Indian River County Conditional Waiver and Release of Lien upon Progress Payment Form

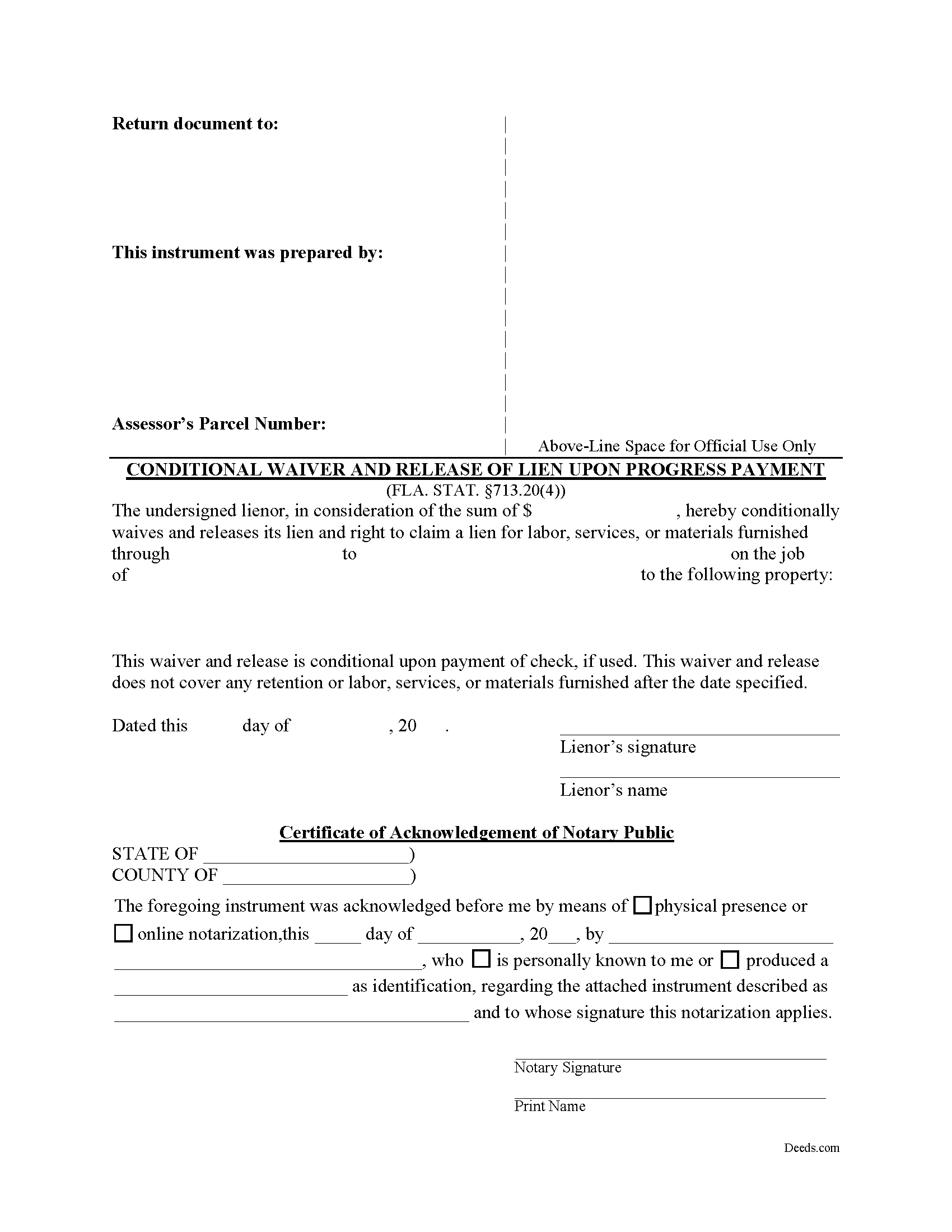

Indian River County Conditional Waiver and Release of Lien upon Progress Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

