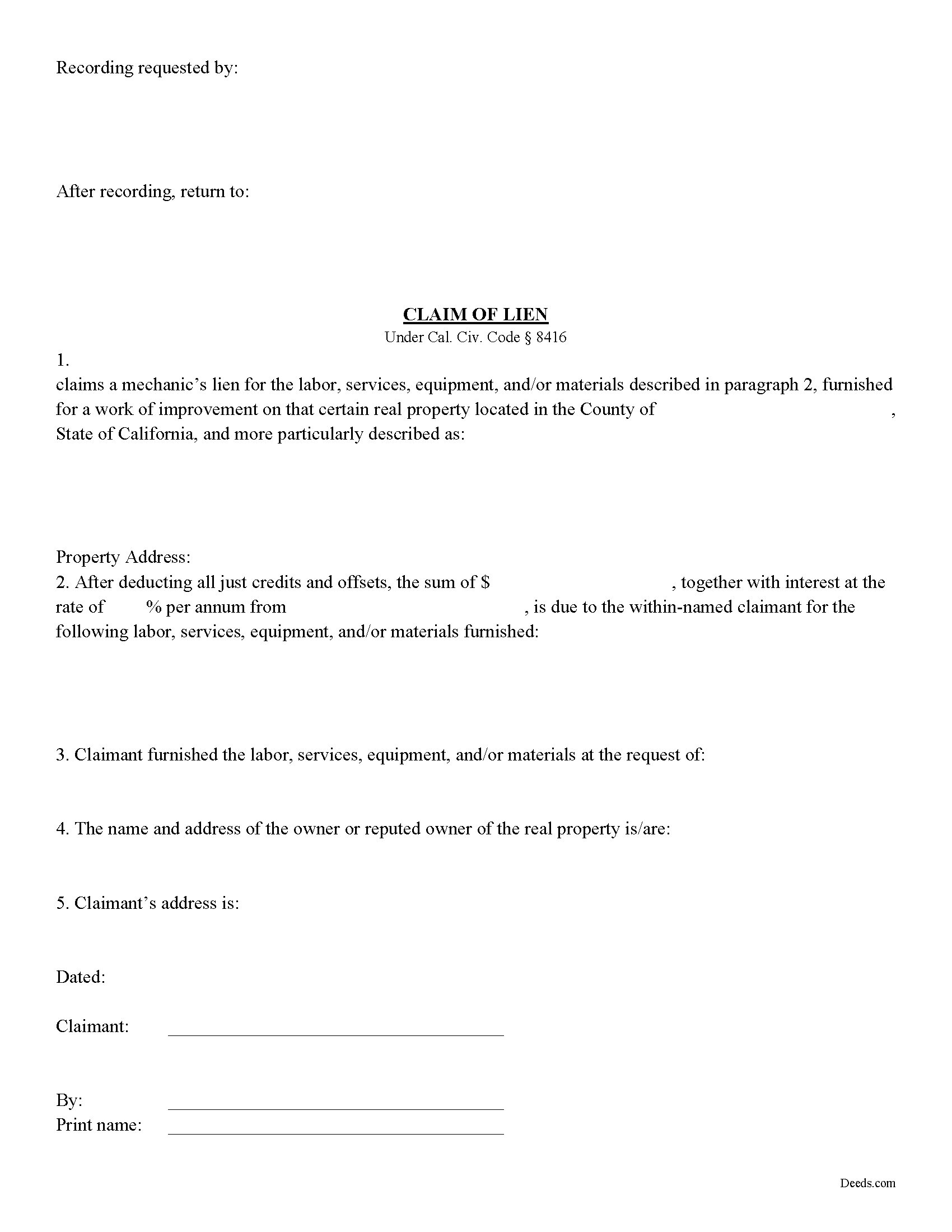

Riverside County Notice of Mechanics Lien Form

Riverside County Notice of Mechanics Lien Form

Fill in the blank Notice of Mechanics Lien form formatted to comply with all California recording and content requirements.

