Miami County Fiduciary Deed Form

Last validated January 29, 2026 by our Forms Development Team

Miami County Fiduciary Deed Form

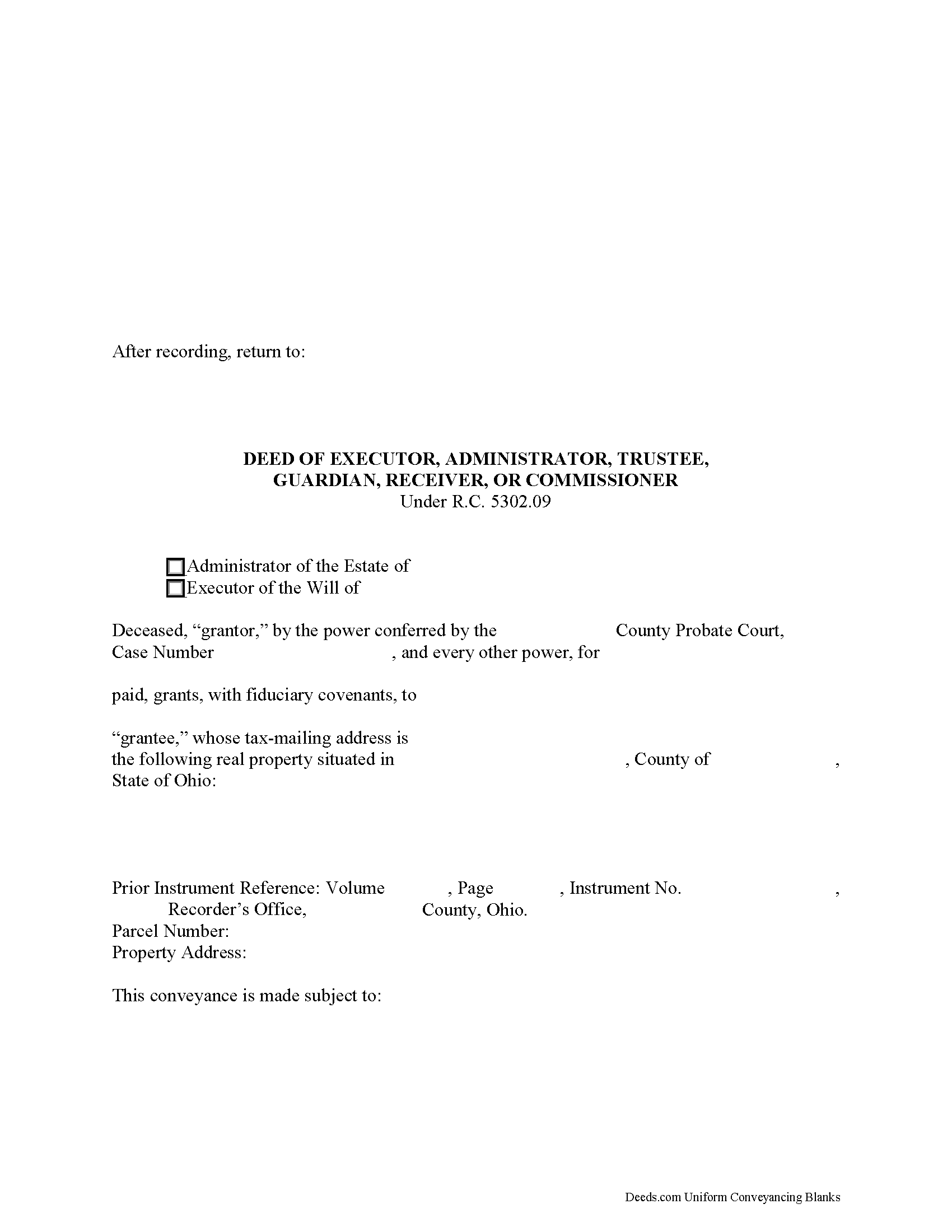

Fill in the blank form formatted to comply with all recording and content requirements.

