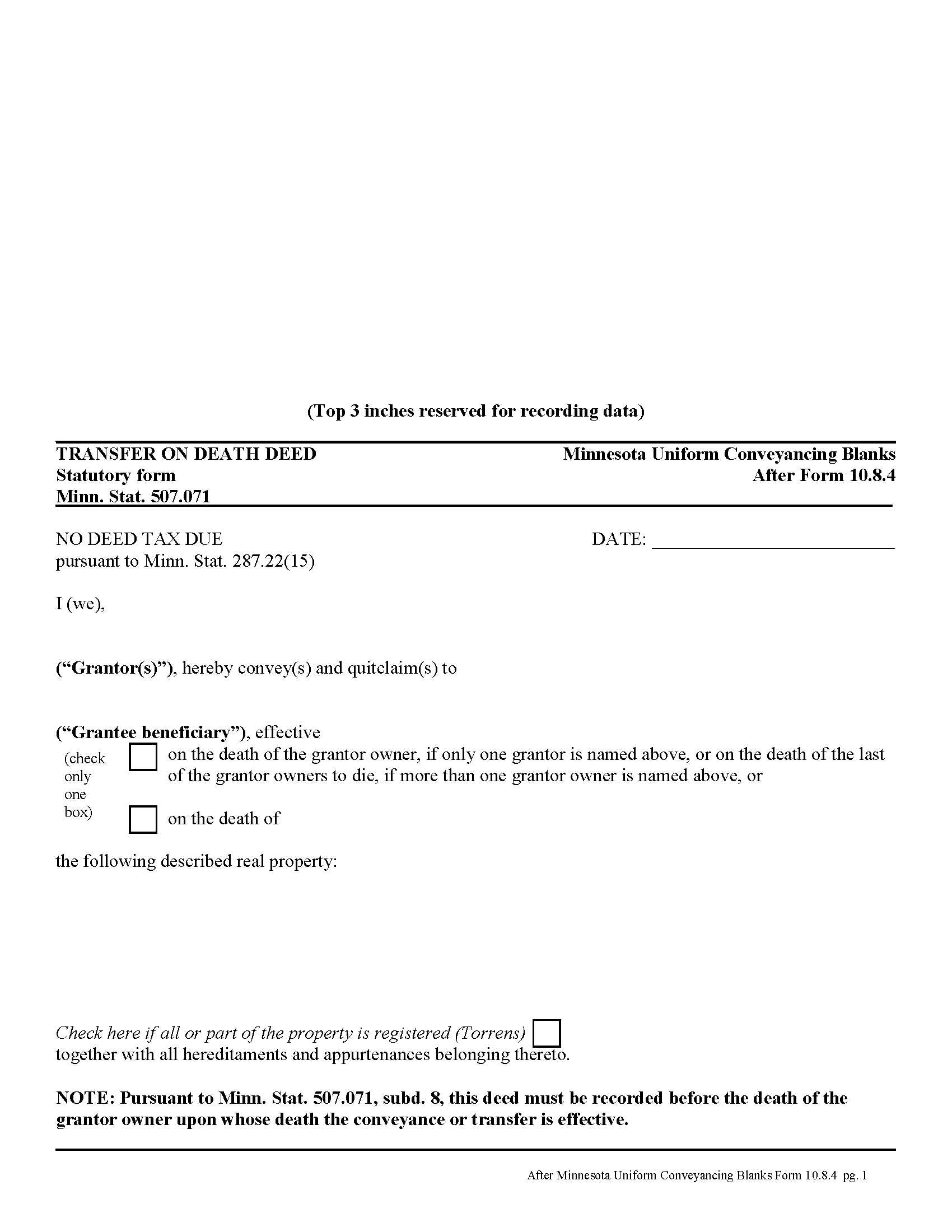

Hennepin County Transfer on Death Deed Form

Hennepin County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

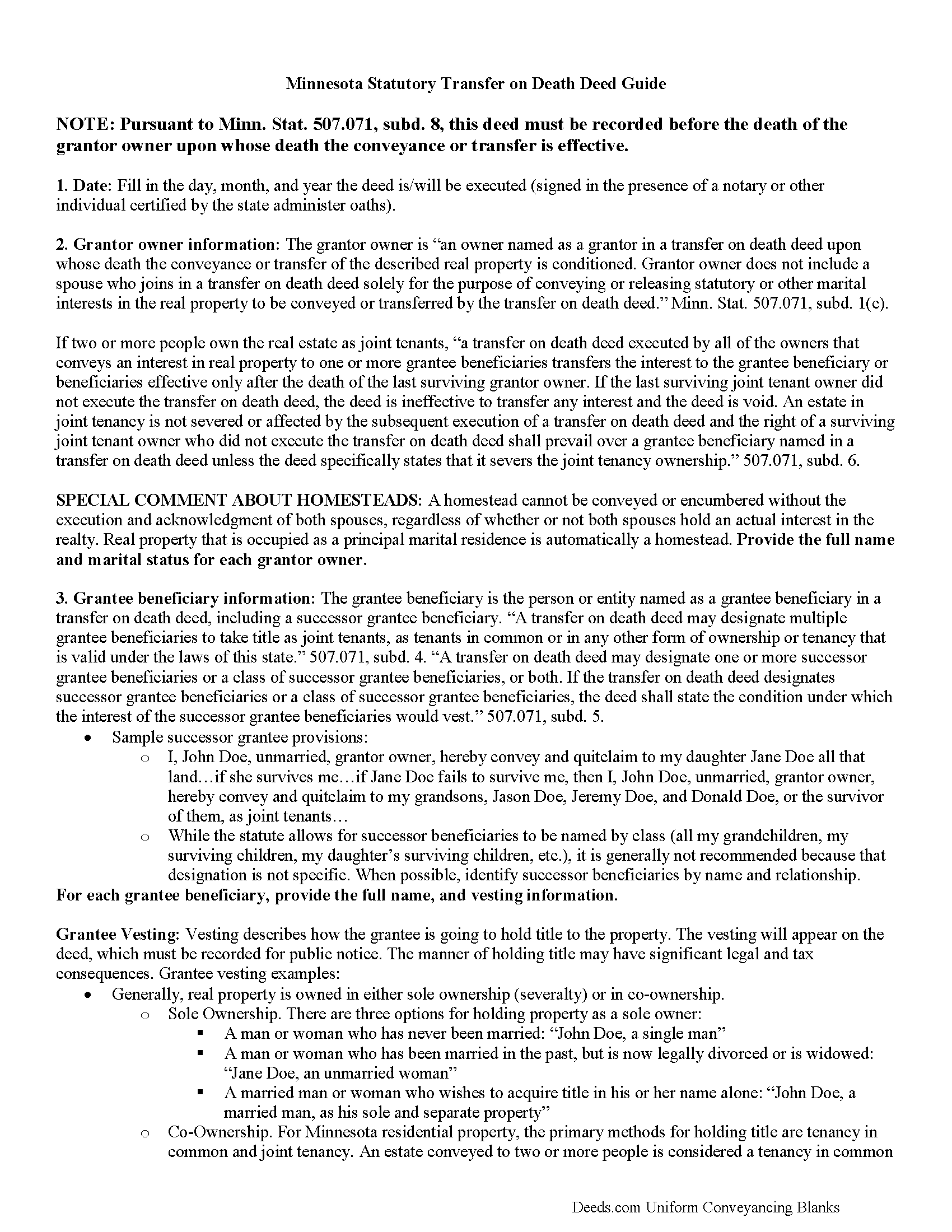

Hennepin County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

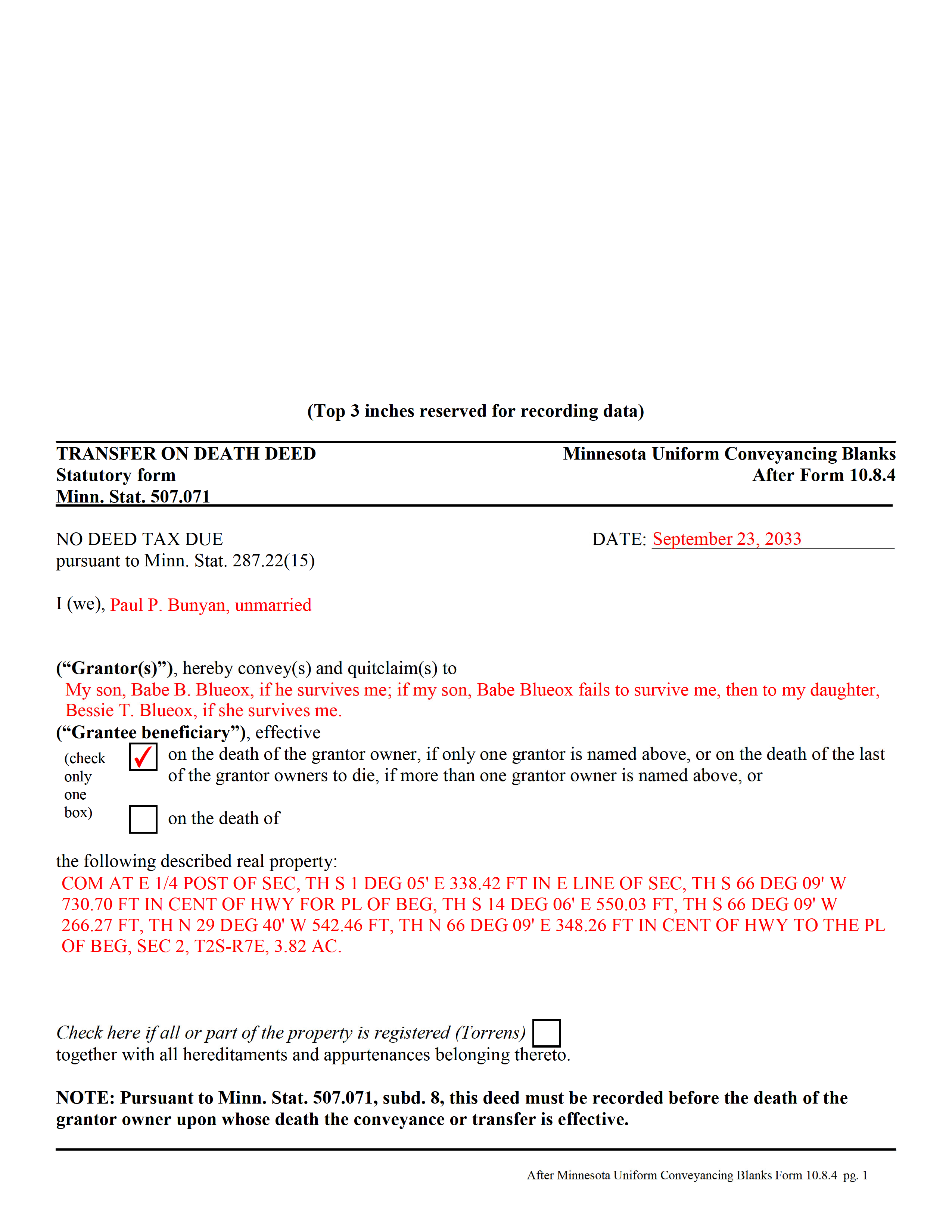

Hennepin County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Hennepin County documents included at no extra charge:

Where to Record Your Documents

Hennepin Recorder/Registrar

Minneapolis, Minnesota 55487-0055

Hours: 8:00 AM to 4:30 PM

Phone: (612) 348-5139

Recording Tips for Hennepin County:

- Verify all names are spelled correctly before recording

- Recording fees may differ from what's posted online - verify current rates

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Hennepin County

Properties in any of these areas use Hennepin County forms:

- Champlin

- Crystal Bay

