Riverside County Assignment of Deed of Trust Form

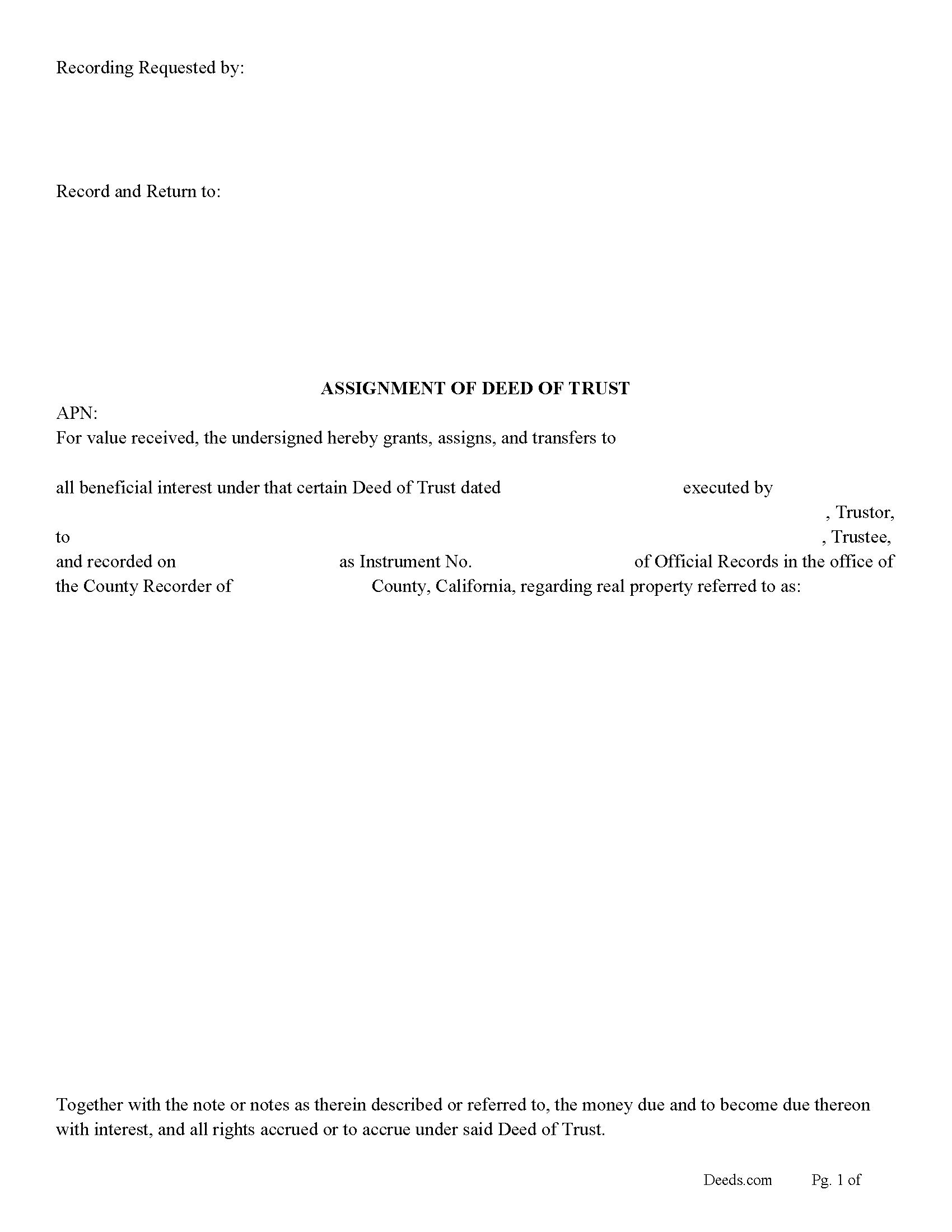

Riverside County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

