San Diego County Disclaimer of Interest Form

San Diego County Disclaimer of Interest Form

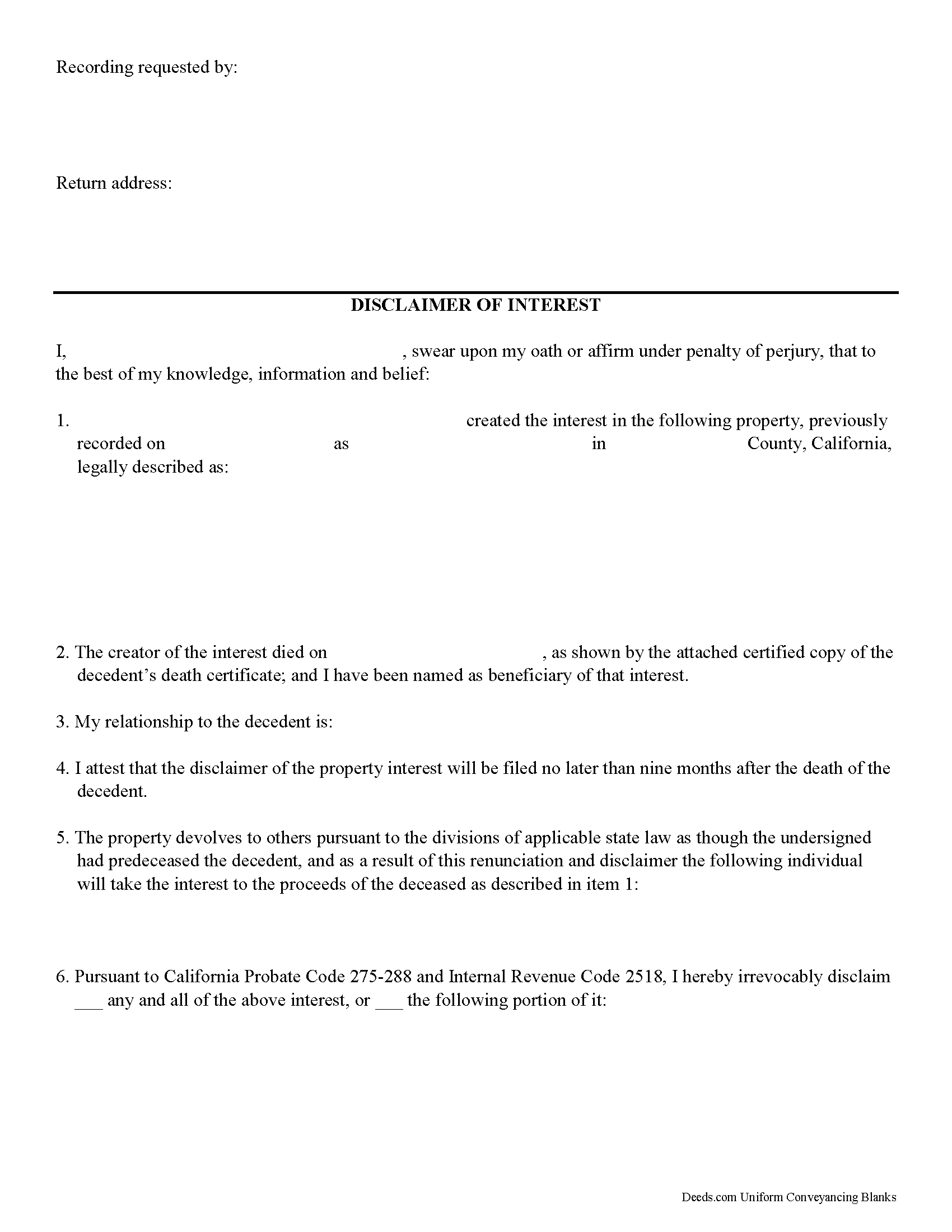

Fill in the blank form formatted to comply with all recording and content requirements.

