Alameda County Trustee Deed Form

Alameda County Trustee Deed Form

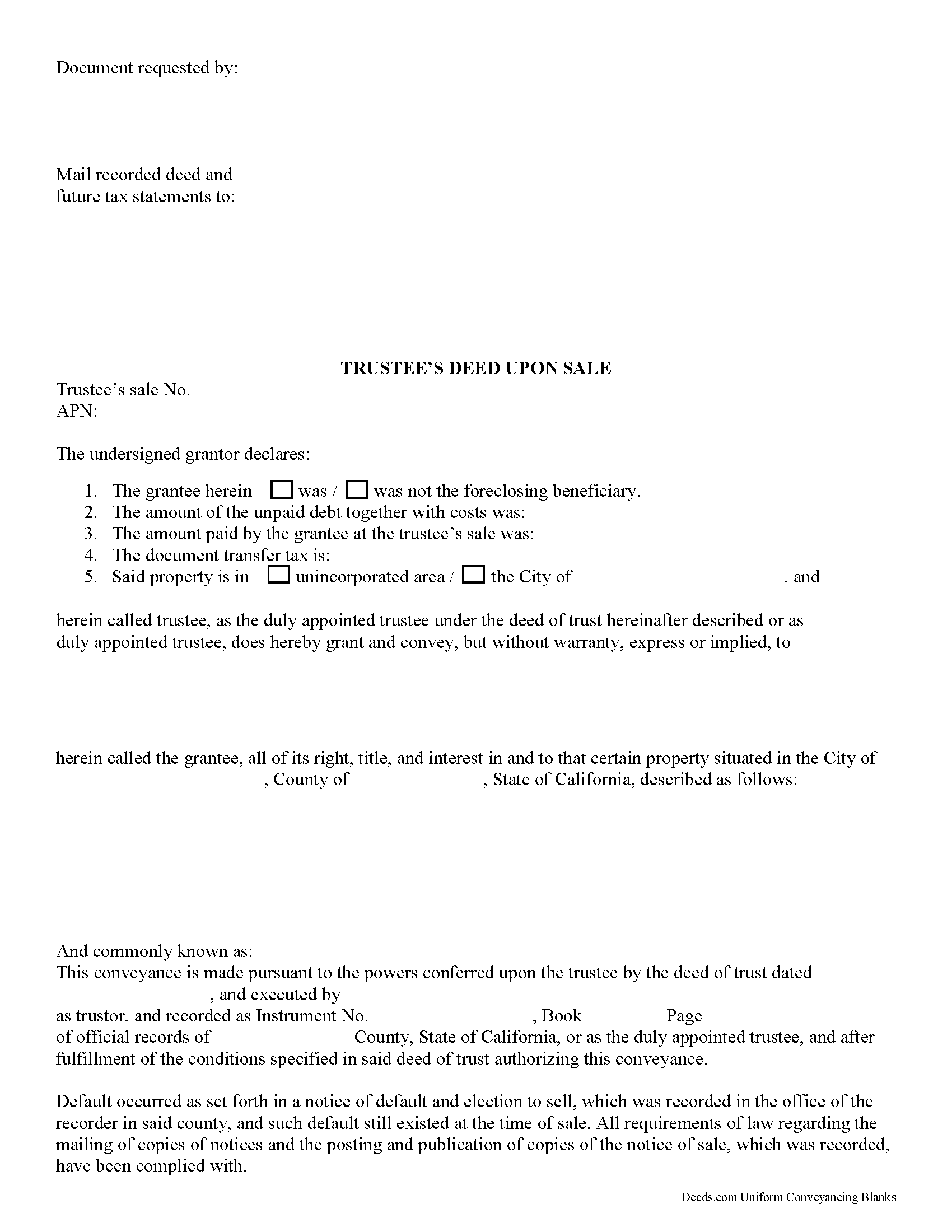

Fill in the blank form formatted to comply with all recording and content requirements.

