Maui County Quitclaim Deed Form

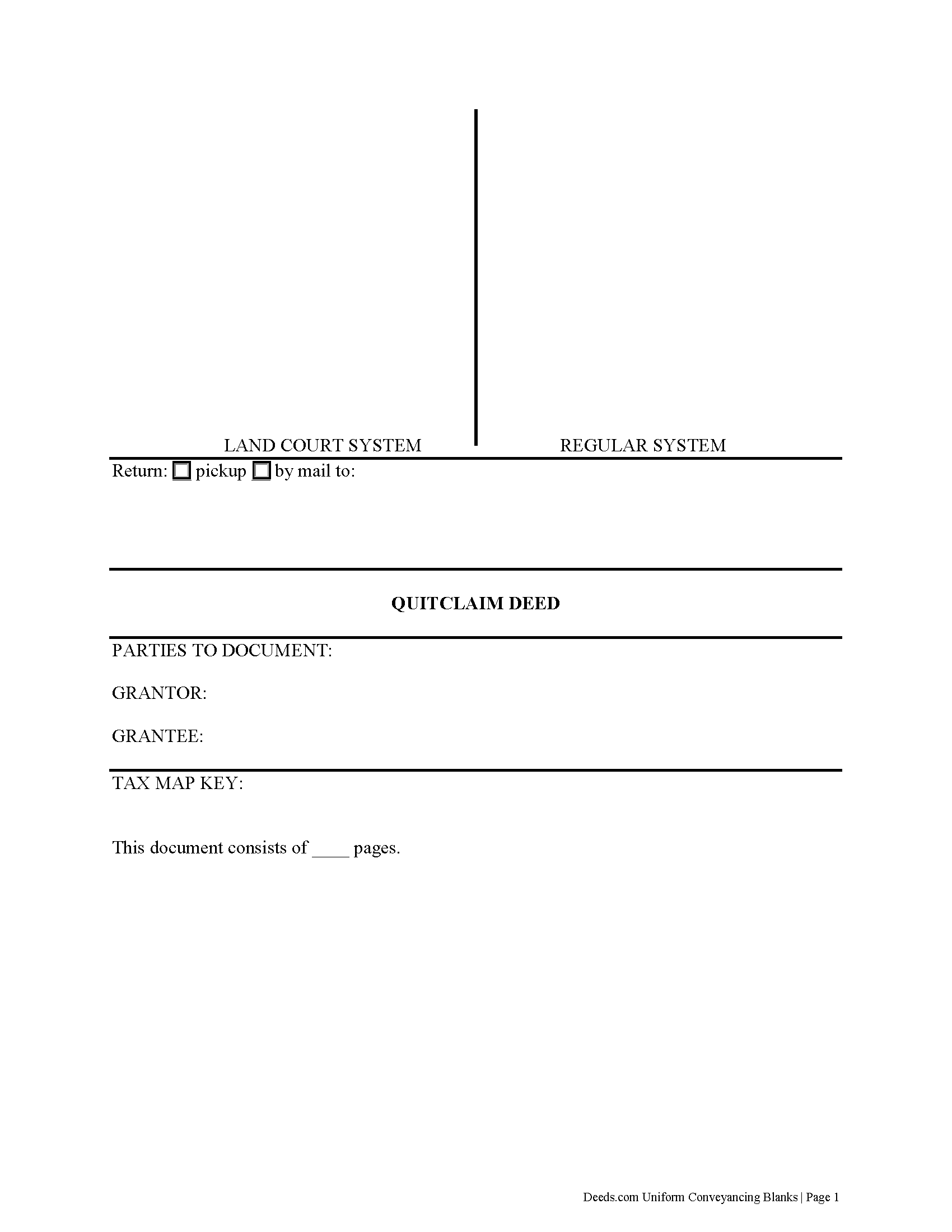

Maui County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Hawaii recording and content requirements.

