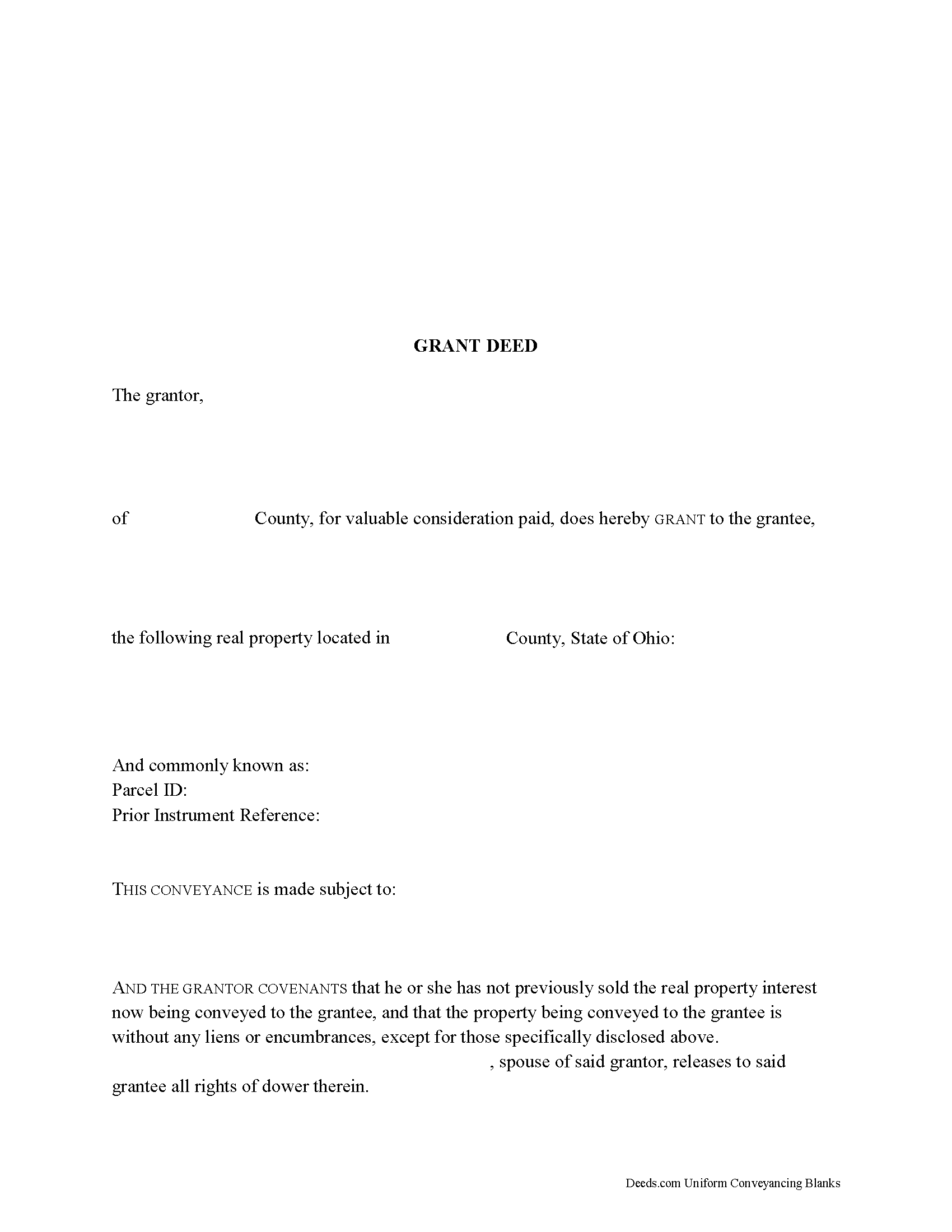

Washington County Grant Deed Form

Washington County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

