West Virginia Personal Representative Deed Forms

West Virginia Personal Representative Deed Overview

How to Use This Form

- Select your county from the list on the left

- Download the county-specific form

- Fill in the required information

- Have the document notarized if required

- Record with your county recorder's office

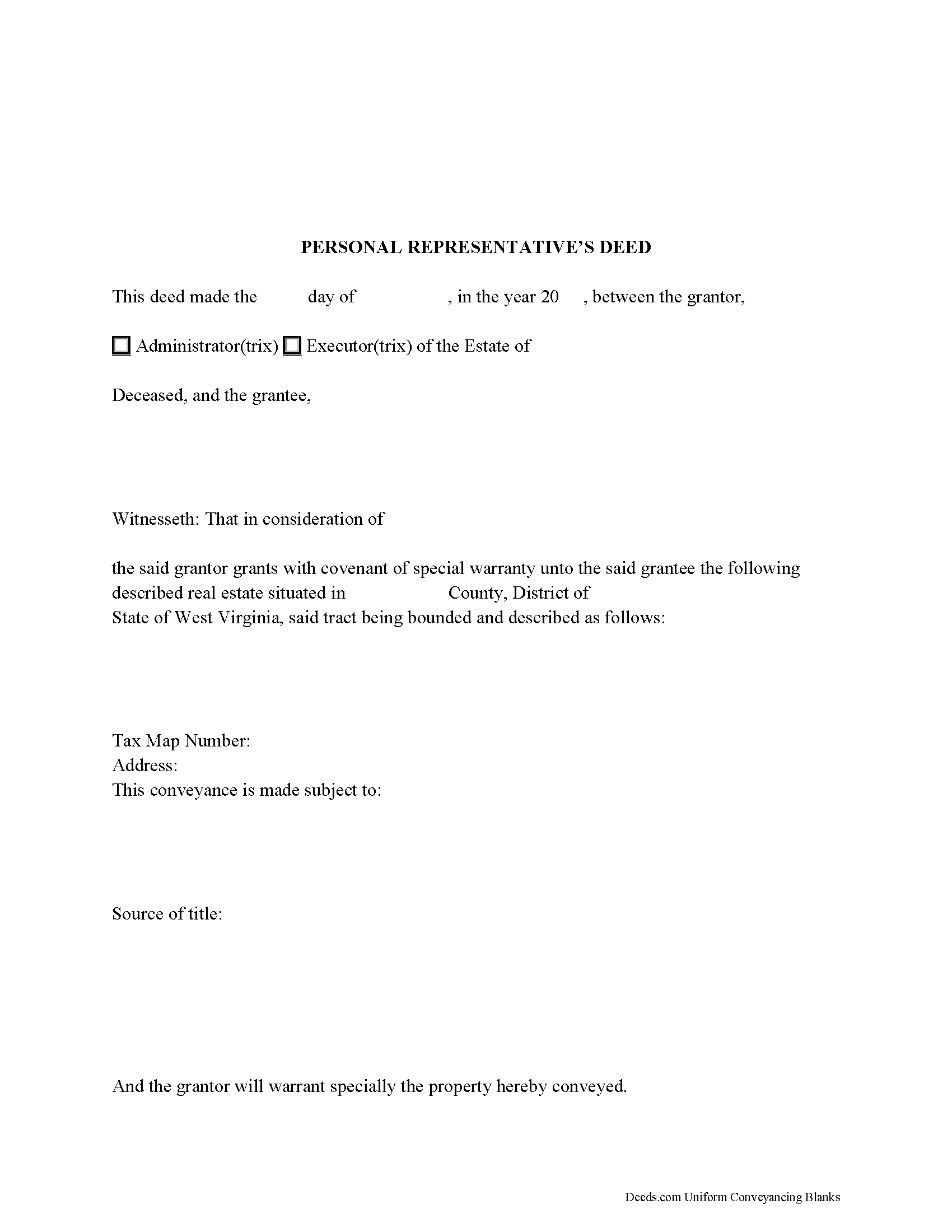

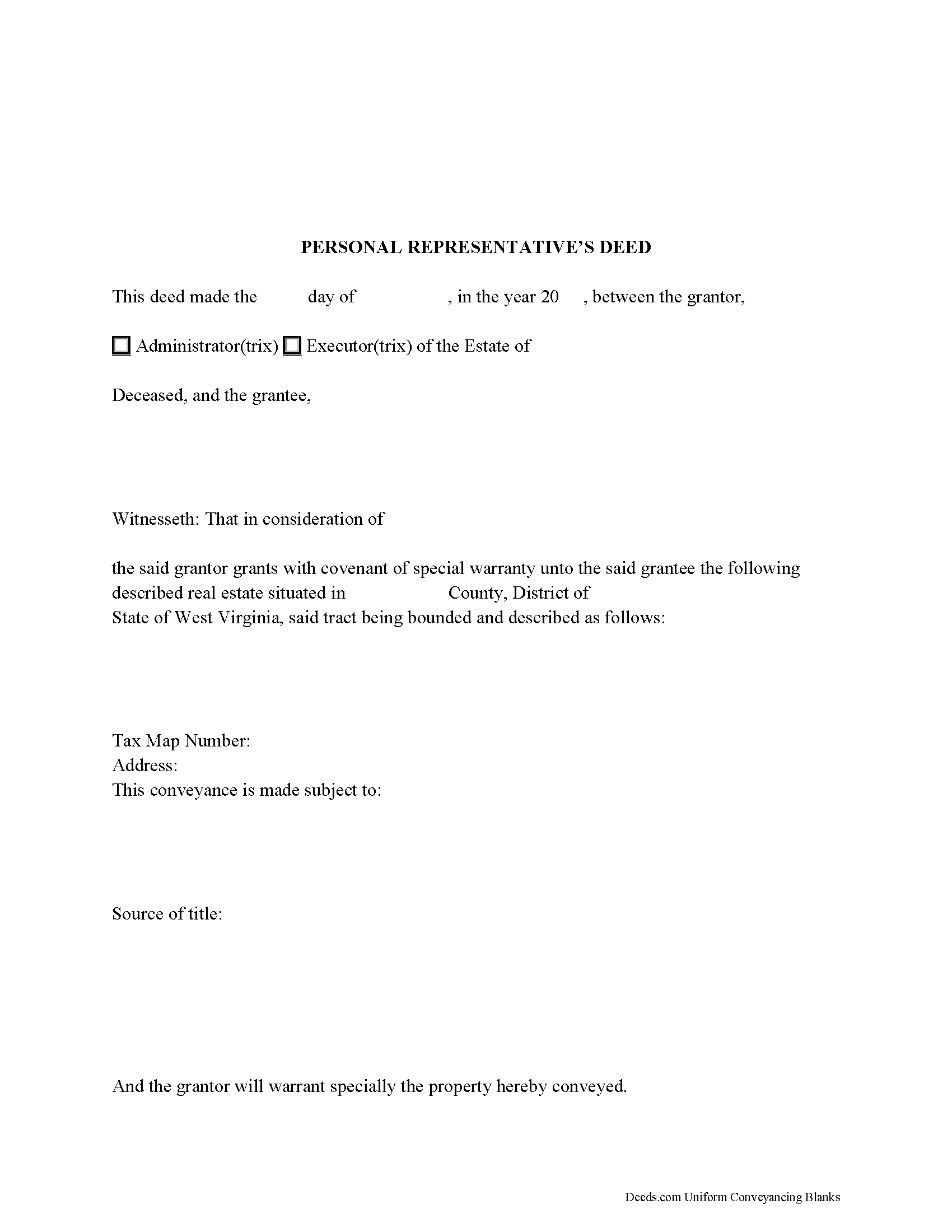

A personal representative is the fiduciary appointed to administer a decedent's estate in probate. When the decedent dies with a will, the personal representative is the executor named in the will, or, if no executor is named, a qualifying beneficiary. When the decedent dies intestate (without a will), the personal representative selected by the court is called the administrator.

In the course of estate settlement, a personal representative may be required to execute and record a deed conveying real property from the estate following a sale. A decedent may designate in their will the specific real estate to be sold, or an estate's assets may be insufficient to pay its debts, and the personal representative may need to commence a suit in equity to subject the real estate to payment under W. Va. Code 44-8-7.

A fiduciary deed follows the statutory form of a deed under W. Va. Code 36-3-5. In addition, West Virginia requires a Declaration of Consideration or Value confirming the actual consideration paid or monetary value of the property being transferred (W. Va. Code 11-22-6).

Due to the nature of the fiduciary as a representative, a special warranty is typically appropriate. A covenant of special warranty means that the grantor promises to warrant and defend the property for the grantee against claims or demands of the grantor and persons acting by, through, or under him (W. Va. Code 36-4-3). This warranty is more limited than that of a general warranty deed because it does not extend prior to the time the grantor obtained title. In West Virginia, covenants run with the land, meaning they are also binding on any successor in title.

In addition to the statutory contents of a deed, personal representative's deeds contain information about the subject estate, such as the decedent's name and date of death, whether he or she left a will, the personal representative's name and his or her source of authority to sell the subject real estate, such as a testamentary power of sale under W. Va. Code 44-5A-3 or an order by the county commission.

The deed must be signed by the executor or administrator in the presence of a notary public before recording in the County Clerk's office for a valid transfer. The instrument should meet all requirements of form and content for documents relating to real property in West Virginia.

Consult a lawyer with questions about estate administration or personal representative's deeds in West Virginia.

(West Virginia PRD Package includes form, guidelines, and completed example)

Important: County-Specific Forms

Our personal representative deed forms are specifically formatted for each county in West Virginia.

After selecting your county, you'll receive forms that meet all local recording requirements, ensuring your documents will be accepted without delays or rejection fees.

How to Use This Form

- Select your county from the list above

- Download the county-specific form

- Fill in the required information

- Have the document notarized if required

- Record with your county recorder's office

Common Uses for Personal Representative Deed

- Transfer property between family members

- Add or remove names from property titles

- Transfer property into or out of trusts

- Correct errors in previously recorded deeds

- Gift property to others