Indian River County Notice to Owner Form

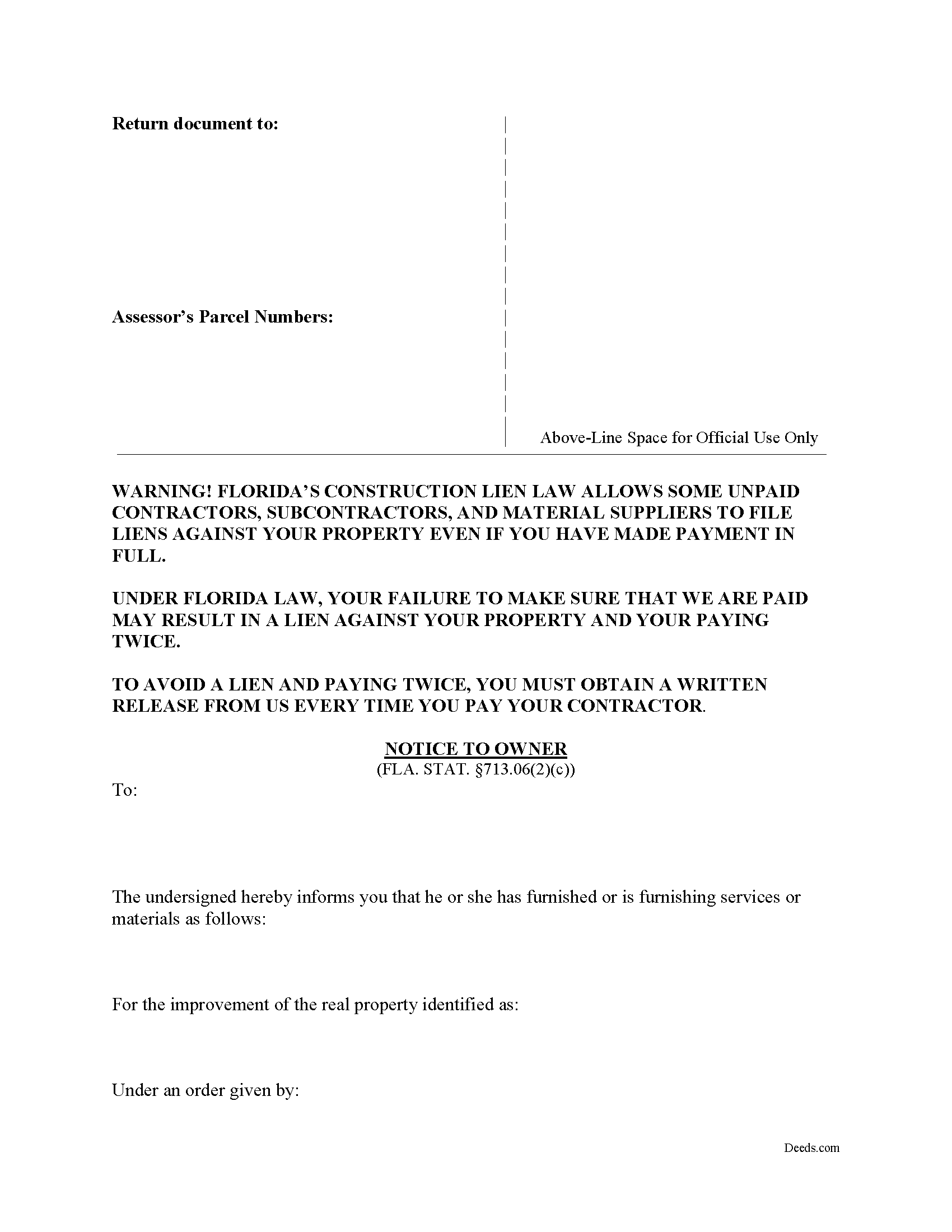

Indian River County Notice to Owner Form

Fill in the blank form formatted to comply with all recording and content requirements.

