Napa County Affidavit of Surviving Spouse Form

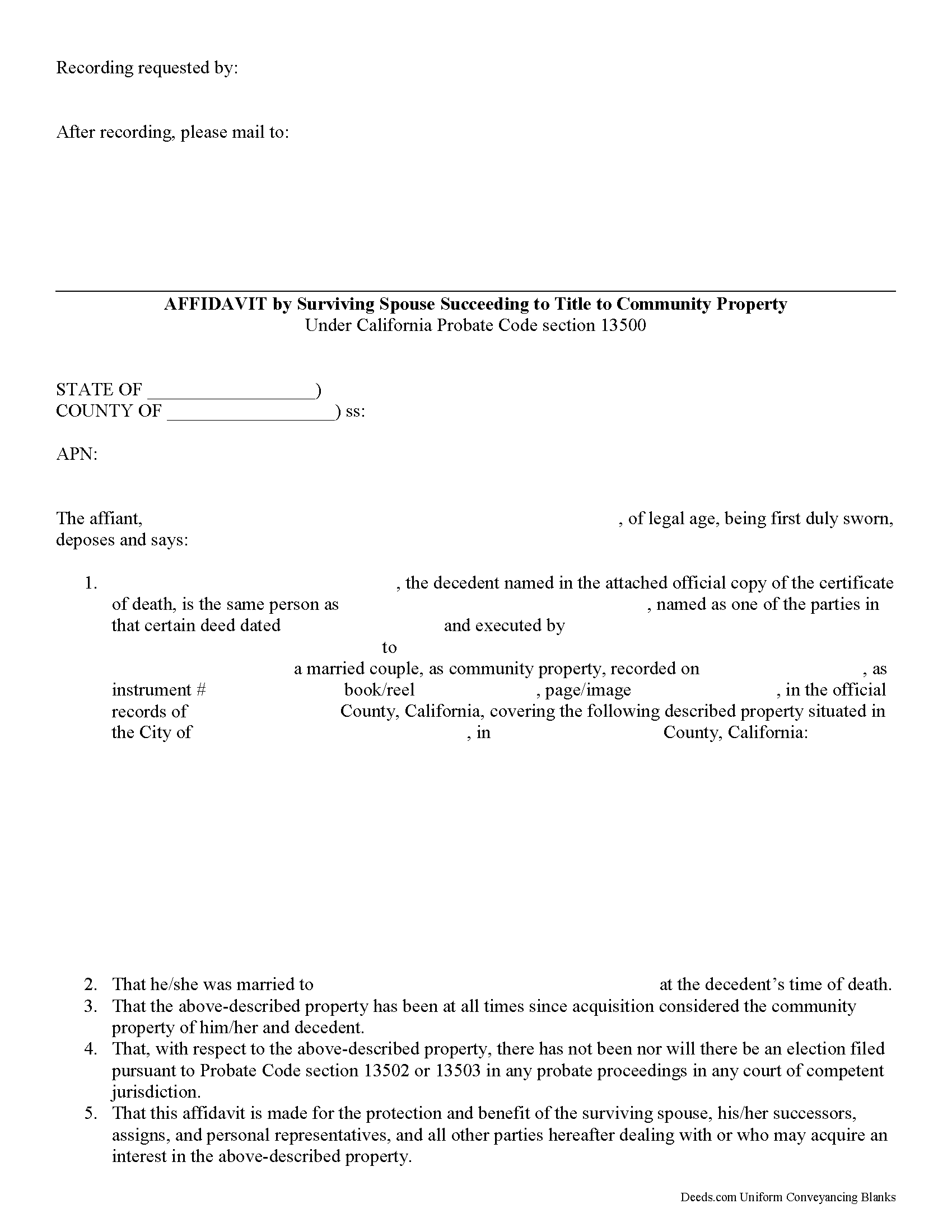

Napa County Affidavit of Surviving Spouse Form

Fill in the blank form formatted to comply with all recording and content requirements.