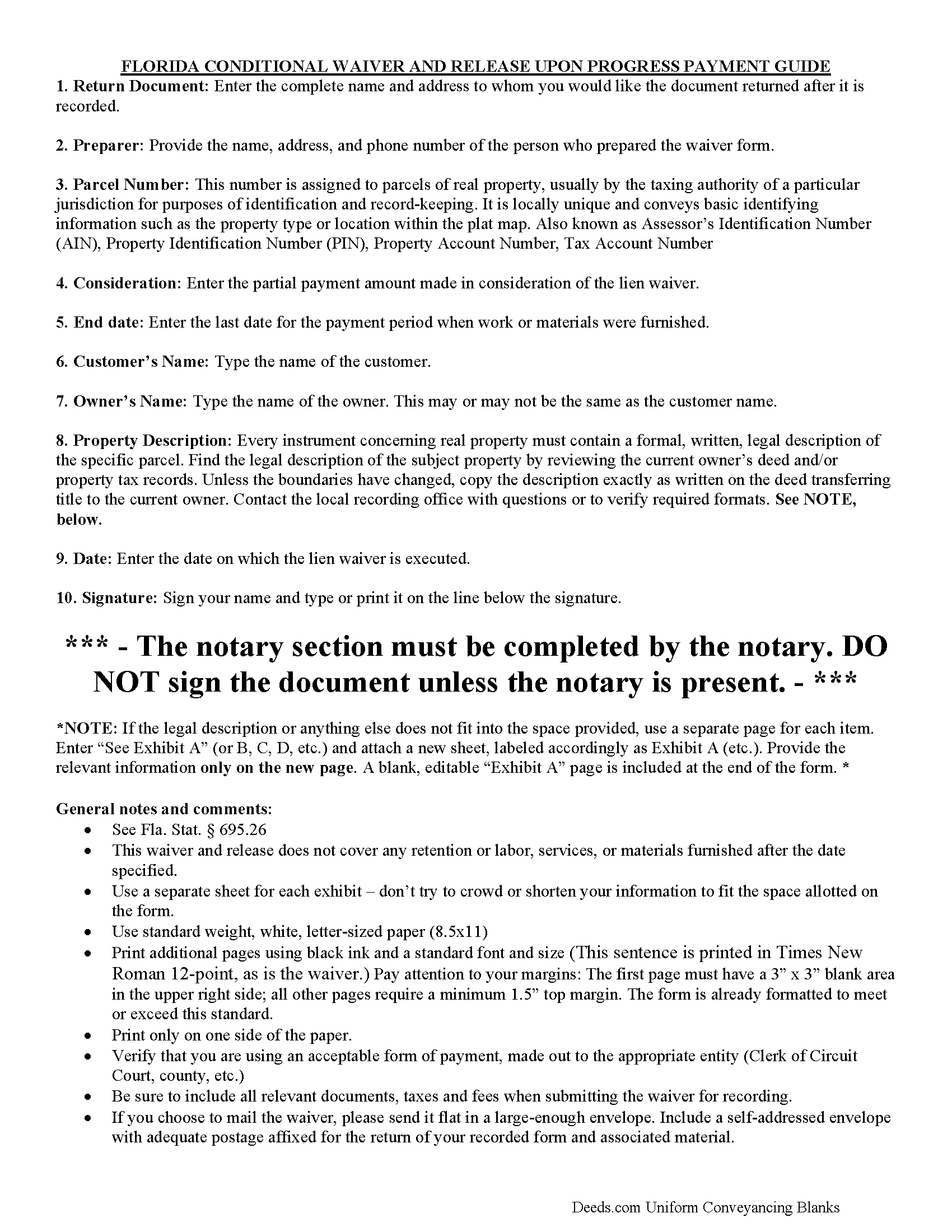

Indian River County Conditional Waiver and Release of Lien upon Progress Payment Guide

Line by line guide explaining every blank on the form.