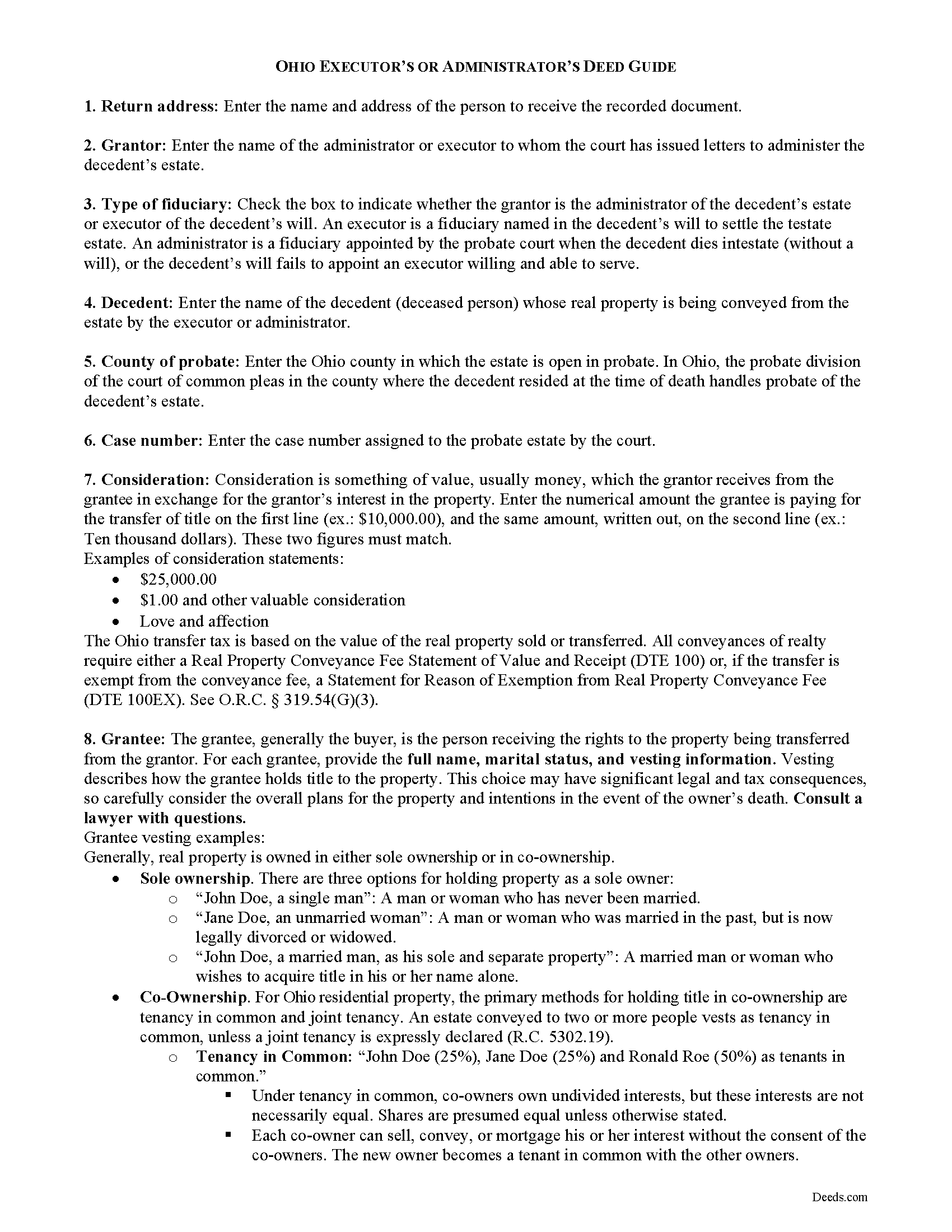

Miami County Fiduciary Deed Guide

Line by line guide explaining every blank on the form.

