Dane County Special Warranty Deed Form

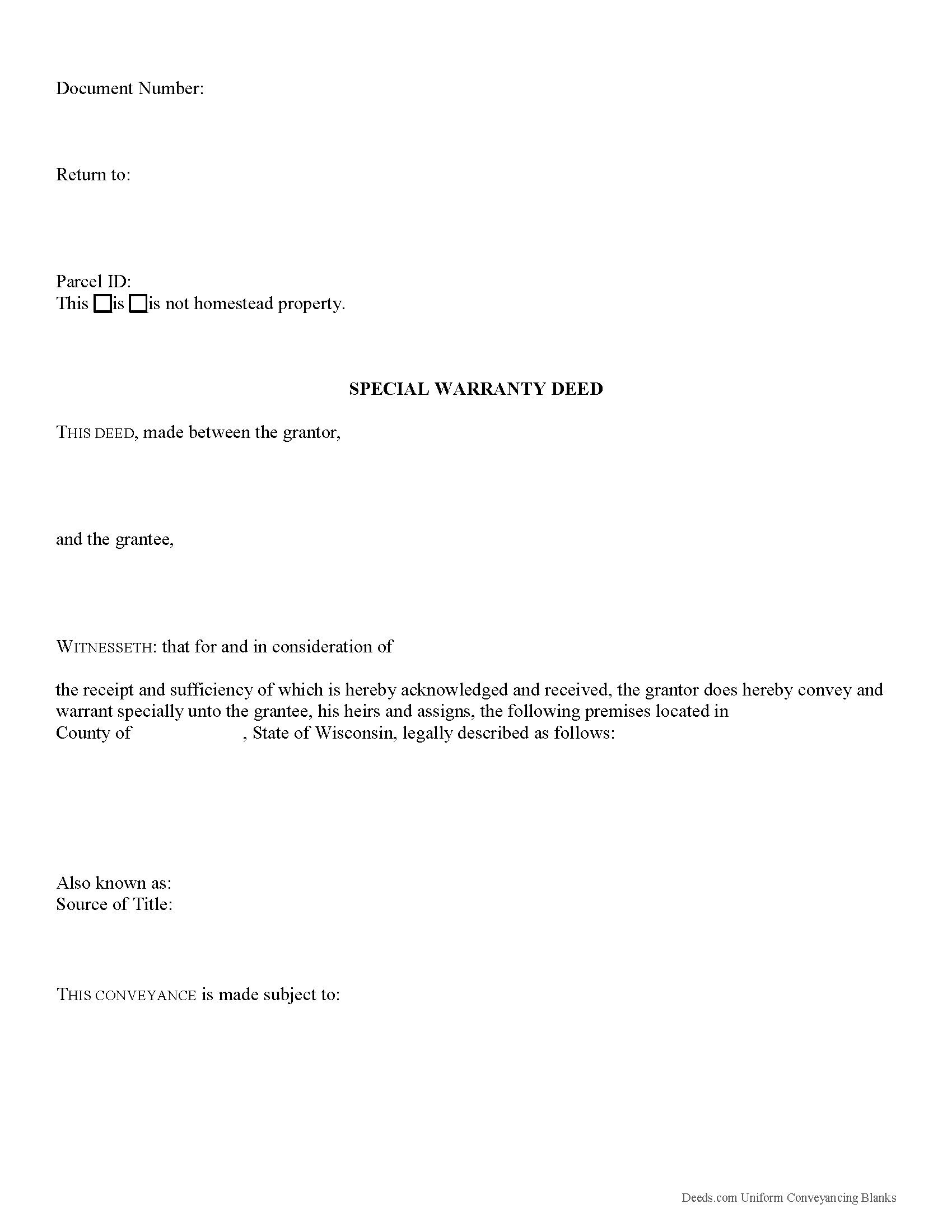

Dane County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

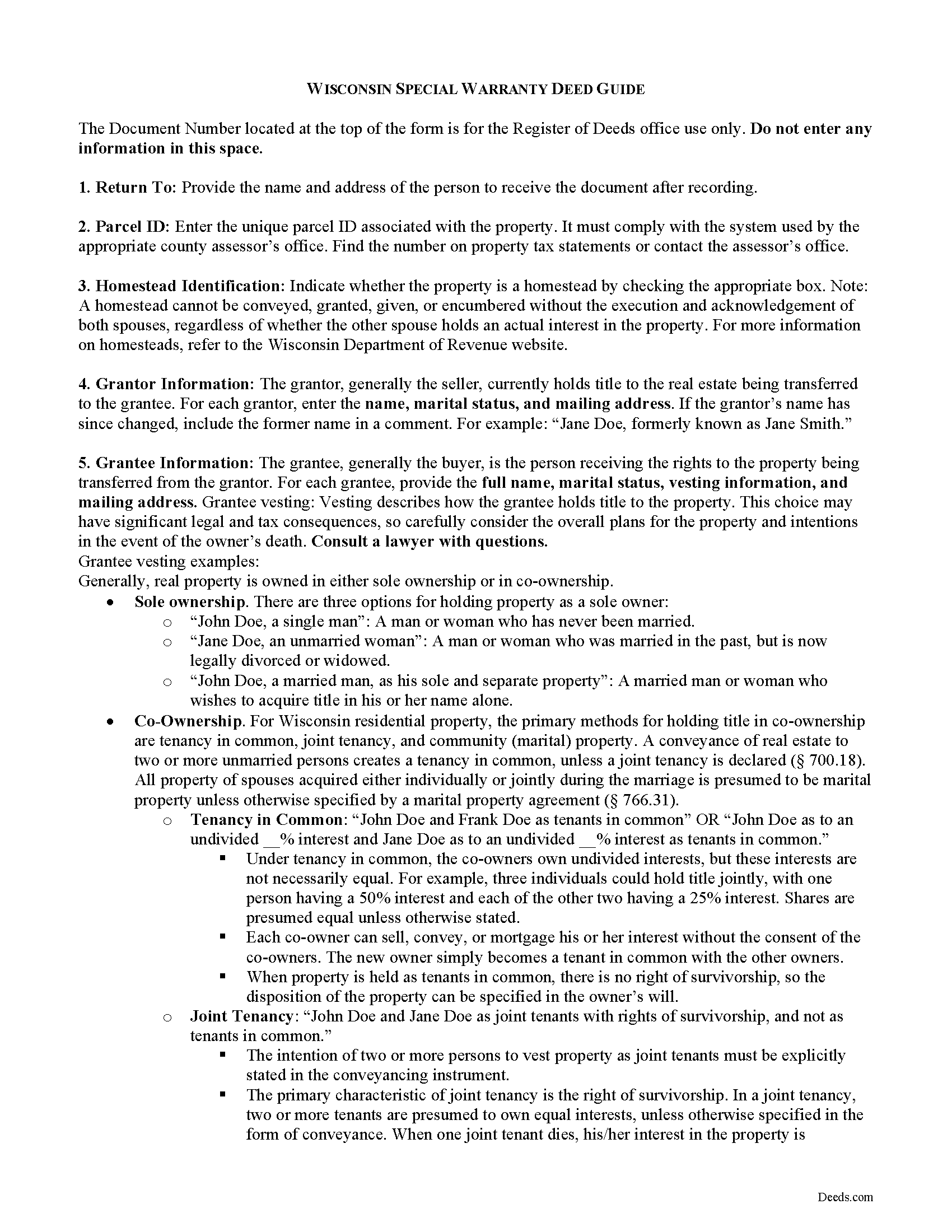

Dane County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

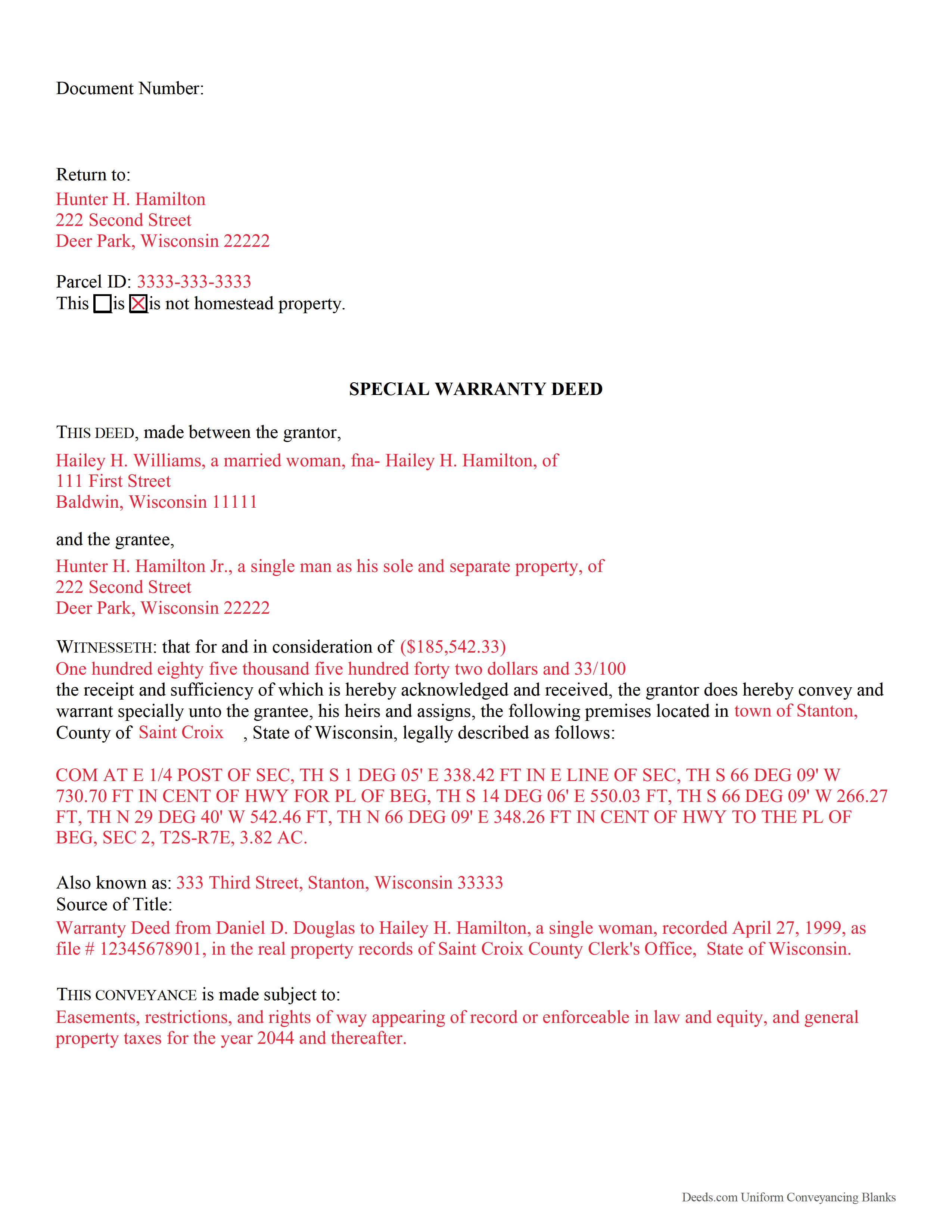

Dane County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Dane County documents included at no extra charge:

Where to Record Your Documents

Dane County Register of Deeds

Madison, Wisconsin 53703 / 53701-1438

Hours: Monday - Friday 7:45am - 4:30pm

Phone: (608) 266-4141

Recording Tips for Dane County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Recorded documents become public record - avoid including SSNs

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Dane County

Properties in any of these areas use Dane County forms:

- Belleville

- Black Earth

- Blue Mounds

