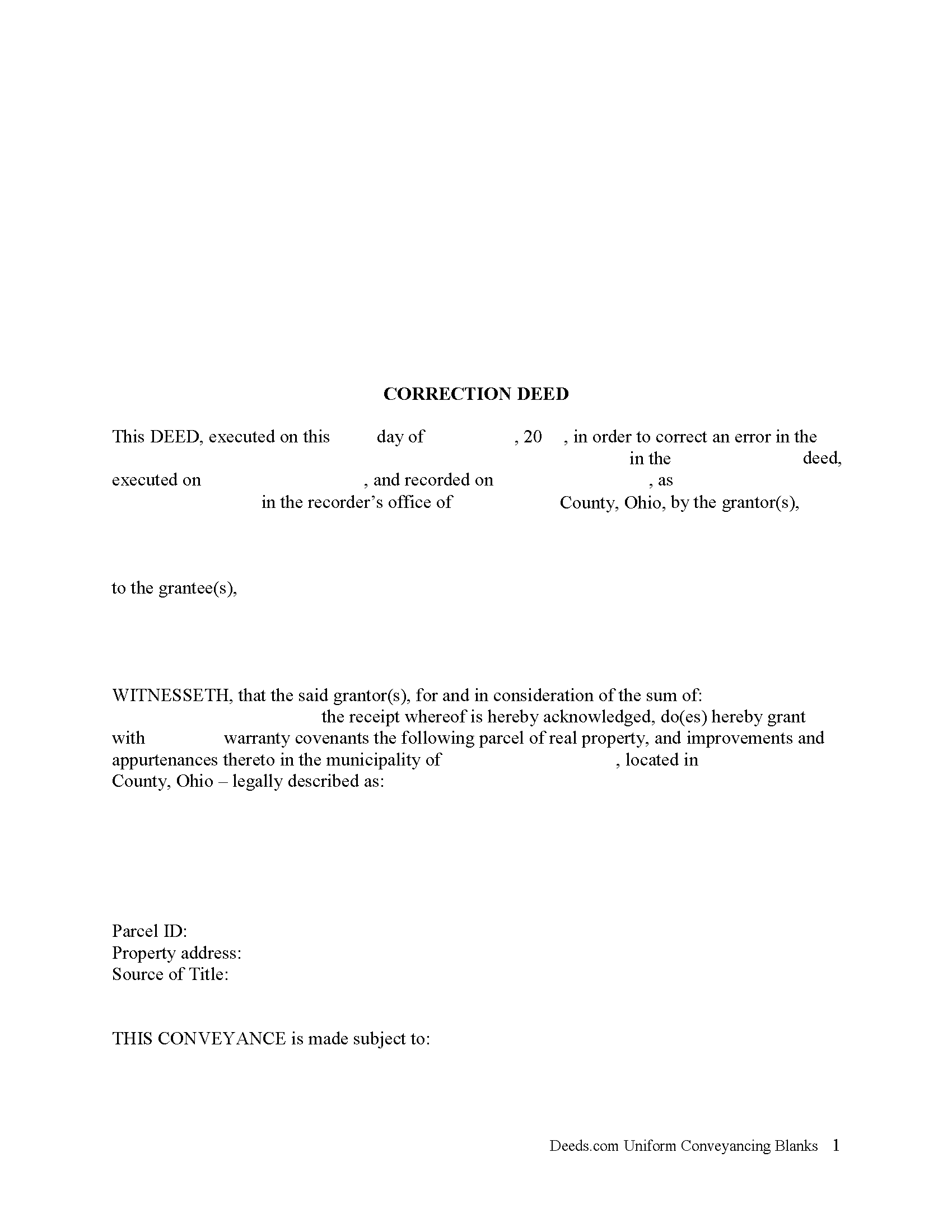

Lucas County Correction Deed Form

Lucas County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