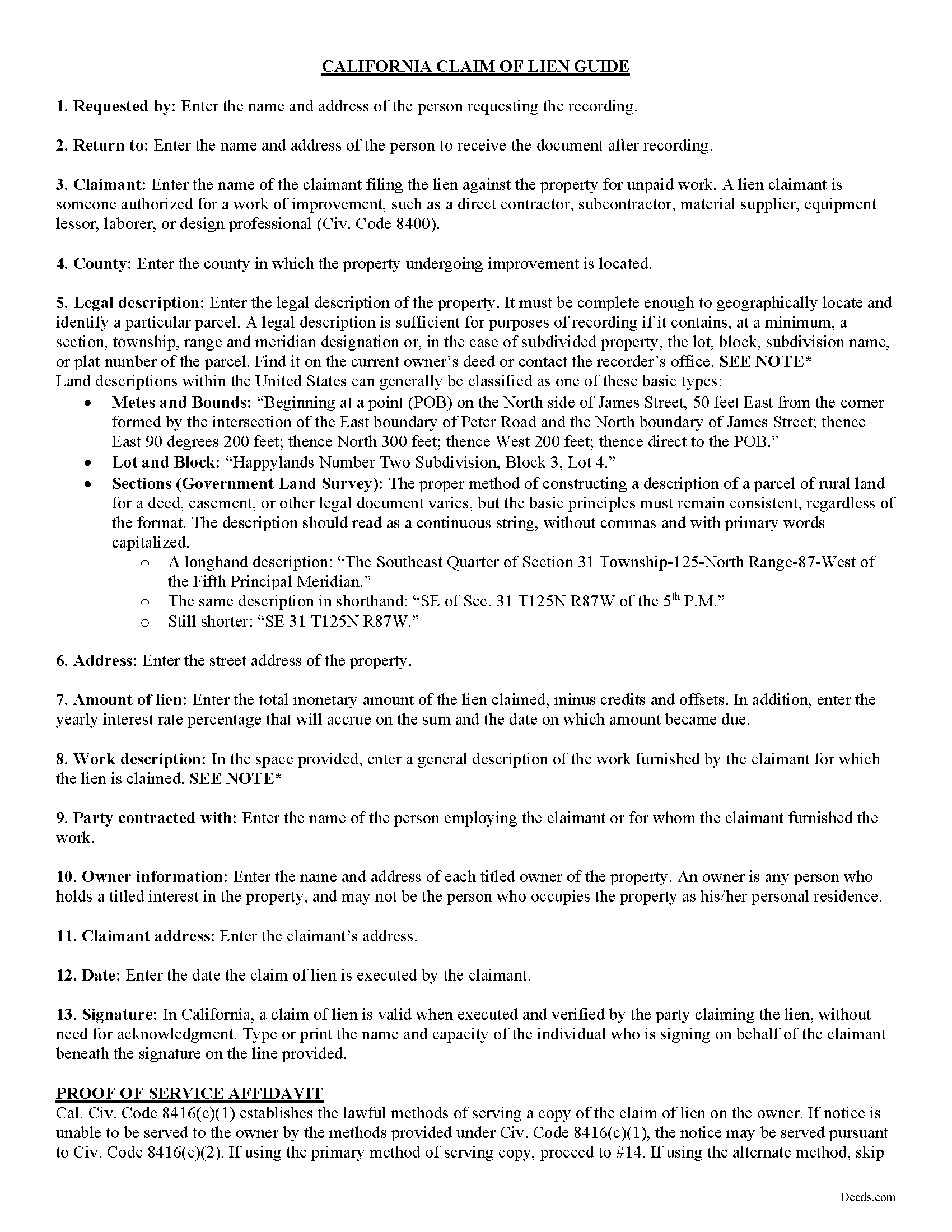

Riverside County Notice of Mechanics Lien Guide

Line by line guide explaining every blank on the form.