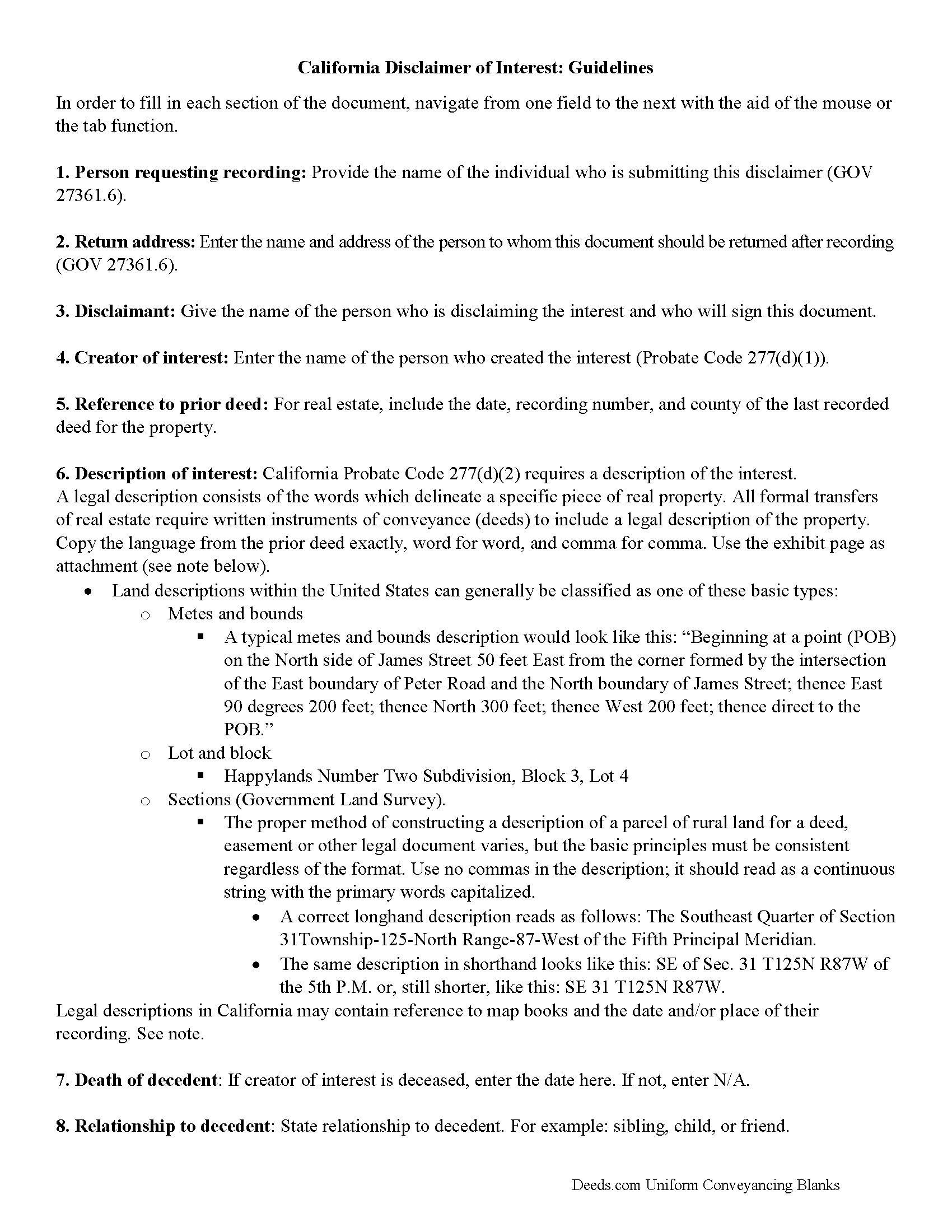

San Diego County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

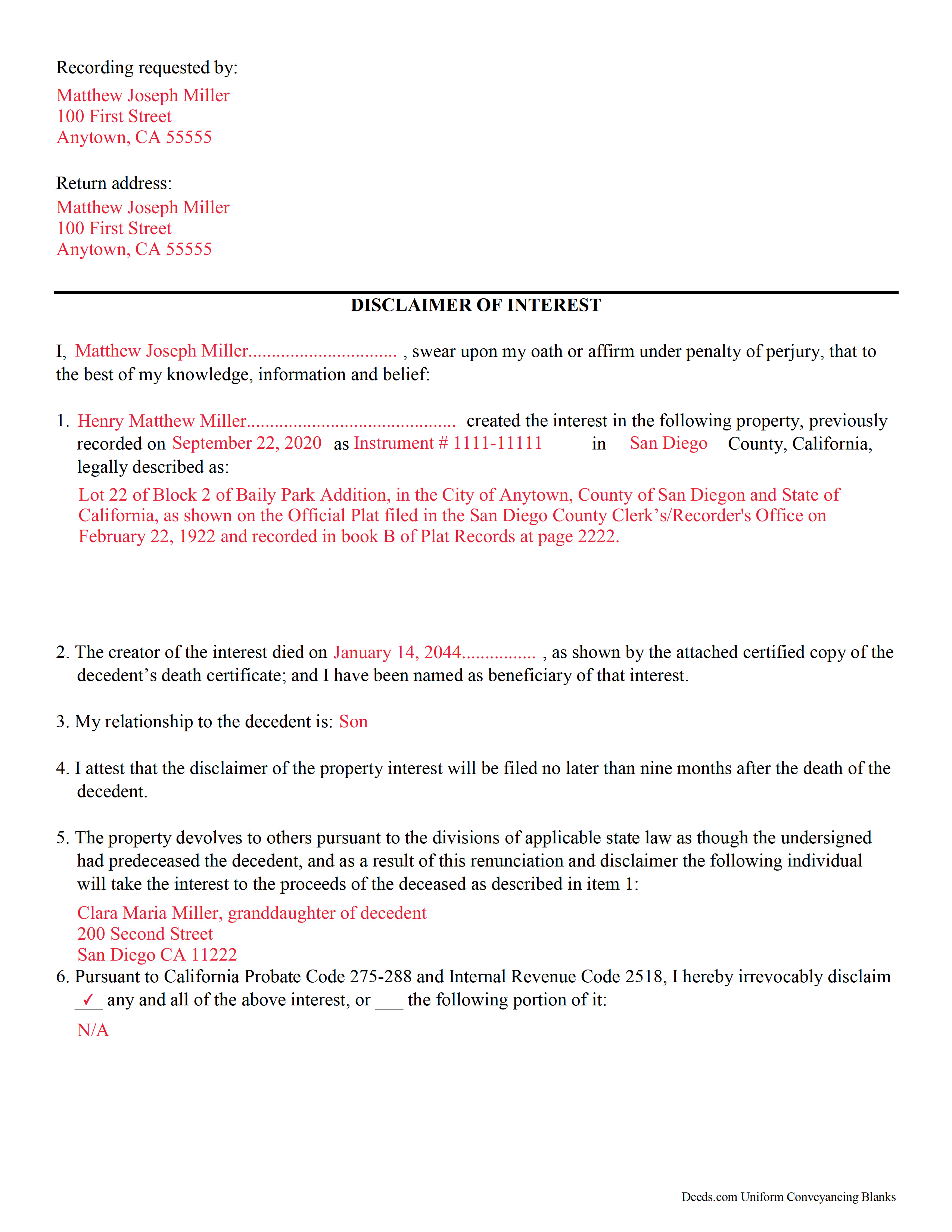

San Diego County Completed Example of the Disclaimer of Interest Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and San Diego County documents included at no extra charge:

Where to Record Your Documents

San Diego Clerk/Recorder Main Office

San Diego, California 92101

Hours: Monday to Friday 8:00am - 5:00pm

Phone: (619) 236-3771, 238-8158; (760) 630-1219 North County

Mail to: San Diego Assessor/Recorder/Clerk

San Diego, California 92112-1750

Hours: N/A

Phone: mailing address

El Cajon Branch Office

El Cajon, California 92020

Hours: Monday through Friday 8:00am - 5:00pm

Phone: (619) 238-8158 or (619) 236-3771 Assessor

San Marcos Branch Office

San Marcos, California 92078

Hours: Monday through Friday 8:00am - 5:00pm

Phone: (619) 238-8158 or (760) 630-1219 North County

Chula Vista Branch Office

Chula Vista, California 91910

Hours: 8:00 a.m. to 5:00 p.m., Monday through Friday, except holidays.

Phone: (619) 238-8158

Recording Tips for San Diego County:

