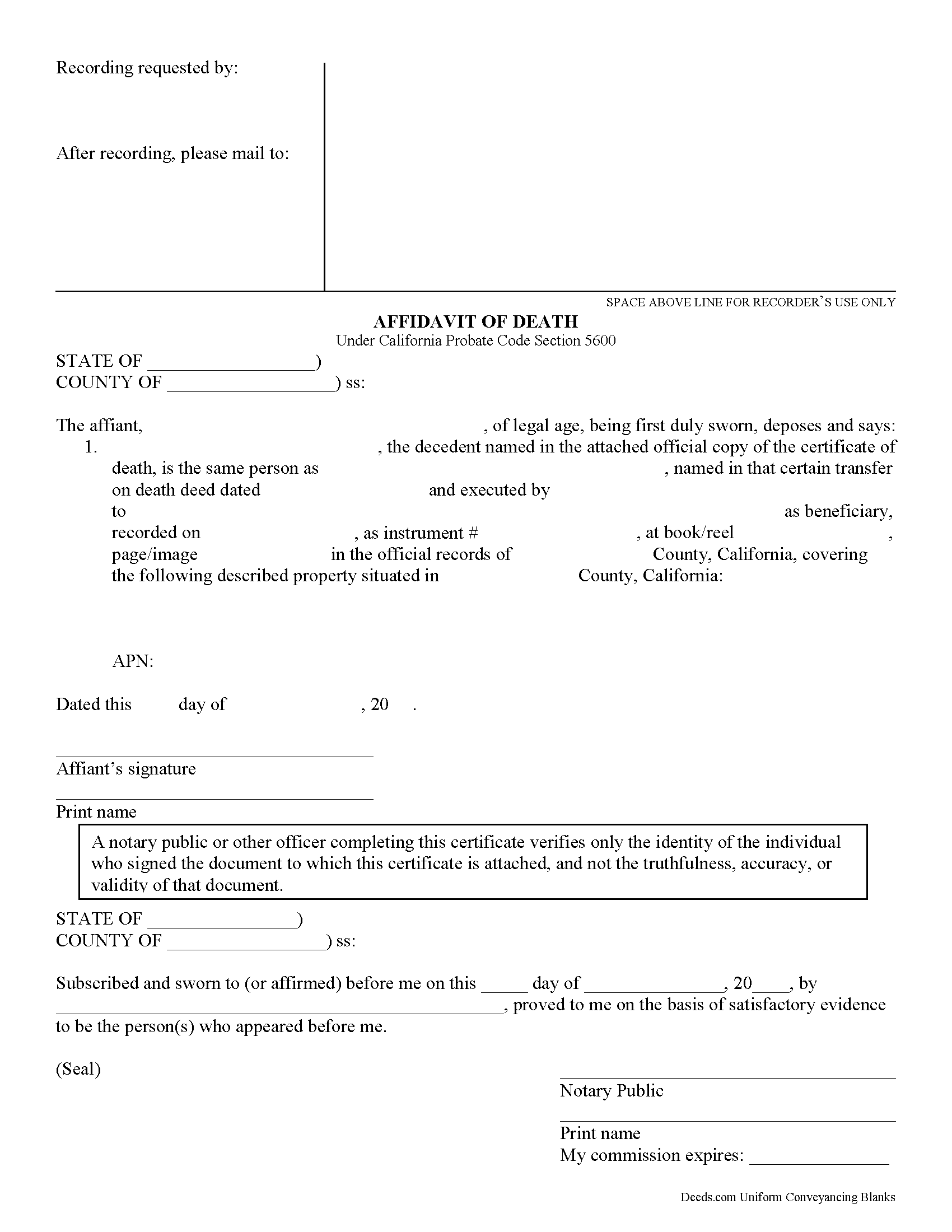

Placer County Transfer on Death Affidavit Form

Placer County Transfer on Death Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

