San Diego County Mineral Deed with Quitclaim Covenants Form

San Diego County Mineral Deed with Quitclaim Covenants Form

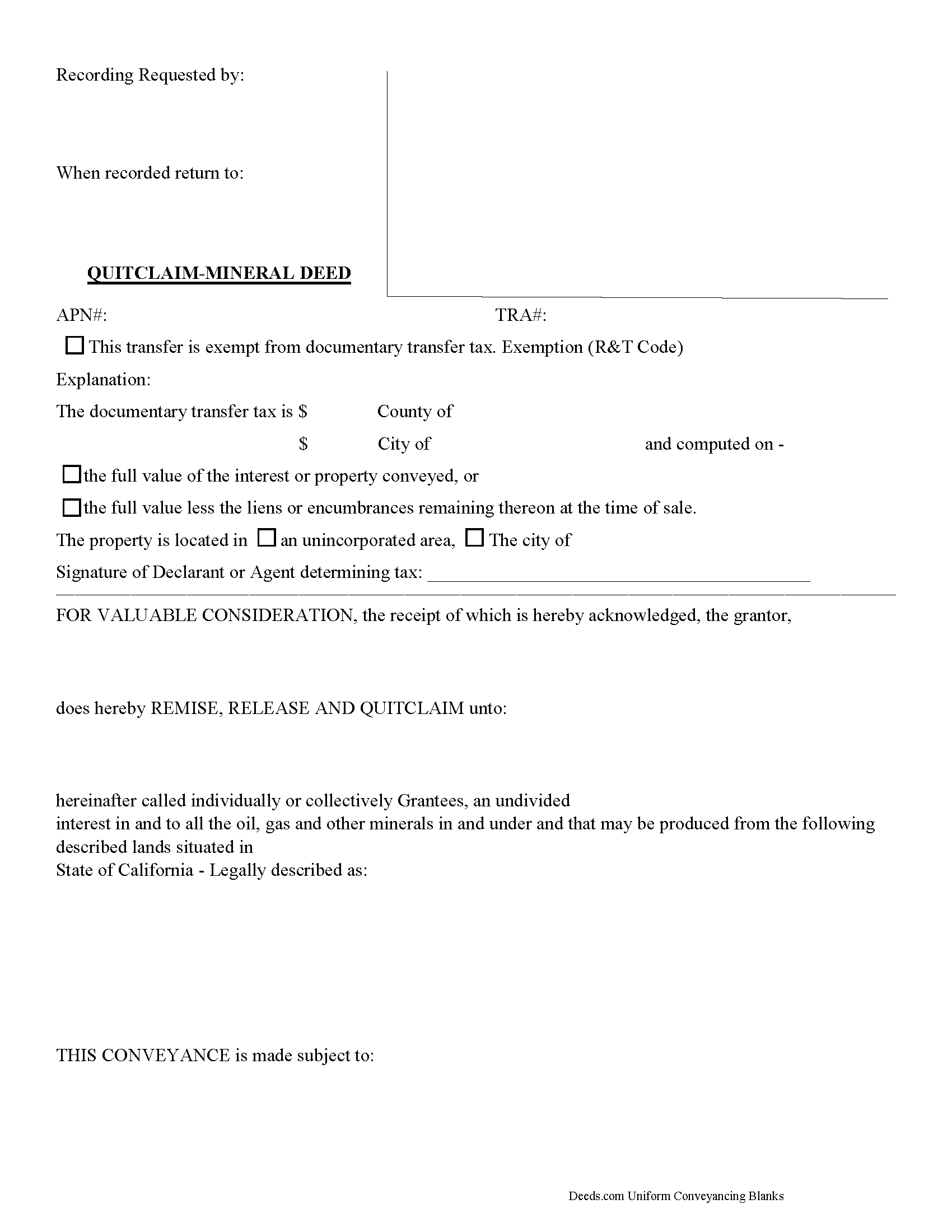

Fill in the blank Mineral Deed with Quitclaim Covenants form formatted to comply with all California recording and content requirements.

