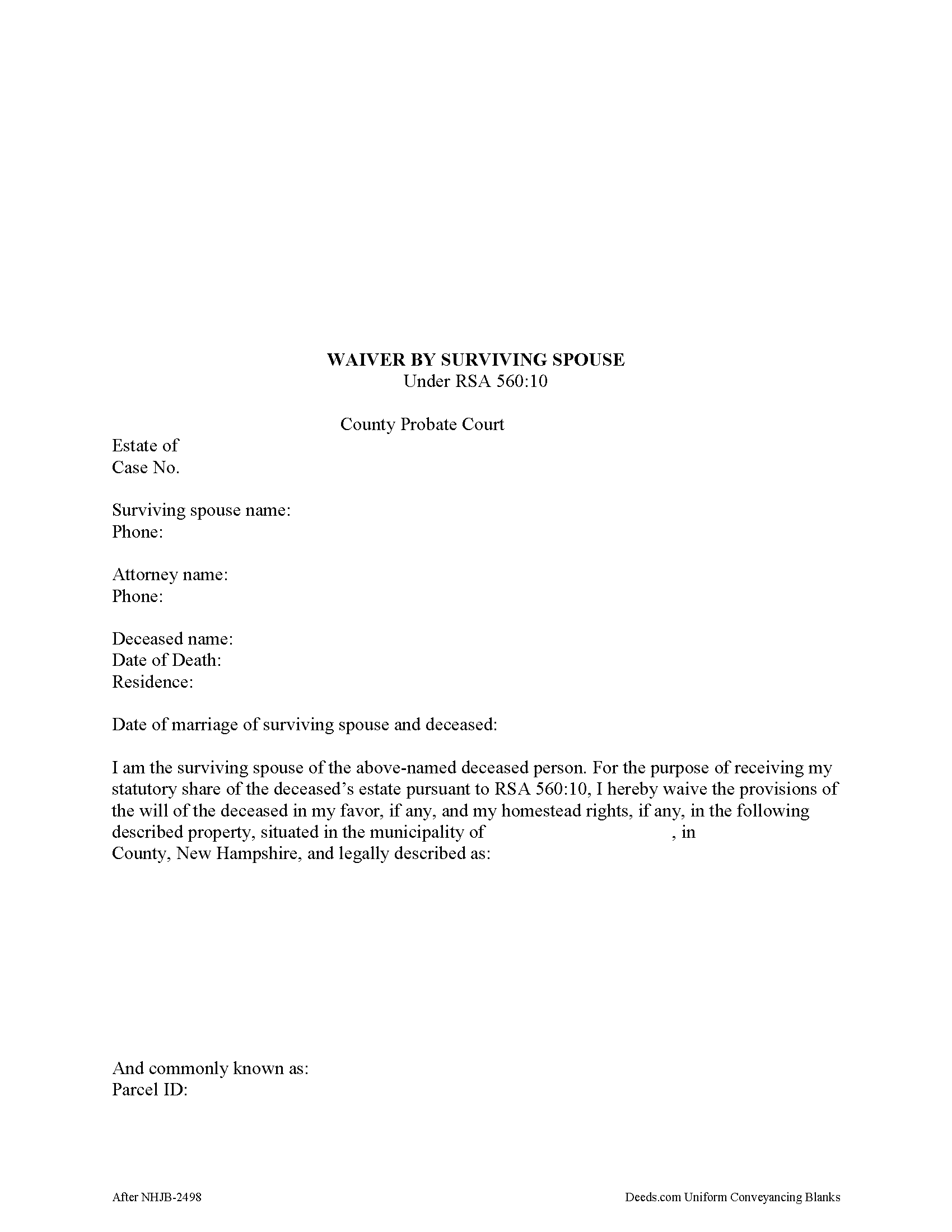

Strafford County Waiver by Surviving Spouse Form

Strafford County Waiver by Surviving Spouse Form

Fill in the blank form formatted to comply with all recording and content requirements.

