Perry County Trustee Deed Form

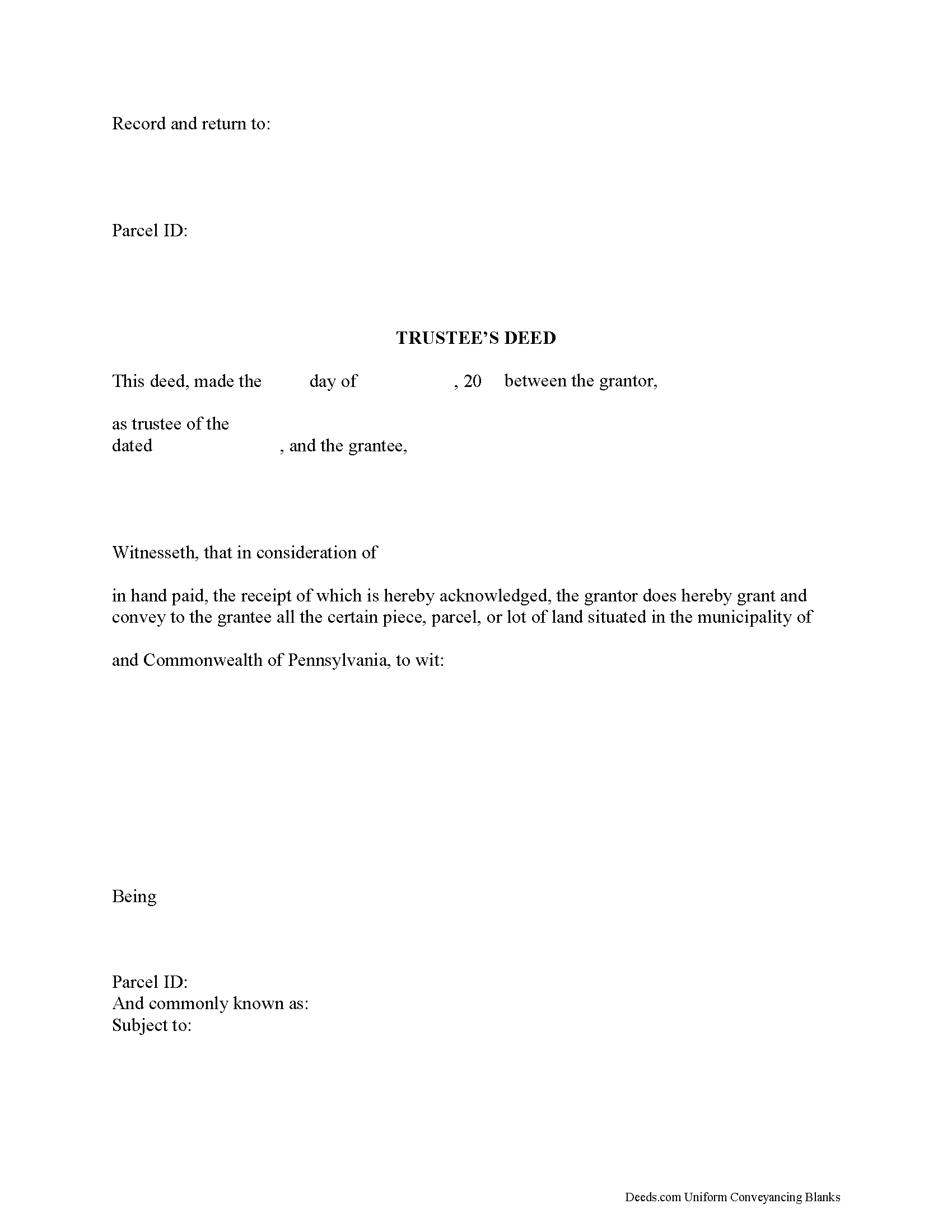

Perry County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

