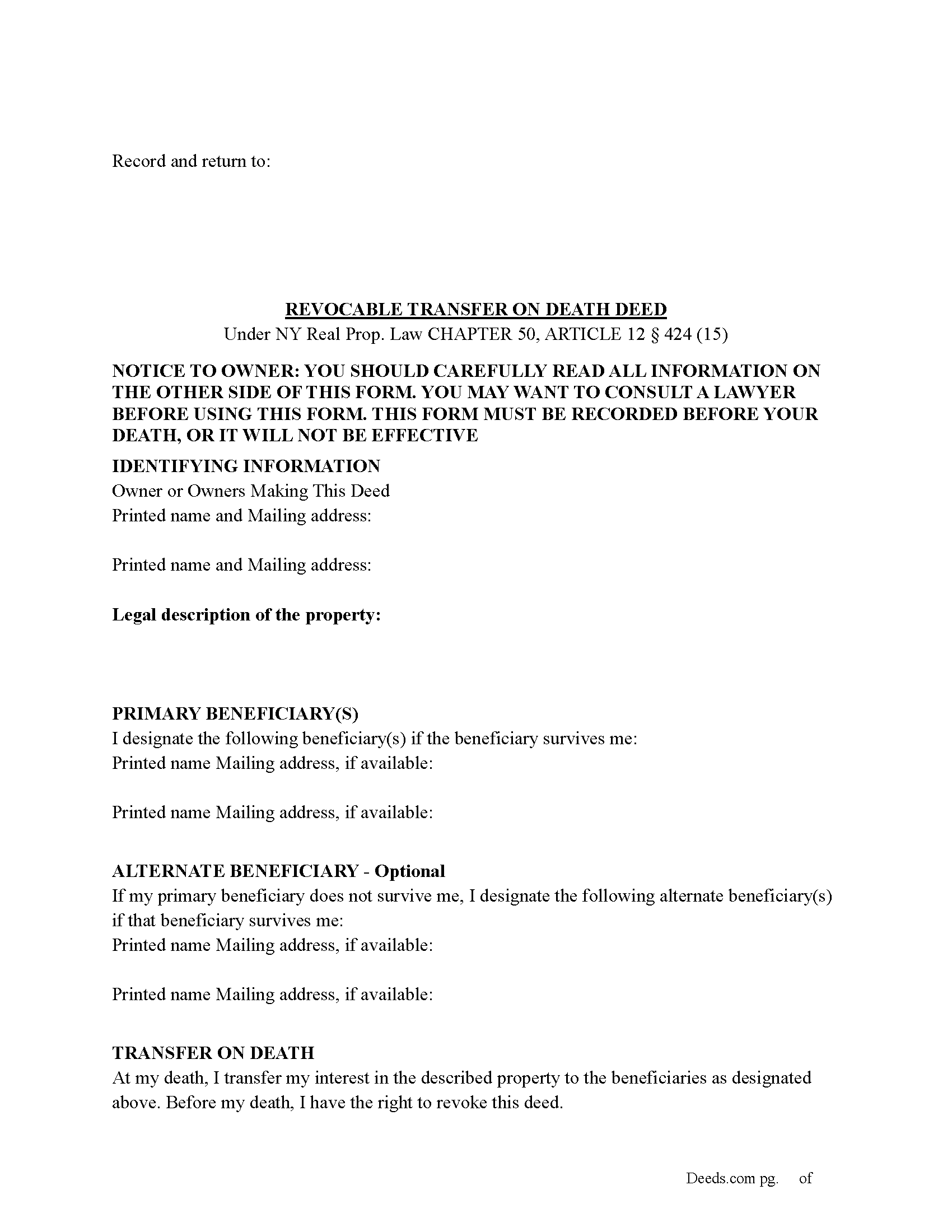

Suffolk County Transfer on Death Deed Form

Suffolk County Transfer on Death Deed Form

Fill in the blank Transfer on Death Deed form formatted to comply with all New York recording and content requirements.