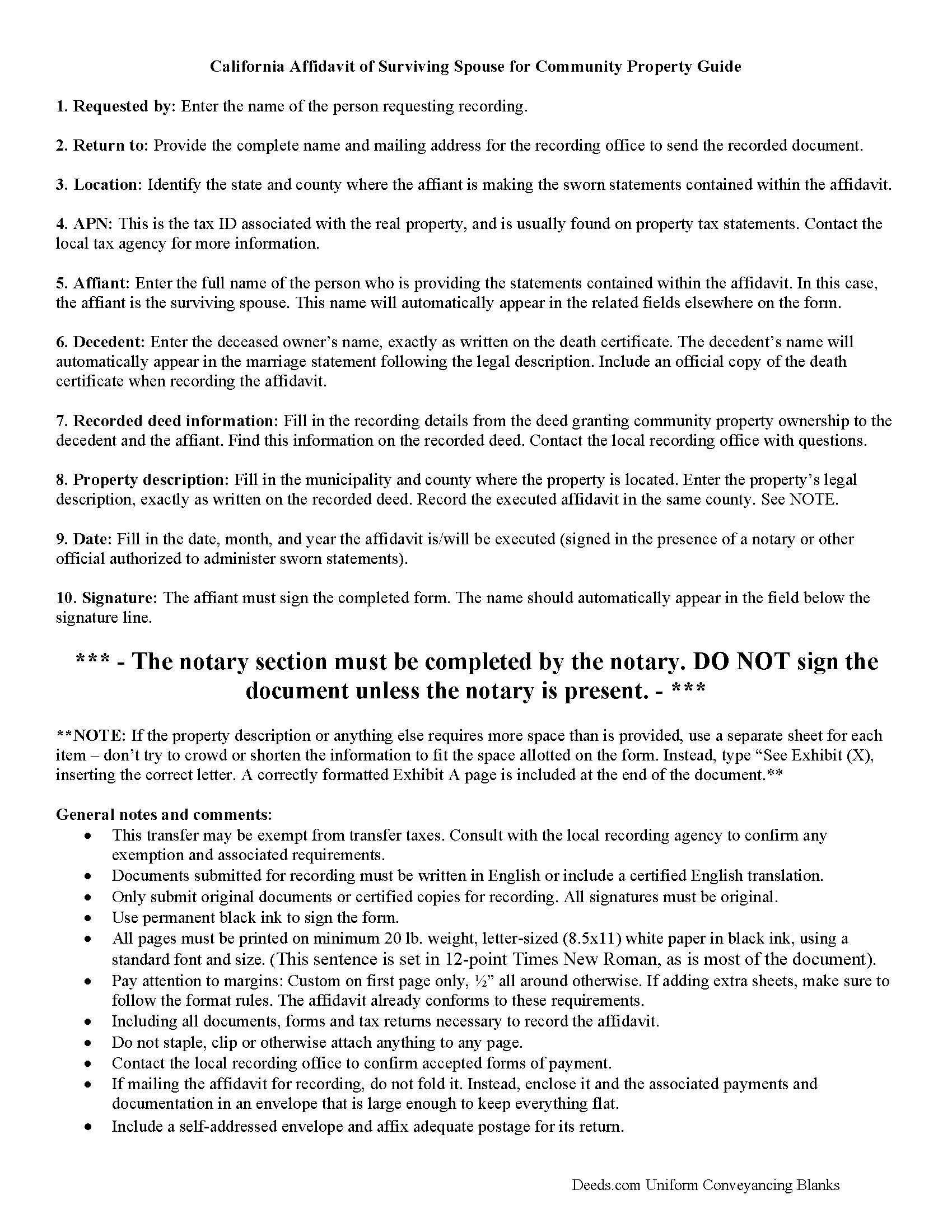

Napa County Affidavit of Surviving Spouse Guide

Line by line guide explaining every blank on the form.