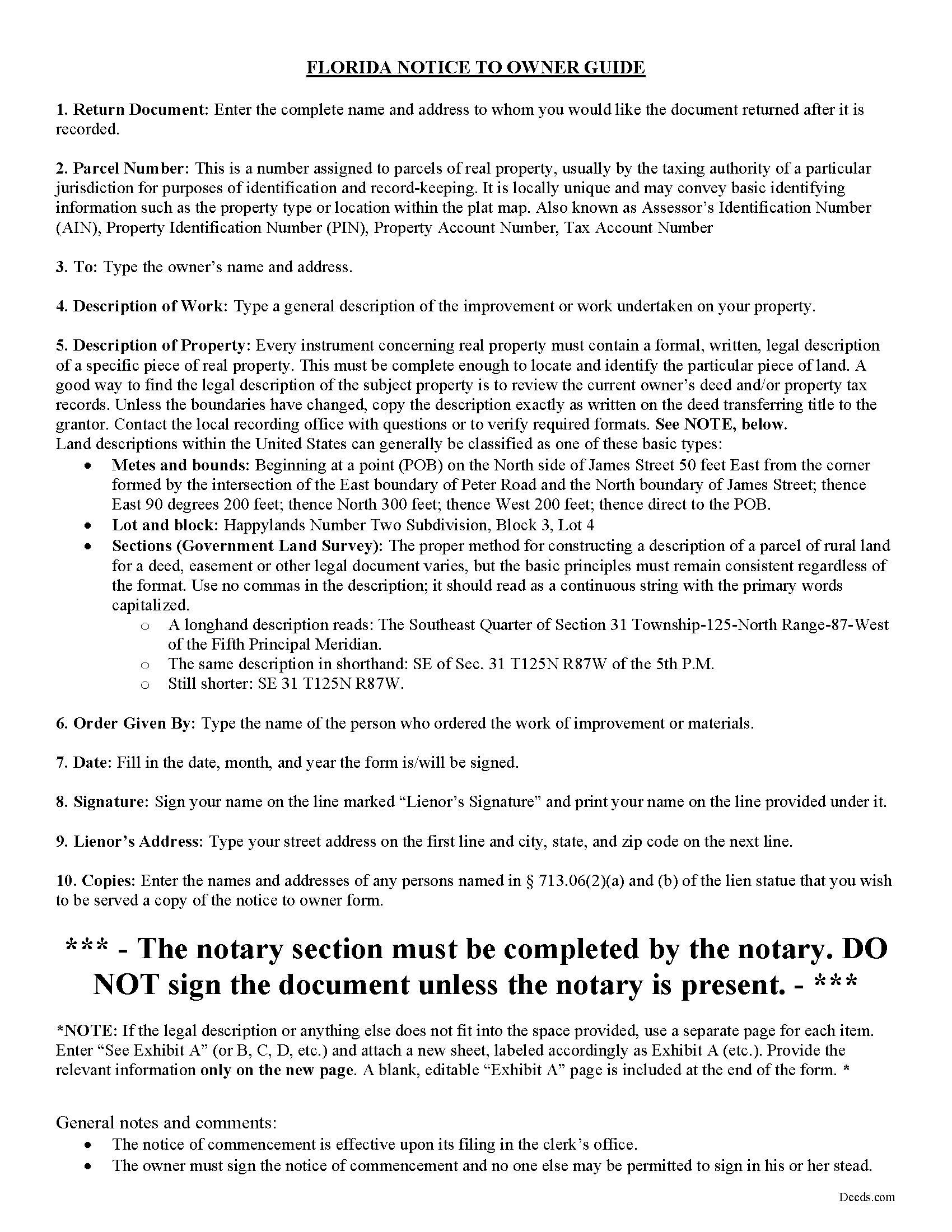

Indian River County Notice to Owner Guide

Line by line guide explaining every blank on the form.

