San Diego County Assignment of Deed of Trust Form

San Diego County Assignment of Deed of Trust Form

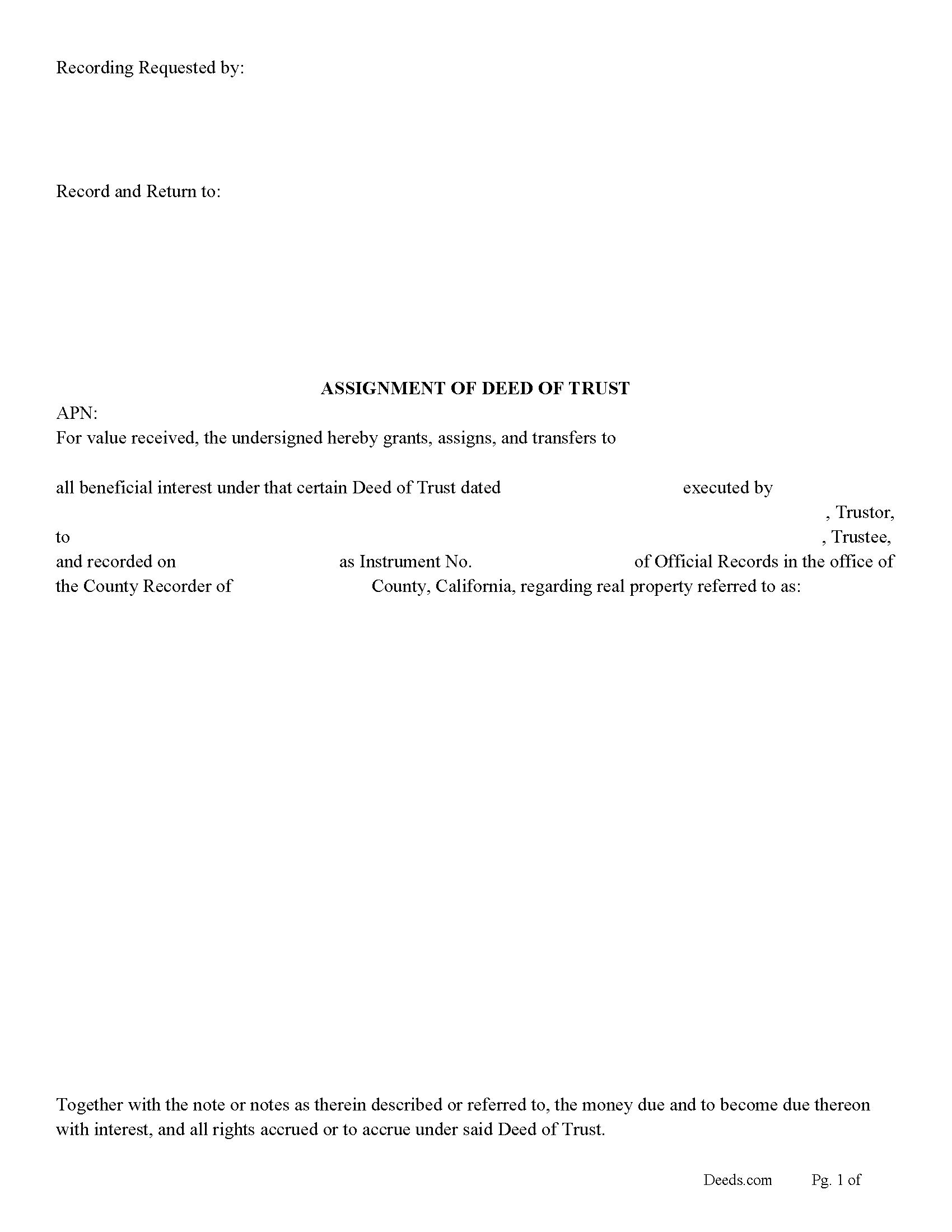

Fill in the blank form formatted to comply with all recording and content requirements.