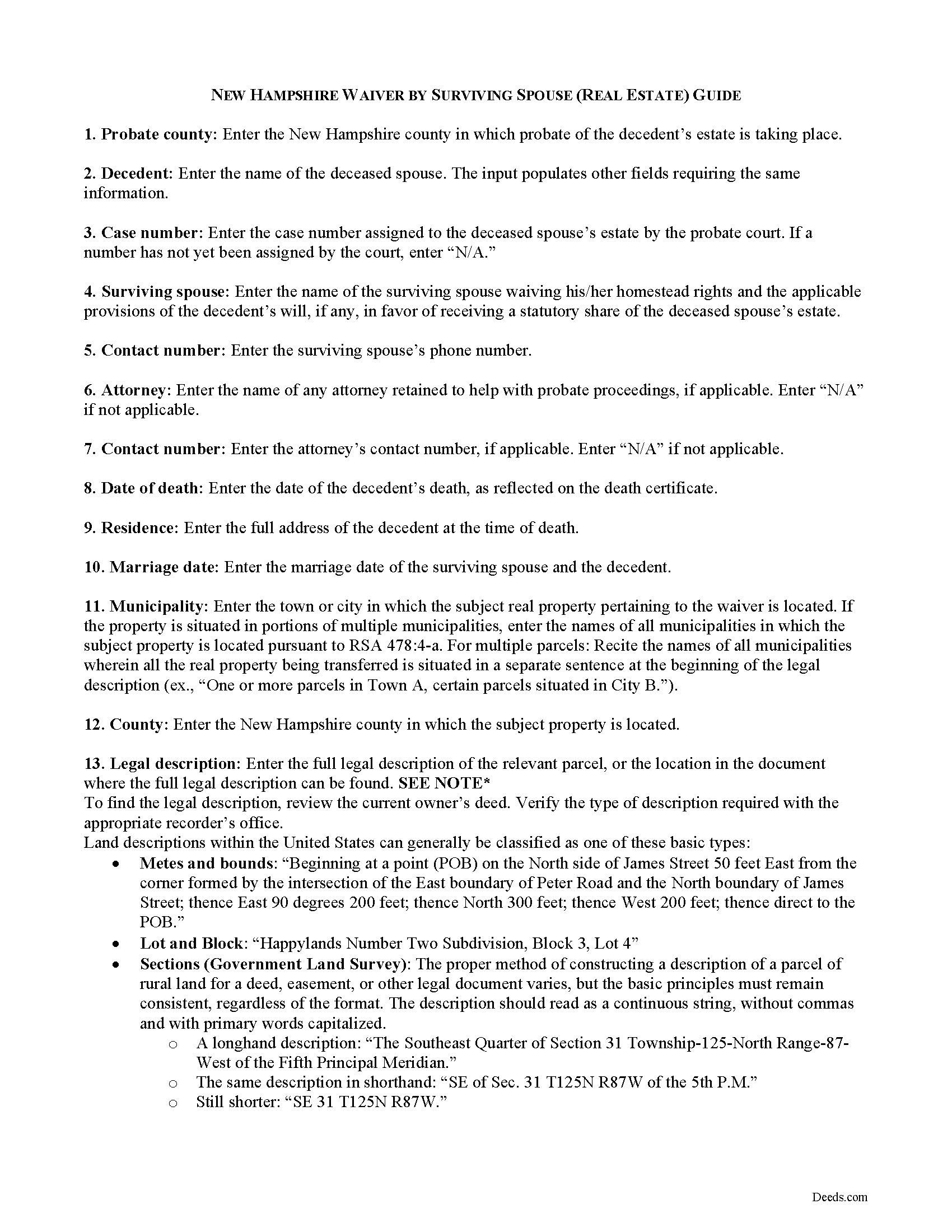

Strafford County Waiver by Surviving Spouse Guide

Line by line guide explaining every blank on the form.

