Ohio Fiduciary Deed Forms

Ohio Fiduciary Deed Overview

How to Use This Form

- Select your county from the list on the left

- Download the county-specific form

- Fill in the required information

- Have the document notarized if required

- Record with your county recorder's office

Ohio Fiduciary Deed for Executors and Administrators

Probate is the legal process of settling and distributing a decedent's estate according to the terms of a probated will or laws of intestate succession. In the context of estate administration, a fiduciary is either an executor (when named in a will) or an administrator (when the decedent dies without a will or does not name an executor) assigned by the court of common pleas to administer the decedent's estate.

If the estate's assets are insufficient to pay debts, the fiduciary may need to sell the decedent's property. Fiduciaries must obtain the court's permission to sell assets from the estate, unless authorized or directed by the decedent's will.

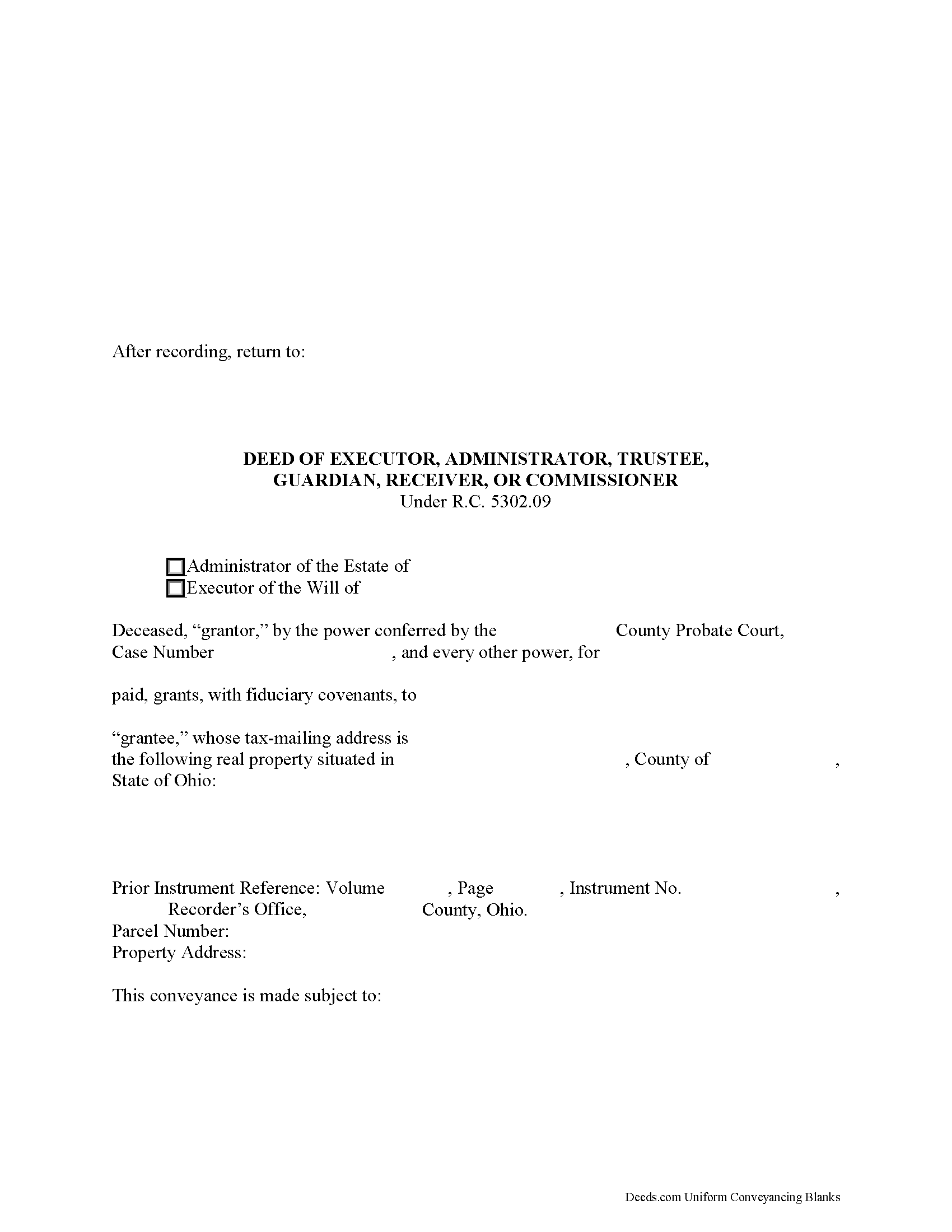

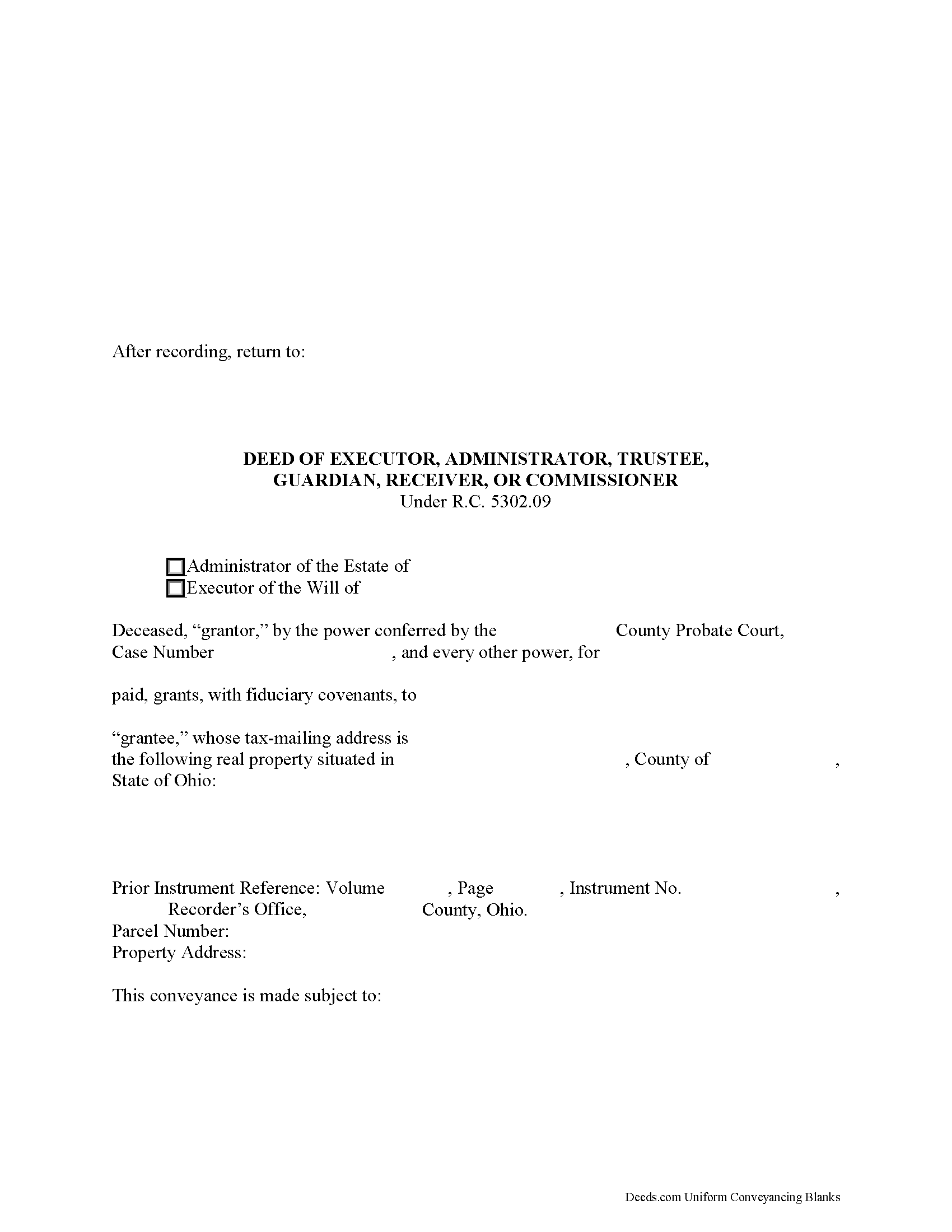

In Ohio, executors and administrators use fiduciary deeds to convey real property from an estate to a purchaser pursuant to a court order. A fiduciary deed is a statutory form (R.C. 5302.09) containing fiduciary covenants that the grantor is the duly appointed, qualified, and acting fiduciary, and that he or she is authorized to make the sale and conveyance of the within described real property. Additionally, the grantor covenants with the grantee that in the proceedings of the sale, he or she has complied with statutory requirements (5302.10).

A fiduciary deed names the executing fiduciary's as grantor, and identifies the county and case number in which the decedent's estate is opened in probate. The deed states the amount of consideration the grantee is paying for the transfer of title, and titles the property in the name and manner of vesting of the grantee.

Deeds in Ohio require a recital of the grantor's source of title, including the prior instrument volume and page numbers. A full legal description of the subject parcel is required. Any restrictions on the property should also be noted. The executing fiduciary must sign the deed in the presence of a notary public before recording in the county where the subject property is located.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Ohio with questions regarding fiduciary deeds, as each situation is unique.

(Ohio Fiduciary Deed Package includes form, guidelines, and completed example)

Important: County-Specific Forms

Our fiduciary deed forms are specifically formatted for each county in Ohio.

After selecting your county, you'll receive forms that meet all local recording requirements, ensuring your documents will be accepted without delays or rejection fees.

How to Use This Form

- Select your county from the list above

- Download the county-specific form

- Fill in the required information

- Have the document notarized if required

- Record with your county recorder's office

Common Uses for Fiduciary Deed

- Transfer property between family members

- Add or remove names from property titles

- Transfer property into or out of trusts

- Correct errors in previously recorded deeds

- Gift property to others