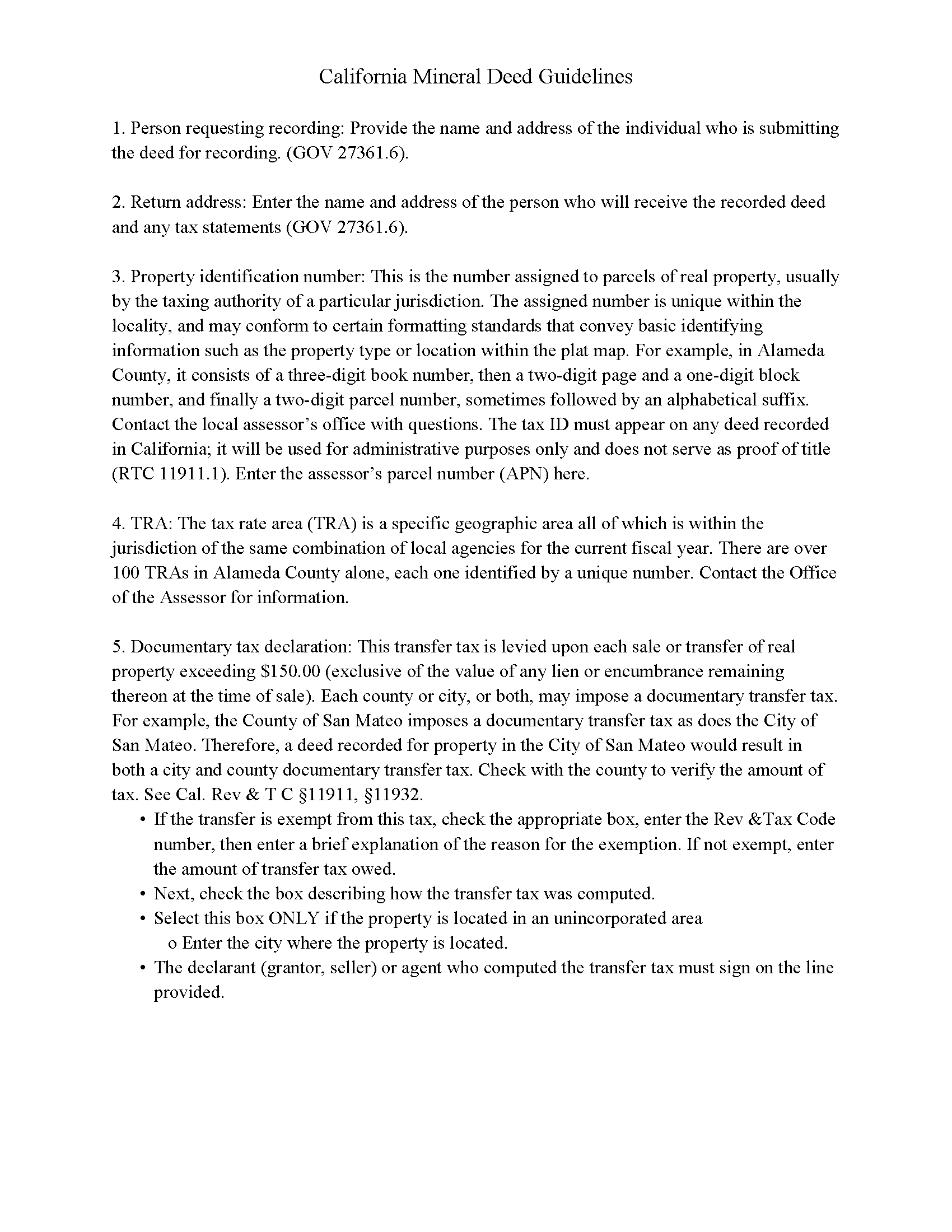

San Diego County Mineral Deed with Quitclaim Covenants Guide

Line by line guide explaining every blank on the Mineral Deed with Quitclaim Covenants form.