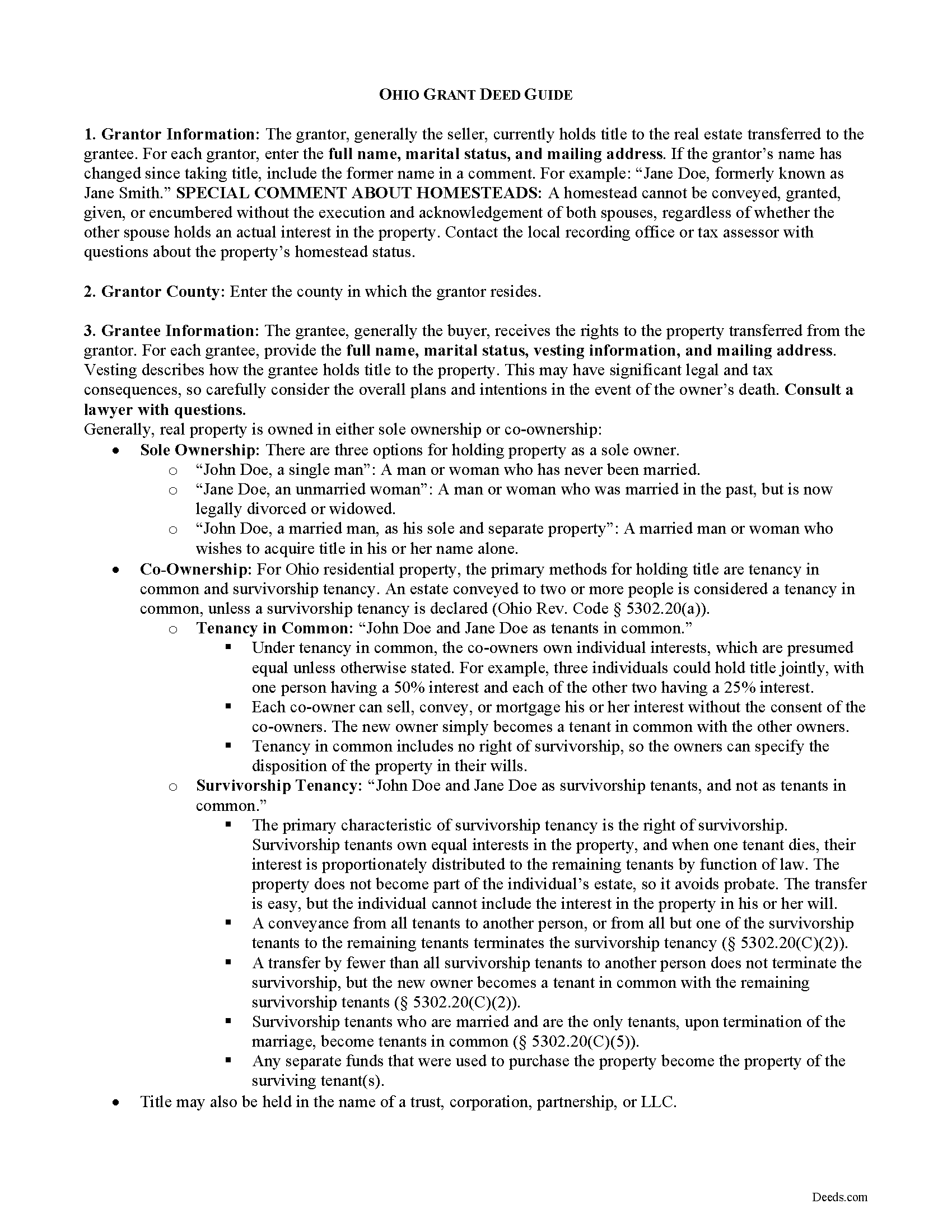

Washington County Grant Deed Guide

Line by line guide explaining every blank on the form.