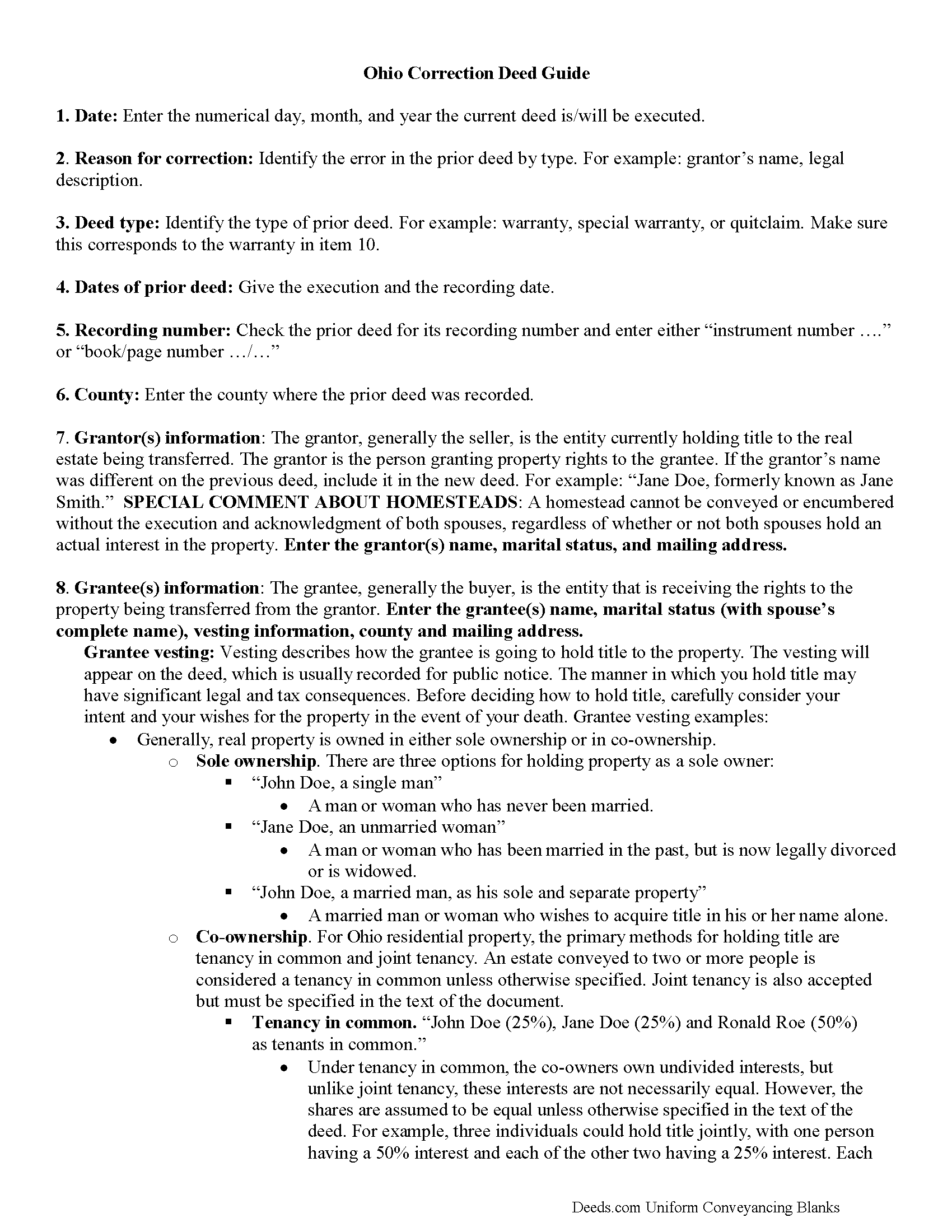

Lucas County Correction Deed Guide

Line by line guide explaining every blank on the form.