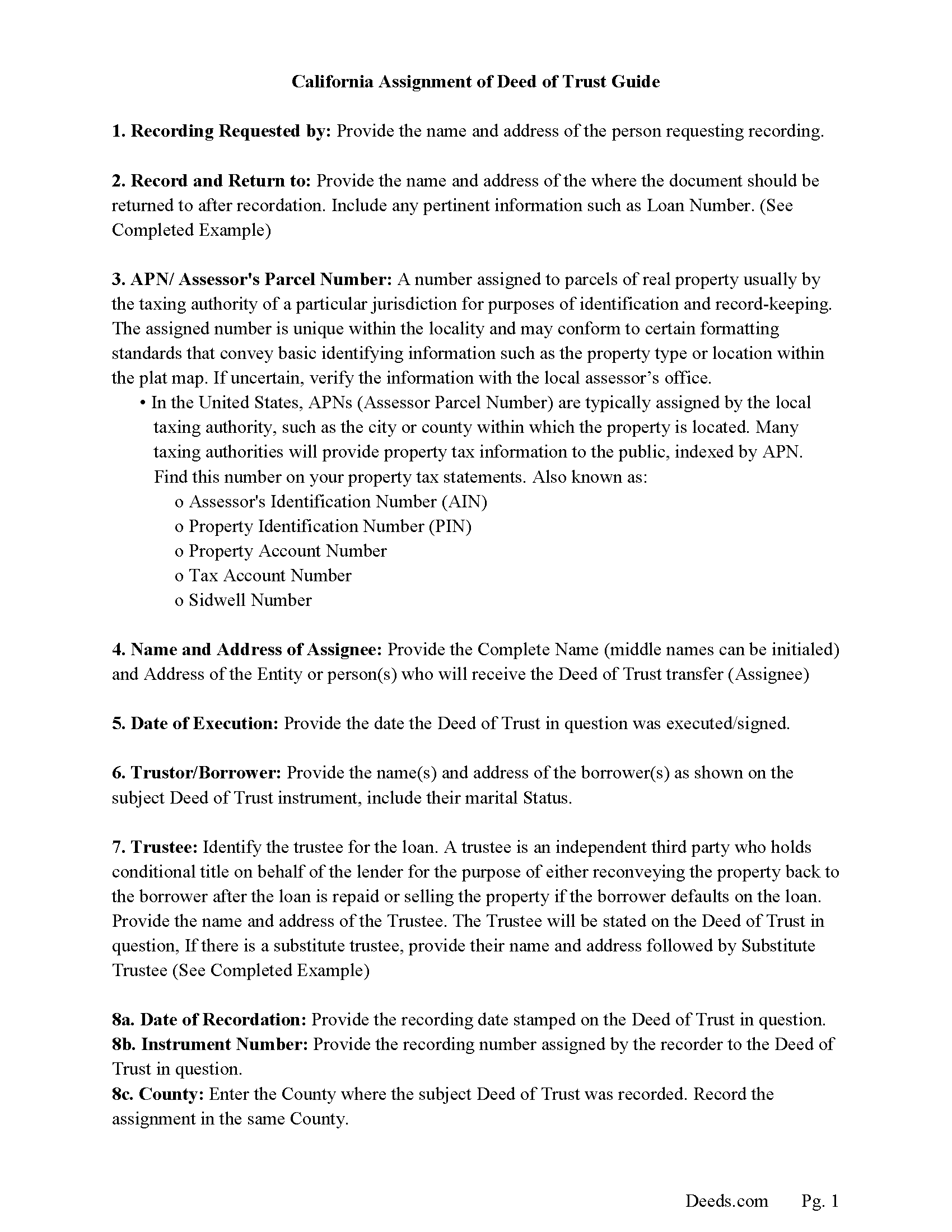

Riverside County Guidelines for Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