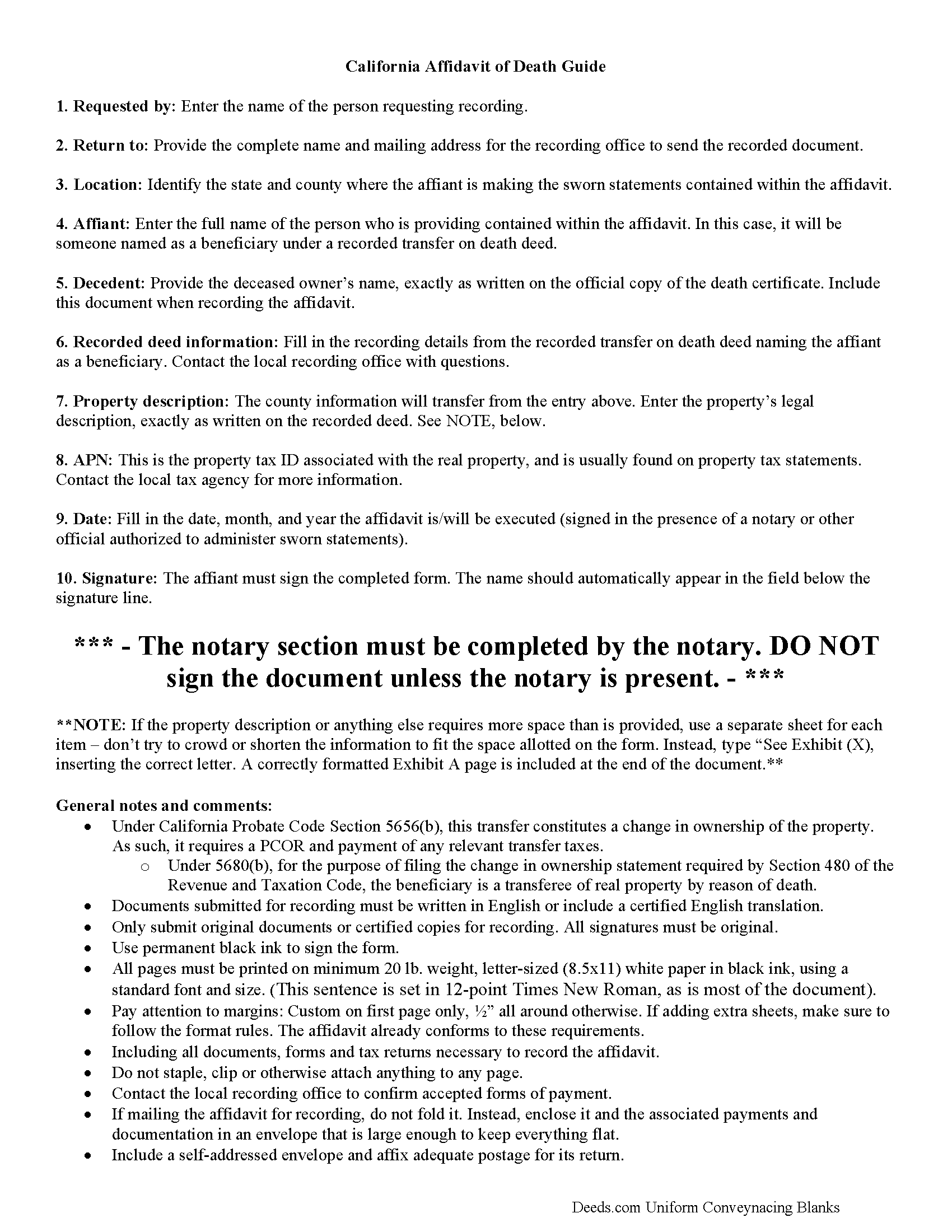

Placer County Transfer on Death Affidavit Guide

Line by line guide explaining every blank on the form.

