Graham County Correction Deed Form

Last validated March 4, 2026 by our Forms Development Team

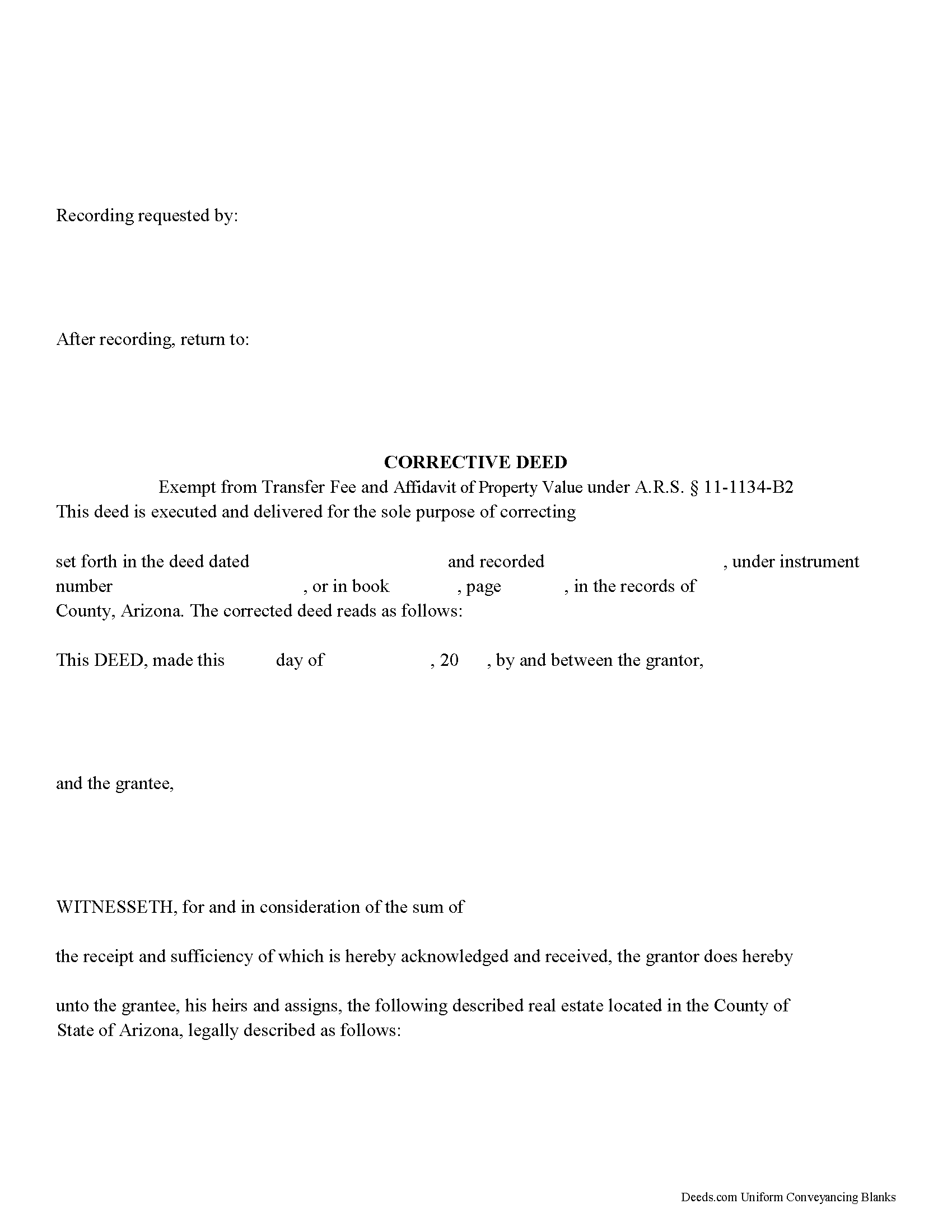

Graham