Indian River County Decedent Interest in Homestead Affidavit Form

Indian River County Decedent Interest in Homestead Affidavit Form

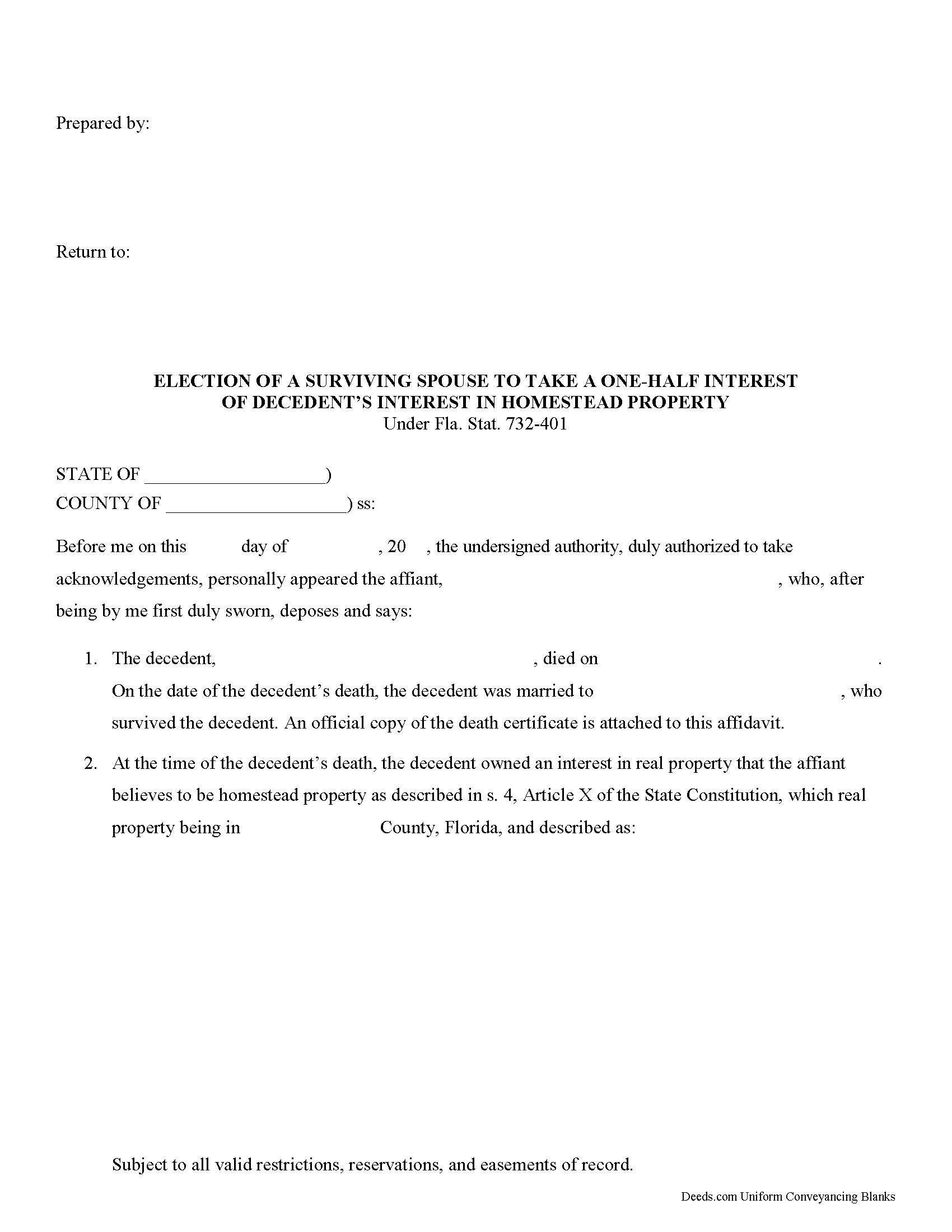

Fill in the blank Decedent Interest in Homestead Affidavit form formatted to comply with all Florida recording and content requirements.