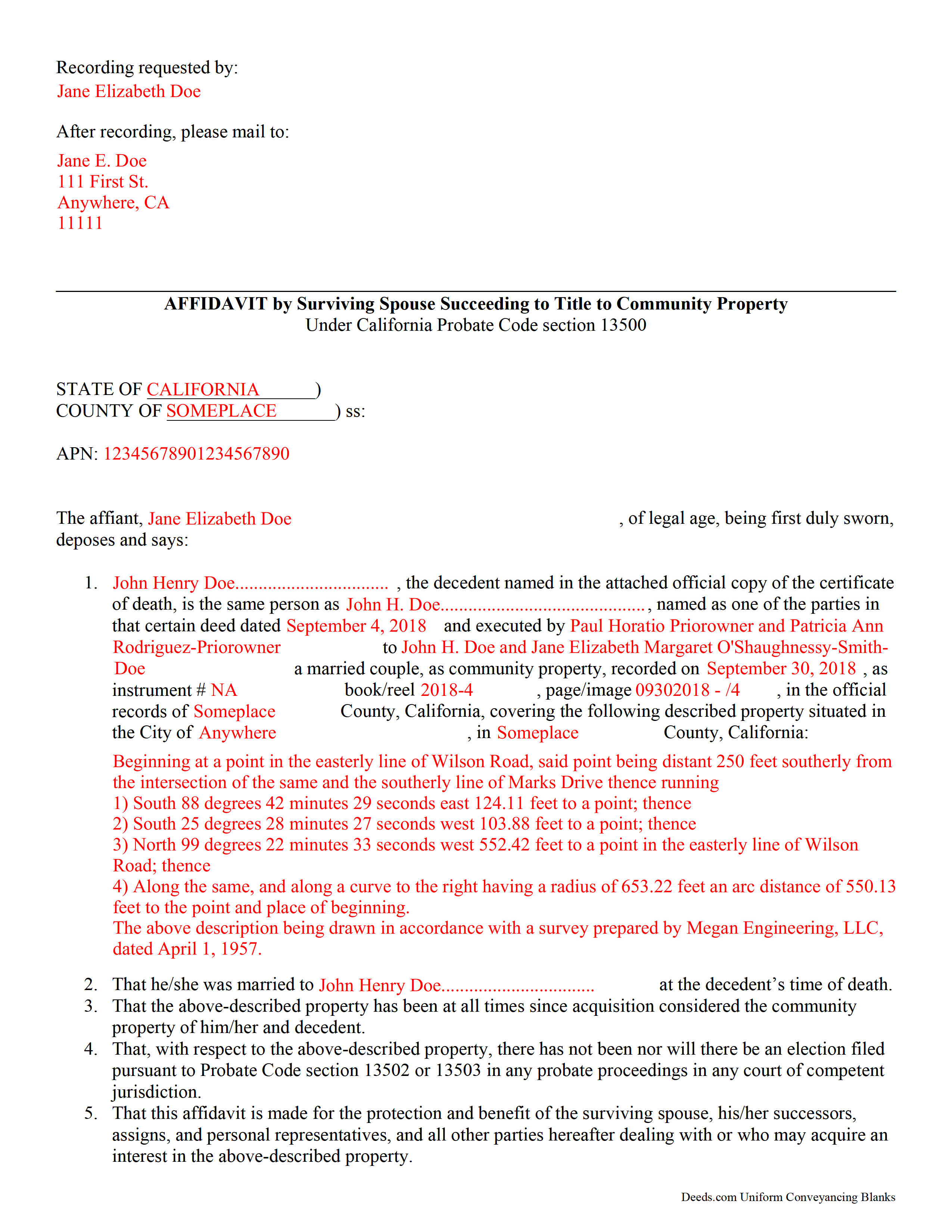

Napa County Completed Example of the Affidavit of Surviving Spouse Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Napa County documents included at no extra charge:

Where to Record Your Documents

Napa County Assessor-Recorder-Clerk

Napa, California 94559-2922 / PO Box 94559-0298

Hours: 8:00 to 4:15 M-F / Recording until 3:00

Phone: (707) 253-4105

Recording Tips for Napa County:

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Napa County

Properties in any of these areas use Napa County forms:

- American Canyon

- Angwin

- Calistoga

- Deer Park

- Napa

- Oakville

- Pope Valley

- Rutherford

- Saint Helena

- Yountville

Hours, fees, requirements, and more for Napa County

How do I get my forms?

Forms are available for immediate download after payment. The Napa County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Napa County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Napa County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Napa County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Napa County?

