Alameda County Personal Representative Deed Form

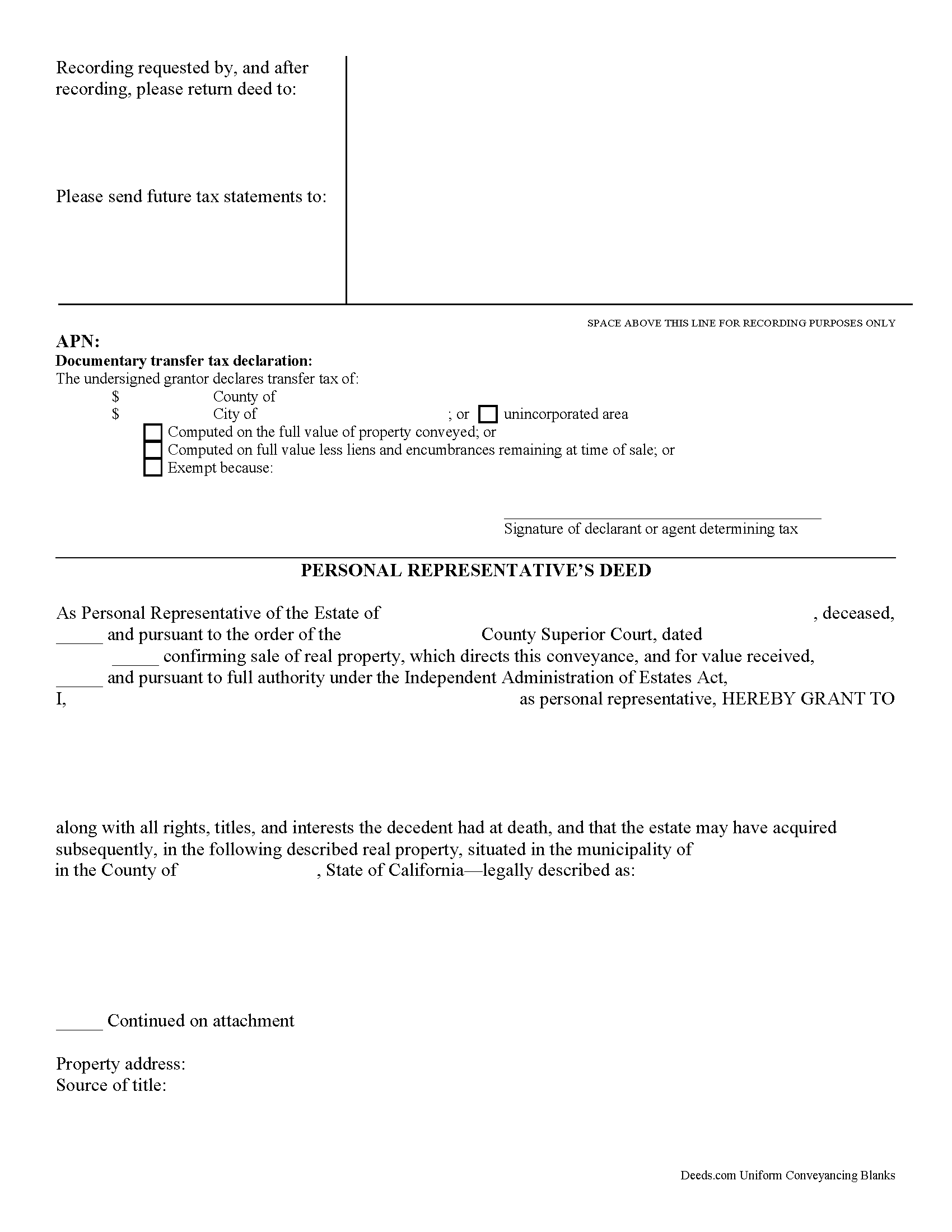

Alameda County Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

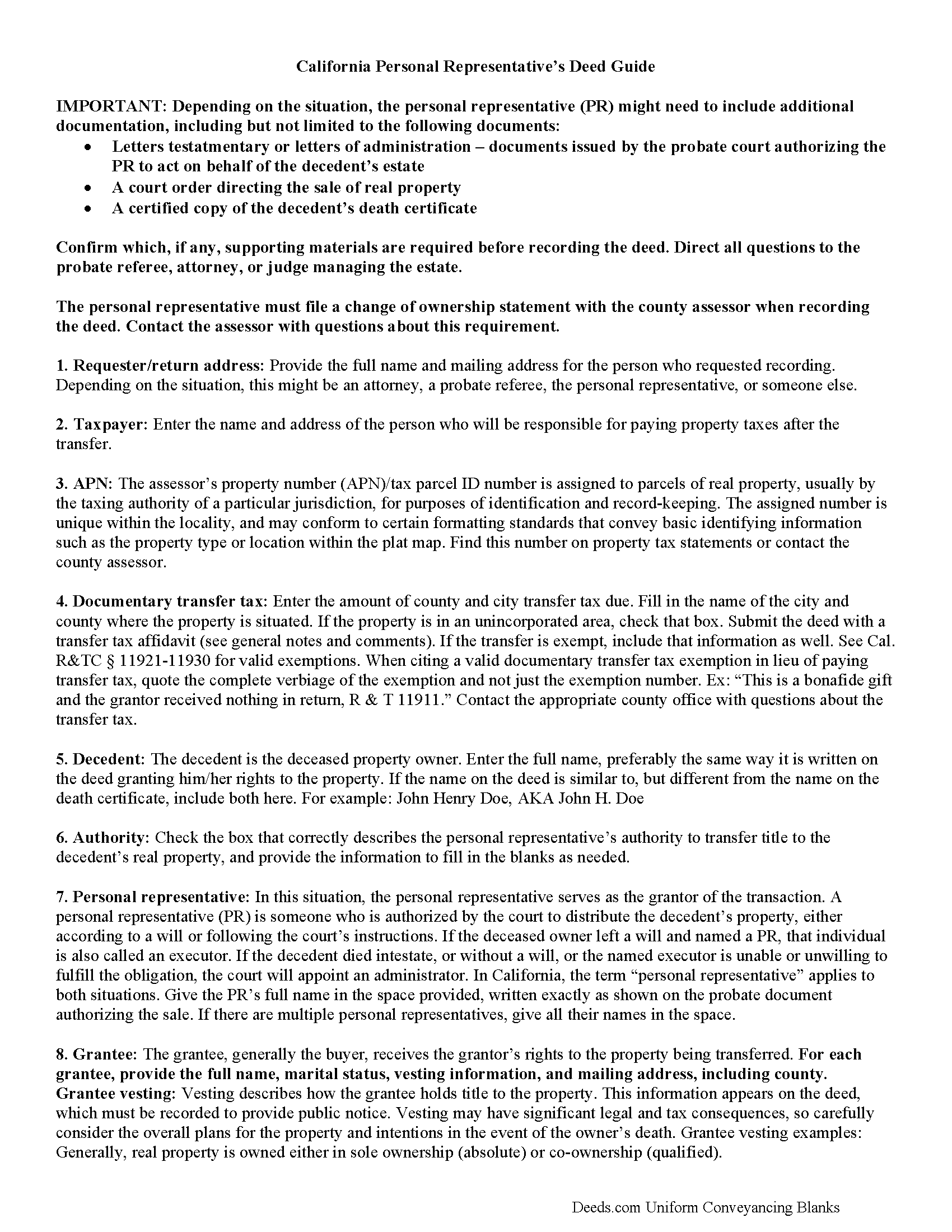

Alameda County Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

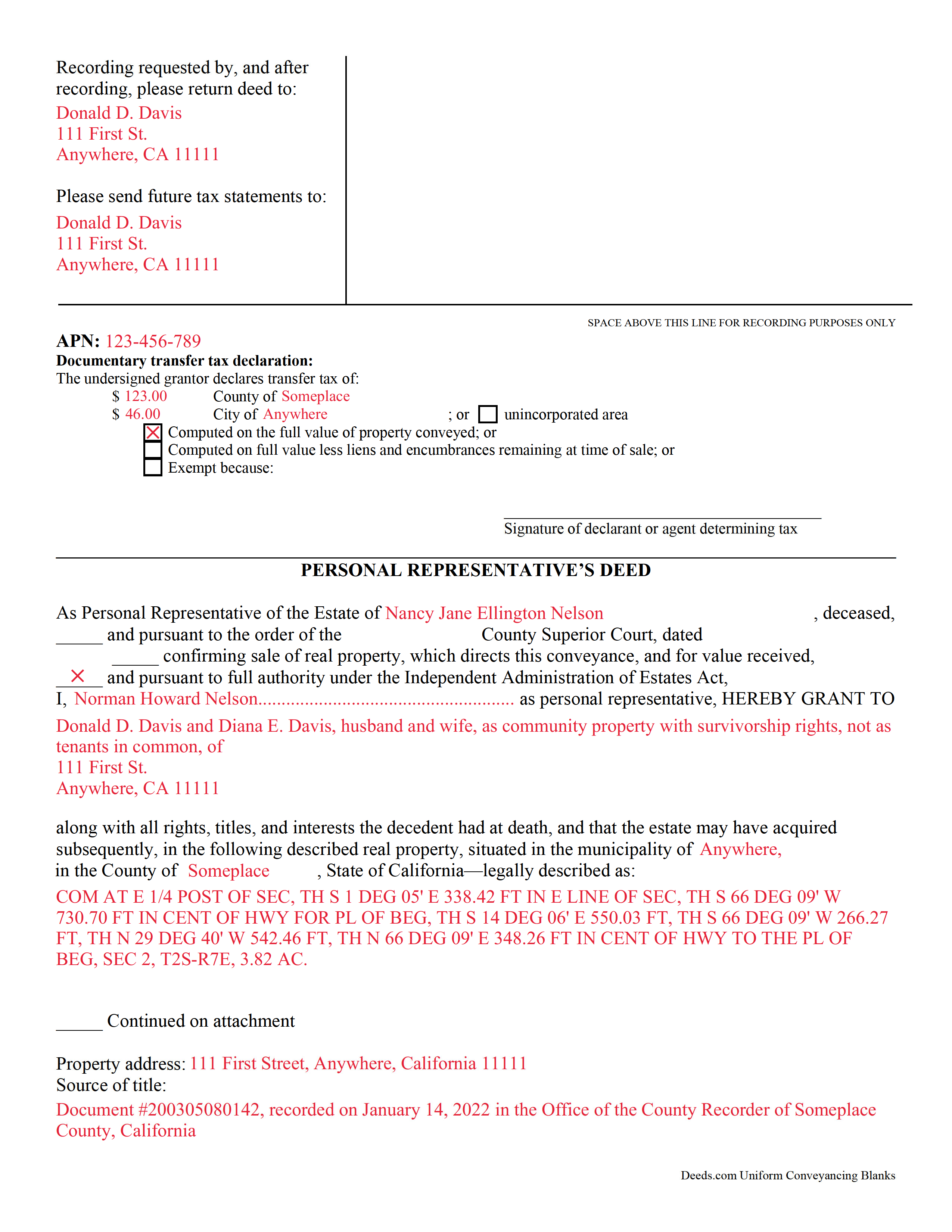

Alameda County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Alameda County documents included at no extra charge:

Where to Record Your Documents

Alameda County Clerk-Recorder

Oakland, California 94607

Hours: Mon-Fri 8:30 to 4:30 (avoid 12:00 to 2:00)

Phone: 510-272-6362 or 888-280-7708

Dublin Office

Dublin, California 94568

Hours: Mon-Fri 8:30 to 4:30

Phone: as above

Recording Tips for Alameda County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- Ask about their eRecording option for future transactions

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Alameda County

Properties in any of these areas use Alameda County forms:

- Alameda

- Albany

- Berkeley

- Castro Valley

- Dublin

- Emeryville

- Fremont

- Hayward

- Livermore

- Newark

- Oakland

- Piedmont

- Pleasanton

- San Leandro

- San Lorenzo

- Sunol

- Union City

Hours, fees, requirements, and more for Alameda County

How do I get my forms?

