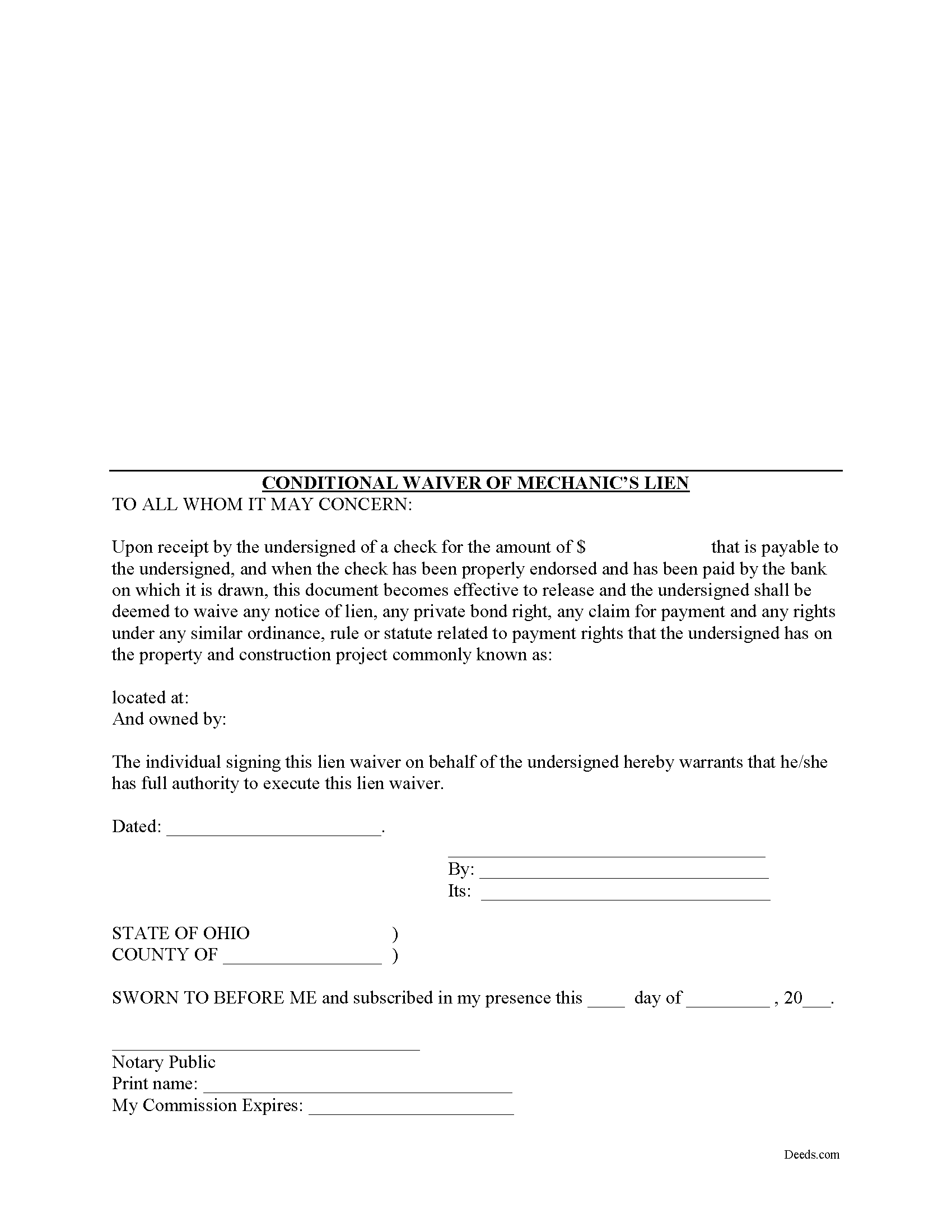

Portage County Conditional Lien Waiver Form

Portage County Conditional Lien Waiver Form

Fill in the blank Conditional Lien Waiver form formatted to comply with all Ohio recording and content requirements.