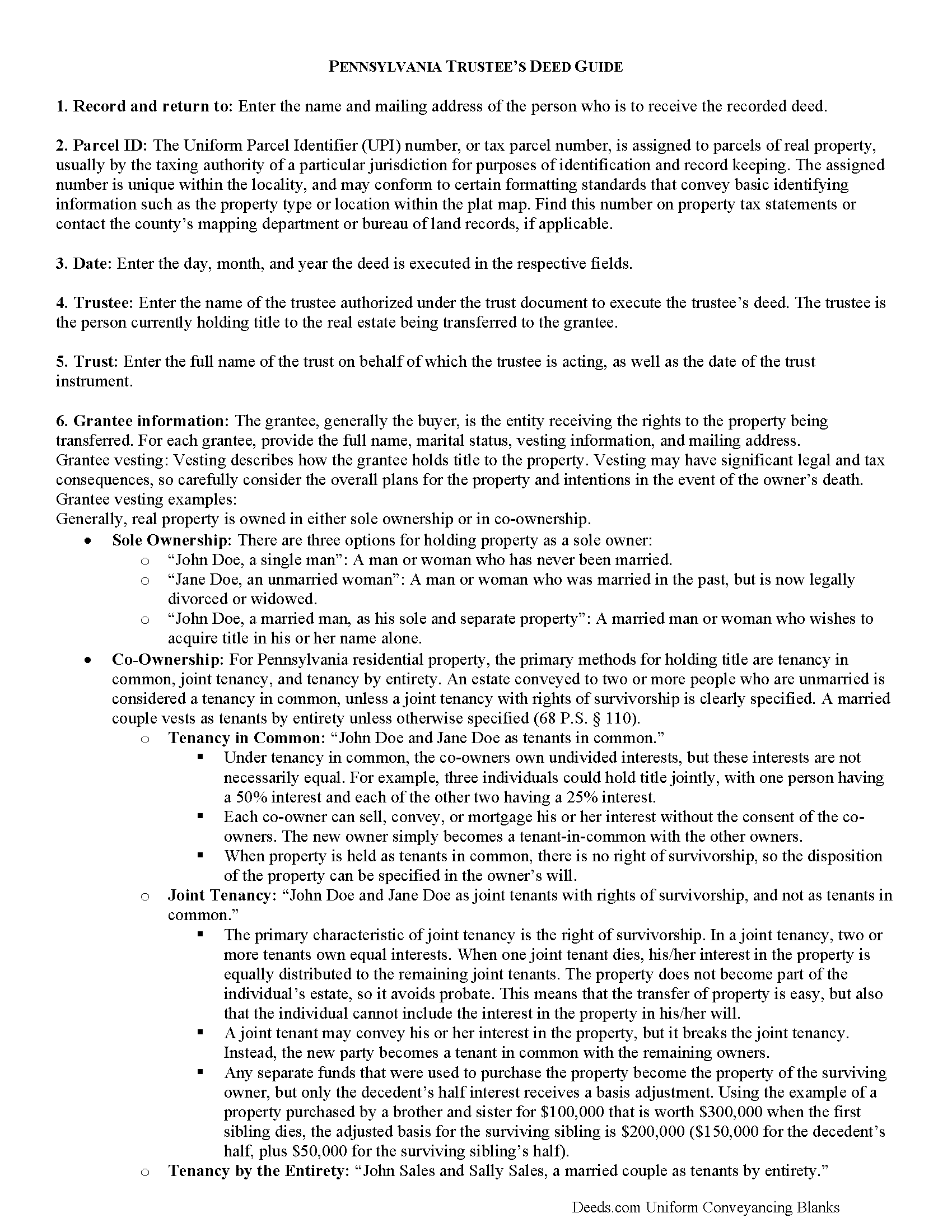

Perry County Trustee Deed Guide

Line by line guide explaining every blank on the form.