Recording fees in Napa County vary. Contact the recorder's office at (707) 253-4105 for current fees.

Questions answered? Let's get started!

Transferring California Community Property to the Surviving Spouse

Section 100(a) of the California Probate Code states that when a married person dies, one-half of the couple's community property belongs to the surviving spouse and the other half stays in the decedent's name, ostensibly for probate distribution. For transfers occurring after July 1, 2001, California property owners gained the option to hold title as community property with the right of survivorship. By vesting this way, the remaining spouse acquires the deceased spouse's portion of the shared property without the need for probate (Cal Civ Code 682.1(a)).

The surviving spouse files an affidavit (a statement of facts, made under oath), along with an official copy of the death certificate, at the recording office for the county where the property is located. The content may vary depending on the circumstances, but it generally contains the names of both spouses, a formal legal description of the shared real estate, and the recording information for the deed transferring ownership to the couple, confirming their intention to hold title as community property. Note that the right of survivorship is not automatic with community property -- it must be written on the face of the deed. To alleviate any questions about the survivorship status, consider including an official copy of the recorded deed.

The affidavit should also confirm, among other things, that the co-owners were married when the decedent died, that there are no probate actions related to the property, and that the surviving spouse is submitting the affidavit to ensure clear title. A clear title is important because it makes future transactions involving the real estate less complicated.

Each case is unique, so contact an attorney with specific questions or for complex situations.

(California Affidavit of Surviving Spouse Package includes form, guidelines, and completed example)

Important: Your property must be located in Napa County to use these forms. Documents should be recorded at the office below.

This Affidavit of Surviving Spouse meets all recording requirements specific to Napa County.

Our Promise

The documents you receive here will meet, or exceed, the Napa County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Napa County Affidavit of Surviving Spouse form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Wesley R T.

December 9th, 2020

Great service and easy use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Van S.

March 25th, 2022

Easy to use...very informative...ttook care of exactly what I was looking for.

Thank you for your feedback. We really appreciate it. Have a great day!

David D.

February 11th, 2019

Quick, easy, thorough, reasonable price. Much better than trying to contact a paralegal (who do not usually respond quickly, it seems)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Harold F.

April 24th, 2020

You're a creditable company that performs well and provides what I requested.

Thank you!

Thomas A.

February 25th, 2021

Deeds.com is an easy-to-use resource for the busy real estate practitioner .

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda I.

August 16th, 2023

So far so good. It was reasonably easy to download and complete the form using information found in my closing paperwork. I haven't yet had my form notarized but plan to do so this week and submit the packet to my county auditor.

Thank you for your feedback. We really appreciate it. Have a great day!

Peter M.

February 3rd, 2020

Quick and complete. Thanks!

Thank you!

Alexander H.

August 17th, 2019

As an experienced attorney new to estate planning, I attest that this website and its documents were very helpful. Their documents including everything one needed to know and was very comprehensive.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patrick R.

August 25th, 2023

I was satisfied and would refer this website to others.

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn T.

June 30th, 2020

This is an extremely user friendly site! I had been searching the internet for days for the proper Gift Deed document. I had no idea that my state, the great state of Mississippi had their own site. I am truly looking forward to using this site for additional available documents. Many more blessings to the creator of this site! Keep them coming! Thank You!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Martin L.

February 26th, 2024

Deeds.com is a lifesaver! They are fast and not too expensive. I highly recommend them!

Recognizing the value of your feedback helps us to enhance our services continually. Thank you for sharing your experience with us.

george k.

March 6th, 2019

Thank u the site helped me get the quick deed forms I needed for TN.i will use it in the furture.

Thank you for your feedback. We really appreciate it. Have a great day!

Nicholas B.

October 24th, 2020

A lot of information to read over but downloading process was great and ill definitely use the service again. Showed me my country and city that my forms would be valid in and the information is step by step with examples and that is great

Thank you for your feedback. We really appreciate it. Have a great day!

Richard W.

March 25th, 2019

Very nice web site with available forms. Being out of state we appreciated instruction sheet details. Rick and Jean Weber, Chicago

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sally F.

January 22nd, 2020

Amazing forms, thanks so much for making these available.

Thank you!