San Diego County Guidelines for Assignment of Deed of Trust

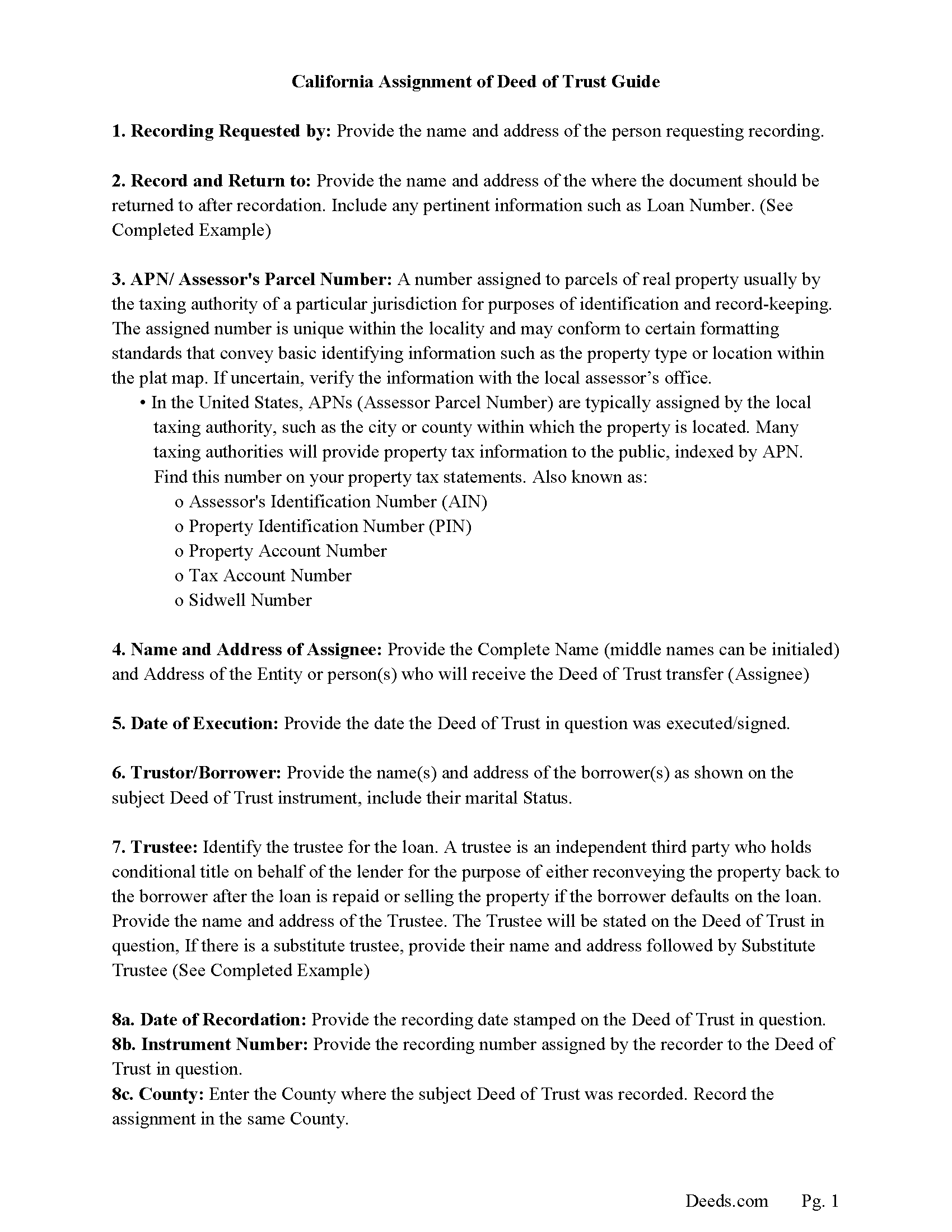

Line by line guide explaining every blank on the form.