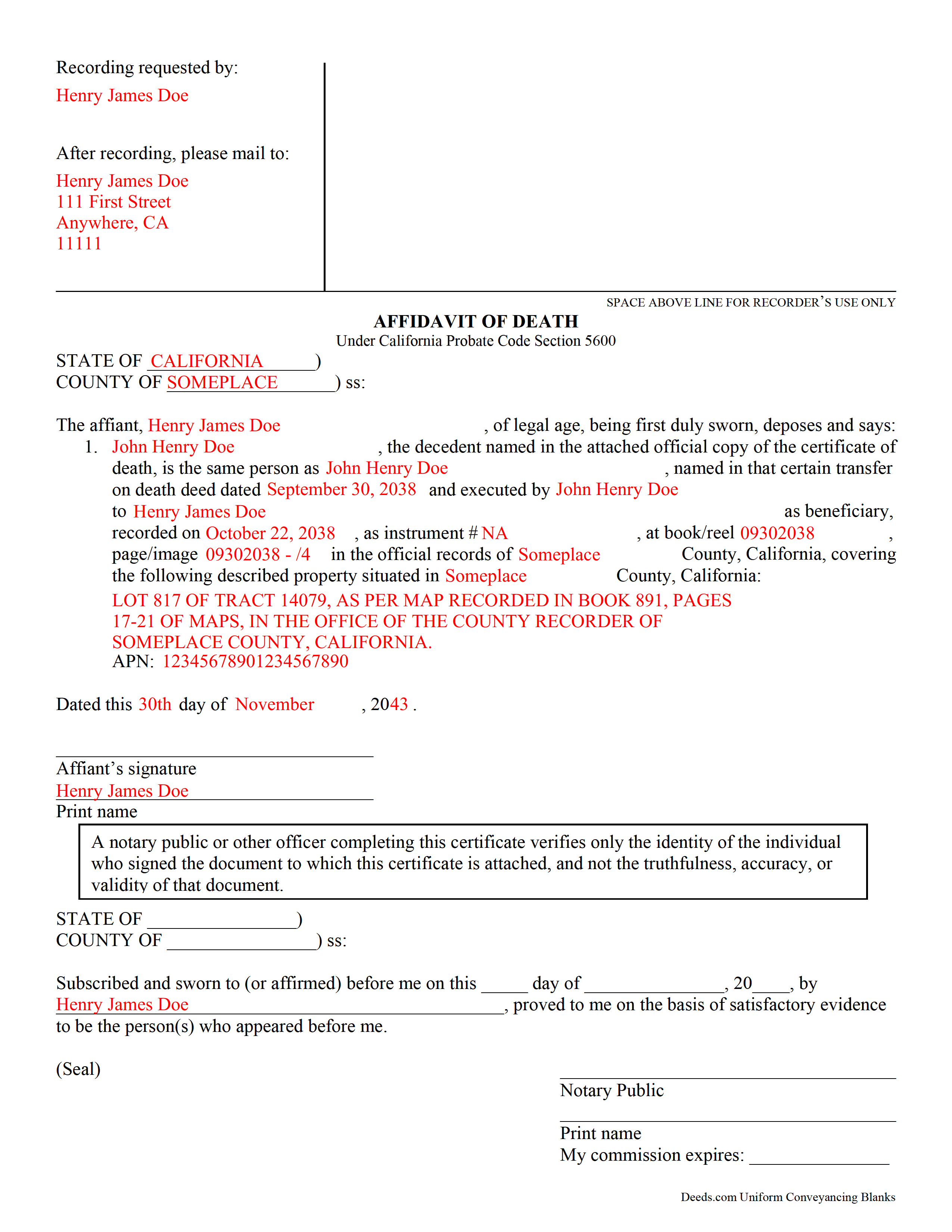

Placer County Completed Example of the Transfer on Death Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Placer County documents included at no extra charge:

Where to Record Your Documents

Satellite Office

Auburn, California 95603

Hours: Monday through Friday 8 a.m. to 4 p.m.

Phone: (530) 886-5600

Placer County Clerk-Recorder

Auburn, California 95603

Hours: Mon to Fri 8:00 to 5:00 / Recording until 4:00

Phone: (530) 886-5600

Recording Tips for Placer County:

- Double-check legal descriptions match your existing deed

- Leave recording info boxes blank - the office fills these

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Placer County

Properties in any of these areas use Placer County forms:

- Alta

- Applegate

- Auburn

- Carnelian Bay

- Colfax

- Dutch Flat

- Emigrant Gap

- Foresthill

- Gold Run

- Granite Bay

- Homewood

- Kings Beach

- Lincoln

- Loomis

- Meadow Vista

- Newcastle

- Olympic Valley

- Penryn

- Rocklin

- Roseville

- Sheridan

- Tahoe City

- Tahoe Vista

- Weimar

Hours, fees, requirements, and more for Placer County

How do I get my forms?

Forms are available for immediate download after payment. The Placer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Placer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Placer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Placer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Placer County?

Recording fees in Placer County vary. Contact the recorder's office at (530) 886-5600 for current fees.

Questions answered? Let's get started!