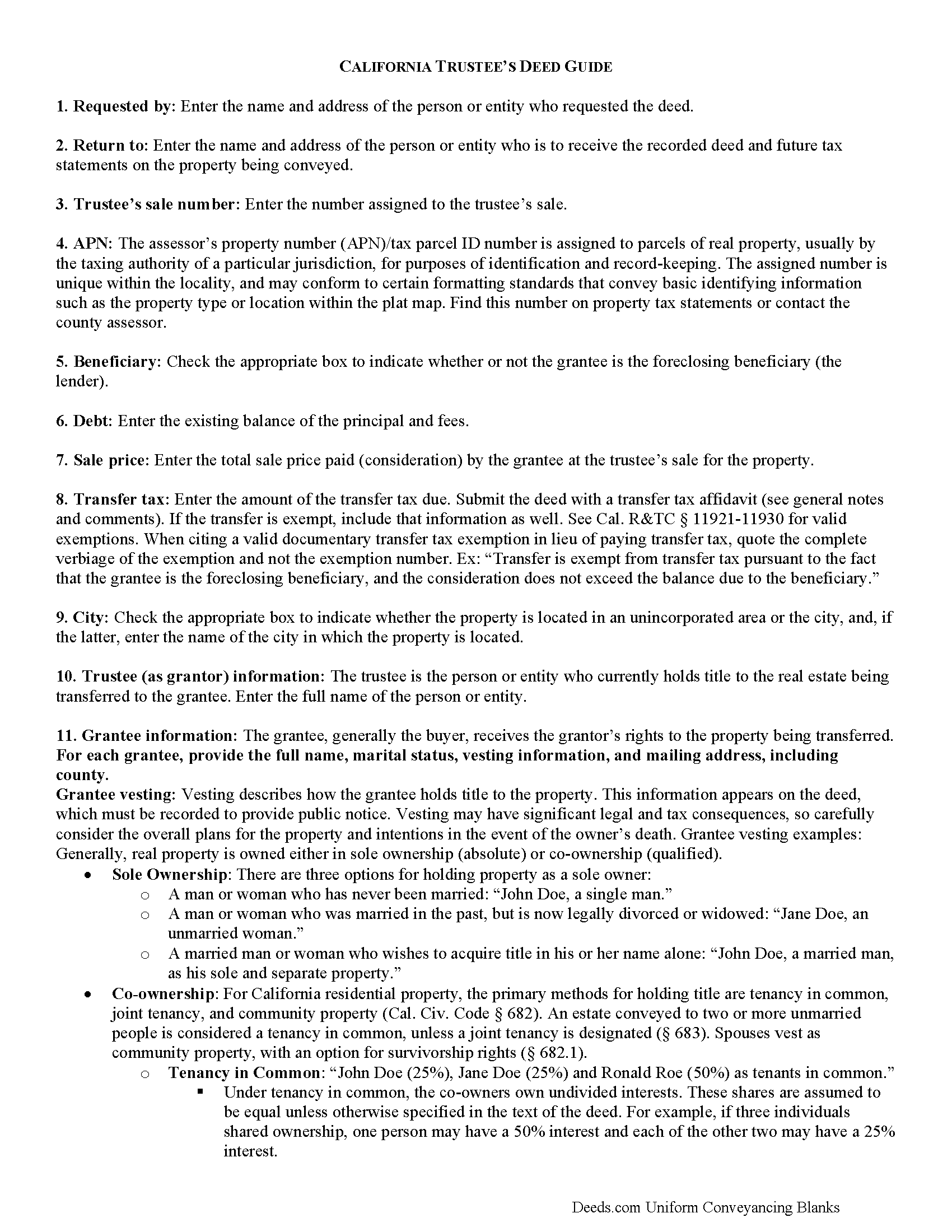

Alameda County Trustee Deed Guide

Line by line guide explaining every blank on the form.