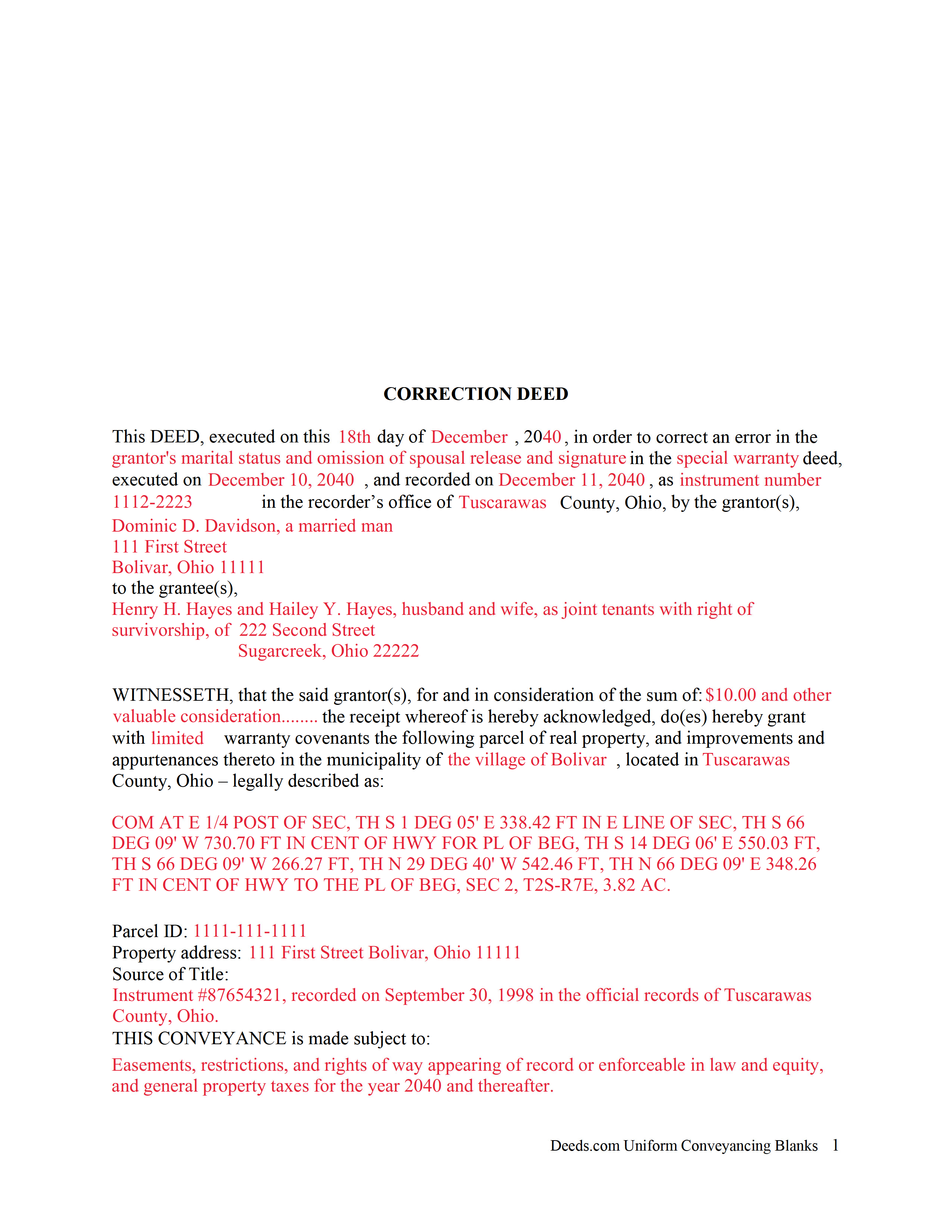

Lucas County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Lucas County documents included at no extra charge:

Where to Record Your Documents

Lucas County Recorder

Toledo, Ohio 43604

Hours: Monday through Friday 8:00 - 5:00 / Recording until 4:30

Phone: 419-213-4400

Recording Tips for Lucas County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Double-check legal descriptions match your existing deed

- Bring extra funds - fees can vary by document type and page count

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Lucas County

Properties in any of these areas use Lucas County forms:

- Berkey

- Harbor View

- Holland

- Maumee

- Monclova

- Neapolis

- Oregon

- Sylvania

- Toledo

- Waterville

- Whitehouse

Hours, fees, requirements, and more for Lucas County

How do I get my forms?

Forms are available for immediate download after payment. The Lucas County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lucas County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lucas County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lucas County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lucas County?

Recording fees in Lucas County vary. Contact the recorder's office at 419-213-4400 for current fees.