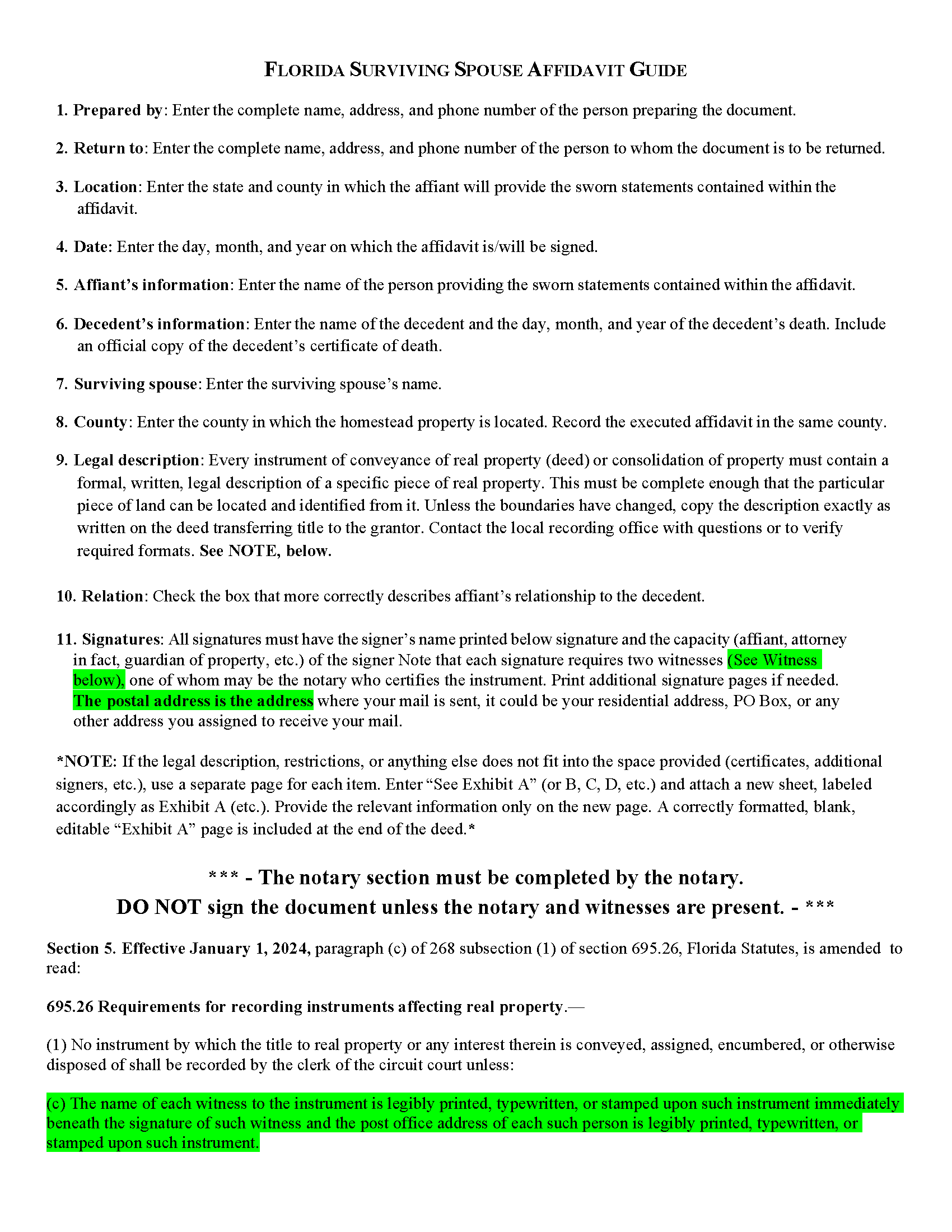

Indian River County Decedent Interest in Homestead Affidavit Guide

Line by line guide explaining every blank on the Decedent Interest in Homestead Affidavit form.

