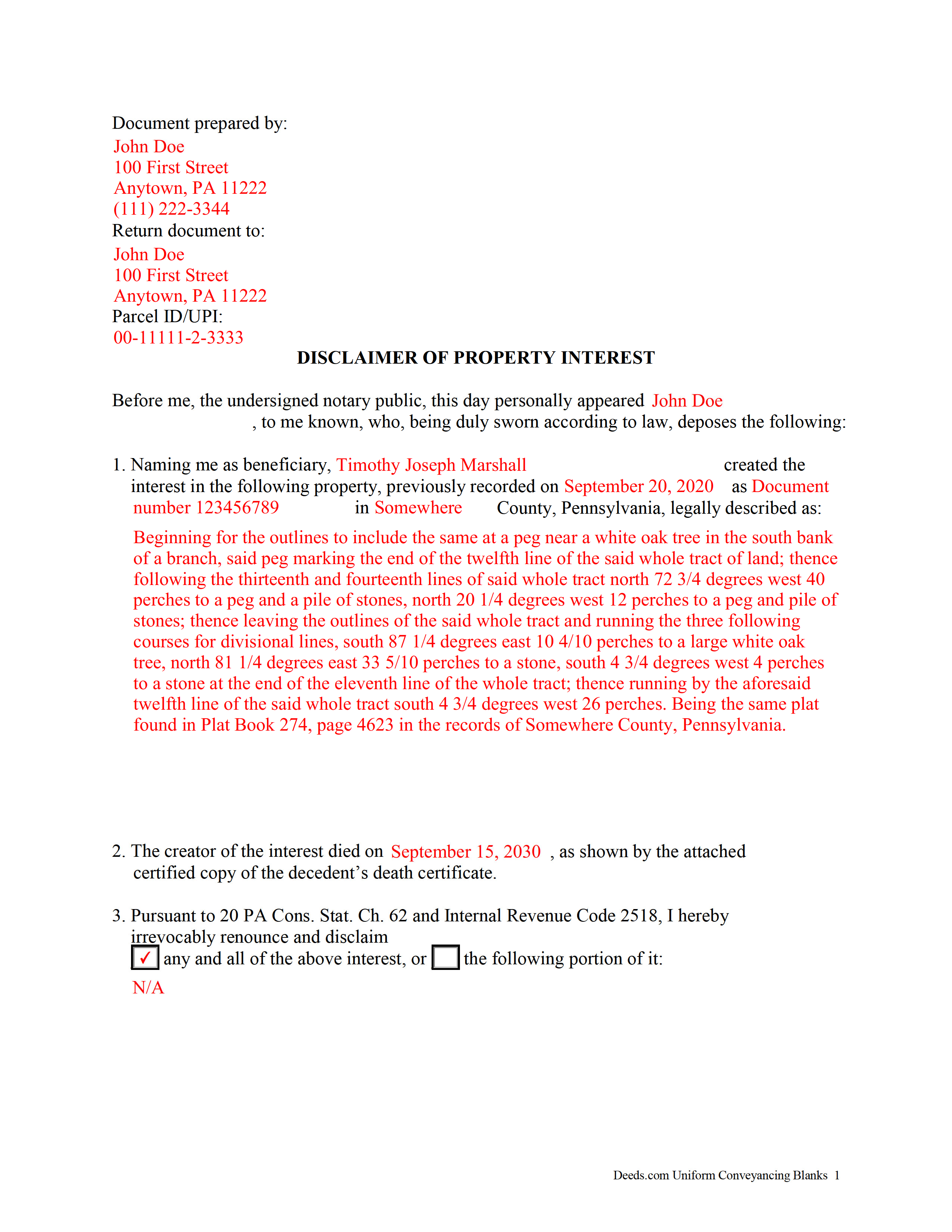

Mercer County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Pennsylvania and Mercer County documents included at no extra charge:

Where to Record Your Documents

Recorder of Deeds - County Courthouse

Mercer, Pennsylvania 16137

Hours: Monday to Friday 8:30am - 4:30pm

Phone: (724) 662-3800

Recording Tips for Mercer County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Mercer County

Properties in any of these areas use Mercer County forms:

- Carlton

- Clark

- Clarks Mills

- Farrell

- Fredonia

- Greenville

- Grove City

- Hadley

- Hermitage

- Jackson Center

- Jamestown

- Mercer

- Sandy Lake

- Sharon

- Sharpsville

- Sheakleyville

- Stoneboro

- Transfer

- West Middlesex

- Wheatland

Hours, fees, requirements, and more for Mercer County

How do I get my forms?