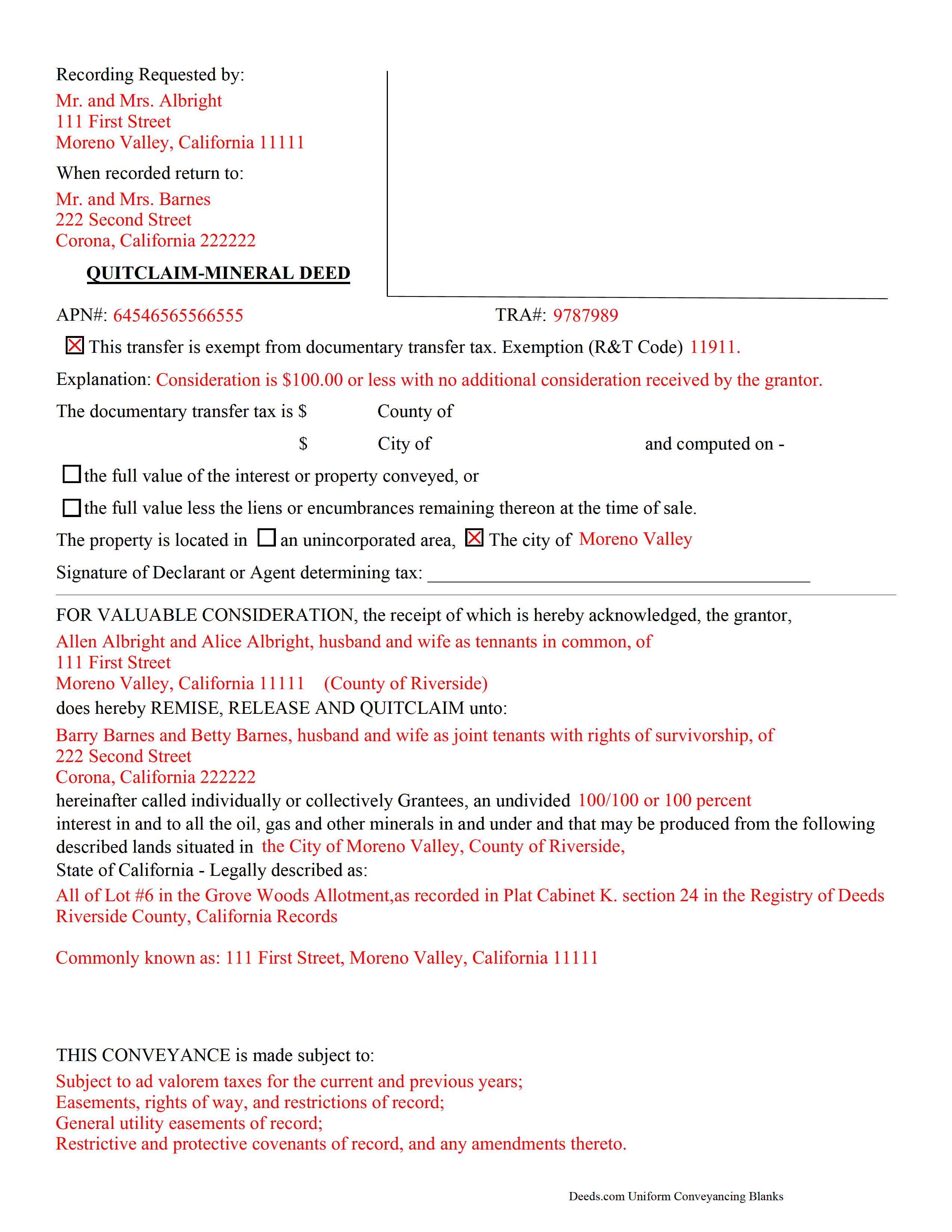

San Diego County Completed Example of the Mineral Deed with Quitclaim Covenants Document