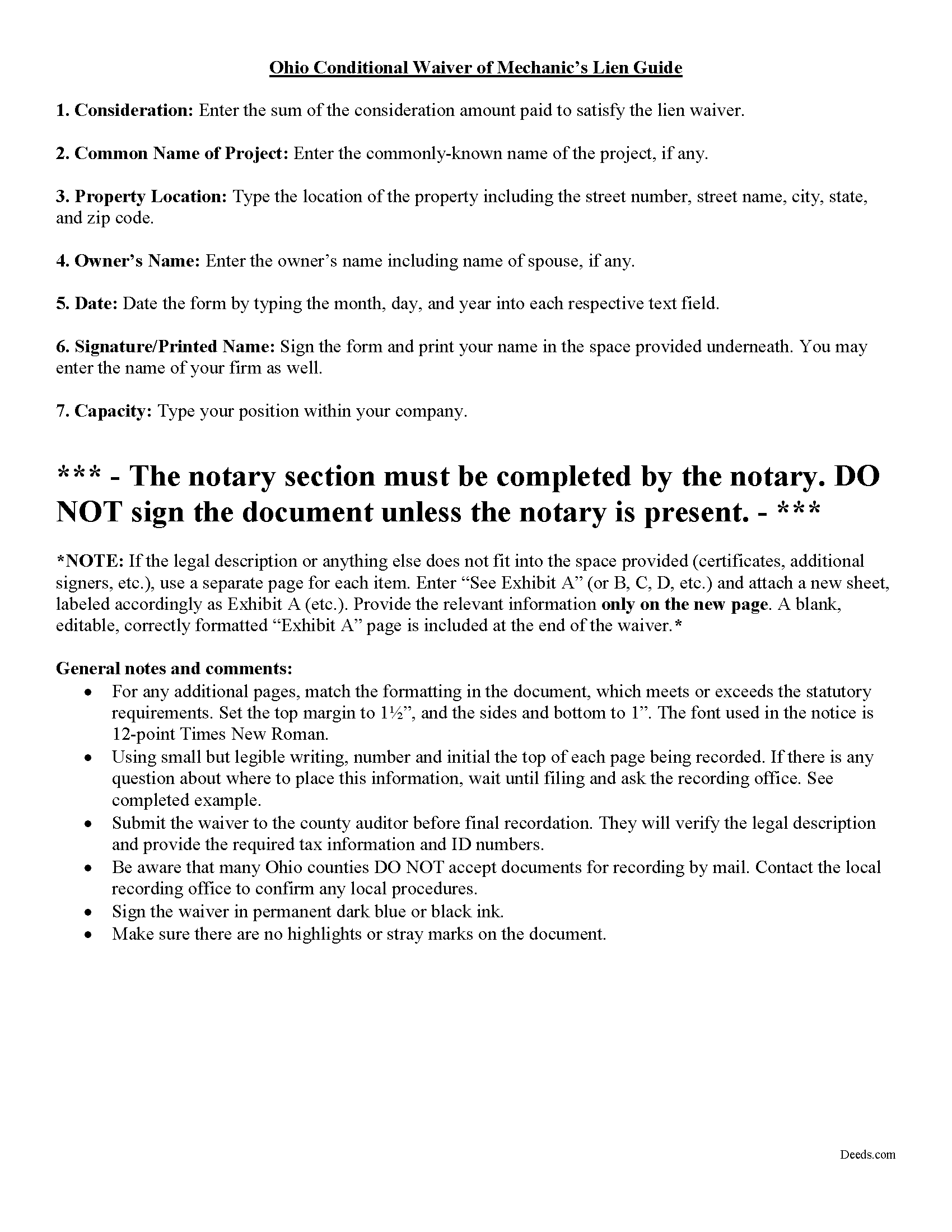

Portage County Conditional Lien Waiver Guide

Line by line guide explaining every blank on the form.