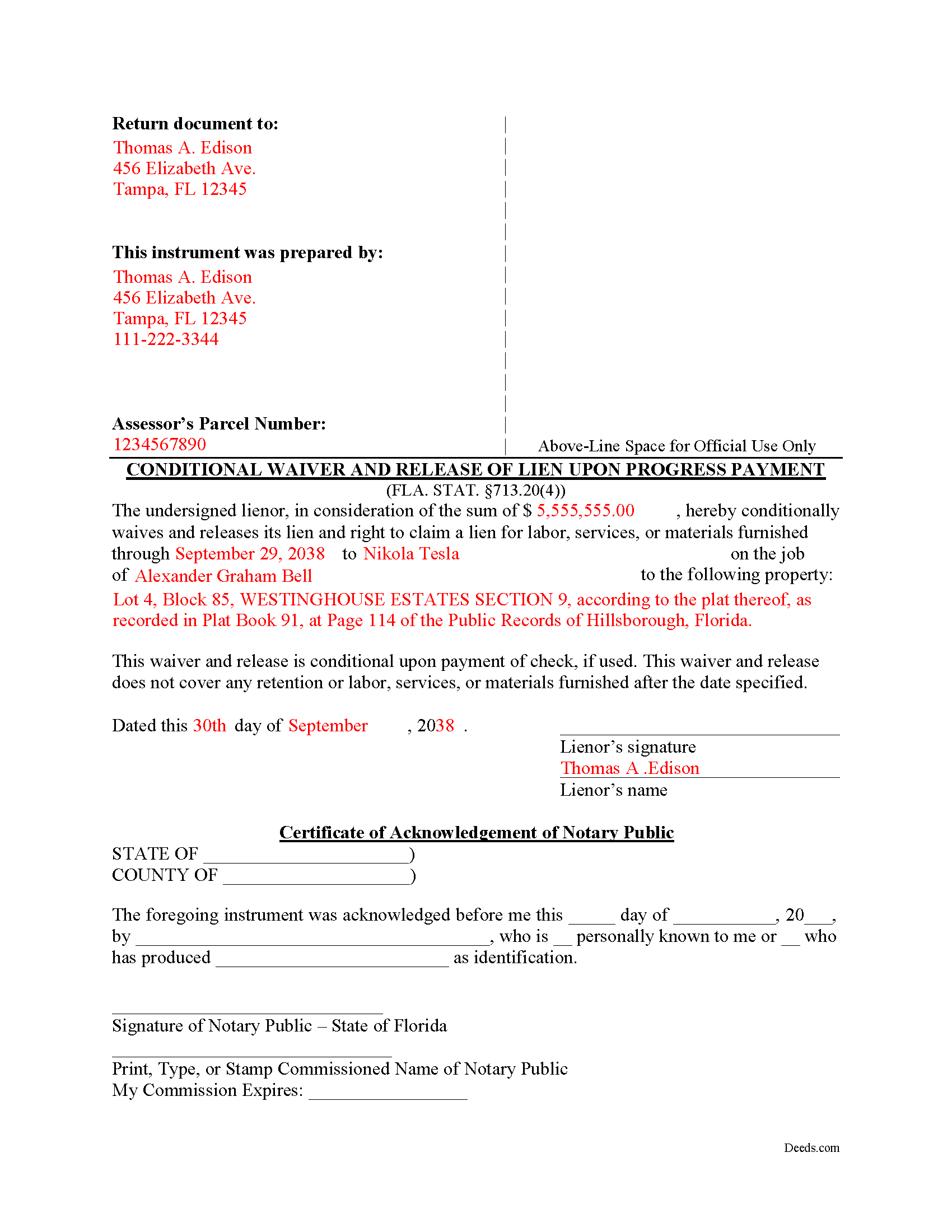

Indian River County Completed Example of the Conditional Waiver and Release of Lien upon Progress Payment Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Indian River County documents included at no extra charge:

Where to Record Your Documents

Recording - County Courthouse

Vero Beach, Florida 32960

Hours: 8:30am to 4:30pm M-F

Phone: (772) 770-5185, Ext 3175 and 3135

Recording Tips for Indian River County:

- Bring your driver's license or state-issued photo ID

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

Cities and Jurisdictions in Indian River County

Properties in any of these areas use Indian River County forms:

- Fellsmere

- Roseland

- Sebastian

- Vero Beach

- Wabasso

- Winter Beach

Hours, fees, requirements, and more for Indian River County

How do I get my forms?

Forms are available for immediate download after payment. The Indian River County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Indian River County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Indian River County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Indian River County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Indian River County?

Recording fees in Indian River County vary. Contact the recorder's office at (772) 770-5185, Ext 3175 and 3135 for current fees.

Questions answered? Let's get started!

Lien waivers or releases are used to surrender the right to a lien, either in full or in part depending on what type of lien release form is used. Florida's Construction Lien Law authorizes statutory waivers at 713.20 Fla. Stat. (2016).

Under 713.20(4), lienors may waive, on condition of payment, part of a lien they already delivered against the owner's interest in the improved property. Such a release contains information about the lienor, the customer, the property owner, the property description, the payment amount, and a date to mark the end of the work period covered by the waiver.

Each case is unique, so contact an attorney with specific questions or any other issues related to Florida Construction Liens.

Important: Your property must be located in Indian River County to use these forms. Documents should be recorded at the office below.

This Conditional Waiver and Release of Lien upon Progress Payment meets all recording requirements specific to Indian River County.

Our Promise

The documents you receive here will meet, or exceed, the Indian River County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Indian River County Conditional Waiver and Release of Lien upon Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Eileen B.

January 9th, 2019

Great form needs more instructions however but aside from that is perfect solution for my needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dorothea B.

October 2nd, 2019

The Affidavit- Death of Joint Tenant form you provided is not the same form as showed on the Los Angeles County property tax website. It appears that the LA county form requires entering additional info that is not included in your form.

Thank you!

Jason U.

September 16th, 2024

Extremely useful! The guide was excellent with the sample. Used and went exceptionally smoothly.

Thank you for your positive words! We’re thrilled to hear about your experience.

Fernando V.

February 28th, 2023

Excellent!

Thank you!

Greg M.

March 16th, 2020

This is a great site! Very easy to use and has all the documents I required. Thank you!

Thank you!

RONALD F.

July 24th, 2020

Great service. Very reasonable cost. All necessary detailed information provided.

Thank you for your feedback. We really appreciate it. Have a great day!

Roberto S.

October 9th, 2024

Everything great thank you

Thank you for your positive words! We’re thrilled to hear about your experience.

KELLY P.

July 19th, 2021

That was easy!!

Thank you!

Arletta B.

September 16th, 2021

Fantastic service, saved me a ton of time and running around. Thanks!

Thank you!

Dawn M.

October 26th, 2020

So helpful and quick! The response time and kindness was amazing! The steps were easy to follow as well. We will definitely be using Deeds.com in the future!

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin C.

August 10th, 2022

Nice site but $30 to download a blank form is a bit much.

Thank you for your feedback. We really appreciate it. Have a great day!

James R.

July 4th, 2019

Easy to understand instructions. Love the examples. Info on the deeds purpose easily comprehendible. Able to Kiosk record without difficulty. Am I pleased? Oh Yeah!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary P.

February 11th, 2019

Excellent easy to follow instructions.

Great to hear Mary, Have a wonderful day!

Janet S.

April 7th, 2021

I would've done this years ago if I'd known how easy it was! The plus is it's not expensive either. Thank you deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen B.

August 1st, 2025

Great forms! No issues at all at the recorder office. Will be back for sure if needed.

Wonderful to hear Karen. Thanks for taking the time to share your experience. Have a great day!