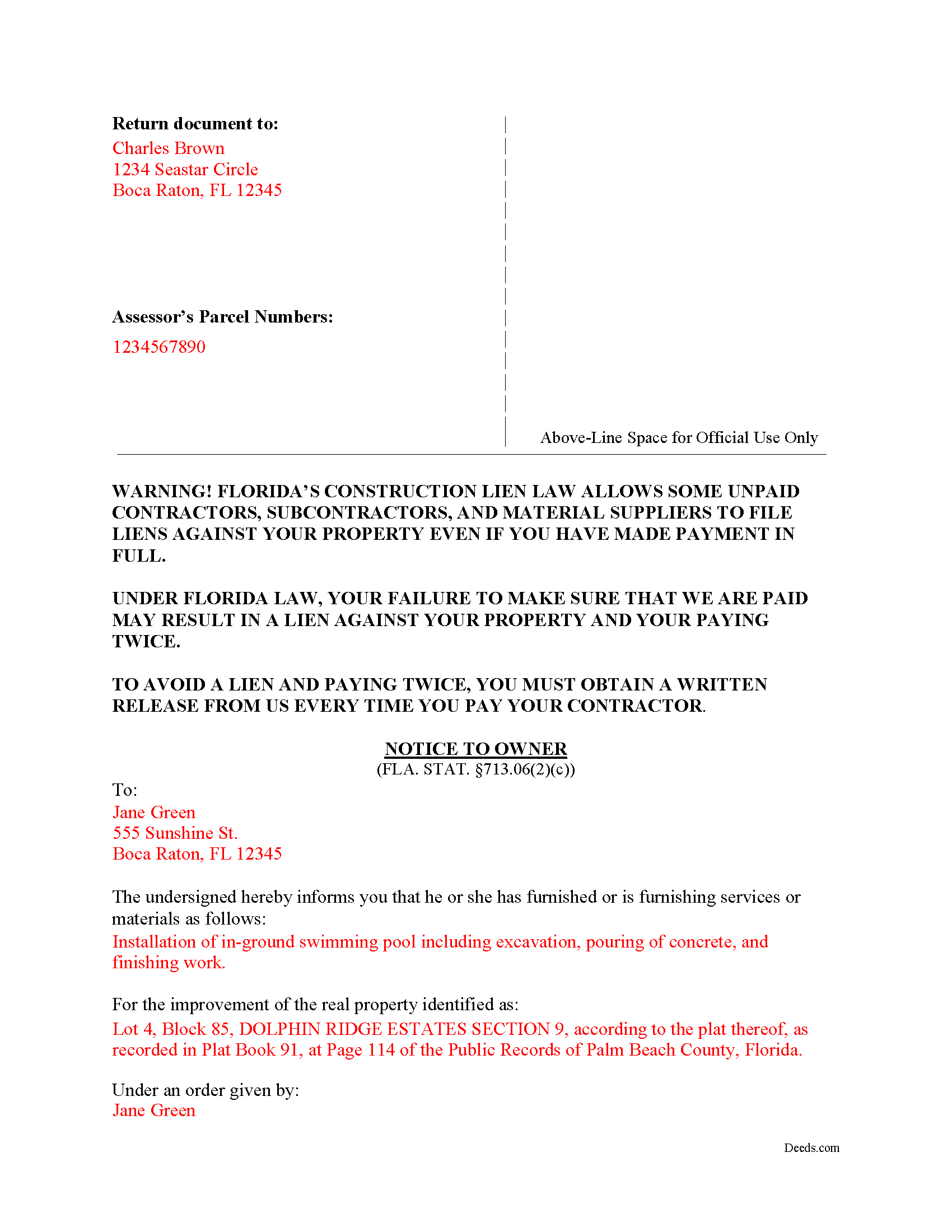

Indian River County Completed Example of the Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Indian River County documents included at no extra charge:

Where to Record Your Documents

Recording - County Courthouse

Vero Beach, Florida 32960

Hours: 8:30am to 4:30pm M-F

Phone: (772) 770-5185, Ext 3175 and 3135

Recording Tips for Indian River County:

- Documents must be on 8.5 x 11 inch white paper

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Indian River County

Properties in any of these areas use Indian River County forms:

- Fellsmere

- Roseland

- Sebastian

- Vero Beach

- Wabasso

- Winter Beach

Hours, fees, requirements, and more for Indian River County

How do I get my forms?