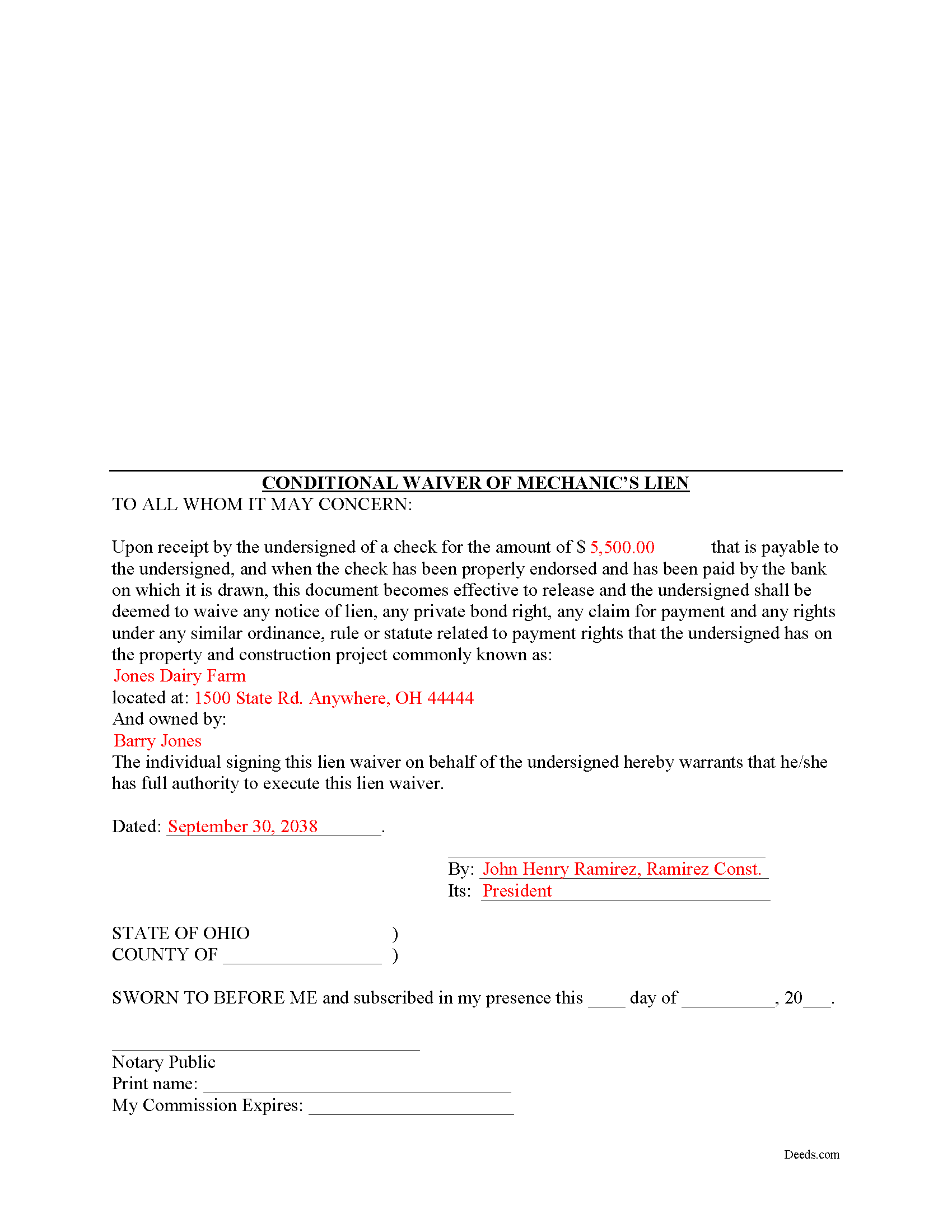

Portage County Completed Example of the Conditional Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Portage County documents included at no extra charge:

Where to Record Your Documents

Portage County Recorder

Ravenna, Ohio 44266

Hours: 8:00am and 4:00pm M-F (last filing 3:45)

Phone: 330-297-3553

Recording Tips for Portage County:

- Check that your notary's commission hasn't expired

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Portage County

Properties in any of these areas use Portage County forms:

- Atwater

- Aurora

- Brady Lake

- Deerfield

- Diamond

- Garrettsville

- Hiram

- Kent

- Mantua

- Mogadore

- North Benton

- Randolph

- Ravenna

- Rootstown

- Streetsboro

- Wayland

- Windham

Hours, fees, requirements, and more for Portage County

How do I get my forms?