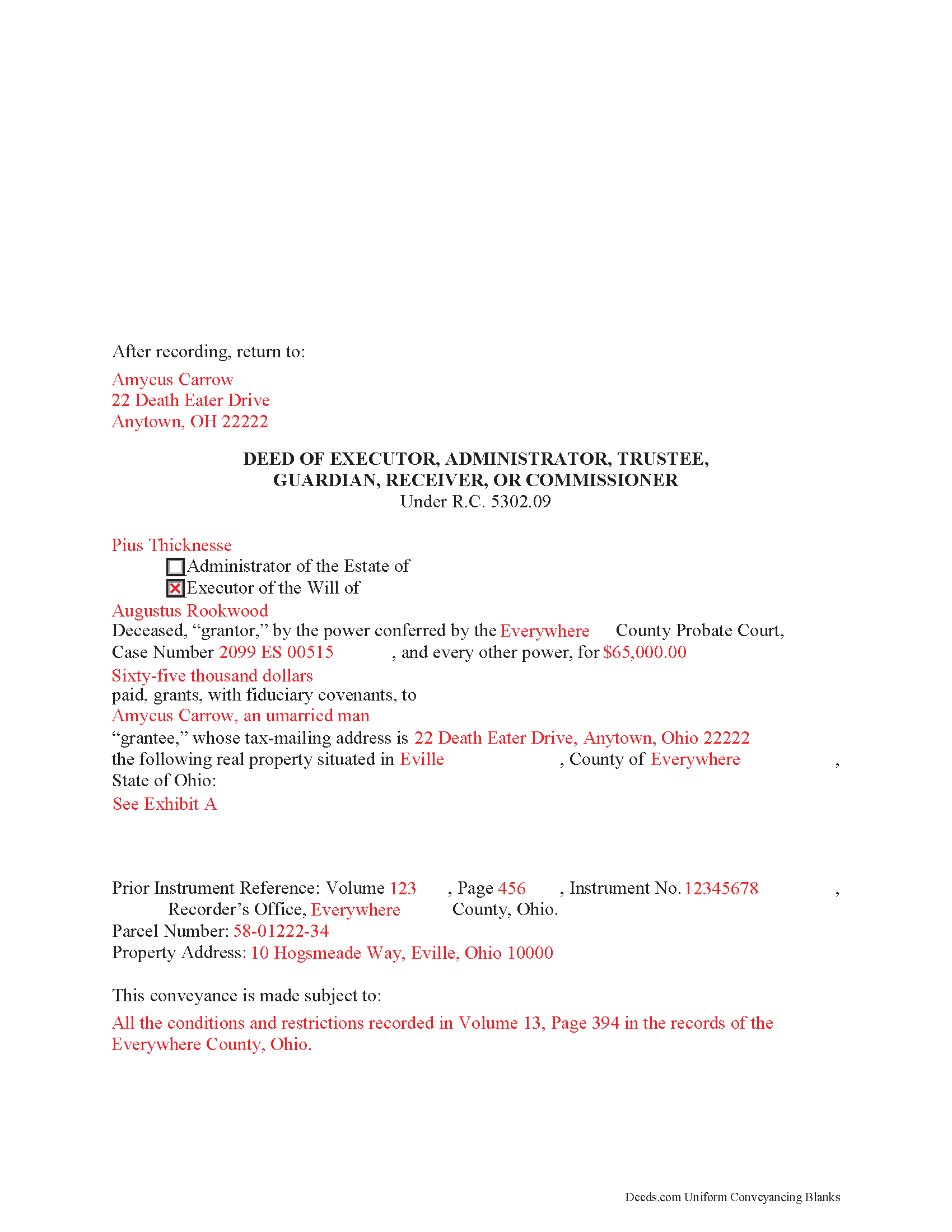

Miami County Completed Example of the Fiduciary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Miami County documents included at no extra charge:

Where to Record Your Documents

Miami County Recorder

Troy, Ohio 45373

Hours: 8:00am and 4:00pm.M-F

Phone: 937-440-6040

Recording Tips for Miami County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Make copies of your documents before recording - keep originals safe

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Miami County

Properties in any of these areas use Miami County forms:

- Bradford

- Casstown

- Conover

- Covington

- Fletcher

- Laura

- Ludlow Falls

- Piqua

- Pleasant Hill

- Potsdam

- Tipp City

- Troy

- West Milton

Hours, fees, requirements, and more for Miami County

How do I get my forms?

Forms are available for immediate download after payment. The Miami County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Miami County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Miami County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Miami County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Miami County?

Recording fees in Miami County vary. Contact the recorder's office at 937-440-6040 for current fees.

Questions answered? Let's get started!

Ohio Fiduciary Deed for Executors and Administrators

Probate is the legal process of settling and distributing a decedent's estate according to the terms of a probated will or laws of intestate succession. In the context of estate administration, a fiduciary is either an executor (when named in a will) or an administrator (when the decedent dies without a will or does not name an executor) assigned by the court of common pleas to administer the decedent's estate.

If the estate's assets are insufficient to pay debts, the fiduciary may need to sell the decedent's property. Fiduciaries must obtain the court's permission to sell assets from the estate, unless authorized or directed by the decedent's will.

In Ohio, executors and administrators use fiduciary deeds to convey real property from an estate to a purchaser pursuant to a court order. A fiduciary deed is a statutory form (R.C. 5302.09) containing fiduciary covenants that the grantor is the duly appointed, qualified, and acting fiduciary, and that he or she is authorized to make the sale and conveyance of the within described real property. Additionally, the grantor covenants with the grantee that in the proceedings of the sale, he or she has complied with statutory requirements (5302.10).