County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

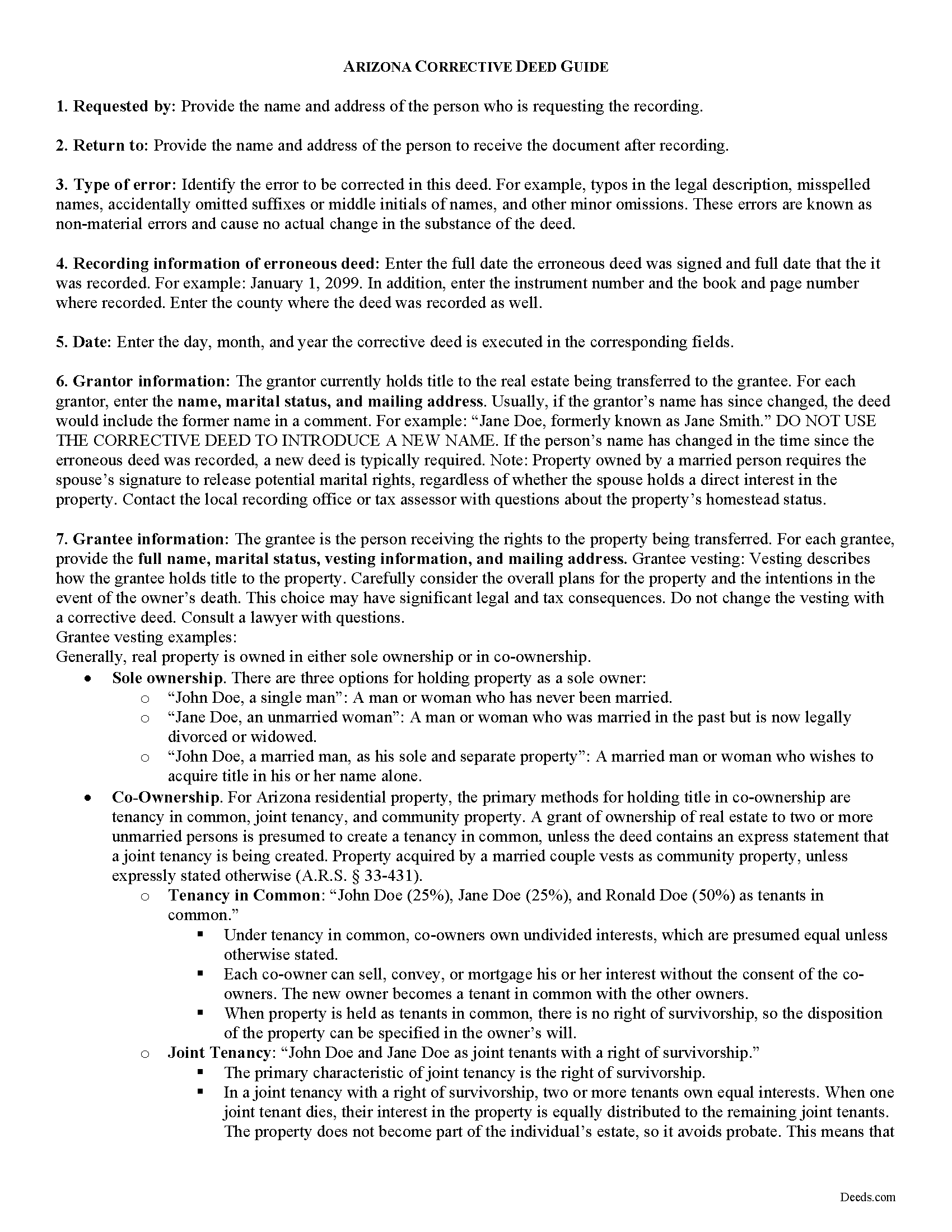

Graham County Correction Deed Guide

Line by line guide explaining every blank on the form.