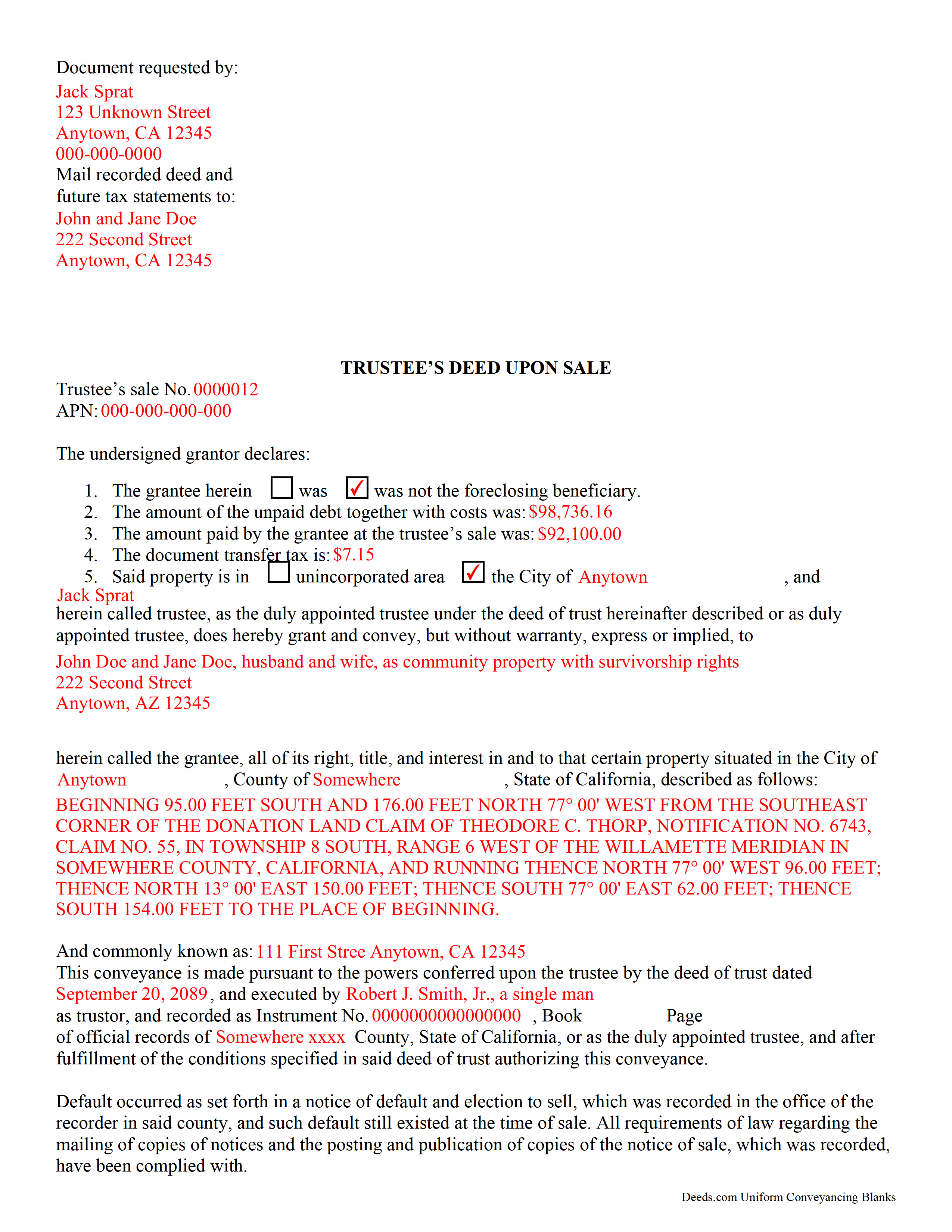

Alameda County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Alameda County documents included at no extra charge:

Where to Record Your Documents

Alameda County Clerk-Recorder

Oakland, California 94607

Hours: Mon-Fri 8:30 to 4:30 (avoid 12:00 to 2:00)

Phone: 510-272-6362 or 888-280-7708

Dublin Office

Dublin, California 94568

Hours: Mon-Fri 8:30 to 4:30

Phone: as above

Recording Tips for Alameda County:

- Bring your driver's license or state-issued photo ID

- White-out or correction fluid may cause rejection

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Alameda County

Properties in any of these areas use Alameda County forms:

- Alameda

- Albany

- Berkeley

- Castro Valley

- Dublin

- Emeryville

- Fremont

- Hayward

- Livermore

- Newark

- Oakland

- Piedmont

- Pleasanton

- San Leandro

- San Lorenzo

- Sunol

- Union City

Hours, fees, requirements, and more for Alameda County

How do I get my forms?

Forms are available for immediate download after payment. The Alameda County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Alameda County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Alameda County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Alameda County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Alameda County?

Recording fees in Alameda County vary. Contact the recorder's office at 510-272-6362 or 888-280-7708 for current fees.