A fiduciary deed names the executing fiduciary's as grantor, and identifies the county and case number in which the decedent's estate is opened in probate. The deed states the amount of consideration the grantee is paying for the transfer of title, and titles the property in the name and manner of vesting of the grantee.

Deeds in Ohio require a recital of the grantor's source of title, including the prior instrument volume and page numbers. A full legal description of the subject parcel is required. Any restrictions on the property should also be noted. The executing fiduciary must sign the deed in the presence of a notary public before recording in the county where the subject property is located.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Ohio with questions regarding fiduciary deeds, as each situation is unique.

(Ohio Fiduciary Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Miami County to use these forms. Documents should be recorded at the office below.

This Fiduciary Deed meets all recording requirements specific to Miami County.

Our Promise

The documents you receive here will meet, or exceed, the Miami County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Miami County Fiduciary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4648 Reviews )

Wayne R.

February 22nd, 2021

Couldn't believe how simple it was to do such a very important family support task and the price was right! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth F.

February 14th, 2022

This was great other than exemption codes did not populate and I couldn't refer to it.

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

October 10th, 2022

I got what I expected. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Pegi B.

January 24th, 2022

This service is fast and easy to use. We will definitely use this service again. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maria S.

January 10th, 2019

The paperwork/forms are fine, but there isn't enough explanation for me to figure out how to file the extra forms (which I do need in my case). The main form, Deed Upon Death is fine. I think the price is pretty high for these forms. I wouldn't have purchased it because there are places to get them for much cheaper (about 6 dollars), but this site had the extra forms I wanted (property in a trust and another form). Unfortunately these were included as a "courtesy" and there are no instructions for them. So three stars for being clear about what was in the package, having the right forms that I need, but instructions for putting them to use and price took a couple of stars off. Downloading was easy and once you download you can type the info into the PDF--that makes working with the forms much easier.

Thank you for the feedback Maria. Regarding the supplement documents, it is best to get assistance from the agency that requires them. These are not legal documents, they should provide full support and guidance for them.

Lester A.

May 29th, 2020

Couldnt have been easier. Docs recorded the next day!

Thanks Lester, glad we could help.

MARY LACEY M.

May 28th, 2025

Deeds.com has become a great assistant to our firm! The service is of highest quality and consistently helpful to our law firm in its recording needs. It's summer in Arizona and no one I know wants to drive to downtown Phoenix to record a property deed so think I will add "grateful" to my praise.

Thank you, Mary! We appreciate your kind words and are glad to help make recording easier — especially when it means avoiding a summer trip to downtown Phoenix. We’re grateful for your continued trust.

Soledad T.

August 30th, 2021

It's Great!!!

Thank you!

Christine G.

April 23rd, 2021

. Easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Jina N.

January 29th, 2019

Awesome site!! You guys really make it simple to understand and access any Deeds that I need. I know you keep very up to date forms, as my county is hard core when it comes to the smallest of details, even compared to every other county across the state. Yet you made it simple and quick, and I never had to redo anything. Even the clerk was impressed that I had it filled out correctly the first time, as that usually never happened. Even the size of type/font and the margins were perfect. That saved a lot of time, money and most of all, frustration. I've recommended you to relatives, friends and co-workers. Thanks to the staff at deeds dot com !! I truly appreciate you. j

Thank you!

Mary G.

March 7th, 2021

Deeds.com was a fast and easy site to use the staff answered my questions online efficiently

Thank you!

Kerrin S.

April 11th, 2020

Wow, this was so easy & helpful. I didn't get it finished in time for recording, so I'm still waiting on that part, but the rest was simple and straight-forward. Thanks!

Thank you!

Patricia M.

August 19th, 2019

Very easy site to navigate and very helpful information

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Matthew C.

March 29th, 2022

Your Transfer on Death Deed is fine and you have plenty of information about that part. But where is the Confirmatory Deed that is required in many jurisdictions in order to actually pass ownership of a property when the Transfer on Death Deed becomes effective? IT IS MISSING!!

Thank you for your feedback. We really appreciate it. Have a great day!

LINDA S.

November 11th, 2020

This was SO much easier than having to go down to the county recorder's office. I would definitely use this company again!

Thank you for your feedback. We really appreciate it. Have a great day!