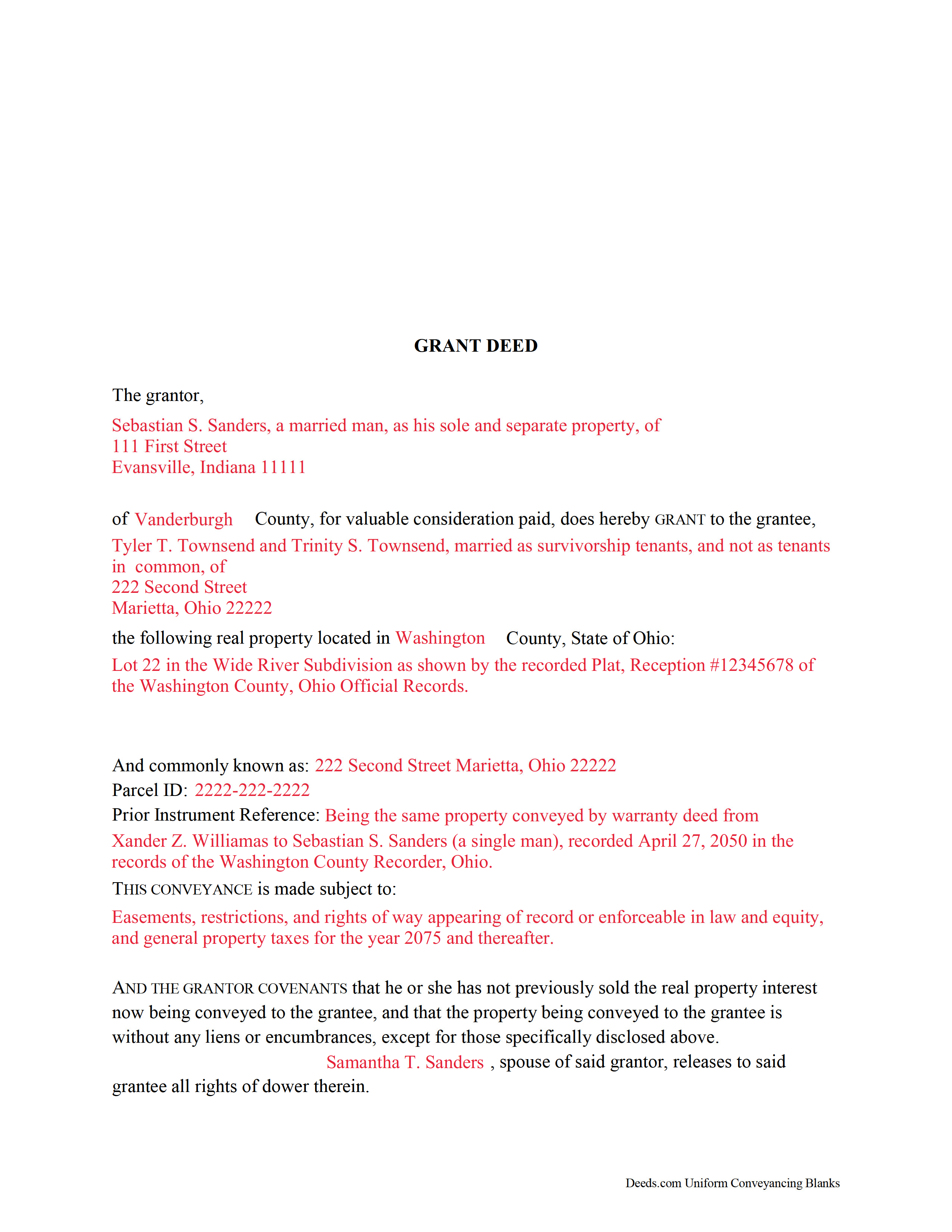

Washington County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Washington County documents included at no extra charge:

Where to Record Your Documents

Washington County Recorder

Marietta, Ohio 45750

Hours: 8:00am to 5:00pm Monday through Friday / Recording until 4:15pm

Phone: 740-373-6623 Ext 235 or 236

Recording Tips for Washington County:

- Recording fees may differ from what's posted online - verify current rates

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Washington County

Properties in any of these areas use Washington County forms:

- Barlow

- Bartlett

- Belpre

- Beverly

- Coal Run

- Cutler

- Fleming

- Graysville

- Little Hocking

- Lowell

- Lower Salem

- Macksburg

- Marietta

- New Matamoras

- Newport

- Reno

- Vincent

- Waterford

- Watertown

- Whipple

- Wingett Run

Hours, fees, requirements, and more for Washington County

How do I get my forms?

Forms are available for immediate download after payment. The Washington County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Washington County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Washington County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Washington County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Washington County?

Recording fees in Washington County vary. Contact the recorder's office at 740-373-6623 Ext 235 or 236 for current fees.

Questions answered? Let's get started!

In Ohio, title to real property can be transferred from one party to another by executing a grant deed. A standard grant deed conveys an interest in real property to the named grantee with covenants that the title is free of any encumbrances (except for those stated in the deed) and that the grantor holds an interest in the property and is free to convey it. These covenants should be explicitly made in the text of the deed.

In Ohio, a lawful grant deed includes the grantor's full name, mailing address, and marital status; the statement "for valuable consideration paid"; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For Ohio residential property, the primary methods for holding title in co-ownership are tenancy in common and survivorship tenancy. An estate conveyed to two or more people is considered a tenancy in common, unless a survivorship tenancy is declared (Ohio Rev. Code Section 5302.20(a)).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Contact the county auditor to verify the legal description prior to recording. In Ohio, any deeds that modify a legal description or contain a new legal description require the name and address of the surveyor who created the legal description (Ohio Rev. Code Section 5301.25(B)). All new metes and bounds descriptions prepared by a registered surveyor must be accompanied by a signed and sealed plat of survey.