Forms are available for immediate download after payment. The Mercer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mercer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mercer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mercer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mercer County?

Recording fees in Mercer County vary. Contact the recorder's office at (724) 662-3800 for current fees.

Questions answered? Let's get started!

A beneficiary of an interest in property in Pennsylvania can disclaim all or part of a bequeathed interest in, or power over, that property under 20 PA Stat. Cons. Ch. 62. This document must be in writing, declared a disclaimer, signed by the disclaimant or a legally authorized representative, and describe the disclaimed property or portion of it ( 6201).

The disclaimer must be delivered to the transferor, donor or representative, trustee or person who has legal title. In the case of an interest passing by death, an executed counterpart may be filed with the clerk of the court in the county where the estate is or will be administered. If it pertains to real property, it may also be recorded with office of the recorder in the county where the property is situated ( 6204).

Even though the Pennsylvania statutes stipulate no time limit to the delivery, the disclaimer must be received no later than 9 months after the transfer is made (e.g. date of death) in order to comply with IRS regulations. In addition, the disclaimer is invalid if the disclaimant has accepted the property, i.e., performed any affirmative act that is consistent with ownership of property, such as acceptance, transfer, or sale of it ( 6206 (a)). A partial acceptance within six months does not preclude a disclaimer ( 6206 (b)).

Once effective, the disclaimer is irrevocable and binding to the disclaimant and all who claim under him or her (( 6205). Be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property.

(Pennsylvania DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Mercer County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Mercer County.

Our Promise

The documents you receive here will meet, or exceed, the Mercer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mercer County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Maria M.

September 27th, 2023

The requested documents I needed were provided and also complete instructions on how to fill them out. I definitely will you this service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph R.

August 22nd, 2025

The form and instructions were easy enough to follow if you had all the information.rnThe only drawback to the form was the length of text allowed for the name of the document (#4). The form self populates in multiple locations but when printed truncated the name if too many characters were used. I kept having to update the name of the document to allow for proper printing.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Randal R.

December 20th, 2019

While disappointed that my request could not be filled, I understand the issue, and appreciate the attempt and the responsiveness. I certainly will be back if the occasion arises!

Thank you!

Ralph O.

September 16th, 2024

The experience has been excellent. The site gave me exactly what I was looking for. The documentation we easy to understand.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Janice H.

June 21st, 2023

Thank you, easy to fill out forms. Now I can relax, knowing that this is done.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jan M.

June 5th, 2019

Fantastic company. They are the absolute best and helped me get the information I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George D.

August 23rd, 2020

The TODD form has been notarized and registered with my county Register of Deeds office, so it works just fine. My only quibble is that when I printed it out, it missed part of the last line of the notary's info and the fine print in the bottom corners. When I printed it at 90% scale, it included those things.

Thank you for your feedback. We really appreciate it. Have a great day!

Glenn N.

February 25th, 2020

Made a hard task easy! Very smooth and we were printed and ready to go

Thank you for your feedback. We really appreciate it. Have a great day!

James B.

July 31st, 2019

Your website is very easy to use. No problem downloading the forms.

Thank you!

Ivory J.

August 1st, 2020

Haven't processed any deed documents so far. I do agree that Deed.com website browsing tool will be helpful.

Thank you!

THOMAS K.

August 17th, 2020

Very pleased with all info and forms

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joy Lynn W.

December 31st, 2020

Timely response and helpful....good job!

Thank you!

Lynn H.

January 12th, 2023

A very informative WEB site. It was simple to access the forms I needed for my specific situation. I would highly recommend Deeds.com. I will be back with future needs when they arise! I was left with a very positive impression. Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan G.

January 11th, 2025

Very easy to use!

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Dorothy B.

November 4th, 2020

Love your deed service. Simple and easy.

Thank you!