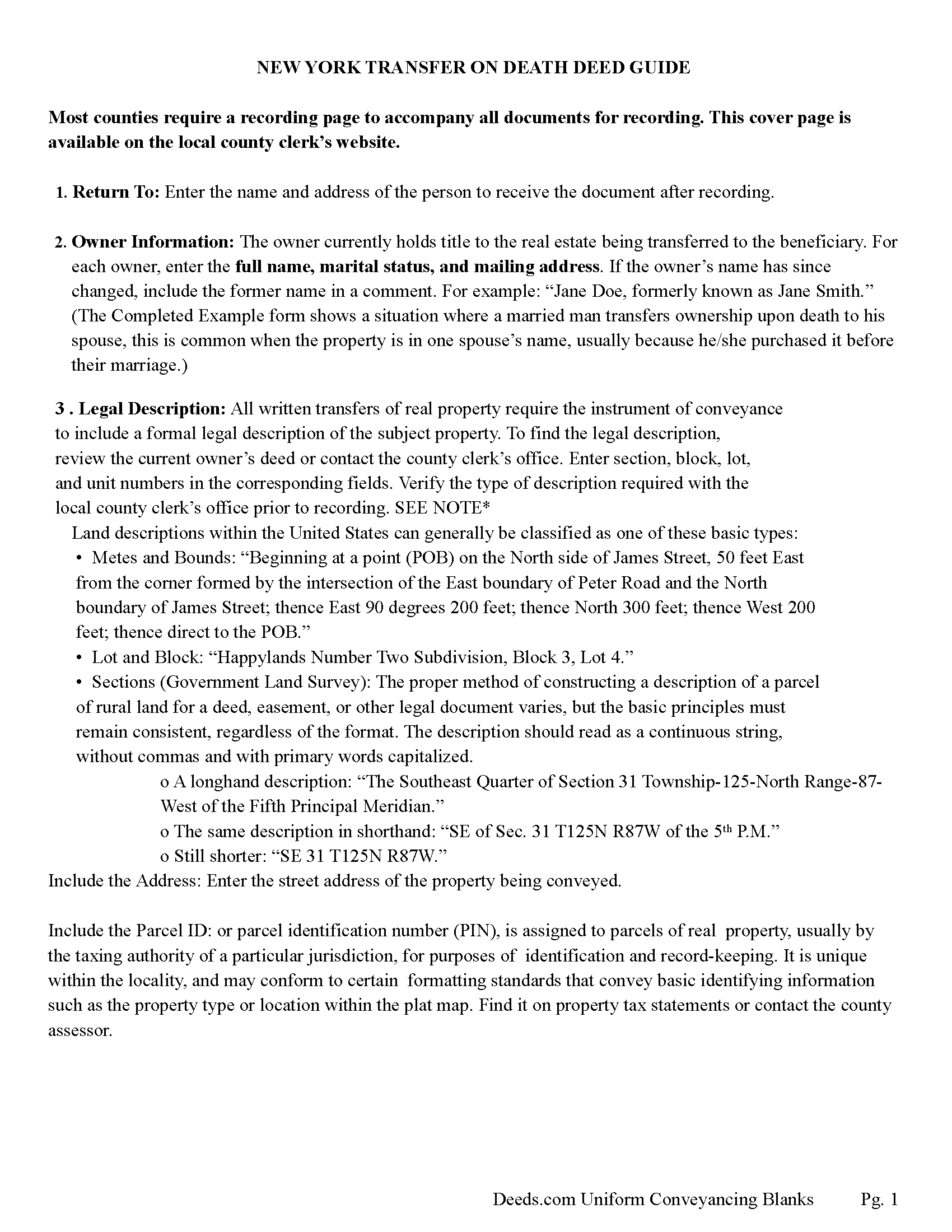

Suffolk County Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

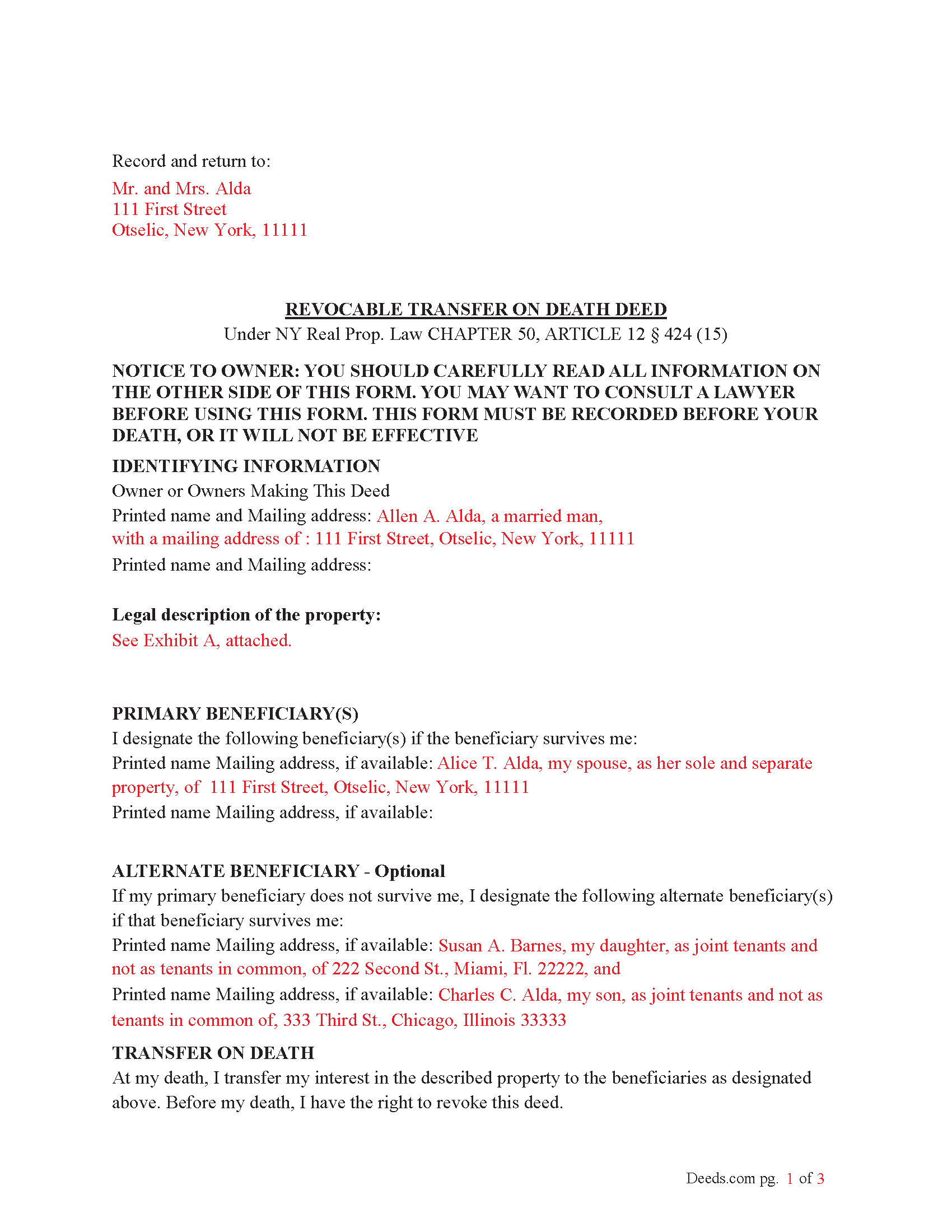

Suffolk County Completed Example of the Transfer on Death Deed Document

Example of a properly completed New York Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Suffolk County documents included at no extra charge:

Where to Record Your Documents

Suffolk County Clerk

Riverhead, New York 11901- 3392

Hours: 8:30 to 4:30 M-F

Phone: (631) 852-2000

Recording Tips for Suffolk County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Request a receipt showing your recording numbers

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Suffolk County

Properties in any of these areas use Suffolk County forms:

- Amagansett

- Amityville

- Aquebogue

- Babylon

- Bay Shore

- Bayport

- Bellport

- Blue Point

- Bohemia

- Brentwood

- Bridgehampton

- Brightwaters

- Brookhaven

- Calverton

- Center Moriches

- Centereach

- Centerport

- Central Islip

- Cold Spring Harbor

- Commack

- Copiague

- Coram

- Cutchogue

- Deer Park

- East Hampton

- East Islip

- East Marion

- East Moriches

- East Northport

- East Quogue

- East Setauket

- Eastport

- Farmingville

- Fishers Island

- Great River

- Greenlawn

- Greenport

- Hampton Bays

- Hauppauge

- Holbrook

