Cheshire County Warranty Deed Form

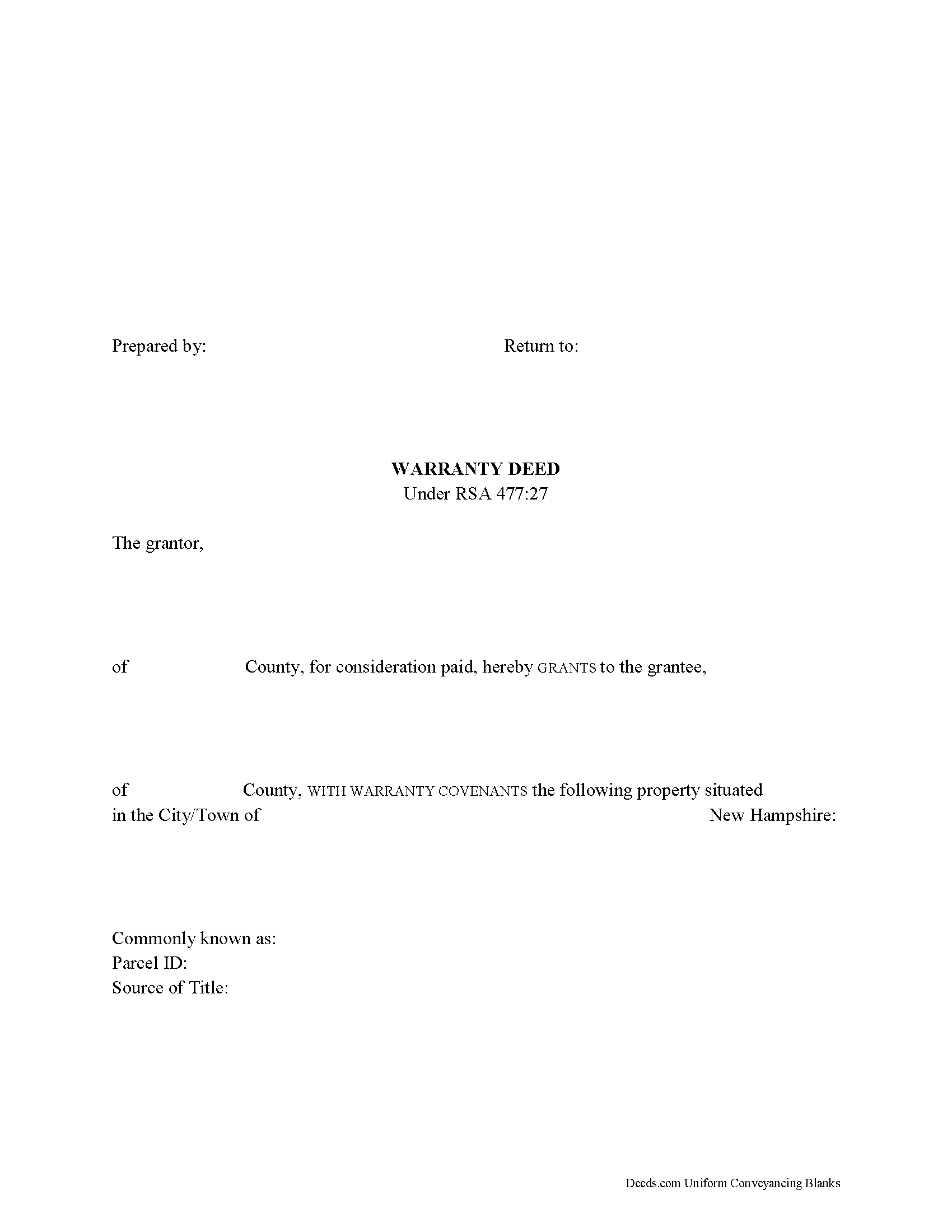

Cheshire County Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

