Napa County Assignment of Deed of Trust Form

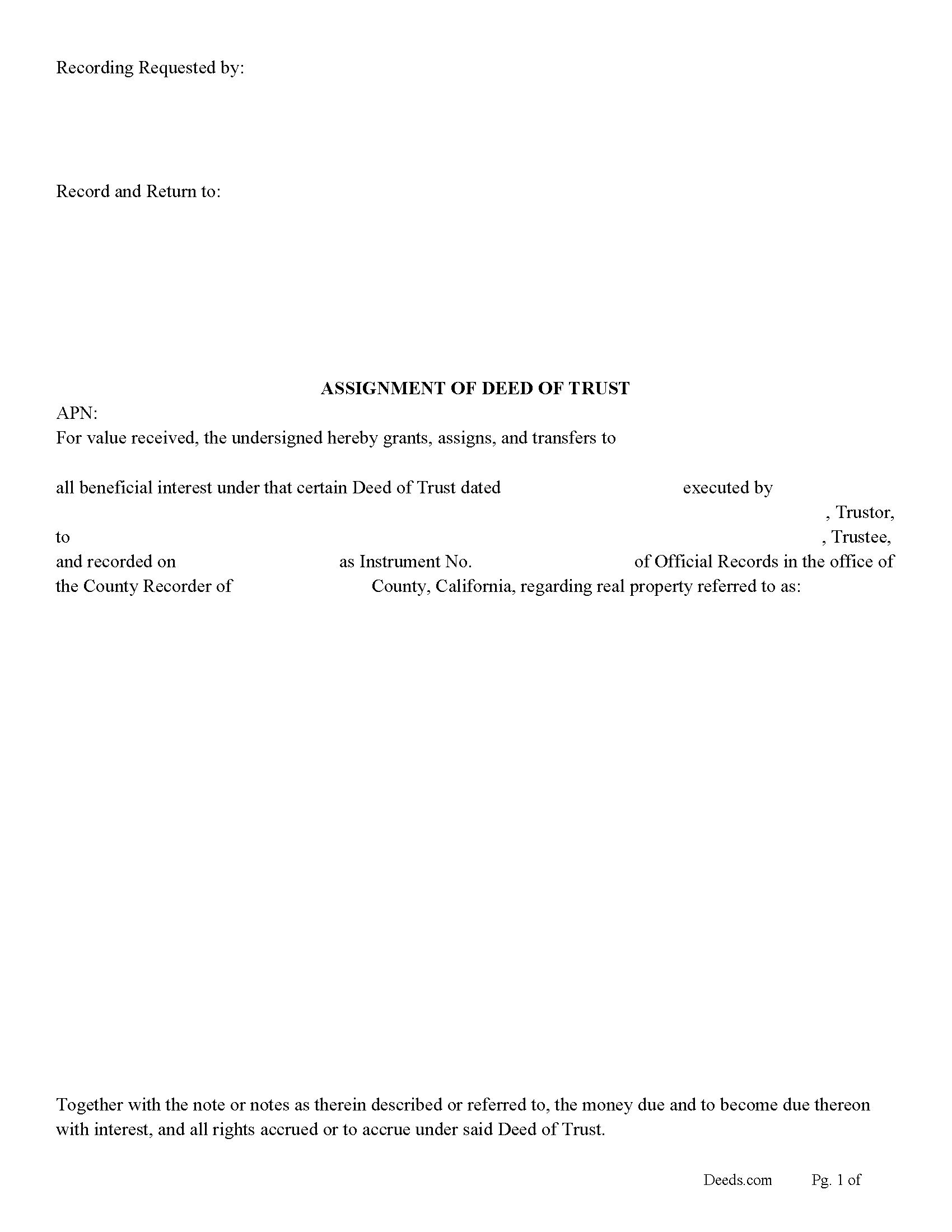

Napa County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

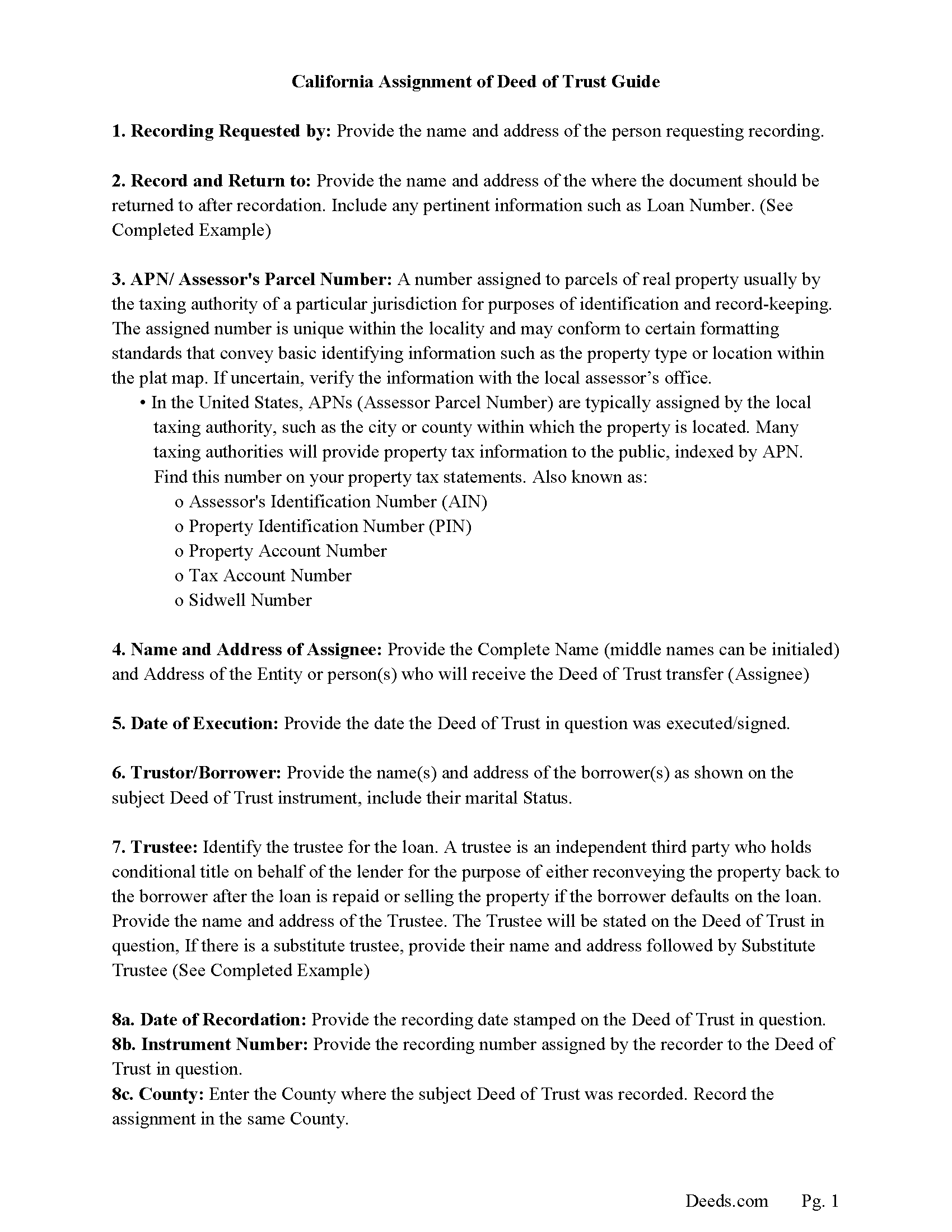

Napa County Guidelines for Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

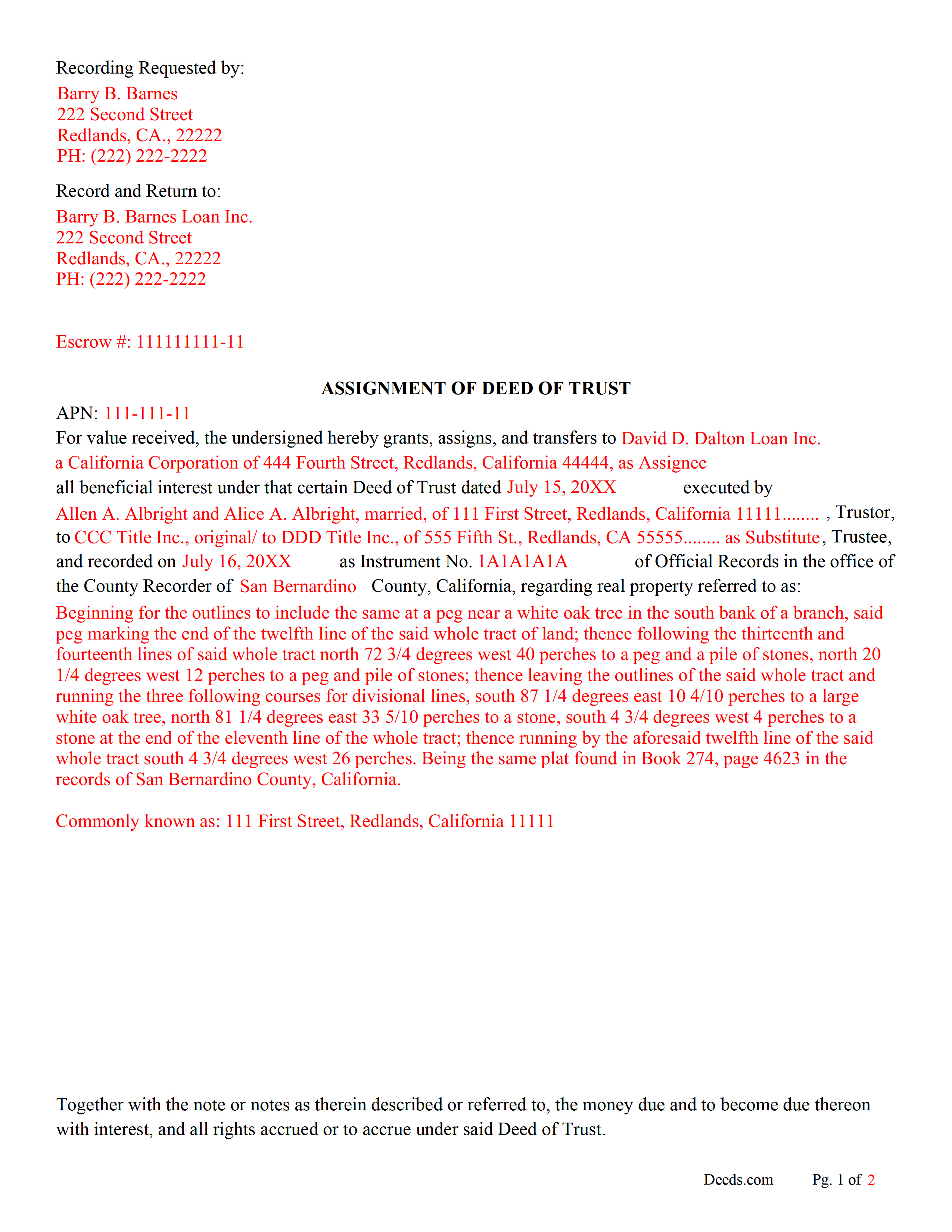

Napa County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

Napa County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

Napa County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

Napa County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Napa County documents included at no extra charge:

Where to Record Your Documents

Napa County Assessor-Recorder-Clerk

Napa, California 94559-2922 / PO Box 94559-0298

Hours: 8:00 to 4:15 M-F / Recording until 3:00

Phone: (707) 253-4105

Recording Tips for Napa County:

- Both spouses typically need to sign if property is jointly owned

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

- Have the property address and parcel number ready

Cities and Jurisdictions in Napa County

Properties in any of these areas use Napa County forms:

- American Canyon

- Angwin

- Calistoga

- Deer Park

- Napa

- Oakville

- Pope Valley

- Rutherford

- Saint Helena

- Yountville

Hours, fees, requirements, and more for Napa County

How do I get my forms?

Forms are available for immediate download after payment. The Napa County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Napa County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Napa County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Napa County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Napa County?

Recording fees in Napa County vary. Contact the recorder's office at (707) 253-4105 for current fees.

Questions answered? Let's get started!