Forms are available for immediate download after payment. The Indian River County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Indian River County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Indian River County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Indian River County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Indian River County?

Recording fees in Indian River County vary. Contact the recorder's office at (772) 770-5185, Ext 3175 and 3135 for current fees.

Questions answered? Let's get started!

A statutory Notice to Owner (NTO) form, under section 713.06 of the Florida Revised Statutes, is a fairly simple document. Sent to an owner by any lienor (subcontractor, sub-subcontractor or material supplier without a direct contract between the two parties), this document informs the owner that the lienor has or will commence the supply of labor, services, or materials for the purpose of improving their real property. The NTO is a first step in securing a mechanics lien on the property.

Florida's lien statute requires lienors as defined at 713.01(18-20) to serve the owner with a NTO form, even if the claimant is not a direct party to a contract with the owner. The lien law sets forth the required contents of the NTO, which must include the lien claimant's name and address, a description of the property, and a description of the services or materials furnished. The claimant must serve the owner either before commencement of the work or furnishing of materials, or within 45 days of such furnishing. Failure to serve the NTO in accordance with the lien statute renders associated liens invalid.

The NTO should be served on the owner in accordance with service methods prescribed under Florida law. The easiest (and least expensive) method is to use certified mail. Other acceptable methods include personal service and posting the notice at the jobsite as a final alternative.

Each case is unique, so contact an attorney with specific questions or for complex situations involving a Notice to Owner or other issue related to Florida's Construction Lien Law.

Important: Your property must be located in Indian River County to use these forms. Documents should be recorded at the office below.

This Notice to Owner meets all recording requirements specific to Indian River County.

Our Promise

The documents you receive here will meet, or exceed, the Indian River County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Indian River County Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Heather T.

January 21st, 2022

Thank you for making this so easy

Thank you!

Joe H.

February 10th, 2020

Very pleased with the service provided. Will use again if the need arises. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carol D.

January 17th, 2019

No review provided.

Thank you!

Kermit S.

October 12th, 2020

Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Andrea R.

December 25th, 2020

I was pleasantly surprised as I didn't even know you can record a quit claim deed digitally. I am in the mortgage business so I will gladly refer all my clients to this website! Deeds.com was prompt and fast with the entire process. My document was recorded and completed in less than 24 hours! Thank you again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Precious M.

June 23rd, 2020

great quick response

Thank you!

Laura S.

April 21st, 2025

Easy to utilize database and instructions!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Melody P.

December 30th, 2020

5 Stars isn't enough! I worked with KVH today (12-30-20) to get some deeds filed in Dallas County before the end of the year. Timing was critical and I thought my only option was to record in person. Someone suggested I try Deeds.com, and I'm very glad I did. KVH provided excellent service. Everything was quick and efficient, and I highly recommend using this service. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jack A.

March 26th, 2021

First time user. Great service. If I need other forms, I'll definitely be using Deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Constance R.

July 13th, 2020

It was very easy to e-file. I liked it.

Thank you for your feedback. We really appreciate it. Have a great day!

Michele S.

February 10th, 2019

This is a great service if you know what youre looking for. Unfortunately it just wasnt right for me and my situation.

Thank you!

George W.

February 26th, 2021

Phenomenal service! If only every request and transaction with other companies could be this seamless and efficient!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela W.

January 3rd, 2019

This was so easy! Doing it this way saved me a bundle. I used the example form to make sure mine was correct. I would highly recommend this to anyone.

Thanks Pamela. We're glad the completed example was helpful.

Laurie D.

January 24th, 2024

Comforting that you include an example of a completed TOD Deed form. Just downloaded all forms for my state & county and I'm SURE this will save a paying for a massive attorney fee!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Remi W.

April 13th, 2020

Submitting documents electronically through Deeds.com saved me time and provided the best possible service for me in the comfort of my own home. There's no faster, better way to record documents than e-recording with Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!