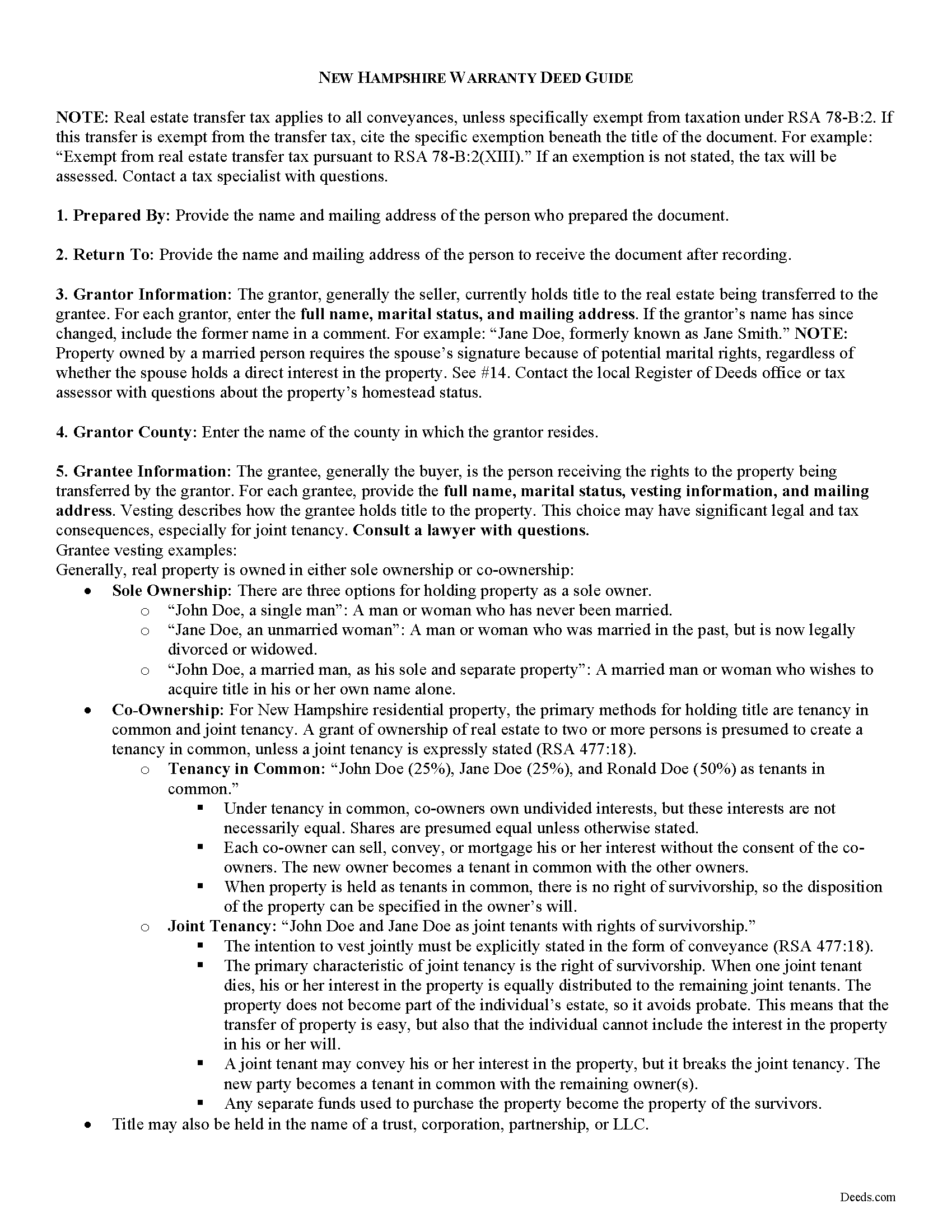

Cheshire County Warranty Deed Guide

Line by line guide explaining every blank on the form.