Using an Affidavit of Death to Claim Real Estate from a California Transfer on Death Deed

Transfer on death deeds allow individual landowners to transfer their real estate when they die, without a will or the need for probate distribution. The transferor simply executes a TODD form, then records it during the course of his/her natural life, and within 60 days of the signing date (5626(a)). Unlike grant deeds or quitclaim deeds, the owner continues to hold title to the property when a transfer on death deed is recorded (5650). As such, TODDs are exempt from transfer taxes and the Preliminary Change of Ownership Report (PCOR).

What happens, then, when the owner dies? Section 5680 defines the process for switching the title over to the beneficiary. The beneficiary may establish the fact of the transferor's death under the procedure provided in California Probate Code Chapter 2 (commencing with Section 210) of Part 4 of Division 2. The first step is obtaining a certified copy of the death certificate. Then research the recording information from the transfer on death deed identifying the beneficiary. Complete an affidavit of death and sign it in front of a notary. Finally, file the affidavit, along with the copy of the death certificate, in the recording office for the county where the property is situated. Note that this act transfers title to the beneficiary, so it also requires the PCOR and any associated taxes and fees.

Beneficiaries take title to the property under the rules set out at section 5652. Be aware that any associated debts, obligations, or agreements in place when the owner died follow the real estate to the beneficiaries. In addition, the title transfers without warranty, so the beneficiaries might find themselves liable for future claims against the property. For these reasons, among others, some beneficiaries might wish to disclaim the gift (5652(a)(1)).

In general, transferring title to the beneficiary of a transfer on death deed is a simple process. Even so, complications may arise. Contact an attorney for complex situations or with any questions.

(California Transfer on Death Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in Placer County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Affidavit meets all recording requirements specific to Placer County.

Our Promise

The documents you receive here will meet, or exceed, the Placer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Placer County Transfer on Death Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Cindy H.

October 21st, 2020

Loved it! Quick and easy, done in 24 hours.

Thank you for your feedback. We really appreciate it. Have a great day!

Lynda D S.

November 2nd, 2022

Sorry, I did not see that I was in the wrong review and just sent a review of a "product" I ordered online. As for Deeds.com I was very happy with the process and speed of getting the forms. I have used this site before. Highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ed d.

December 23rd, 2020

Fast efficient hassle free

Thank you for your feedback. We really appreciate it. Have a great day!

Johnny A.

December 15th, 2018

My complete name is Johnny Alicea Rodriguez And the DEED is on my half brother and mine name. Jimmy Dominguez and myself Thanks

Norma G.

May 9th, 2019

Thank you! This is very helpful

Thank you!

Nancy C.

January 15th, 2021

Simple and easy to download. After reading the instructions/sample pages I did still have some questions regarding the beneficiary deed for the state of MO.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kenneth M.

August 2nd, 2019

It was adequate to serve my current need, however turned out to be more expensive than I cared for.

Thank you for your feedback. We really appreciate it. Have a great day!

Biinah B.

December 24th, 2020

Wished I had known about this site earlier. Just what we needed. Get tool to get lip to date legal help.

Thank you for your feedback. We really appreciate it. Have a great day!

Deanie F.

June 27th, 2019

Very happy with the product and really appreciated being able to get it on line.

Thanks for the kind words Deanie. We appreciate you, glad we could help!

Claude F.

February 8th, 2021

quick and easy to use, thank you

Thank you!

DAVID K.

May 15th, 2020

You are definitely the place to go for forms and other things which I need to solve my problems. Thanks for your help.

Thank you!

Cynthia H.

September 5th, 2021

Thank you for having these forms so reasonable and easy to access. I only WISH I would have looked here 1st, spent way to much valuable time trying to get help with this deed. This was so EASY and quick... THANK YOU THANK YOU Highly Recommend

Thank you!

Charles Z.

February 23rd, 2021

I am very happy with the service and would use again. Super fast, efficient, and very helpful friendly staff. I would recommend and would use again.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia C.

December 29th, 2021

Deeds.com saved me time and research by offering a beneficiary deed and full instructions for filling it out. My home will now pass directly to my only son without probate. This form and other complimentary forms was an excellent value.

Thank you for your feedback. We really appreciate it. Have a great day!

Kecia L.

February 9th, 2021

Great place to find much needed documents. A huge thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!