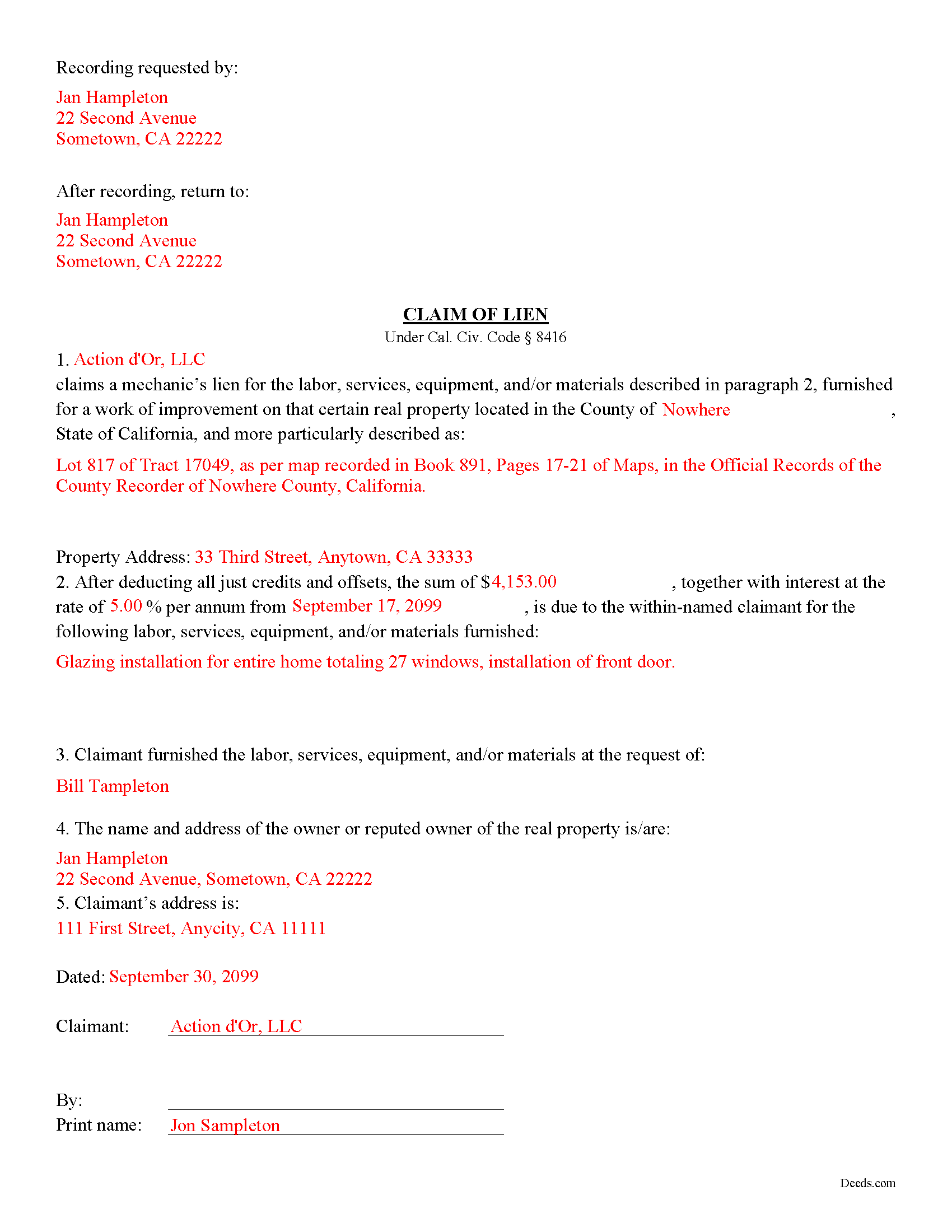

Riverside County Completed Example of the Notice of Mechanics Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Riverside County documents included at no extra charge:

Where to Record Your Documents

County Administrative Center

Riverside, California 92501 / 92502-0751

Hours: Monday through Friday 8:00 am to 5:00 pm

Phone: (951) 486-7000 or (800) 696-9144 from within county

Gateway Office

Riverside, California 92507

Hours: Monday through Friday 8:00 am to 5:00 pm

Phone: (951) 486-7000 or (800) 696-9144

Hemet Office

Hemet, California 92543-1496

Hours: Monday through Friday 8:00 to 12:00 & 1:00 to 4:30

Phone: (951) 486-7000 or (800) 696-9144 from within county

Palm Desert Office

Palm Desert, California 92211

Hours: Monday through Friday 8:00 to 5:00 Phone / Counter & Recording until 4:30

Phone: (760) 863-8732 or (800) 696-9144

Temecula Office

Temecula, California 92591-6027

Hours: Monday through Friday 8:00 am to 4:30 pm

Phone: (951) 486-7000 or (800) 696-9144

Blythe Office

Blythe, California 92225

Hours: Recorder Services: First Wednesday of the month 10:00 to 12:00 & 1:00 to 3:00

Phone: (760) 921-5050 or (800) 696-9144

Recording Tips for Riverside County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Riverside County

Properties in any of these areas use Riverside County forms:

- Aguanga

- Anza

- Banning

- Beaumont

- Blythe

- Cabazon

- Calimesa

- Cathedral City

- Coachella

- Corona

- Desert Center

- Desert Hot Springs

- Hemet

- Homeland

- Idyllwild

- Indian Wells

- Indio

- La Quinta

- Lake Elsinore

- March Air Reserve Base

- Mecca

- Menifee

- Mira Loma

- Moreno Valley

- Mountain Center

- Murrieta

- Norco

- North Palm Springs

- Nuevo

- Palm Desert

- Palm Springs

- Perris

- Rancho Mirage

- Riverside

- San Jacinto

- Sun City

- Temecula

- Thermal

- Thousand Palms

- Whitewater

- Wildomar

- Winchester

Hours, fees, requirements, and more for Riverside County

How do I get my forms?

Forms are available for immediate download after payment. The Riverside County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Riverside County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Riverside County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Riverside County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Riverside County?

Recording fees in Riverside County vary. Contact the recorder's office at (951) 486-7000 or (800) 696-9144 from within county for current fees.

Questions answered? Let's get started!

Mechanic's liens are an available remedy in the state of California for unpaid direct contractors, subcontractors, material suppliers, equipment lessors, laborers, design professionals, and any person providing work authorized for a site improvement (Civ. Code 8400).

To file a mechanic's lien in California, a claimant must have served preliminary notice to the property owner in accordance with Civ. Code 8410. In general, all work must have ceased before filing a claim of lien.

A direct contractor cannot enforce a lien unless a claim of lien is filed within 90 days after completion of work, or within 60 days after the owner records a notice of completion (Civ. Code 8412). A claimant other than a direct contractor may not enforce a lien unless the claimant records a claim of lien after it has ceased to provide work, or before the earlier of the following times: Ninety days after completion of the work of improvement, or thirty days after the owner records a notice of completion or cessation (Civ. Code 8414).

The law requires strict compliance with the statute in drafting and serving a mechanic's lien since it is an impediment on the owner's title that can affect his or her property rights. Once filed, a mechanic's lien can interfere with the owner's ability to sell the property or obtain financing.

The claim of mechanic's lien must be filed as a written statement, signed and verified by the claimant, containing a statement of the claimant's demand after all just credits and offsets; the name of the owner or reputed owner; a general description of the work furnished by the claimant; the name of the person by whom the claimant was employed or to whom the claimant furnished work; a description of the site sufficient for identification; and the claimant's address (Civ. Code 8416).

In addition to the claim of lien, a statutory statement of notice of mechanic's lien must be included in the document (Civ. 8416(a)(8)). As evidence that the claim of mechanic's lien has been properly served on the owner, the person serving a copy of it must also complete and sign a proof of service affidavit (Civ. 8416(c)(1)). California law also allows that if the owner cannot be served a manner provided by Civ. Code 8416(c)(1), the notice may be served on the direct contractor or construction lender (Civ. 8416(c)(2)).

As a claimant, be careful about the amount claimed in a mechanic's lien. Exercise good faith in the claimed amount without any exaggeration or inflation. Any mistakes or attempts to "fluff up" the amount can be detrimental to any lien right. You might even be liable for damages to the property owner in a lawsuit for a false claim of mechanic's lien. The amount cannot include any attorney's fees, lost profits, or delay damages. These may be recoverable, however, if your lien later transforms into a legal action. You are entitled to claim interest though, which is measured from the date on which the amount became due.