- White-out or correction fluid may cause rejection

- Check margin requirements - usually 1-2 inches at top

- Bring extra funds - fees can vary by document type and page count

- Request a receipt showing your recording numbers

Cities and Jurisdictions in San Diego County

Properties in any of these areas use San Diego County forms:

- Alpine

- Bonita

- Bonsall

- Borrego Springs

- Boulevard

- Camp Pendleton

- Campo

- Cardiff By The Sea

- Carlsbad

- Chula Vista

- Coronado

- Del Mar

- Descanso

- Dulzura

- El Cajon

- Encinitas

- Escondido

- Fallbrook

- Guatay

- Imperial Beach

- Jacumba

- Jamul

- Julian

- La Jolla

- La Mesa

- Lakeside

- Lemon Grove

- Lincoln Acres

- Mount Laguna

- National City

- Oceanside

- Pala

- Palomar Mountain

- Pauma Valley

- Pine Valley

- Potrero

- Poway

- Ramona

- Ranchita

- Rancho Santa Fe

- San Diego

- San Luis Rey

- San Marcos

- San Ysidro

- Santa Ysabel

- Santee

- Solana Beach

- Spring Valley

- Tecate

- Valley Center

- Vista

- Warner Springs

Hours, fees, requirements, and more for San Diego County

How do I get my forms?