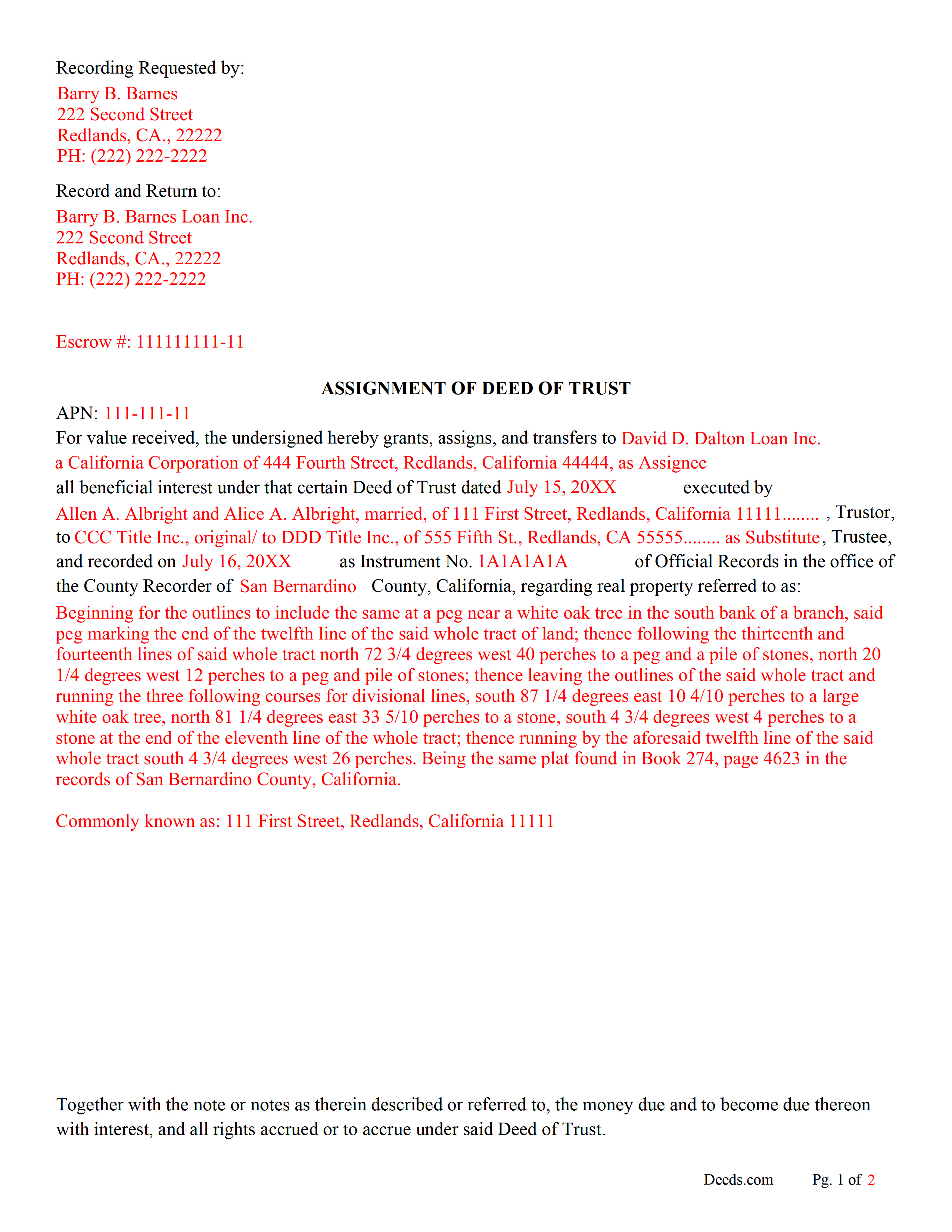

Riverside County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

Riverside County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

Riverside County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

Riverside County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Riverside County documents included at no extra charge:

Where to Record Your Documents

County Administrative Center

Riverside, California 92501 / 92502-0751

Hours: Monday through Friday 8:00 am to 5:00 pm

Phone: (951) 486-7000 or (800) 696-9144 from within county

Gateway Office

Riverside, California 92507

Hours: Monday through Friday 8:00 am to 5:00 pm

Phone: (951) 486-7000 or (800) 696-9144

Hemet Office

Hemet, California 92543-1496

Hours: Monday through Friday 8:00 to 12:00 & 1:00 to 4:30

Phone: (951) 486-7000 or (800) 696-9144 from within county

Palm Desert Office

Palm Desert, California 92211

Hours: Monday through Friday 8:00 to 5:00 Phone / Counter & Recording until 4:30

Phone: (760) 863-8732 or (800) 696-9144

Temecula Office

Temecula, California 92591-6027

Hours: Monday through Friday 8:00 am to 4:30 pm

Phone: (951) 486-7000 or (800) 696-9144

Blythe Office

Blythe, California 92225

Hours: Recorder Services: First Wednesday of the month 10:00 to 12:00 & 1:00 to 3:00

Phone: (760) 921-5050 or (800) 696-9144

Recording Tips for Riverside County:

- Ensure all signatures are in blue or black ink

- Check margin requirements - usually 1-2 inches at top

- Ask about their eRecording option for future transactions

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Riverside County

Properties in any of these areas use Riverside County forms:

- Aguanga

- Anza

- Banning

- Beaumont

- Blythe

- Cabazon

- Calimesa

- Cathedral City

- Coachella

- Corona

- Desert Center

- Desert Hot Springs

- Hemet

- Homeland

- Idyllwild

- Indian Wells

- Indio

- La Quinta

- Lake Elsinore

- March Air Reserve Base

- Mecca

- Menifee

- Mira Loma

- Moreno Valley

- Mountain Center

- Murrieta

- Norco

- North Palm Springs

- Nuevo

- Palm Desert

- Palm Springs

- Perris

- Rancho Mirage

- Riverside

- San Jacinto

- Sun City

- Temecula

- Thermal

- Thousand Palms

- Whitewater

- Wildomar

- Winchester

Hours, fees, requirements, and more for Riverside County

How do I get my forms?

Forms are available for immediate download after payment. The Riverside County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Riverside County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Riverside County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Riverside County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Riverside County?

Recording fees in Riverside County vary. Contact the recorder's office at (951) 486-7000 or (800) 696-9144 from within county for current fees.

Questions answered? Let's get started!

The current Lender/Beneficiary uses this form to assign a Deed of Trust to another lender. This is often done when a Deed of Trust has been sold. This allows the new Lender the right to collect payments of the debt. A typical Deed of Trust contains a Power of Sale clause, allowing a non-judicial foreclosure. (The power of sale may be exercised by the assignee if the assignment is duly acknowledged and recorded.) (California Code 2932.5)

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their deed of trust debt has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(California Assignment of Deed of Trust Package includes form, guidelines, and completed example) For use in California only.

Important: Your property must be located in Riverside County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Riverside County.

Our Promise

The documents you receive here will meet, or exceed, the Riverside County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Riverside County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

dill h.

March 5th, 2019

easy-peasy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna R.

November 22nd, 2021

Hi! Is there a setting that I can click on that will make sure I'm notified via email when an update is made to my requests? Thank you!

Thanks for your feedback, we'll have someone look into it.

Glenda R.

June 16th, 2020

My experience with deeds.com during this pandemic that has us inconvenienced has made it easy for personal business to continue as usual. I will recommend deeds.com to anyone I learn of needing the assistance.

Thank you for your feedback. We really appreciate it. Have a great day!

Jack B.

May 2nd, 2020

The service was fast, but I didn't learn about the results until I logged in. I would have liked to get email when the report was finished.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael L.

February 28th, 2021

Easy and quick. I will always use this efficient service even if the recorders office opens again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph K.

May 1st, 2020

I'm very impressed. We're a small nonprofit, and we usually walk our documents into our county offices for recording. So I was a little bit skeptical about how things would work if we did it electronically. But it was a smooth, quick, painless, and reasonably priced process. I expect that this will be our preferred method even after county offices re-open.

Thank you for your feedback. We really appreciate it. Have a great day!

Scott P.

October 24th, 2020

So far so good

Thank you!

Pamela L.

June 18th, 2023

Well this could not have been any easier for me! Deeds made this whole process very efficient, and simple. I will definitely be a return customer when needed. Thank You!

Thank you Pamela, we appreciate you!

Chanda C.

June 2nd, 2020

It's going well so far!

Thank you!

Liza B.

June 22nd, 2021

Fantastic forms and service, could not be happier, wish you girls did more than deed forms.

Thank you!

Charlotte M.

April 1st, 2024

Absolutely perfect! Quitclaim deed form was easy to complete and the recorder had no issues with it whatsoever, a rarity around here! Thanks sooo much!

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

James W.

June 10th, 2019

It turned out that I was able to search for what I needed on the local county website, which is what your site suggested be tried. I was impressed with your honesty and practical instructions for searches your site gave. I'm pretty sure I'll be back.

Thank you for your feedback James. Glad to hear we were able to steer you in the right direction.

Klint D.

October 2nd, 2020

Quick and easy

Thank you!

Tony R.

July 23rd, 2021

As advertised. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kristie B.

August 19th, 2022

Horrible. As an agent, trying to find a simple answer was never accomplished.

Sorry to hear that Kristie. We do hope that you found what you were looking for elsewhere.