- Holtsville

- Huntington

- Huntington Station

- Islandia

- Islip

- Islip Terrace

- Jamesport

- Kings Park

- Lake Grove

- Laurel

- Lindenhurst

- Manorville

- Mastic

- Mastic Beach

- Mattituck

- Medford

- Melville

- Middle Island

- Miller Place

- Montauk

- Moriches

- Mount Sinai

- Nesconset

- New Suffolk

- North Babylon

- Northport

- Oakdale

- Ocean Beach

- Orient

- Patchogue

- Peconic

- Port Jefferson

- Port Jefferson Station

- Quogue

- Remsenburg

- Ridge

- Riverhead

- Rocky Point

- Ronkonkoma

- Sag Harbor

- Sagaponack

- Saint James

- Sayville

- Selden

- Shelter Island

- Shelter Island Heights

- Shirley

- Shoreham

- Smithtown

- Sound Beach

- South Jamesport

- Southampton

- Southold

- Speonk

- Stony Brook

- Upton

- Wading River

- Wainscott

- Water Mill

- West Babylon

- West Islip

- West Sayville

- Westhampton

- Westhampton Beach

- Wyandanch

- Yaphank

Hours, fees, requirements, and more for Suffolk County

How do I get my forms?

Forms are available for immediate download after payment. The Suffolk County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Suffolk County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Suffolk County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Suffolk County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Suffolk County?