Once a lien is in place, a claimant has an enormous bargaining chip to induce payment by the property owner. However, obtaining a lien alone will not always guarantee payment. In California, a mechanic's lien is only effective for ninety days and will expire thereafter (Civ. Code 8460). Therefore, you must file an action in court to enforce the lien. For those wary of going to court, less adversarial options such as arbitration may be available.

Even if you correctly record you mechanic's lien by following all the required steps and ensuring the accuracy of all your filings, be aware that others may have preexisting claims. Creditors' claims are governed by the golden rule of priority of "first in time, first in right." Recall the old proverb, "The early bird gets the worm," because the same situation applies here. If a senior lien claimant seeks to enforce his or her claim first, your lien becomes junior to that claim. Therefore, when property is ordered sold to pay out a judgment and the senior claimant is paid, the amount remaining after sale might not be enough to satisfy what you were originally owed.

Additionally, it may even be split on a pro rata basis between you and other claimants. You're not completely out of luck, but it will be more difficult to collect the remainder. Your remedy will be through a deficiency judgment against the property owner for any amount that the sale of the property won't cover. Furthermore, even if you properly record before others, some types of property interests will have a "super priority" over yours, such as a construction mortgage due to the policy interest in encouraging lenders to finance construction projects. In summary, although priority cannot always be guaranteed, you should be diligent to mark important dates on your calendar for sending preliminary notice and filing the claim of lien.

Finally, remember that mechanic's lien laws are complicated, and mistakes or oversights can be fatal to your lien rights. Please contact an attorney with questions about mechanic's liens, or for any other issues regarding real property in California.

Important: Your property must be located in Riverside County to use these forms. Documents should be recorded at the office below.

This Notice of Mechanics Lien meets all recording requirements specific to Riverside County.

Our Promise

The documents you receive here will meet, or exceed, the Riverside County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Riverside County Notice of Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Rod G.

August 7th, 2020

You guys have it DOWN!! You made it easy to navigate your site and services. You explained things effectively. You are helpful and fast. NO WAY would even entertain using a different deed/ document recording service. I'll be back! Thank you. Rod

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Yvonne A.

April 25th, 2021

love your Deeds.com website...

Thank you!

Armstrong K.

March 29th, 2021

Very smooth and speedy process. Thank you.

Thank you!

Martha B.

January 11th, 2019

Not too hard to do, I did get it checked out by an attorney after I completed it just to be safe. He said it was fine, made no changes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

paula b.

July 18th, 2022

Very helpful and easy to download, thankyou.

Thank you!

Rhonda H.

September 24th, 2020

Love the names on the example! thanks for the smiles!

Thank you for your feedback. We really appreciate it. Have a great day!

Veronica F.

April 24th, 2019

Im so happy with this site. It was quick and painless and worth the money hassle free if I ever need to settle another deed I will be back.

Thank you Veronica, we really appreciate your feedback.

Michael L.

March 3rd, 2019

Perfect timely service! Will use again!

Thank you!

Robert H.

December 2nd, 2021

I was surprised that how comprehensive your website is. I quickly found what I was looking for, and it was just what I needed.

Thank you!

Blanche S.

March 25th, 2022

Thank you I hope I've done it all right!!

Thank you!

Darrell G.

October 14th, 2022

Very easy to work with.

Thank you!

Billy G.

September 17th, 2024

Bought the wrong form and they refunded my money Honest company

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

SANTTINA W.

August 13th, 2022

IT WAS SO VERY HELPFUL AND EASY TO DO WILL RETUN TO THE SITE AGAIN.

Thank you for your feedback. We really appreciate it. Have a great day!

KELLY S.

May 31st, 2022

Thank you for being here. very easy to understand and your site is great. I will always use you.

Thank you for your feedback. We really appreciate it. Have a great day!

Sherry C.

September 9th, 2020

The experience was great. It was so easy to get my document recorded and it was done the same day!

Thank you!