Example of a properly completed California Mineral Deed with Quitclaim Covenants document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and San Diego County documents included at no extra charge:

Where to Record Your Documents

San Diego Clerk/Recorder Main Office

San Diego, California 92101

Hours: Monday to Friday 8:00am - 5:00pm

Phone: (619) 236-3771, 238-8158; (760) 630-1219 North County

Mail to: San Diego Assessor/Recorder/Clerk

San Diego, California 92112-1750

Hours: N/A

Phone: mailing address

El Cajon Branch Office

El Cajon, California 92020

Hours: Monday through Friday 8:00am - 5:00pm

Phone: (619) 238-8158 or (619) 236-3771 Assessor

San Marcos Branch Office

San Marcos, California 92078

Hours: Monday through Friday 8:00am - 5:00pm

Phone: (619) 238-8158 or (760) 630-1219 North County

Chula Vista Branch Office

Chula Vista, California 91910

Hours: 8:00 a.m. to 5:00 p.m., Monday through Friday, except holidays.

Phone: (619) 238-8158

Recording Tips for San Diego County:

- Check that your notary's commission hasn't expired

- Leave recording info boxes blank - the office fills these

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in San Diego County

Properties in any of these areas use San Diego County forms:

- Alpine

- Bonita

- Bonsall

- Borrego Springs

- Boulevard

- Camp Pendleton

- Campo

- Cardiff By The Sea

- Carlsbad

- Chula Vista

- Coronado

- Del Mar

- Descanso

- Dulzura

- El Cajon

- Encinitas

- Escondido

- Fallbrook

- Guatay

- Imperial Beach

- Jacumba

- Jamul

- Julian

- La Jolla

- La Mesa

- Lakeside

- Lemon Grove

- Lincoln Acres

- Mount Laguna

- National City

- Oceanside

- Pala

- Palomar Mountain

- Pauma Valley

- Pine Valley

- Potrero

- Poway

- Ramona

- Ranchita

- Rancho Santa Fe

- San Diego

- San Luis Rey

- San Marcos

- San Ysidro

- Santa Ysabel

- Santee

- Solana Beach

- Spring Valley

- Tecate

- Valley Center

- Vista

- Warner Springs

Hours, fees, requirements, and more for San Diego County

How do I get my forms?

Forms are available for immediate download after payment. The San Diego County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in San Diego County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by San Diego County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in San Diego County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in San Diego County?

Recording fees in San Diego County vary. Contact the recorder's office at (619) 236-3771, 238-8158; (760) 630-1219 North County for current fees.

Questions answered? Let's get started!

In California, a Mineral Quitclaim Deed (as per Civil Code Sections 1092, 1104-1107, 1113; Government Code Sections 27279-27297.7, 27320-27337) is used for transferring oil, gas, and mineral rights from the grantor to the grantee. It is a transfer of ownership, NOT A LEASE, and does not include exceptions or reservations.

Transfer Details: The deed transfers all kinds of mineral rights, including oil and gas. The grantor has the discretion to specify the percentage of mineral rights the grantee will receive.

Rights Conferred: This deed gives the grantee rights to access the land for mining, drilling, exploration, operation, development, storage, handling, transportation, and marketing of these minerals.

No Title Warranty: The grantor transfers mineral rights without any warranty of title, either express or implied, meaning the grantee accepts the title as it is, with all its potential discrepancies.

Uses: Mineral deeds with quitclaim are often used in situations where the grantor wants to quickly release any interest they might have in mineral rights, such as in settling estates, resolving disputes, clearing up uncertainties about ownership in a title's history or when mineral rights have previously been severed or fragmented from surface rights and cloud a title, making it difficult to transfer property. Resolution often involves the holder(s) of the mineral rights, quit-claiming any rights he/she/they have or might have in the subject property.