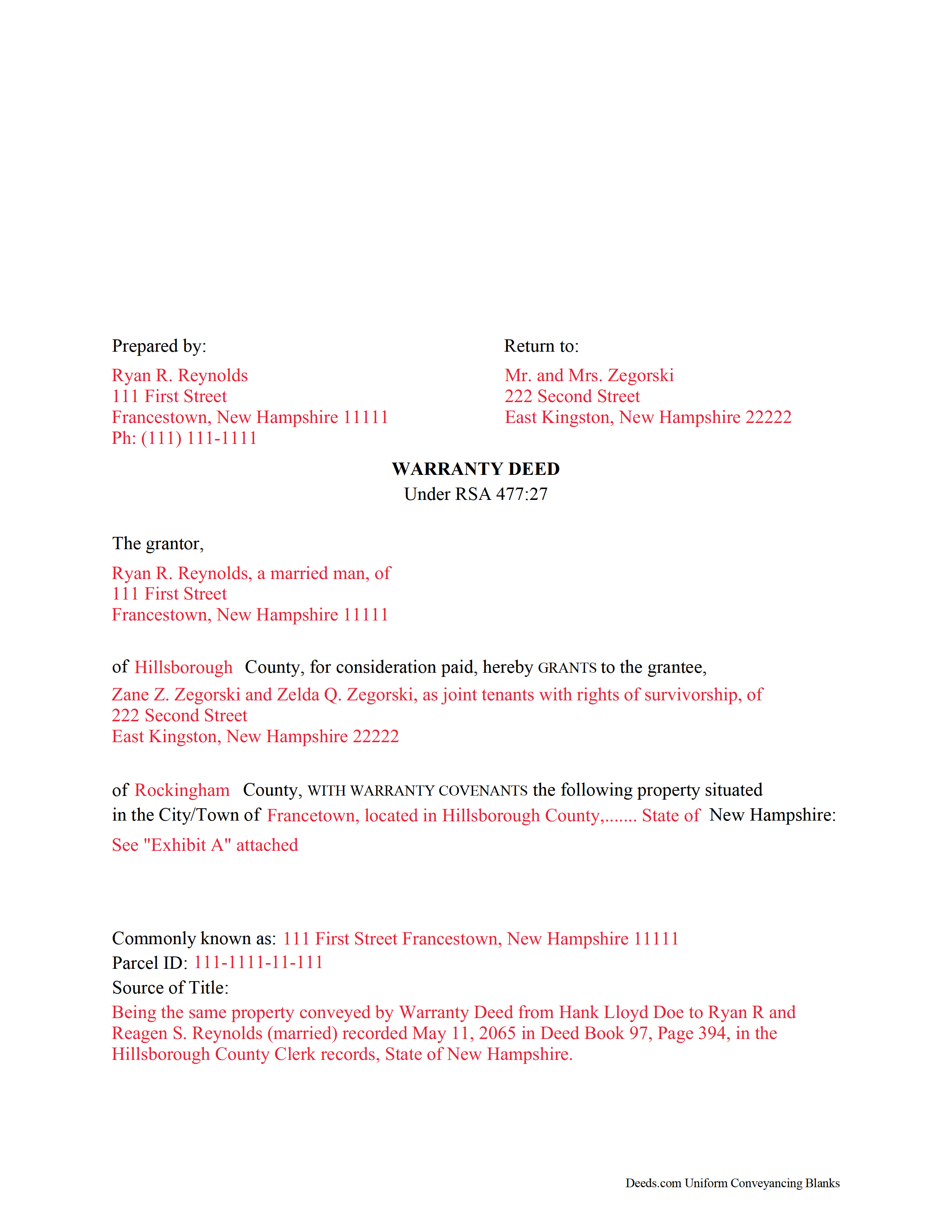

Cheshire County Completed Example of the Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Hampshire and Cheshire County documents included at no extra charge:

Where to Record Your Documents

Registry of Deeds

Keene, New Hampshire 03431

Hours: 8:00 to 4:00 M-F / In-Office Recording Stops at 3:45 pm.

Phone: (603) 352-0403

Recording Tips for Cheshire County:

- Check that your notary's commission hasn't expired

- Double-check legal descriptions match your existing deed

- Recorded documents become public record - avoid including SSNs

- Make copies of your documents before recording - keep originals safe

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Cheshire County

Properties in any of these areas use Cheshire County forms:

- Alstead

- Ashuelot

- Chesterfield

- Drewsville

- Dublin

- Fitzwilliam

- Gilsum

- Harrisville

- Hinsdale

- Jaffrey

- Keene

- Marlborough

- Marlow

- Nelson

- North Walpole

- Rindge

- Spofford

- Stoddard

- Sullivan

- Swanzey

- Troy

- Walpole

- West Chesterfield

- West Swanzey

- Westmoreland

- Winchester

Hours, fees, requirements, and more for Cheshire County

How do I get my forms?

Forms are available for immediate download after payment. The Cheshire County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cheshire County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cheshire County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cheshire County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cheshire County?

Recording fees in Cheshire County vary. Contact the recorder's office at (603) 352-0403 for current fees.

Questions answered? Let's get started!

In New Hampshire, real property can be transferred from one party to another by executing a warranty deed.

Warranty deeds are statutory in New Hampshire under RSA 477:27 and transfer fee simple title with covenants, or guarantees from the seller (grantor). The grantor promises that, at the time of conveyance, he or she "was lawfully seized in fee simple of the granted premises" and has good right to sell and convey said premises; that the property is free from all encumbrances, except for restrictions stated within the deed; and that he or she will warrant and defend the property against any lawful claims and demands made by all persons (RSA 477:27).