The current Lender/Beneficiary uses this form to assign a Deed of Trust to another lender. This is often done when a Deed of Trust has been sold. This allows the new Lender the right to collect payments of the debt. A typical Deed of Trust contains a Power of Sale clause, allowing a non-judicial foreclosure. (The power of sale may be exercised by the assignee if the assignment is duly acknowledged and recorded.) (California Code 2932.5)

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their deed of trust debt has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(California Assignment of Deed of Trust Package includes form, guidelines, and completed example) For use in California only.

Important: Your property must be located in Napa County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Napa County.

Our Promise

The documents you receive here will meet, or exceed, the Napa County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Napa County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4606 Reviews )

Rosanne E.

October 8th, 2020

Excellent response and all went well with downloading documents. Thank you for offering this important service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dennis E.

March 21st, 2019

Easy to complete form. Examples were very helpful in using correct verbiage for form. Also way less expensive than the $500 an attorney wanted to charge me for doing the very same thing!!!

Thanks Dennis, we appreciate you taking the time to leave your feedback.

Angela W.

February 16th, 2022

All went well.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald H.

April 17th, 2020

Easy to use and very quick turn around ... Very satisfied with ease of use and services provided ...

Thank you for your feedback. We really appreciate it. Have a great day!

jonnie F.

August 25th, 2020

Easiest and most efficient way to process your documents, this company is amazing. They help me meet the deadline on a critical inspection by processing my NOC in less then a day. Thank You.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael W.