- Cambridge

- Cottage Grove

- Cross Plains

- Dane

- De Forest

- Deerfield

- Madison

- Marshall

- Mazomanie

- Mc Farland

- Middleton

- Morrisonville

- Mount Horeb

- Oregon

- Stoughton

- Sun Prairie

- Verona

- Waunakee

- Windsor

Hours, fees, requirements, and more for Dane County

How do I get my forms?

Forms are available for immediate download after payment. The Dane County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dane County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dane County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dane County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dane County?

Recording fees in Dane County vary. Contact the recorder's office at (608) 266-4141 for current fees.

Questions answered? Let's get started!

In Wisconsin, title to real property can be transferred from one party to another using a special warranty deed. When recorded, a special warranty deed conveys an interest in real property to the named grantee with limited warranties of title.

A special warranty deed offers a more limited warranty than a general warranty deed. Special warranty deeds convey real property in fee simple to the grantee, typically with a covenant from the grantor that the property is free from encumbrances made by the grantor. The grantor also covenants that he will defend title against any lawful claim arising by, through, or under the grantor, but none other. This means that the deed will not protect the grantee against title issues that arose prior to the time the grantor acquired title. A special warranty deed is recognizable by the terms "convey and warrant specially," but no warranties are implied in Wisconsin, so any special warranty covenants must be explicitly stated in the deed (706.10(6)).