San Diego County Completed Example of the Assignment of Deed of Trust Document

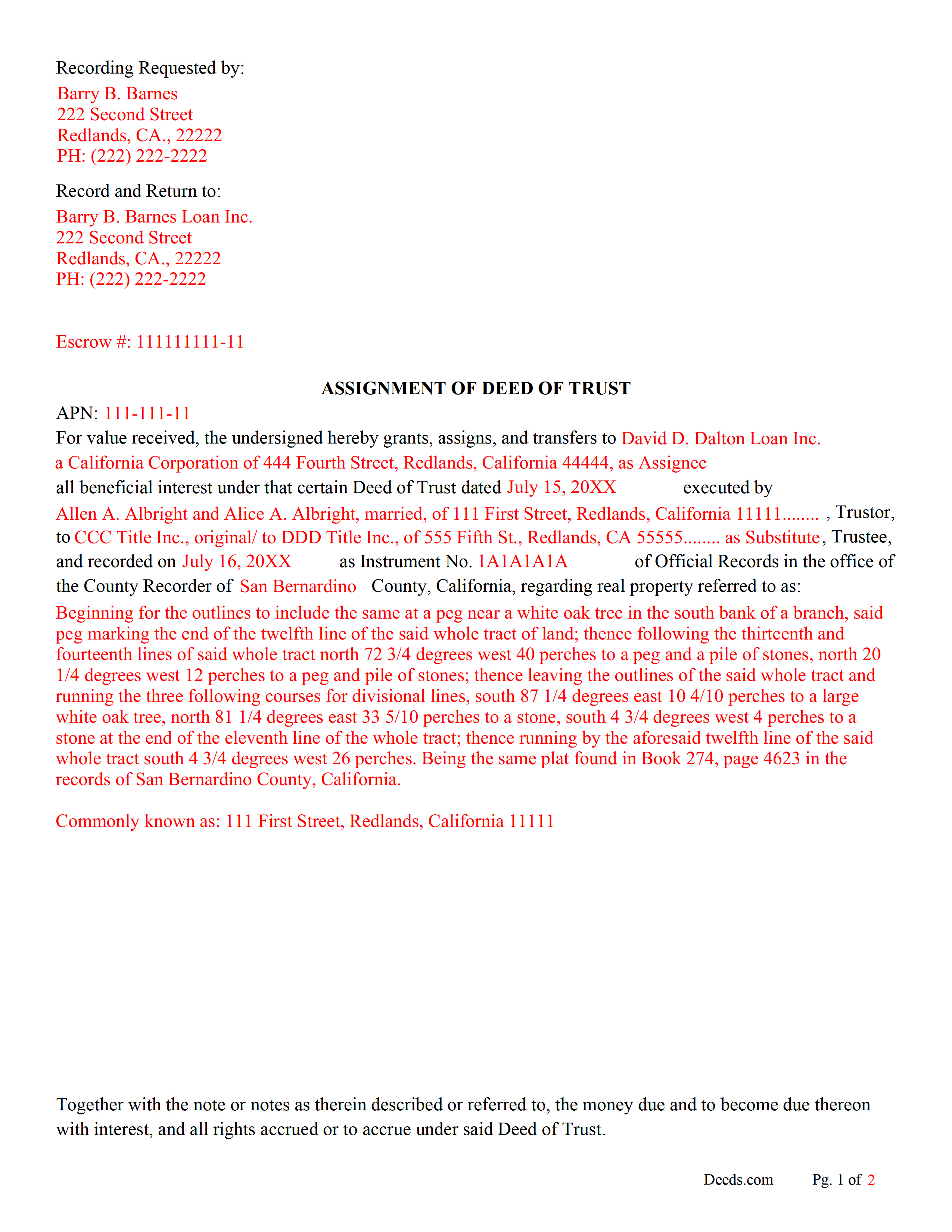

Example of a properly completed form for reference.

San Diego County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

San Diego County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

San Diego County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and San Diego County documents included at no extra charge:

Where to Record Your Documents

San Diego Clerk/Recorder Main Office

San Diego, California 92101

Hours: Monday to Friday 8:00am - 5:00pm

Phone: (619) 236-3771, 238-8158; (760) 630-1219 North County

Mail to: San Diego Assessor/Recorder/Clerk

San Diego, California 92112-1750

Hours: N/A

Phone: mailing address

El Cajon Branch Office

El Cajon, California 92020

Hours: Monday through Friday 8:00am - 5:00pm

Phone: (619) 238-8158 or (619) 236-3771 Assessor

San Marcos Branch Office

San Marcos, California 92078

Hours: Monday through Friday 8:00am - 5:00pm

Phone: (619) 238-8158 or (760) 630-1219 North County

Chula Vista Branch Office

Chula Vista, California 91910

Hours: 8:00 a.m. to 5:00 p.m., Monday through Friday, except holidays.

Phone: (619) 238-8158

Recording Tips for San Diego County:

- Ask if they accept credit cards - many offices are cash/check only

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

- Ask about their eRecording option for future transactions

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in San Diego County

Properties in any of these areas use San Diego County forms:

- Alpine

- Bonita

- Bonsall

- Borrego Springs

- Boulevard

- Camp Pendleton

- Campo

- Cardiff By The Sea

- Carlsbad

- Chula Vista

- Coronado

- Del Mar

- Descanso

- Dulzura

- El Cajon

- Encinitas

- Escondido

- Fallbrook

- Guatay

- Imperial Beach

- Jacumba

- Jamul

- Julian

- La Jolla

- La Mesa

- Lakeside

- Lemon Grove

- Lincoln Acres

- Mount Laguna

- National City

- Oceanside

- Pala

- Palomar Mountain

- Pauma Valley

- Pine Valley

- Potrero

- Poway

- Ramona

- Ranchita

- Rancho Santa Fe

- San Diego

- San Luis Rey

- San Marcos

- San Ysidro

- Santa Ysabel

- Santee

- Solana Beach

- Spring Valley

- Tecate

- Valley Center

- Vista

- Warner Springs

Hours, fees, requirements, and more for San Diego County

How do I get my forms?