Legal Requirements and Recording: The quitclaim deed must be in writing and include the names and addresses of all parties involved, as required by Government Code Sections 27324, 27321.5, 27361.6, and 27288.1. It must be recorded by the County Recorder in the county where the property is located (Civil Code Section 1169) and adhere to California's "race-notice" recording statute (Civil Code Sections 1213-1214).

Formatting and Execution Requirements: The deed must follow specific formatting guidelines (Government Code Section 27361.6) and be executed before two disinterested witnesses. The names of all parties must be legibly signed or printed near the signature (Government Code Sections 27280.5, 27361.6).

Language and Other Considerations: Quitclaim deeds not in English are not suitable for recording (Government Code Section 27293). The deed should also include a complete legal description of the property and the vesting choice of the grantee.

Implications: The use of a quitclaim deed can have a permanent effect on property rights. It is advisable to consult a legal professional to fully understand the implications of executing such a document.

(California Mineral Deed with Quitclaim Package includes form, guidelines, and completed example)

Important: Your property must be located in San Diego County to use these forms. Documents should be recorded at the office below.

This Mineral Deed with Quitclaim Covenants meets all recording requirements specific to San Diego County.

Our Promise

The documents you receive here will meet, or exceed, the San Diego County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your San Diego County Mineral Deed with Quitclaim Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4595 Reviews )

Clifford J.

July 4th, 2022

a lil pricey but i was able to knock out what needed to be done within 2 hours and not all day.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

SUSAN B.

September 16th, 2024

THE PROCEDURE IN GETTING THIS MECHANICS LIEN PROCESSED HAS SO FAR BEEN RELATIVELY SIMPLY - BETTER THAN HAVING TO WAIT ON MAIL OR GO IN PERSON TO GET RECORDED

We are delighted to have been of service. Thank you for the positive review!

Kris S.

July 15th, 2021

Being a real estate agent I know just enough about legal documents to get in trouble. Thankfully the pros here know what they are doing.

Thank you for your feedback. We really appreciate it. Have a great day!

James M.

January 3rd, 2023

It would be helpful to have a joint tenant example.

Thank you!

Clifford B.

May 6th, 2021

I appreciate the formatting to match the expectations of the specific Registry of Deeds that I will be filing with. That is very helpful. In my case the easement is for septic disposal field and sample wording for different purposes would be helpful.

Thank you!

JEFFREY C.

July 18th, 2020

This is pretty amazing...! Very simple and immediate. I would definitely recommend deed.com

Thank you!

Kimberly K.

January 29th, 2020

Easy to use was very satisfied with service would recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Laurel D.

October 7th, 2020

This is a great service. I can't believe how fast my document was recorded!

Thank you for your feedback. We really appreciate it. Have a great day!

Guido d.

November 17th, 2020

Excellent service. Easy to use, easy to upload, and very cost effective!

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis D.

November 7th, 2019

Downloaded perfect. Can hardly wait to get them done.

Thank you!

Gary S.

November 4th, 2022

Thank you! Quick, timely and excellent quality document!

Thank you for your feedback. We really appreciate it. Have a great day!

FEDERICO T.

June 21st, 2019

It was a little confusing to retrieve the documents. I was waiting for an email, but then I went toyour portal and I saw the messages and the document.

Thank you for your feedback Frederico.

Tim T.

June 8th, 2023

Very easy to find forms and good examples for filling out forms!

Thank you for your feedback. We really appreciate it. Have a great day!

Jeanette S.

January 2nd, 2020

Easy to use and instructions were very clear. If possible, it would be nice to be able to download the entire package at one time - it was a little cumbersome to download each item separately. (Of course, I didn't know which of the items I needed, so downloaded them all)

Thank you for your feedback. We really appreciate it. Have a great day!

Maribeth M.

June 25th, 2021

Usually I have trouble registering things online, even though people tell me it's easy. This time, it WAS easy and fast, and I'm grateful I didn't have to drive somewhere and stand in line. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!