Unlike a quitclaim deed under RSA 477:28, a warranty deed guarantees the property against any and all claims. Quitclaim deeds only guarantee the title against claims that arose during the time the grantor held title to the property.

A lawful warranty deed includes the grantor's full name, mailing address, and marital status, and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For New Hampshire residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless a joint tenancy is expressly stated (RSA 477:18).

As with any conveyance of realty, a warranty deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. Include a spousal waiver of interest under RSA 148:5-a, if applicable. Finally, the deed must meet all state and county standards of form and content for recorded documents.

Sign the deed in the presence of a notary public or other authorized official. For a valid transfer, record the deed at the recording office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

A Real Estate Transfer Tax Declaration of Consideration must be filed for both the grantor and grantee (RSA 78-B:1). Contact the local assessor's office to determine the appropriate version of the form.

The grantee must file an original Form PA-34, Inventory of Property Transfer, with the Department of Revenue Administration within 30 days of recording of the deed, and also file a copy of the PA-34 with the local assessing official of the municipality where the property is located (RSA 74:18).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about using warranty deeds or for any other issues related to transfers of real property in New Hampshire.

(New Hampshire WD Package includes form, guidelines, and completed example)

Important: Your property must be located in Cheshire County to use these forms. Documents should be recorded at the office below.

This Warranty Deed meets all recording requirements specific to Cheshire County.

Our Promise

The documents you receive here will meet, or exceed, the Cheshire County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cheshire County Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Mary K.

October 25th, 2020

Fantastic way to record any deed! Done in less than a few hours, right to your inbox. Very small fee compared to driving to office or waiting for the mail.

Thank you for your feedback. We really appreciate it. Have a great day!

F Michael C.

June 15th, 2021

Very easy to use and no hidden costs. You get to download whatever you need and can save it and even reuse it. So it's like having your own library of form that you pay for once. They even give you more related forms than you ask for and it turned out we needed some if those forms as well. The forms meet what our county requires for margins in records and so on. So I will use deeds.com again when I need a different kind of legal form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela B.

June 18th, 2023

Very easy to use. Time will tell if I have any issues getting it recorded. Beats using an attorney who won't return calls and emails like I used before. I like the form plus instructions and an example of the completed form.

Thank you for your feedback. We really appreciate it. Have a great day!

Shana D.

June 9th, 2022

I ordered the wrong forms because I didn't do enough research to understand what I needed. Their customer service was more understanding than I deserved.

Thank you!

Karl L.

January 30th, 2025

Excellent Service Terrific Follow Up and Follow Throught

Your appreciative words mean the world to us. Thank you.

JACQUELINE R.

March 23rd, 2021

We have been waiting for a Title Company to put a release of Lien together for the past 3 months. I figured it was taking way to long and decided to use template here instead. In less than hour I was able to add all the information on the template and provide forms to our Seller to use. We were buying and he didnt think they were necessary. But I refused to pay him in full until he agreed to sign papers at the bank, and of course in front of a notary. We turned around and filed the Release of lien paperwork at County Clerks office, we officially own our house. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Arletta B.

September 16th, 2021

Fantastic service, saved me a ton of time and running around. Thanks!

Thank you!

Esther R.

February 25th, 2019

Very easy to follow and complete.

Thank you for your feedback. We really appreciate it. Have a great day!

CORA T.

January 17th, 2022

very convenient and quick access

Thank you!

Sandra B.

February 15th, 2022

Easy to navigate through. Documents were in orderly fashion. Highly recommend. Step by step instructions

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ralph W.

April 18th, 2020

very professional

Thank you!

Patricia K.

August 8th, 2019

Able to find the information that I needed.

Thank you!

Jonelle R.

March 13th, 2023

Paperwork very easy to retrieve. Hope going to get it recorded will be this easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John C.

February 26th, 2024

Ease and speed of recording are remarkable. This is especially true of deeds with problems: I often get feedback within minutes and can correct problems immediately and still complete the filing in the same day. I wish more counties accepted electronic filing! It would be helpful to list counties that do/do not accept electronic filing so I would not have to upload documents to find out my effort was fruitless.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Tramelle O.

March 29th, 2021

This is perfect! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!