Questions answered? Let's get started!

In California, a deed of trust is used as a mortgage alternative to secure a loan for real property. The borrower is the trustor of a deed of trust, and a trustee (usually an agent of the lending institution) is named as grantee, with the lending institution (secured lender) as the beneficiary (Cal. Civ. Code 2929.5(e)(1),(5)). The trustee's duty is to either reconvey the title upon satisfaction of the loan, or to initiate foreclosure as directed by the beneficiary.

Under the terms of the deed of trust, the beneficiary can initiate a non-judicial foreclosure if the trustor defaults on the loan or fails to satisfy the terms of the trust. The trustee is obligated to carry out certain steps before the foreclosure sale can take place. These processes, as well as mandates for the sale, are governed by Cal. Civ. Code 2924-2924h. Once the sale ends, the highest bidder receives a trustee's deed confirming the transfer of title. The trustee's deed is named for the trustee, who executes the deed and acts as the grantor.

The trustee's deed confirms the information from the deed of trust, including the trustor name (the borrower), the trustee, and the beneficiary (lender) under the deed of trust, in addition to vesting title in the grantee's name. If the property receives no bids at public auction, title reverts to the beneficiary of the deed of trust.

The deed must comply with format and content requirements for instruments concerning real property (warranty deed, quitclaim deed, etc.) laid out in Chapter 6 of the Government Code, and be signed by the trustee and notarized with an all-purpose acknowledgment before it is recorded and filed in the county where the property is located.

Note that a deed of trust is separate from a living trust. While the deed of trust functions as a sort of mortgage, a living trust is used for estate planning. In living trusts, a trustee uses a quitclaim deed or special warranty deed to convey property into and out of the trust and has other duties in managing the living trust. The trustee under a deed of trust is not bound by statutes governing a general trust.

Because foreclosures can be complicated, contact a lawyer with any questions or for help regarding your unique situation.

(California Trustee Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Alameda County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Alameda County.

Our Promise

The documents you receive here will meet, or exceed, the Alameda County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Alameda County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Esfir K.

October 3rd, 2022

I had to call 3 times, two calls were hanged up on me. Thank you to 3rd representative, who helped me with my question. Unfortunately, I do not know her name. She was very patient, kind, professional. I am very thankful for her help.

Thank you!

Kenneth H.

January 9th, 2020

Easy download, informative examples. Very good experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

lee s.

March 21st, 2019

Over all quality of document was good. The issue I had was where it states claimant did not have a contract with the owner or their agent. I did have a contract with their agent, and there was no option for both. So had improvise.

Thank you for your feedback. We really appreciate it. Have a great day!

KAREN I.

May 14th, 2024

it worked. fantastic. thanks!

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Susann T.

November 4th, 2020

I have been very happy with the prompt assistance that I have received from deeds.com! How refreshing this is when so often good customer service seems rare these days!

Thank you for your feedback. We really appreciate it. Have a great day!

Clifford A.

April 6th, 2023

Very efficient and smooth process. Thank you!

Thank you!

curtice c.

September 30th, 2022

I bought the Transfer on Death Deed documents. Great product and the accompanying example and guides were great.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert W.

February 22nd, 2020

With the guide everything went great

Thank you!

Hanna M.

June 10th, 2019

Very helpful information! Thank you for your service!

Thank you!

Jack B.

January 26th, 2020

All worked out well.

Thank you!

Duane S.

June 5th, 2019

Really glad to find your site. Made filing so much easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Nancy H.

December 31st, 2018

Site was excellent and saved a trip to the County office to pick up forms.

Thank you Nancy. Glad we could help. Have a great day!

Ted C.

May 7th, 2021

Everything was straight forward. I think I was able to accomplish my objective.

Thank you!

Christine B. B.

May 20th, 2019

The Personal Representatives Deed is definitely a helpful document for my files. I find it need just a little tweaking by deeds.com , There should be more space for the legal description. I did see in the FAQ's you recommend putting it in the Exhibit and this is what I did. Also I couldn't get the year to be accepted and had to write it in. These are just some minor suggestions, on the whole I was grateful to find this document. Thank you.

Thank you for your feedback. Sorry to hear that you had trouble with the date field, we will have it reviewed.