In addition to meeting all state and local standards for recorded documents, a lawful special warranty deed includes the grantor's full name, mailing address, and marital status, the consideration given for the transfer, and the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Wisconsin residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and community (marital) property. A conveyance of real estate to two or more unmarried persons creates a tenancy in common, unless a joint tenancy is declared (700.18). All property of spouses acquired either individually or jointly during the marriage is presumed to be marital property unless otherwise specified by a marital property agreement (766.31).

Deeds in Wisconsin must be accompanied by a receipt that evidences completion of a Wisconsin Real Estate Transfer Return. The real estate transfer fee is levied based on either the consideration made for the transfer or the current fair market value of the real property, as reflected on the form (77.22(1)). Submit the form electronically via the Wisconsin Department of Revenue website. All conveyances require a completed form or an exemption stated on the face of the deed. Find a list of exempt documents at 77.25.

As with any conveyance of realty, a special warranty deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The finished copy of the deed must be signed by the grantor and notarized. Additionally, the grantor's spouse must join in signing to release rights of homestead, regardless of whether he or she holds an actual interest in the property conveyed. Record the original completed deed, along with any additional materials, at the Register of Deeds office of the county where the property is located. Contact the same office to verify recording fees and accepted forms of payment.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Wisconsin lawyer with any questions related to the transfer of real property.

(Wisconsin SWD Package includes form, guidelines, and completed example)

Important: Your property must be located in Dane County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Dane County.

Our Promise

The documents you receive here will meet, or exceed, the Dane County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dane County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Monte J.

June 28th, 2019

Very helpful.

Thank you!

Don M.

February 8th, 2023

ONCE A PERSON STARTS THE PROCESS, IT IS QUITE EASY, THE PROCESS THAT IS.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alexia B.

June 11th, 2020

Excellent service with rapid turn around time!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Peter M.

July 30th, 2020

GREAT! site, had everything we needed to complete our estate planning for our children

Thank you for your feedback. We really appreciate it. Have a great day!

Sidney L.

July 22nd, 2022

Not a fan. Filling in the WI RE transfer return was simple enough. However, it downloaded as a DOR file and I can't find a program to open it. So, I have no way to print the form to complete the process.

Thank you for your feedback. We really appreciate it. Have a great day!

Steven N.

November 7th, 2024

I was introduced to Deeds.com from my title company. I wanted the title company to do a courtesy recording for me and they suggested Deeds.com. Best suggestion in a while. The interface to use the website was seemlessly easy. The communication with the service staff was thorough and prompt. After the initial verification process (which the photo app was a little tricky), everything was easy. Will use them again.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Dorothea B.

October 2nd, 2019

The Affidavit- Death of Joint Tenant form you provided is not the same form as showed on the Los Angeles County property tax website. It appears that the LA county form requires entering additional info that is not included in your form.

Thank you!

Biinah B.

December 24th, 2020

Wished I had known about this site earlier. Just what we needed. Get tool to get lip to date legal help.

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela G.

November 18th, 2020

I have an apple phone. I could not fill in the form to pay because apple phones do not have a dash that can be used when the field requires a phone number with a dash. I had to borrow an android phone in which the telephone keypad had a dash that could be used. It was easy to pay using an android phone but impossible to pay using an apple phone. Remove the requirement for dashes to allow apple phones to use this service.

Thank you!

Patricia U.

February 25th, 2021

Quick and easy document recording from home! Wish I knew about this before!

Thank you for your feedback. We really appreciate it. Have a great day!

Russell F.

June 18th, 2019

Thanks for the prompt response to my inquiry. I appreciate the extra effort provided by Tom and Melbra. Great job!

Thank you!

Vicki J.

November 17th, 2020

Reasonably priced and Extremely easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tom B.

December 18th, 2020

I ended up loading the same file twice and was unable to delete one of them. I did send e request in to have one deleted and I did get a response back that only one file was processed. This was done in a timely manner but required more additional time. It would have been nice to be able to delete the file myself and finish the process at the same time. Other than this every thing did go very well. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Gerald C.

May 25th, 2019

Pros, quick purchase and document availability including instructions and examples. Cons, For the cert. of trust, the form would not accept the length of our trust name with no way to get around. The pdf file printing did not meet the requirements for 2.5" top margin and .5" other margins as well as the 10pt font size as the form information was shrunk down even when normal printing.

Thank you for your feedback. We really appreciate it. Have a great day!

diana l.

July 19th, 2024

Easy to use & got my one question answered in less than 5 minutes! Excellence.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!