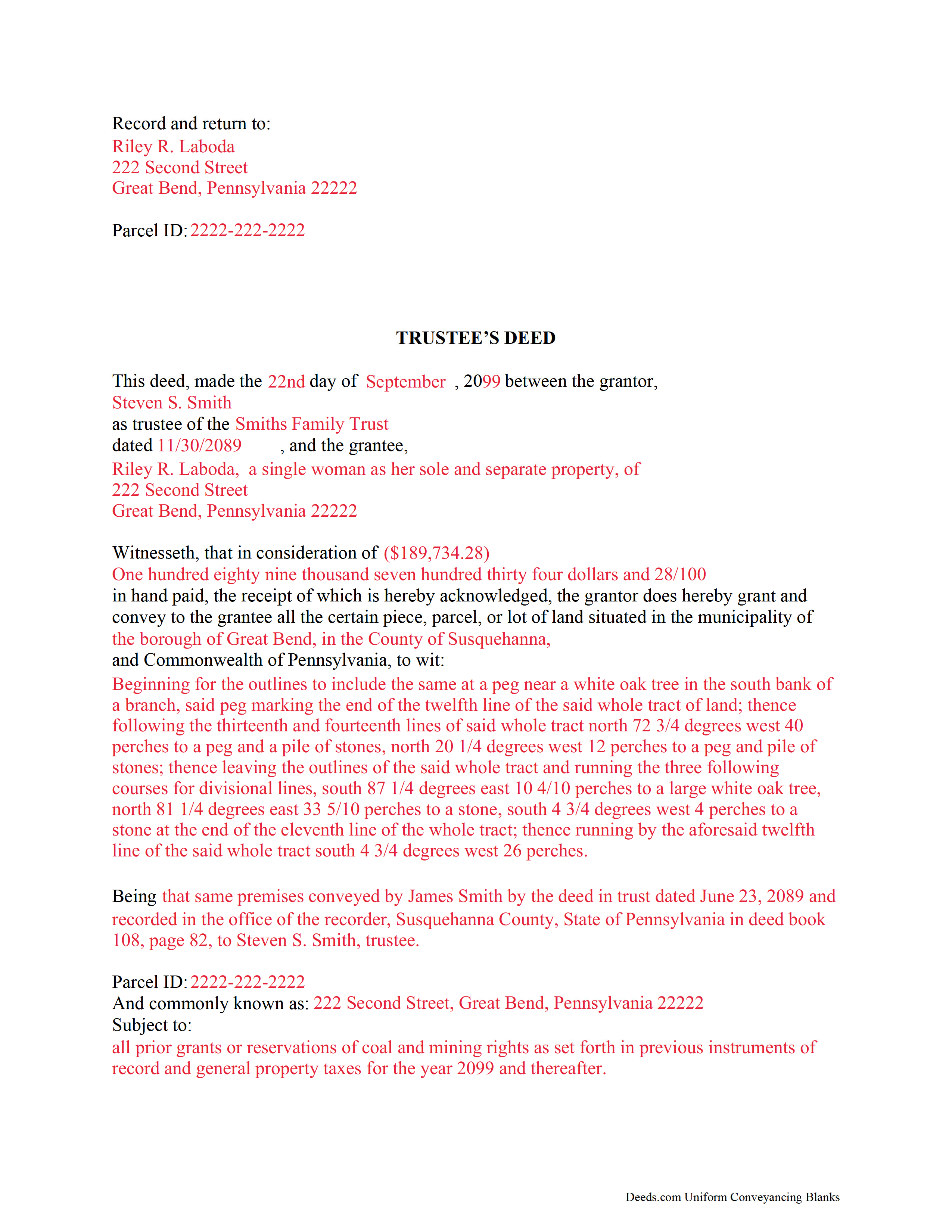

Perry County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Pennsylvania and Perry County documents included at no extra charge:

Where to Record Your Documents

Perry County Recorder of Deeds

New Bloomfield, Pennsylvania 17068

Hours: 8:00am - 4:00pm Mon-Fri

Phone: (717) 582-2131

Recording Tips for Perry County:

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

- Make copies of your documents before recording - keep originals safe

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Perry County

Properties in any of these areas use Perry County forms:

- Blain

- Duncannon

- Elliottsburg

- Ickesburg

- Landisburg

- Liverpool

- Loysville

- Marysville

- Millerstown

- New Bloomfield

- New Buffalo

- New Germantown

- Newport

- Shermans Dale

Hours, fees, requirements, and more for Perry County

How do I get my forms?

Forms are available for immediate download after payment. The Perry County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Perry County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Perry County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Perry County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Perry County?

Recording fees in Perry County vary. Contact the recorder's office at (717) 582-2131 for current fees.

Questions answered? Let's get started!

Title 20, Chapter 77 of the Pennsylvania Statutes governs trusts in the State of Pennsylvania.