Ohio law requires deeds to include a reference to the instrument granting title to the current grantor (Ohio Rev. Code Section 5301.011). That document's volume and page or instrument number should appear on the face of the deed, as well as the county where the document is filed.

Ohio recognizes dower rights, which means that if a married man or woman owns an interest in real property, his or her spouse automatically holds an interest in 1/3 of the real property, if they have not relinquished or been barred from it (Ohio Rev. Code Section 2103.02). As such, if the grantor is married and his or her spouse retains dower rights to the property being conveyed, the spouse must relinquish his or her dower rights. If applicable, the spouse's name should appear on the face of the deed. Consult a lawyer with questions regarding dower rights and release.

Detail any restrictions associated with the property and sign the deed in the presence of a notary public or other authorized official. Finally, the form must meet all state and local standards for recorded documents. Submit the deed to the appropriate county auditor's office before recording, to update the county's tax list (Ohio Rev. Code Section 319.20).

Record the deed at the recorder's office in the county where the property is located. Contact the same office to confirm accepted forms of payment. A Conveyance Fee Statement (Form DTE 100, or DTE 100EX if claiming an exemption) must be signed by the grantee and filed with the deed.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about grant deeds, or for any other issues related to the transfer of real property in Ohio.

(Ohio Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Washington County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Washington County.

Our Promise

The documents you receive here will meet, or exceed, the Washington County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Washington County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Charles H.

December 8th, 2020

Website is user-friendly and very helpful, butI will have to wait until I submit my documents to the Clerk of Court to see if they are acceptable.

Thank you for your feedback. We really appreciate it. Have a great day!

Heather T.

January 21st, 2022

Thank you for making this so easy

Thank you!

Johnnie W.

June 26th, 2023

Five stars for quick retrieval/no hassle of forms. Will review them again once I have completed the forms and they have been accepted.

Thank you for your feedback. We really appreciate it. Have a great day!

Juanita B.

November 12th, 2020

Very easy and fast transaction. Thank you for complete set of forms needed for property transfer.

Thank you for your feedback. We really appreciate it. Have a great day!

David W.

March 10th, 2021

Thanks to all of you. You provide a great service! Dave in Ca.

Thank you for your feedback. We really appreciate it. Have a great day!

Rhonda D.

February 24th, 2021

The boxes do not allow you to add the entire information. The after recording return to box would not let me add a zipcode.

Thanks for the feedback Rhonda, we’ll take a look at that input field.

Richard W.

May 25th, 2023

Very happy I tried your service/product. The quit deed forms were excepted by the register of deeds with no issue. Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Randy F.

March 19th, 2020

SO FAR SO GOOD, DOC'S DOWNLOADED WITHOUT A PROBLEM

Thank you!

Veronica F.

April 24th, 2019

Im so happy with this site. It was quick and painless and worth the money hassle free if I ever need to settle another deed I will be back.

Thank you Veronica, we really appreciate your feedback.

Susan N.

July 29th, 2020

Very easy to use and I received the information in a timely manner. I will use this service again.

Thank you!

Stephen E.

May 6th, 2020

Thank you for your great response on my needs. In less than 24 hours I had my documents in hand as needed. Looking forward to working with Deeds.com again. Steve Esler

Thank you for your feedback Steve, glad we could help.

Linda D.

July 17th, 2019

It was easy to download the form I wanted BUT there were 2 other options listed for "open/download." I didn't want to risk more charges for something I couldn't determine I needed so I passed them up. There were a few others listed with the option to "view" so I did that, without down-loading, and there were no additional charges. I would've liked that opportunity for 2 others that didn't offer "view" so maybe deeds.com missed a sale?

Thank you for your feedback Linda. All the documents available for download in your account are included with your payment, no additional charges.

Patricia W.

January 29th, 2019

The "Trustee's Deed" should have been labeled a Deed of Trust because that's what it really is. So now I just wasted $19.97 getting something I can't use.

Thank you for your feedback. Sorry to hear of your confusion. We have canceled your order and payment for the trustee's deed document.

Iva R.

August 20th, 2020

Great service. Fast, got everything done (form, recording) done in a couple of hours, lightning speed in the real estate world. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Sandra P.

July 25th, 2020

Thank so much! It' was pretty easy with the help of my Brother in-law .

Thank you for your feedback. We really appreciate it. Have a great day!