Forms are available for immediate download after payment. The San Diego County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in San Diego County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by San Diego County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in San Diego County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in San Diego County?

Recording fees in San Diego County vary. Contact the recorder's office at (619) 236-3771, 238-8158; (760) 630-1219 North County for current fees.

Questions answered? Let's get started!

Use the disclaimer to renounce an interest in real property in California.

A beneficiary in California can disclaim a bequeathed asset or power. For a complete list, see Probate Code 267. A disclaimer, which must be in writing and signed by the beneficiary, allows that beneficiary to renounce his or her interest in the property. California statutes allow for the partial rejection of the interest, which must be clearly identified on the disclaimer.

Besides the beneficiary, state the name of the creator of the interest, as well as the next beneficiary to whom the interest will pass, e.g., the next person in line to inherit. In the case of real property, give the entire legal description of the land and provide recording information for the prior deed in order to avoid any problems in the chain of title.

A disclaimer is irrevocable and binding for anyone who makes a claim against the beneficiary, for example, potential creditors. It must be received within nine months after the decedent's death, the transfer, or the 21st birthday of the beneficiary (Probate Code 279) and is only valid if no actions have indicated acceptance of the property.

It must be filed with any of the following entities according to Probate Code 280(a): the superior court in the county where the estate is administered; the representative of the deceased or executor of the estate; the creator of the interest; or "any other person having custody or possession of or legal title to the interest." When in doubt as to the drawbacks and benefits of renouncing the property, consult with an attorney.

(California Disclaimer of Interest Package includes form, guidelines, and completed example)

Important: Your property must be located in San Diego County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to San Diego County.

Our Promise

The documents you receive here will meet, or exceed, the San Diego County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your San Diego County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Lowell P.

May 26th, 2020

Exceptionally helpful instruments that are compliant with State law and anticipate various contingencies. Very pleased.

Thank you for your feedback. We really appreciate it. Have a great day!

Viola J.

August 2nd, 2021

You made this so easy to process the Executor Deed. THANK YOU a thousand times. Appreciate that all forms are in one place and I did not have to search all over the internet to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vicki A.

October 29th, 2023

Very fast and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John H.

April 19th, 2021

I haven't begun yet, but this looks like what I need.

Thank you!

Daniel S.

February 11th, 2019

It was easy to find the forms I was looking for and the guided steps and examples of how to use the form were beneficial.

Thank you for your feedback. We really appreciate it. Have a great day!

Shelly S.

January 20th, 2021

Was able to sell a property with the information obtained from your website without using an attorney! Extremely happy.

Thank you!

David Y.

March 10th, 2020

Really great forms. Did the quitclaim, everything was perfect, recorded with no problems at all. Thanks!

Thank you!

Pamela B.

June 18th, 2023

Very easy to use. Time will tell if I have any issues getting it recorded. Beats using an attorney who won't return calls and emails like I used before. I like the form plus instructions and an example of the completed form.

Thank you for your feedback. We really appreciate it. Have a great day!

DENNIS M.

January 18th, 2023

very simple and complete

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

janelle s.

September 15th, 2020

Uncertain about use as I am new to online forms. Through use I am sure it will feel more comfortable. I like the storage of filled in info forms because I might be using I will be using them or the info in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

BARBARA L.

February 15th, 2023

Fairly easy to use. I had to really search to get some info. I had to use the Exhibit feature because the description box was way too small and I ended up re-typing it. The package had good and useful links. The County Clerk looked at it and said, "I see you used an online form, and that's OK, but..." and proceeded to show me a couple of things that were left out. They recorded it with no problems.

Thank you!

Sara M.

February 4th, 2025

This makes work so much easier now that I don't have to drive to each county to record. Thank you.

It was a pleasure serving you. Thank you for the positive feedback!

Scott W.

March 31st, 2020

Wow! That was easy! I was expecting a more difficult process. Upload your docs and wait for a response. Which was minutes later. I would give it 6 stars.

Thank you for your kind words Scott, glad we could help.

Jean K.

February 25th, 2021

The website worked fine and I would have been happy to pay the extra money except the deed I needed was "not available". Ended up calling the courthouse anyway.

Thank you for your feedback. We really appreciate it. Have a great day!

Angela B.

July 22nd, 2020

The site made everything very easy to understand and access. I was able to get everything I needed and the cost was reasonable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!