- Dayton

- Eden Prairie

- Excelsior

- Hamel

- Hopkins

- Howard Lake

- Long Lake

- Loretto

- Maple Plain

- Minneapolis

- Minnetonka

- Minnetonka Beach

- Mound

- Navarre

- Osseo

- Rockford

- Rogers

- Saint Bonifacius

- Saint Louis Park

- Saint Paul

- Spring Park

- Wayzata

- Young America

Hours, fees, requirements, and more for Hennepin County

How do I get my forms?

Forms are available for immediate download after payment. The Hennepin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hennepin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hennepin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hennepin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hennepin County?

Recording fees in Hennepin County vary. Contact the recorder's office at (612) 348-5139 for current fees.

Questions answered? Let's get started!

Minnesota's transfer on death deeds are governed by Minn. Stat. 507.071.

Transfer on death deeds are useful estate planning tools for owners of Minnesota real estate. In most cases, when a land owner dies, his/her real property enters the probate system along with the rest of the estate. Some people avoid probate by owning property as joint tenants. The nature of joint tenancy includes the right of survivorship, which, by function of law, automatically distributes a deceased joint tenant's title rights to the surviving tenants. Joint tenants, however, share a current interest in the real property, and all owners must execute any changes or reconveyances. By executing and recording a transfer on death deed instead, owners still avoid the need for probate distribution of that portion of their assets. Transfer on death deeds do NOT pass a current or future interest in the property, so the owner's interests are fully protected while he/she remains alive.