Questions answered? Let's get started!

In Ohio, a deed can be corrected either by re-recording the prior deed with corrections made directly on it, or by recording a new deed, called correction or corrective deed. In both cases, the reason for the correction, the recording number and execution/recording dates need to be stated. The choice between the two options may depend on county preference or the nature of the defect. Correction in general is only effective when it clarifies or completes the title of the prior deed. Altering the nature of the document by means of a correction deed is not advisable.

Thus, correcting the name or missing initial in the grantor's or grantee's name, the grantee's tax address, a minor error in the acknowledgement or even in the legal description can all be achieved through a correction deed. If the grantor re-acknowledges the corrected deed, errors of omission can be resolved as well, as can the marital status and spousal release and more serious errors in the legal description.

The Ohio Bar Association publishes guidelines for title standards and advise to never use a correction deed in order to add or delete a grantee, to make major changes in the legal description, such as a changing the lot number, or to add or delete restrictive covenants or easements. Taking minimal requirements for sufficiency and definiteness as the standard for effective conveyances, they list and explain errors that may not impair the marketability of a title and indicate that "lapse of time, subsequent conveyances, the manifest or typographical nature of errors or omission, accepted rules of construction and other considerations should be relied upon to approve marginally sufficient or questionable descriptions" (Ohio Title Standards, section 3.2, 2012).

In many counties, submit all deeds to the assessor prior to recording. Sometimes, only changes to the legal description need to be approved by the auditor before they can be recorded. The statement of value form DTE 100-EX needs to accompany the correction deed and indicate the reason for exemption. Bear in mind, however, that any changes to the legal description may affect transfer tax assessment. Spend time considering the different outcomes of each option and contact the local authorities, either the recorder's or the auditor's office for specific requirements and practices.

(Ohio Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Lucas County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Lucas County.

Our Promise

The documents you receive here will meet, or exceed, the Lucas County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lucas County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4579 Reviews )

Wes C.

March 26th, 2022

The forms are easy to use and the examples and guidance are easy to understand and follow.

Thank you for your feedback. We really appreciate it. Have a great day!

Curley B.

January 6th, 2023

So far, I'm pleased. I am a first-time user, as most of my clients are in California. I look forward to working with you more in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Anthony P.

December 7th, 2021

Documents exactly as described, no complaints.

Thank you!

Nancy A.

June 23rd, 2021

First time user and I was pleasantly surprised how quick and easy it was to get my Deed recorded. And the fee was not outrageous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cecilia G.

July 24th, 2023

This site is so easy to use. It is so convenient to have access to forms for all states. I’d recommend this site to anyone who needs to create any real estate documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Jenine E.

April 4th, 2021

The information seems complete and accurate. The form was easy to use and save. I'll let you know if we encounter problems getting the deed processed.

Thank you for your feedback. We really appreciate it. Have a great day!

Fernando V.

February 28th, 2023

Excellent!

Thank you!

Emanuel W.

December 16th, 2021

Excellent service! We surely use again

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca V.

May 18th, 2023

The staff is Great to work with, Thank You

Thank you!

Karelia W.

February 14th, 2024

Was a bit skeptical because I'd never heard of it, but just got something submitted and confirmed recorded in less than 24 hrs. UI could use some work but other than that, straightforward and works!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Nancy B.

July 22nd, 2021

Very user-friendly. Looks like everything I needed in one place. Great job.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bertha V. G.

May 17th, 2019

Great information and very easy to understand.

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel B.

October 29th, 2019

A very easy to use and reasonably priced site. My documents were immediately available as was my receipt.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Glenn W.

May 5th, 2021

I love this tool and it is easy to work with. The interface is straight forward and notifications are consistently accurate.

Thank you for your feedback. We really appreciate it. Have a great day!

Lauren W.

October 30th, 2019

I took a chance and downloaded the Beneficiary Deed form -- would have liked to have been able to see the form before I paid, but I took a chance as everywhere else I looked online wanted me to fill out form online and then pay $30+ for each deed. I'm doing several, so I was glad to be able to just download the blank form that appears to be one I can directly type into on my computer. Yay! Would use your site again if needed. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!