Forms are available for immediate download after payment. The Alameda County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Alameda County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Alameda County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Alameda County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Alameda County?

Recording fees in Alameda County vary. Contact the recorder's office at 510-272-6362 or 888-280-7708 for current fees.

Questions answered? Let's get started!

Personal representative's deeds are used to transfer real property from both testate (with a will) and intestate (without a will) estates. These documents provide essential information about the specific probate estate and related property transfer in one document.

When a person dies, the probate court authorizes someone to take responsibility for distributing the remaining assets according to the instructions set out in the decedent's will (if one exists), while also following state and local laws. This person is often known as an executor or an administrator of the estate. California, however, identifies the individual who accepts that fiduciary duty as a personal representative (PR).

One common task involves transferring title on the decedent's real estate. Deeds used for this purpose must meet the same state and local requirements as warranty or quitclaim deeds. They also include other details, such as facts about the deceased property owner, the probate case, and anything else deemed necessary by the situation. In addition, the PR must file a PCOR with the county assessor's office when recording the completed deed.

Note that these deeds may need to be recorded with the probate court as well as the county recording office. Consult with the legal professional involved in managing the specific probate case to ensure that all recording and notice requirements are met.

See California Probate Code, Division 7. Administration of Estates of Decedents for more information. Remember that each case is unique, so contact an attorney with specific questions or for complex circumstances.

(California Personal Representative Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Alameda County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed meets all recording requirements specific to Alameda County.

Our Promise

The documents you receive here will meet, or exceed, the Alameda County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Alameda County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

janice b.

April 29th, 2021

This is a very helpful site when you don't know exactly what to do. Very clear in explaining the wording on deeds. Thank you it made a big difference knowing the right way to do things.

Thank you for your feedback. We really appreciate it. Have a great day!

Martin M.

November 14th, 2020

This site is great. Simple to use with excellent instructions. Will recommend to others.

Thank you!

Raad A.

November 25th, 2022

Not easy to navigate

Thank you for your feedback.

Kevin C.

August 10th, 2022

Nice site but $30 to download a blank form is a bit much.

Thank you for your feedback. We really appreciate it. Have a great day!

Ed C.

June 16th, 2025

I purchased the DIY quitclaim deed forms for Florida and couldn’t be happier. The forms were clear, professional, and easy to follow. I had everything filled out and recorded without a single issue. Worth every penny — the site is great, and the forms are exactly what I needed. Highly recommend!

Thanks so much, Ed! We’re thrilled to hear that the Florida quitclaim deed forms worked perfectly for you and that the recording process went smoothly. We appreciate your trust and recommendation!

Ronald T H.

June 21st, 2019

Wow ! Easy to use. Thanks Ron Holt

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

GINA G.

April 15th, 2020

Excelente service!

Thank you!

Karen C.

July 28th, 2022

Easily find and print forms necessary for peace of mind.

Thank you for your feedback. We really appreciate it. Have a great day!

Hayley C.

November 19th, 2020

Love this site, so easy to work with and customer service is amazing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody L.

November 8th, 2020

Beware, you cannot save the information you typed and change it later. It will be a PDF upon saving. So if you need corrections...you have to start all over!

Thank you for your feedback. We really appreciate it. Have a great day!

Bobby T.

June 17th, 2020

Great!! Helps me out

Thank you!

Roger G.

October 25th, 2019

Straight to the point and easy to use site.

Thank you!

Judy H.

October 20th, 2023

great response to my question.

We are delighted to have been of service. Thank you for the positive review!

Sunny S.

November 23rd, 2020

Easy to use and quick turnaround. I would use again.

Thank you!

Joseph D.

July 1st, 2022

Exellent and easy! Thqanks!

Thank you for your feedback. We really appreciate it. Have a great day!