Recording fees in Suffolk County vary. Contact the recorder's office at (631) 852-2000 for current fees.

Questions answered? Let's get started!

To use the Transfer on Death (TOD) Deed under New York’s Real Property Law (RPP) CHAPTER 50, ARTICLE 12 § 424 (effective July 19, 2024), follow these steps:

1. Complete the TOD Deed

Designate a beneficiary: Clearly name the individual or entity (such as a charity or trust) who will inherit your property upon your death.

Include contingent beneficiaries if desired (NOT required). These are backup beneficiaries who would inherit the property if your primary beneficiary cannot (e.g., if they predecease you). Ensure the deed is filled out correctly, including the legal description of the property.

2. Execute the TOD Deed: The TOD deed must be signed by the property owner (the transferor) in the presence of two witnesses and a Notary Public. The witnesses should not be the beneficiaries themselves, as this could raise legal issues.

3. Record the TOD Deed: The completed deed must be recorded with the County Clerk's office where the property is located during your lifetime. Recording the deed is crucial because, without it, the transfer will not be valid upon your death.

4. Retain Ownership During Lifetime: After recording the TOD deed, you retain full control of the property during your lifetime. You can still sell, mortgage, or revoke the TOD deed at any time.

If you change your mind, you can revoke the TOD deed by filing a revocation form or executing a new TOD deed, which automatically invalidates the previous one.

5. Upon Your Death: Upon your death, the property automatically transfers to the designated beneficiary without going through probate.

Key points about when it takes effect:

Timing of Transfer: The deed only takes effect upon the death of the property owner. Until then, the owner retains full control over the property and can revoke or change the TOD deed at any time.

Recording Requirement: For the TOD deed to be valid, it must be recorded with the county clerk during the property owner's lifetime. If the deed is not recorded before death, it will not be effective.

Probate Avoidance: By using a TOD deed, the property passes directly to the named beneficiary without going through probate, simplifying the transfer process and reducing legal costs.

Important: Your property must be located in Suffolk County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Suffolk County.

Our Promise

The documents you receive here will meet, or exceed, the Suffolk County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Suffolk County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Mike M.

October 27th, 2020

Get Rid of the places to initial each page on the Trust Deed. The Co. Recorder (Davis) does not require that each page be initialled... If I and the "borrower" had initialed each page, then I would have to use US Mail to get the form from AZ to UT because scans of initials are not acceptable, but only a notarized signature from the borrower is...

Thank you for your feedback. We really appreciate it. Have a great day!

Jamal .

July 29th, 2020

So far so good!

Thank you!

David H.

June 8th, 2020

Exceeded expectations; bundle included not only the form but also detailed instructions and definitions and a completed "John Doe" example.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jerry K G.

August 23rd, 2022

I got what I asked for, almost instantly.

Thank you!

Sally F.

January 22nd, 2020

Amazing forms, thanks so much for making these available.

Thank you!

Emery N.

May 16th, 2019

Thank you for your service,,you have a very good site,,easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Phyllis C.

January 7th, 2022

So far So Good. Ill come back and re review after it is all finished. I have downloaded all the documents. next I need to fill them out.

Thank you!

Nancy R.

October 25th, 2024

Deeds.com is very precise, helpful and friendly. I found the form I needed without any effort and everything worked perfect and smooth. I recommend it 100%. Thank you.

We are delighted to have been of service. Thank you for the positive review!

Michael V.

April 30th, 2020

Exactly what I needed and VERY fair price. I paid $19.97 for what a local attorney wanted $200 to do. I filled out the form using the line by line guide and filed it at the court house today. Absolutely no problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra C.

December 30th, 2020

Quick and easy. Would recommend this site to everyone. Deed was sent to the site and recorded at my local county within 24 hours. Website could be set up better. Not labeled well for us that is not computer savvy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sheri L.

July 9th, 2019

Very helpful even though what I'm looking for hasnt updated yet. I'll use you again.

Thank you!

Ralph O.

September 16th, 2024

The experience has been excellent. The site gave me exactly what I was looking for. The documentation we easy to understand.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Kathyren O.

April 25th, 2019

Very helpful and I will be using your services in the near future. Thank you Kathyren Oleary

Thanks Kathyren, we really appreciate your feedback.

Melanie W.

October 23rd, 2022

I used deeds.com to complete a gift deed for transferring a house to our son. Finding the correct form and completing it correctly was extremely easy due to wonderful explanations and examples provided with the purchase of the form. The registrar filing the deed told me she was impressed with the work we did. An attorney would have charged $150 so the $28.00 was well worth the money.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary C.

August 30th, 2022

The Deeds.com site made is relatively simple to download a Beneficiary Deed form specific to St Louis, which is great, because neither the city or state provide this. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!