October 21st, 2022

Easy to use and fast

Thank you!

Steve R.

April 28th, 2023

Quick, clean, easy. A hat trick.

Thank you!

Johnnie G.

July 6th, 2020

We had hoped, as this was direct through our State recorder's office, State-specific data would be pre-filled in. Also there is no help when transferring the home title from a Revocable Trust to the living Trustee and new spouse (no example given, no help for which code to use). And the example doesn't match the prior deed revision format submitted by our attorney. So, not the best experience. We may have to get an attorney involved...what we were hoping to avoid

Thank you for your feedback. We really appreciate it. Have a great day!

Leo H.

May 26th, 2021

The deed was very easy to use and the material provided were helpful in completing the form. We haven't filed it yet, but I assume that all will go well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janis H.

February 13th, 2020

Amazing! Great forms - created the quitclaim fairly easy, recorded with no issues. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Lana B.

August 25th, 2019

Was very helpful!

Thank you!

Carol S.

November 18th, 2020

Excellent ...easy, timely!

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara G.

January 30th, 2020

Thank you everything was as expected very good service

Thank you Barbara, we really appreciate you.

Kristina H.

January 23rd, 2020

Everything I needed to complete my release of lien was easy to obtain from Deed.com - and the example and instructions were helpful as well. The website is simple and efficient. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alex J.

August 6th, 2020

Very simple to use. I am a private homeowner with no experience in such things and it was very easy to do which was quite a relief. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!