A trust is a wealth management tool commonly used in estate planning. There are three main parties to a trust: the settlor, who funds the trust by conveying assets into it; the trustee, who administers the trust and controls its assets; and the beneficiary, who has a present or future interest in the trust (P.S. 7703). Note that a sole trustee cannot also be the sole beneficiary (P.S. 7732(a)(5)).

Under a trust, the acting trustee manages the trust as directed by the settlor. This arrangement works, in part, because the trustee holds what amounts to a proxy title to the trust's assets. If the trust contains real property that the settlor wishes to sell, the trustee executes and records a document called a trustee's deed to transfer the title to the grantee/buyer -- the settlor is not identified in the transaction.

In most cases, trustee's deeds are modified quitclaim or special warranty deeds. Quitclaim deeds contain no warranties of title, and special warranty deeds only offer the grantee protection against title claims originating while grantor controlled the property. Generally, a trustee uses a quitclaim deed if the settlor and grantee are close relatives (spouses, parent to child, etc.). A trustee of a living trust might also use a quitclaim deed to transfer property out of the trust and to himself as an individual. Third-party purchasers might require a special warranty deed in order to obtain a mortgage or title insurance.

Besides fulfilling the requirements for all instruments affecting real property in the State of Pennsylvania (tax parcel number, legal description, prior deed information, certificate of residence, and so on), the trustee's deed names the trustee as the grantor and gives the date and the name of the trust under which the trustee is acting. A certificate of trust is sometimes included to verify the trust's existence and the trustee's authority to act on behalf of the trust. As with other instruments, the deed must be signed and acknowledged in the presence of a notary, then recorded in the county where the property is situated.

Trust law can be thorny, and each situation is unique. Consult an attorney with specific questions or for complicated circumstances.

(Pennsylvania TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Perry County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Perry County.

Our Promise

The documents you receive here will meet, or exceed, the Perry County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Perry County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Elizabeth W.

February 9th, 2023

would have been smart to give each pdf a name instead of unintelligible numbers...

Thank you for your feedback. We really appreciate it. Have a great day!

Gordon W.

April 7th, 2022

Nice forms but it sure would have been nice to be able to at least print the guide and the example so that I don't spend all of my time bouncing back and forth between windows on a laptop.

Thank you for your feedback. We really appreciate it. Have a great day!

Terry S.

February 14th, 2023

I was very happy with the document package that I purchased. It contained all of the necessary documents and a few extras I had not thought about. Perhaps if you provided a link to download all of the documents with one click, it would make it a little easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Katherine M.

June 26th, 2019

Very helpful!

Thank you!

Robert S.

March 2nd, 2025

My Quick claim formsi downloaded had not come through so I contacted customer service and they provided me with the instructions on how to retrieve my forms, A plus service.

We are delighted to have been of service. Thank you for the positive review!

James G.

June 21st, 2023

This was very hard to follow, and the form looked horrible.

Sorry to hear that James. Some documents can certainly be more difficult than others. Your order and payment has been canceled. We do hope that you find something more suitable to your needs and aesthetic requirements elsewhere.

Suzanne M.

December 17th, 2021

Easy to download this form. I will use it when the time comes to transfer title of my house.

Thank you for your feedback. We really appreciate it. Have a great day!

Darrel V.

September 27th, 2020

Pretty easy to use and timely, too!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Robert B.

April 2nd, 2019

Excellent, easy to operate, saved $$$ by doing this TOD deed myself. WILL BUY AGAIN!!

Thank you Robert. Have a fantastic day!

Pouya N.

November 6th, 2020

THEY ARE AWSOME. MAKE IT REALLY EASY AND EFFICIENT TO WORK. THANK YOU

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James G.

November 18th, 2019

Deed.com had some hard to find mineral interest deeds for Oklahoma.I'm an attorney in Texas with no Ok experience. The examples on Deed.com were very useful and saved me lots of time. James G.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda G.

August 22nd, 2021

I like it so far- now I just need to complete my filing in the County seat!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Justin C.

January 28th, 2021

I was a first-time customer to Deeds.com and was very pleased with my ability to navigate the site and find just what I needed in a very short time. Great value for the price.

Thank you for your feedback. We really appreciate it. Have a great day!

Janey M.

March 12th, 2019

Easy to use site. Just what I needed!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!