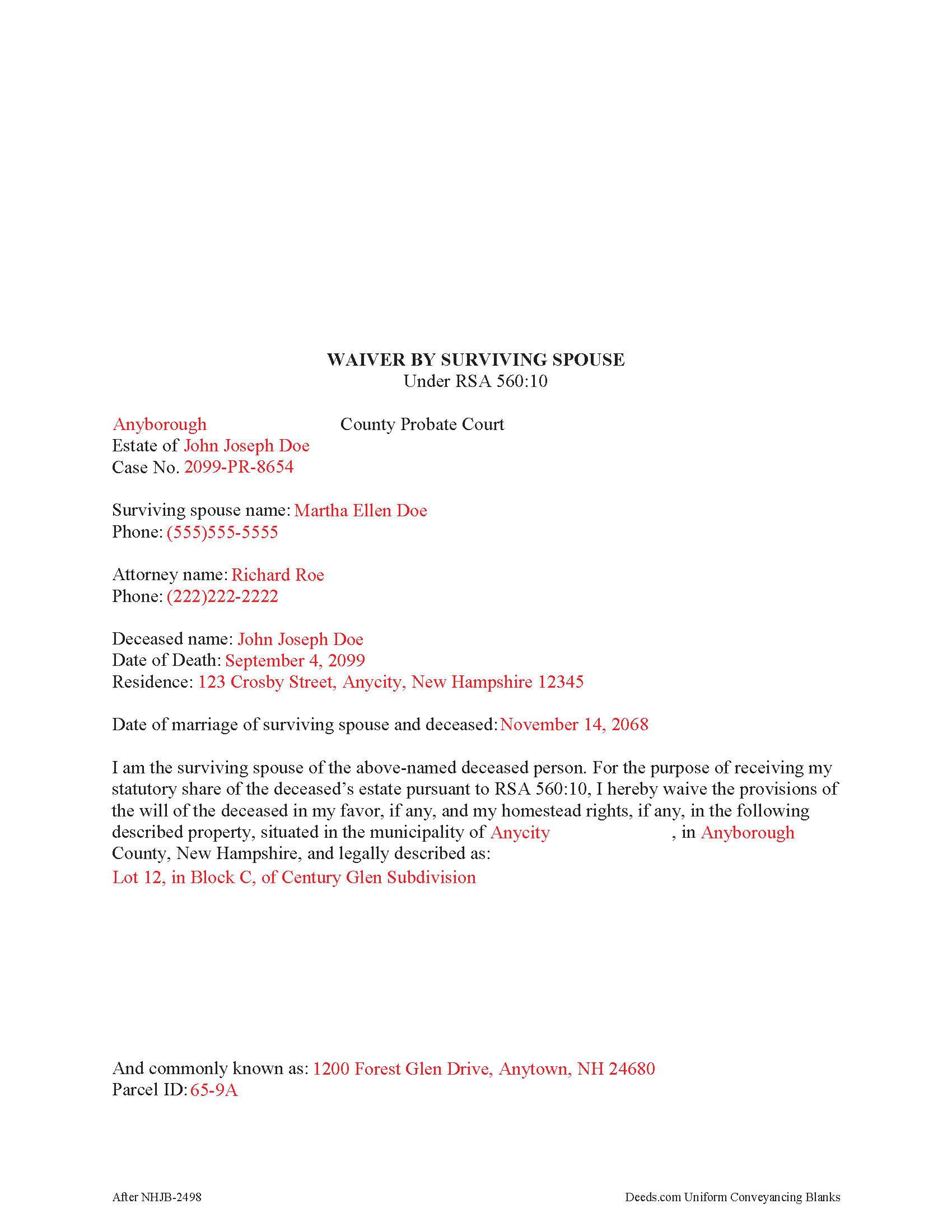

Strafford County Completed Example of the Waiver by Surviving Spouse Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Hampshire and Strafford County documents included at no extra charge:

Where to Record Your Documents

Registry of Deeds

Dover, New Hampshire 03820

Hours: Monday through Friday 8:30 AM - 4:00 PM / Recording stops at 3:30 PM

Phone: (603) 742-1741

Recording Tips for Strafford County:

- Documents must be on 8.5 x 11 inch white paper

- Ask if they accept credit cards - many offices are cash/check only

- Ask about their eRecording option for future transactions

- Leave recording info boxes blank - the office fills these

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Strafford County

Properties in any of these areas use Strafford County forms:

- Barrington

- Center Strafford

- Dover

- Durham

- Farmington

- Lee

- Madbury

- Milton

- Milton Mills

- New Durham

- Newington

- Rochester

- Rollinsford

- Somersworth

- Strafford

Hours, fees, requirements, and more for Strafford County

How do I get my forms?