Forms are available for immediate download after payment. The San Diego County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in San Diego County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by San Diego County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in San Diego County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in San Diego County?

Recording fees in San Diego County vary. Contact the recorder's office at (619) 236-3771, 238-8158; (760) 630-1219 North County for current fees.

Questions answered? Let's get started!

The current Lender/Beneficiary uses this form to assign a Deed of Trust to another lender. This is often done when a Deed of Trust has been sold. This allows the new Lender the right to collect payments of the debt. A typical Deed of Trust contains a Power of Sale clause, allowing a non-judicial foreclosure. (The power of sale may be exercised by the assignee if the assignment is duly acknowledged and recorded.) (California Code 2932.5)

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their deed of trust debt has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(California Assignment of Deed of Trust Package includes form, guidelines, and completed example) For use in California only.

Important: Your property must be located in San Diego County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to San Diego County.

Our Promise

The documents you receive here will meet, or exceed, the San Diego County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your San Diego County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Tonya B.

March 3rd, 2022

Easy and fast. I will definitely use this service again.

Thank you for your feedback. We really appreciate it. Have a great day!

Edward B.

May 13th, 2020

Thank you for the rapid response. I shall persevere in my search using other public records. I shall keep your website handy for other such searches in the future.

Thank you!

Joseph E.

January 15th, 2023

At first I didn't trust all the 5 star reviews. So, I contacted lawyers to check their prices. The price being well over one hundred dollars made my mind up. I gave it a go, the form isn't hard and the directions are easy to follow. 5/5

Thank you for your feedback. We really appreciate it. Have a great day!

Ron M.

December 2nd, 2020

The download of forms, etc. was easy and the guides that were provided were good, but more information would have been nice as to where to find tax map #, parcel #, and district mentioned in Exemptions from Property Transfer Fees (and Declaration of Consideration or Value. In general, I was quite pleased with your product.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heather T.

January 21st, 2022

Thank you for making this so easy

Thank you!

Allen P.

January 7th, 2023

Information very useful and helpful. It would be helpful to inform purchasers that legal size paper is needed to print documents. We had to run to the store and purchase some.

Thank you for your feedback. We really appreciate it. Have a great day!

Stefan L.

May 5th, 2022

Great templates and very efficient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Amie S.

January 8th, 2019

The forms that I downloaded from Deeds were perfect for what I needed. I even checked with a lawyer to see if the papers would work and she said yes.

Thanks Amie, have a great day!

Sinh L.

January 13th, 2020

Deeds.com did such a wonderful job that I had to leave a positive review. I did a deed retrieval and ran across some hiccups. Deeds.com was able to help me get my deed and even went beyond to help me have a more in depth understanding of it's title history. They responded quickly to all my messages. Great customer service. Definitely recommend! Thank you Deeds.com and thank you KVH.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James S.

August 26th, 2020

unbelievable Deeds Rocks Start to finish 2=Day Recommended by Coconino County Recorders office in Arizona there were incomplete sections. I would correct and resubmit . All done Yeah!!!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Amy S.

March 7th, 2022

So convenient! I love this service. I highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth W.

February 9th, 2023

would have been smart to give each pdf a name instead of unintelligible numbers...

Thank you for your feedback. We really appreciate it. Have a great day!

marshall w.

September 24th, 2019

was not ready to pay for much needed forms but very important

Thank you for your feedback. We really appreciate it. Have a great day!

Wayne R.

February 22nd, 2021

Couldn't believe how simple it was to do such a very important family support task and the price was right! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shelby D.

May 1st, 2021

Not very helpful since I am married and the example provided is for single person. Nevada homestead requires spouse to sign off on quit claim deed but no guidance provided as to where this acknowledgment is placed on template form. There should be example for married person as well. Had to use another service. Waste of $21.

Thank you for your feedback. We really appreciate it. Have a great day!