Unlike most other real estate deeds, transfer on death deeds do not convey any rights or interests to the beneficiaries until the grantor owner's death. But, under Minn. Stat. 524.2-702, named beneficiaries must outlive the grantor owners by at least 120 hours to become eligible for the property. The owner retains absolute title to and control over the real property until death. He/she may rent, use, sell or reconvey the land at will, and with no obligation to the beneficiary (Minn. Stat. 507.071, subd. 10). As a result, the beneficiary has no guarantee of any present or future interest in the property. In addition, a "transfer on death deed that is executed, acknowledged, and recorded in accordance with this section is not revoked by the provisions of a will" (subd. 19).

Transfer on death deeds allow flexibility -- in addition to individuals, the grantor owner may "transfer an interest in real property to the trustee of an inter vivos trust even if the trust is revocable, to the trustee of a testamentary trust or to any other entity legally qualified to hold title to real property under the laws of this state" (subd. 9).

Under Minn. Stat. 507.071, transfer on death deeds must:

- convey or assign an interest in real property (subd. 2)

- name one or more grantee beneficiaries (subds. 2 and 4)

- explicitly state that it takes effect at the death of the named grantor owner(s)

- comply with other Minnesota deed requirements including joinder of spouse in conveying homestead (507.02, subd. 2)

- standard recording requirements regarding legibility, recordability, notarization, and original signature (507.24)

- Notice recording statutes (507.34, 508.48, 508A.48)

Ultimately, transfer on death deeds offer a useful alternative for Minnesota land owners who wish to pass property to specific beneficiaries without probate intervention.

NOTE: All actions related to executing, revoking, or otherwise changing a Minnesota transfer on death deed must be submitted for recording in the county where at least part of the land is located, while the grantor owner is alive. (507.071, subd. 8).

Important terms:

Grantor owner: "means an owner named as a grantor in a transfer on death deed upon whose death the conveyance or transfer of the described real property is conditioned" (subd. 1c).

Owner: "means a person having an ownership or other interest in all or part of the real property to be conveyed or transferred by a transfer on death deed" (subd. 1d).

Beneficiary or grantee beneficiary: "means a person or entity named as a grantee beneficiary in a transfer on death deed, including a successor grantee beneficiary" (subd. 1a).

(Minnesota TOD Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Hennepin County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Hennepin County.

Our Promise

The documents you receive here will meet, or exceed, the Hennepin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hennepin County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Martha G.

January 7th, 2020

Well-designed site. Incredibly easy to find what I needed, very reasonable cost.

Thank you for your feedback. We really appreciate it. Have a great day!

Ralph B.

November 25th, 2023

My needs were met quickly and efficiently with very little wait. Deeds.com made it easy to understand and use their program and I couldn't be more happy with the results!

It was a pleasure serving you. Thank you for the positive feedback!

Samuel M.

October 8th, 2020

it was convenient to have a starting place, however, though the property is in Colorado, the probate is in Iowa, so I had to create my own document because you locked my capacity to edit the form I paid for. If I pay for it, I should be able to edit everything including non fill in text. I could not open it in word, as I normally could.

Thank you for your feedback. We really appreciate it. Have a great day!

Alexis R.

January 25th, 2021

Excellent service and reasonable fees. Highly recommend this company.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Erlinda M.

August 14th, 2019

Very convenient & easy to use this website. Information was helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara G.

July 29th, 2019

I got what I needed very quickly. Thank you.

Thank you!

RICHARD A.

March 4th, 2023

Smooth, simple, and complete. A great forms service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ken D.

August 17th, 2021

The service was easy, fast, and worked well. I will be back.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles C.

October 1st, 2020

Easy to use, fast!

Thank you!

CAROL C.

July 30th, 2020

Deeds.com is very user friendly and quite simple to use. Customer service is also prompt in responding to any inquiry. I have been pleased with them since I began using them over 3-years ago.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christopher S.

October 5th, 2024

very easy to use, and comprehensive...I like the e-recording package

We are grateful for your feedback and looking forward to serving you again. Thank you!

Jamie P.

December 9th, 2024

Got it next business day in the morning. Saved me phone call and perhaps a trip to courthouse. Very pleased.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Ming W.

December 22nd, 2020

couldn't believe how efficient and perfect job you have done!! I will recommend your website to all friends.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth M.

August 18th, 2021

So fare easy and straight forward

Thank you for your feedback. We really appreciate it. Have a great day!

Josephine H.

April 26th, 2022

This was so helpful! I was able to get the right forms. Presto! Peace of mind.

Thank you for your feedback. We really appreciate it. Have a great day!