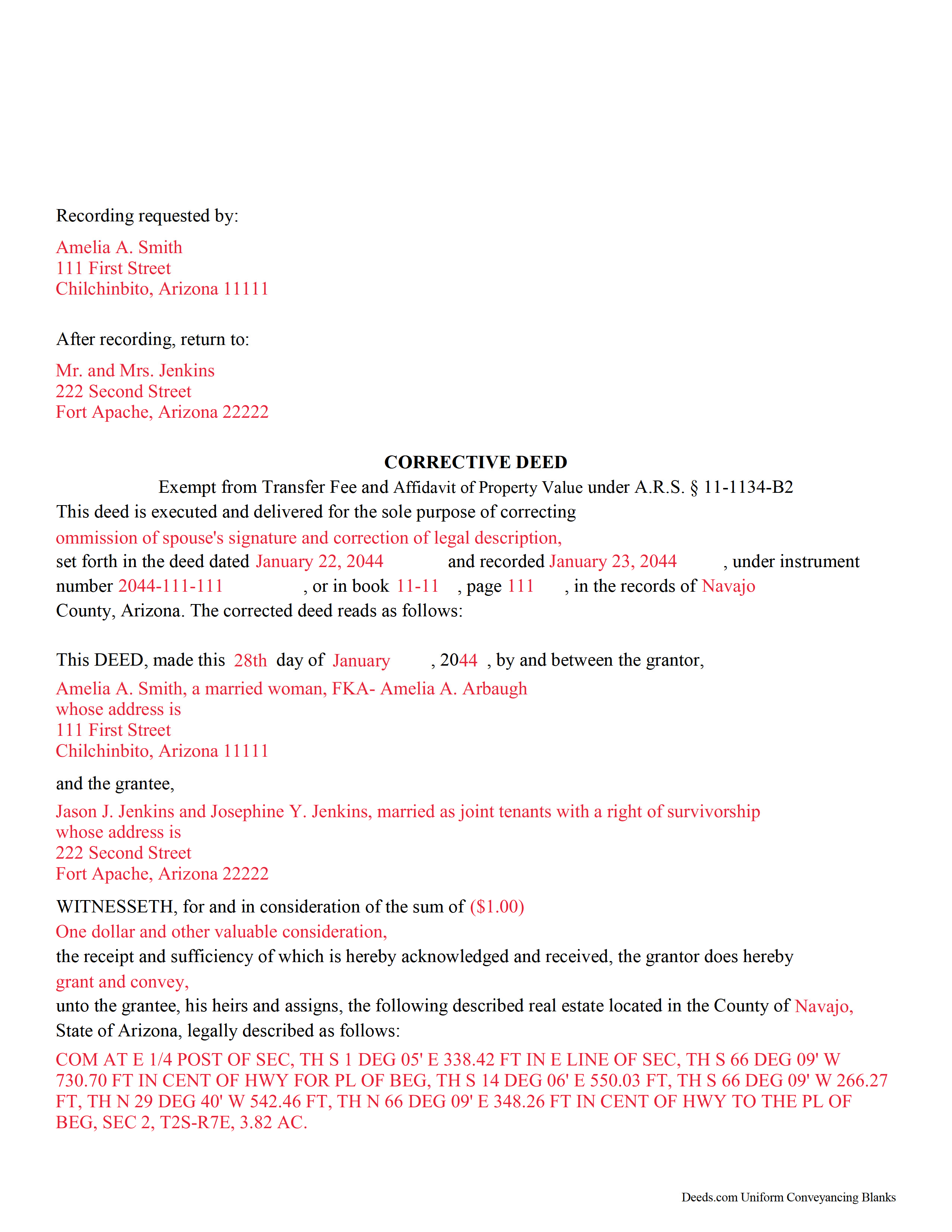

Graham County Completed Example of a Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Graham County documents included at no extra charge:

Where to Record Your Documents

County Recorder

Safford, Arizona 85546 / 85548

Hours: 7:00 a.m. to 6:00 p.m. Monday through Thursday / e-Recording until 5 on Friday

Phone: 928-428-3560

Recording Tips for Graham County:

- Documents must be on 8.5 x 11 inch white paper

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Graham County

Properties in any of these areas use Graham County forms:

- Bylas

- Central

- Eden

- Fort Thomas

- Pima

- Safford

- Solomon

- Thatcher

Hours, fees, requirements, and more for Graham County

How do I get my forms?

Forms are available for immediate download after payment. The Graham County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Graham County?