Maui County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

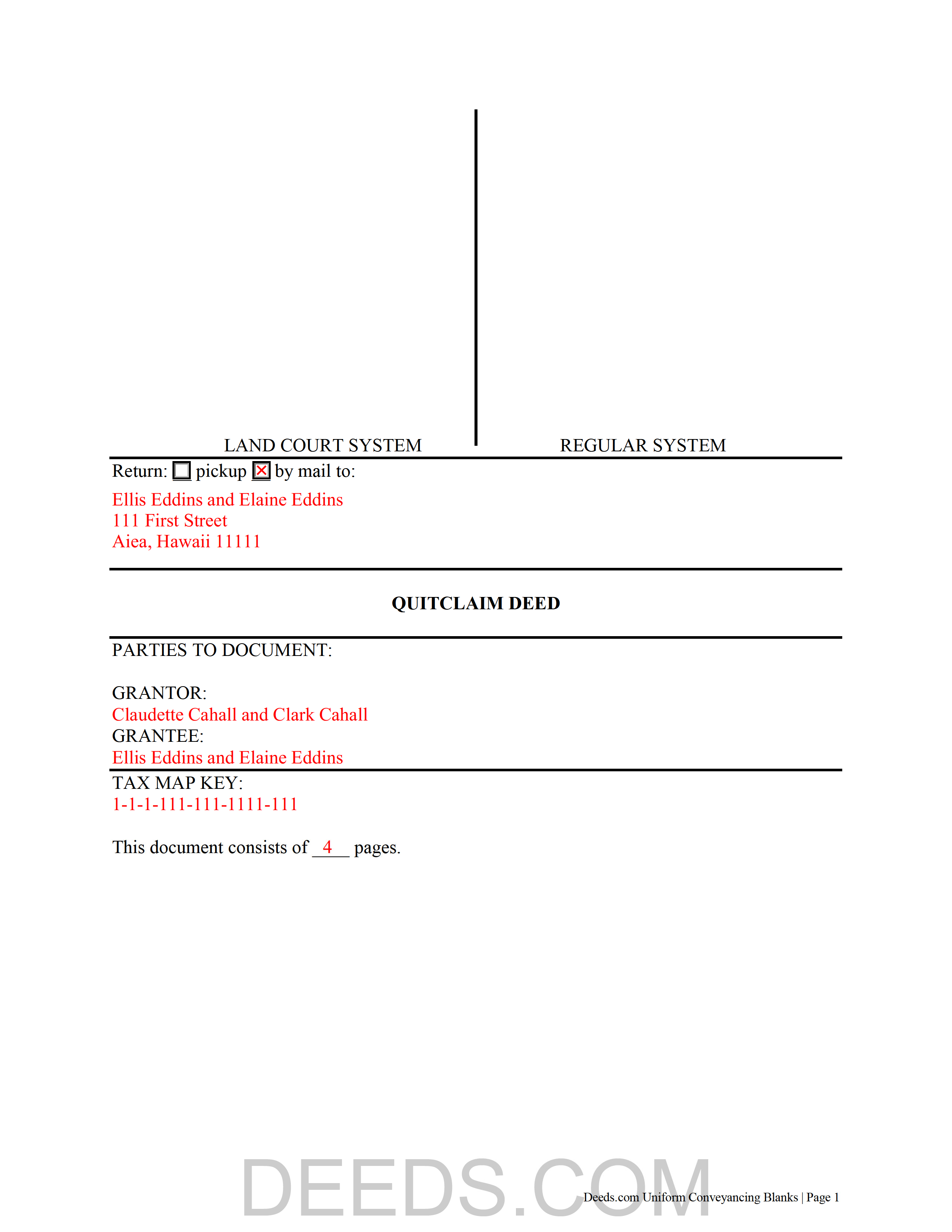

Maui County Completed Example of the Quitclaim Deed Document

Example of a properly completed Hawaii Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Hawaii and Maui County documents included at no extra charge:

Where to Record Your Documents

Hawaii Bureau of Conveyances

Honolulu, Hawaii 96813 /96803

Hours: 7:45am to 4:30pm / Recording: 8:01am to 3:29pm

Phone: (808) 587-0147

Recording Tips for Maui County:

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Maui County

Properties in any of these areas use Maui County forms:

- Haiku

- Hana

- Hoolehua

- Kahului

- Kalaupapa

- Kaunakakai

- Kihei

- Kualapuu

- Kula

- Lahaina

- Lanai City

- Makawao

- Maunaloa

- Paia

- Pukalani

- Puunene

- Wailuku

Hours, fees, requirements, and more for Maui County

How do I get my forms?

Forms are available for immediate download after payment. The Maui County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Maui County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Maui County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Maui County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Maui County?

Recording fees in Maui County vary. Contact the recorder's office at (808) 587-0147 for current fees.

Questions answered? Let's get started!