Forms are available for immediate download after payment. The Portage County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Portage County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Portage County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Portage County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Portage County?

Recording fees in Portage County vary. Contact the recorder's office at 330-297-3553 for current fees.

Questions answered? Let's get started!

Ohio's mechanic's lien law does not provide for a statutory lien waiver form, but Ohio courts recognize elective lien waivers under principles of contract law. The waivers identify the claimant, the party responsible for paying, the project, relevant dates, and the amount paid. Sign the completed waiver in front of a notary, then record it in the land records of the county where the project is located.

In general, a lien waiver is used to release an owner's property from a lien claim, either in full or in part, and either conditional, meaning the payment must clear the bank prior to waiving lien rights, or unconditional, meaning that the claimant waives the lien immediately, regardless of whether or not the payment clears the bank.

For instance, if the customer owes $5,000.00 on a construction job and remits a partial payment of $2,500.00, the payor may request a waiver that states he or she has paid that amount and in turn the claimant will give up the right to a lien for $2,500.00 of the total amount. If the check has not yet cleared the bank, use a conditional waiver that is only effective upon actual receipt of payment.

Each case is unique, and the lien law is complicated so contact an attorney familiar with Ohio mechanic's liens with specific questions or for complex situations.

Important: Your property must be located in Portage County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver meets all recording requirements specific to Portage County.

Our Promise

The documents you receive here will meet, or exceed, the Portage County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Portage County Conditional Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Nawal F.

June 1st, 2023

Friendly user

Thank you!

Terry M.

January 8th, 2020

Very responsive. I was notified very quickly if the deed I was looking for was available.

Thank you!

barbara m.

March 16th, 2021

deeds.com is the most efficient, easy to use site for legal forms I've found! Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dee S.

October 24th, 2023

Great service and so quick at responding!

We are motivated by your feedback to continue delivering excellence. Thank you!

Walter K.

November 24th, 2021

Works ok but could have more specific information. My wife and I both own the Quit Claim property, should we both sign as Grantors?

Thank you!

Lowell P.

May 26th, 2020

Exceptionally helpful instruments that are compliant with State law and anticipate various contingencies. Very pleased.

Thank you for your feedback. We really appreciate it. Have a great day!

gary c.

January 26th, 2022

process was easy and simple to do

Thank you for your feedback. We really appreciate it. Have a great day!

Kim H.

October 17th, 2020

Great site. quick turnaround and communication. I needed an exception that they told me I needed and where to get the info within hours. I returned warranty deed with exception and the deed was recorded the same day! Great turnaround!

Thank you for your feedback. We really appreciate it. Have a great day!

Peggy H.

December 9th, 2022

Very good!

Thank you!

James A.

January 2nd, 2020

Good.

Thank you!

Quanah N.

July 30th, 2022

Instruction easy to follow

Thank you!

Ron S.

April 5th, 2019

Fair price and beneficiary deed was recorded without issue. Completion instructions provided were insufficient in some cases.

Thank you!

Mikel R.

February 16th, 2021

Definitely recommend. Superb customer service. Well worth the money! Thanks again!

Thank you for your feedback. We really appreciate it. Have a great day!

Ariel S.

June 3rd, 2020

Awesome....love the ease of use and response.

Thank you for the kinds words Ariel, we appreciate you! Have a fantastic day!

Christine K.

March 26th, 2021

This site was fast and easy to use. I would highly recommend using them. Thank you Deeds.com!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!