Forms are available for immediate download after payment. The Strafford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Strafford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Strafford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Strafford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Strafford County?

Recording fees in Strafford County vary. Contact the recorder's office at (603) 742-1741 for current fees.

Questions answered? Let's get started!

Use this document to waive a surviving spouse's testate distribution and homestead rights, if any, in order to take a statutory share of the deceased spouse's estate. Widows or widowers may opt to execute a waiver of surviving spouse when the statutory share for a surviving spouse under RSA 560:10 is greater than the testate distribution.

Pursuant to RSA 560:14, file the waiver with the probate court within six months of the administrator's appointment, and, when real property is involved, record in the registry of deeds of the county where the property to which it pertains is located.

The document must state the surviving spouse's name, the decedent's name and date of death, and the date of marriage of the surviving spouse and decedent. Because the document relates to real property, it also requires a legal description of the relevant realty. The surviving spouse waiving testamentary distribution and homestead rights must sign in the presence of a notary public.

Consult an attorney licensed in the State of New Hampshire with questions regarding rights of surviving spouses.

(New Hampshire WBSS Package includes form, guidelines, and completed example)

Important: Your property must be located in Strafford County to use these forms. Documents should be recorded at the office below.

This Waiver by Surviving Spouse meets all recording requirements specific to Strafford County.

Our Promise

The documents you receive here will meet, or exceed, the Strafford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Strafford County Waiver by Surviving Spouse form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

David C.

February 7th, 2021

I found it pretty easy to navigate, all worked well. Need a better example of excise tax. Lastly, your link in the email to get to this page doesn't work :)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charmaine D.

August 7th, 2022

Very easy to use.

Thank you!

Eileen B.

January 9th, 2019

Great form needs more instructions however but aside from that is perfect solution for my needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christopher M.

February 5th, 2024

Awesome company. Fast, friendly, professional.

We are delighted to have been of service. Thank you for the positive review!

james b.

May 29th, 2020

worked great

Thank you!

Dhanminder D.

July 30th, 2020

The service was great. Thank you.

Thank you!

Kevin M.

April 1st, 2020

Easy to navigate. Comprehensive

Thank you!

Clifford B.

May 6th, 2021

I appreciate the formatting to match the expectations of the specific Registry of Deeds that I will be filing with. That is very helpful. In my case the easement is for septic disposal field and sample wording for different purposes would be helpful.

Thank you!

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Robert L.

September 28th, 2020

It was easy for me to open an account and upload a document for recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Anita C.

November 3rd, 2021

I found this site when looking for help filing a quitclaim deed to change my property deed to my married name. I received the correct forms, an example filled out, and a guide specific to my state. I have already submitted it for review to my county assessor's office (they were extremely helpful also) and it looks as if it should sail through. Thank you Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

April 30th, 2019

Easy to follow directions and instructions to properly and legally fill-in the Deed that I requested. It was also very easy and convenient. If I was going to employ an Attorney or Legal Documents Preparer, they would easily charge me between $150 to $225 a Deed! For the cost of $19.97, anyone would pursue this price! Thank you, Deeds.com for a wonderful and terrific experience! I'm going to need you again to change Titles for my other Investment Properties.

Thank you for your feedback. We really appreciate it. Have a great day!

Lance G.

December 13th, 2018

You did not include the Notice of Intent to File a Lien Statement form which is necessary to properly file a mechanic's lien in Colorado. If you are going to charge people $20 to download the forms, you should include all of them not half of them.

Thank you for your feedback. We really appreciate it. Have a great day!

Will C.

April 8th, 2019

I was very happy with my interaction. The county didn't supply the book and page which was what I needed. The tech refunded my money since I didn't get the info I needed. I will use Deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!

Nanc T.

October 3rd, 2024

Great experience, highly recommend.

Thank you for your positive words! We’re thrilled to hear about your experience.