A quitclaim deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). In this type of deed, the grantor does not warrant that he or she owns the property; the grantor is only transferring the property. As there is no guarantee of a clear title, quitclaim deeds provide very little protection for grantees. Once acknowledged or proved and certified as provided, record the deed with the Bureau of Conveyances (BOC) office where the property is located.

Hawaii maintains two separate systems for recording: Land Court (Torrens) and Regular System. The BOC processes documents for both Land Court and Regular System. Check the prior deed to determine which system to record in. A label appearing in the upper left-hand corner signifies recording in the Land Court system; a label in the upper right-hand corner signifies recording in the Regular System. If both sides contain labels, the deed is dual-system recorded. Make sure to record in the correct system, and consult the BOC or an attorney with any questions. Registered land, and the ownership thereof, is subject to the same burdens and incidents that are attached to unregistered land (HRS 501-81).

Every conveyance that is not recorded is void as against any subsequent purchaser, lessee, or mortgagee in good faith and for a valuable consideration, not having actual notice of the same real estate or portion thereof, or interest therein, whose conveyance is first duly recorded (HRS 502-83).

Quitclaim deeds must include the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Hawaii residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. An estate conveyed to two or more people, including spouses, is considered a tenancy in common, unless the conveying instrument explicitly expresses otherwise (HRS 509-1).

A lawful quitclaim deed must also be signed by the grantor and must have an acknowledgement endorsed on it or attached to it in the form provided or authorized by sections HRS 502-42 or HRS 502-45 (HRS 502-41). Acknowledgements can be made in Hawaii or in another state. Consult the State of Hawaii Department of Land & Natural Resources Bureau of Conveyances for a checklist of requirements before submitting the deed for recording.

Pursuant to HRS 18:247-1, documents conveying real property are subject to a documentary transfer tax. All documents subject to transfer tax must be accompanied by Form P-64A (HRS 18:247-6(a)). All documents exempt from transfer tax must be accompanied by Form P-64B (HRS 18:247-6(b)). See HRS 18:247-3 for a list of documents exempt from the tax.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with questions about quitclaim deeds or for any other issues related to the transfer of real property in Hawaii.

Important: Your property must be located in Maui County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Maui County.

Our Promise

The documents you receive here will meet, or exceed, the Maui County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Maui County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

James G.

March 30th, 2022

Very Happy. Forms saved me from making some very silly mistakes had I done them on my own.

Thank you!

Carl T.

May 21st, 2020

Very simple to download and manage. very Impressed!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lawrence W.

January 17th, 2019

Great so Far!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer S.

December 11th, 2019

Fabulous

Thank you!

Diane D.

July 7th, 2021

. I purchased 3 different items yesterday. Truthfully, it was a bit annoying, I could not figure out how to put them in a cart and had to do 3 transactions. I'm in the process of reviewing my purchases. Thank you! .

Thank you for your feedback. We really appreciate it. Have a great day!

Joe L.

February 12th, 2019

Great service, and fast.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara J.

February 27th, 2020

I haven't actually used any forms yet, but I am very pleased with the simplicity of the website. I love the nmber and variety of forms offered. Thank you for such a great website,

Thank you!

Nick A.

January 13th, 2022

Easy to use website. Found what I was looking for.

Thank you for your feedback. We really appreciate it. Have a great day!

Maria D.

May 22nd, 2020

Deeds.com has done a great job. I really recommend to everyone who needs this service, fast & reliable. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chad R.

January 31st, 2020

a refreshing web based legal form site Thanks I will recommend to friend

Thank you!

Terri S.

October 16th, 2019

Form was easy to complete, price was reasonable and everything worked out just fine. Would absolutely use this service again if needed, Thank you :)

Thank you for your feedback. We really appreciate it. Have a great day!

Marianne F.

September 28th, 2020

This serve was very fast and efficient. I was very pleased at how quickly I received my recorded document.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John T.

May 5th, 2022

Great site, I was able to navigate with ease. We appreciate all those who contributed in making this possible

Thank you!

Robert B.

September 28th, 2021

Excellent service. Unbelievably rapid and detailed responses. Was not happy to have to pay the fee but totally worth it.

Thank you for your feedback. We really appreciate it. Have a great day!

DAVID F.

September 16th, 2021

excellent experience with this product. Well worth the cost to save time running down forms

We appreciate your business and value your feedback. Thank you. Have a wonderful day!