Yes. Our form blanks are guaranteed to meet or exceed the applicable formatting requirements used for recording in Graham County, including margin requirements, font requirements, and other layout standards. This guarantee applies to formatting, not to the legal sufficiency of information entered by the user or the suitability of a form for a particular transaction.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Graham County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Graham County?

Recording fees in Graham County vary. Contact the recorder's office at 928-428-3560 for current fees.

Questions answered? Let's get started!

What happens when there is an error in your deed? What can you do to fix it? One option may be filing a corrective deed.

A corrective deed is an instrument used to correct a small error in a deed that has been recorded at an earlier date. Corrections can only be made to non-material errors, causing no actual change in the substance of the deed. Common mistakes include typographical errors in the legal description, misspelled names, accidentally omitted suffixes or middle initials, etc.

Major, or material, changes to the substance of the deed have a legal effect in how property is titled, and therefore require a new deed. Adding or removing a grantee, for example, or significant changes to the legal description, may all require a new deed of conveyance. When in doubt about the gravity of an error and whether a correction deed is the appropriate vehicle to address it, consult with a lawyer.

On the corrective deed, give the recording information from the previously filed document, then identify which section contains the error. Provide the correct details in the body of the deed. The corrective deed states the nature of the error and recites the date and recording information of the erroneous deed.

For the corrective deed to be valid, all parties who signed the erroneous deed must sign the corrective deed in the presence of a notarial official. If the grantor is married, Arizona requires that both spouses sign the deed (A.R.S. 33-452). Finally, the form must meet all state and local standards for recorded documents. Submit the completed corrective deed to the local recording office.

Most transfers of real property are subject to a transfer tax and must be accompanied by an Affidavit of Property Value. However, corrective deeds are exempt from both because the property has already been transferred (A.R.S. 11-1133, 11-1134).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about corrective deeds or any other issues related to real property in Arizona.

(Arizona Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Graham County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Graham County.

Our Promise

The documents you receive here are guaranteed to meet or exceed the applicable Graham County recording format requirements. If there is a rejection caused by our formatting, we will correct the issue or refund your payment. This guarantee applies to document formatting only and does not extend to information entered by the user, the selection of the form, or the legal effect of the completed document.

Save Time and Money

Get your Graham County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4664 Reviews )

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Arthur M.

February 25th, 2021

Efficient and easy to use. Thanks.

Thank you!

Gladys F.

September 21st, 2020

The process was very friendly and easy to use. I appreciated the status updates as well as clear instructions on what was needed to get the file ready for recording.

Thank you!

Johnnie W.

June 26th, 2023

Five stars for quick retrieval/no hassle of forms. Will review them again once I have completed the forms and they have been accepted.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas S.

April 13th, 2019

Very nice.

Thank you!

John L.

April 22nd, 2023

WOW, This site saved me from going to a lawyer. Not only do they give you great directions, they also include a sample that is extremely helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin G.

February 1st, 2024

Very user friendly. I was totally amazed. Thank you so much.

We are delighted to have been of service. Thank you for the positive review!

MANUEL O.

December 4th, 2020

great service Loved!

Thank you!

Deborah G.

June 4th, 2019

Great website and very easy to use

Thank you for your feedback Deborah, we really appreciate it. Have a great day!

RICHARD A.

March 4th, 2023

Smooth, simple, and complete. A great forms service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James D.

March 31st, 2023

I had a satisfying experience very informative and easy to navigate.

Thank you!

Matt G.

May 10th, 2019

The process went smoothly and gave me what I needed. As an improvement, I would recommend that deeds.com sends an email when there is a new message in the portal. I didn't get any updates and had to log in to track progress each time.

Thank you for your feedback. We really appreciate it. Have a great day!

Keith R.

October 11th, 2021

Great! Love the platform. Very helpful!!

Thank you!

Johnathan D.

March 30th, 2021

Very helpful and quick responses

Thank you!

Thomas R.

June 21st, 2024

First time user. Was pleased with the easy of use and the step-by-step directions provided by the website.

We are motivated by your feedback to continue delivering excellence. Thank you!