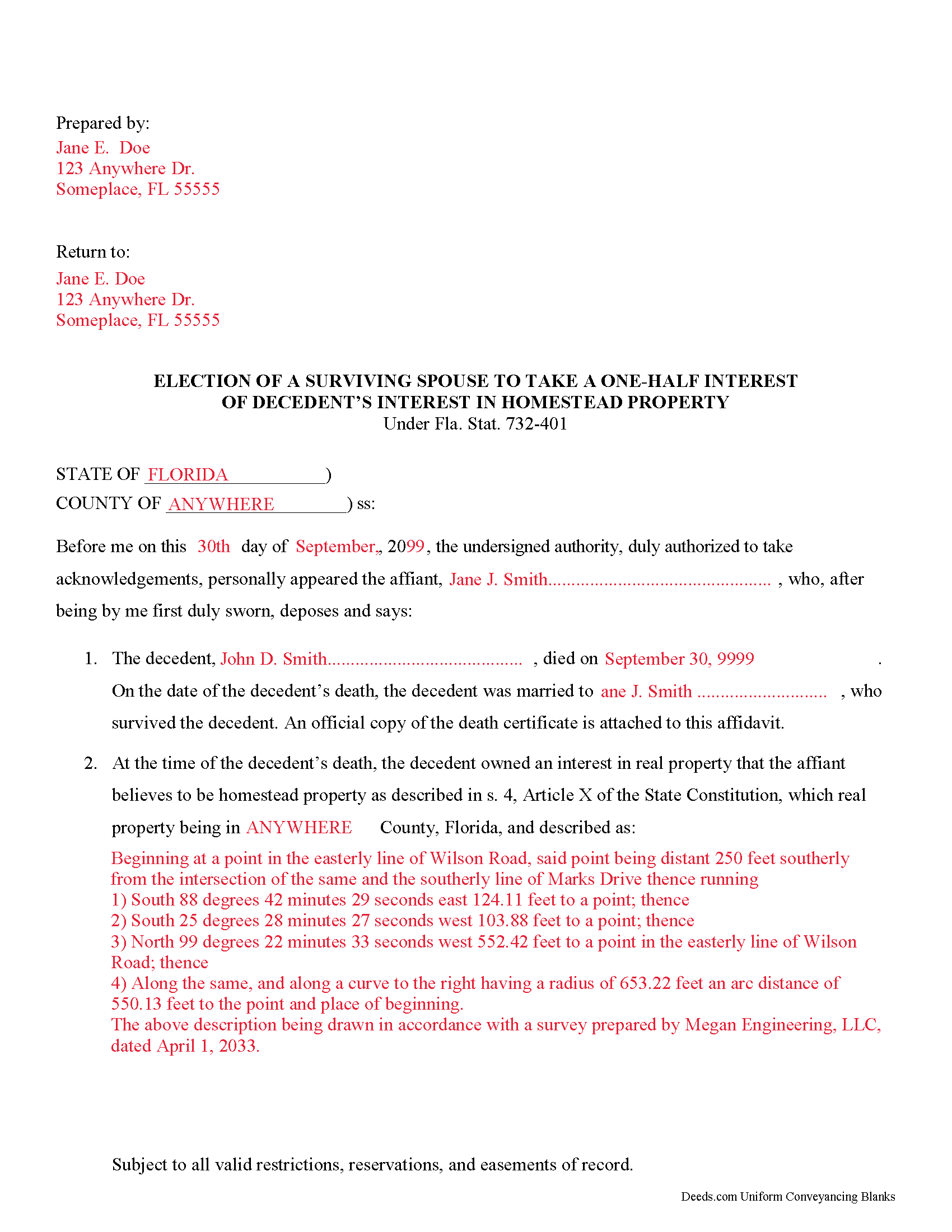

Indian River County Completed Example of the Decedent Interest in Homestead Affidavit Document

Example of a properly completed Florida Decedent Interest in Homestead Affidavit document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Indian River County documents included at no extra charge:

Where to Record Your Documents

Recording - County Courthouse

Vero Beach, Florida 32960

Hours: 8:30am to 4:30pm M-F

Phone: (772) 770-5185, Ext 3175 and 3135

Recording Tips for Indian River County:

- Ensure all signatures are in blue or black ink

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Indian River County

Properties in any of these areas use Indian River County forms:

- Fellsmere

- Roseland

- Sebastian

- Vero Beach

- Wabasso

- Winter Beach

Hours, fees, requirements, and more for Indian River County

How do I get my forms?

Forms are available for immediate download after payment. The Indian River County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Indian River County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Indian River County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Indian River County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Indian River County?

Recording fees in Indian River County vary. Contact the recorder's office at (772) 770-5185, Ext 3175 and 3135 for current fees.

Questions answered? Let's get started!

Decedent's interest in homestead affidavit

Under Florida law, real estate that is identified as a homestead but is not included in a deceased owner's will passes to beneficiaries in the same manner as other intestate property. If the decedent is survived by a spouse and one or more descendants, however, the surviving spouse has three main options as set out in section 732.401 of the Florida Statutes:

- take a life estate in the homestead, with a vested remainder to the descendants alive at the time of the decedent's death per stirpes (according to Black's Law Dictionary, 8th ed., "proportionately divided between beneficiaries according to their deceased ancestor's share").

- take an undivided one-half interest in the late spouse's homestead as a tenant in common, with the remaining one-half interest held by any descendants per stirpes.

- disclaim the interest as directed in chapter 739.

When a surviving spouse chooses to take the one-half interest in the property, he/she files a decedent's interest in homestead affidavit. This document allows the spouse to waive the marital rights to a life estate in the property. Instead, the surviving spouse and any descendants hold title as tenants in common. As tenants in common, each party can independently sell his/her interests to the property without notice or joinder from the others.

In most cases, the affidavit must be filed within six months of the decedent's death. The affidavit can be made by the surviving spouse him/herself or, with the court's approval, an attorney in fact or guardian of the property of the surviving spouse. The document is then filed in the county or counties in which the homestead property is located. Once recorded, the surviving spouse's decision is irrevocable.

Each case is unique, so contact an attorney with specific questions or for complex situations.

Product description:

Use this document when the owner of homestead property dies without including the real estate in the will and the surviving spouse elects to forego his/her life estate interest in favor of one-half share and convert his/her interest in a life estate to a tenancy in common with the descendants.

(Florida Decedent Interest in Homestead Package includes form, guidelines, and completed example)

Important: Your property must be located in Indian River County to use these forms. Documents should be recorded at the office below.

This Decedent Interest in Homestead Affidavit meets all recording requirements specific to Indian River County.

Our Promise

The documents you receive here will meet, or exceed, the Indian River County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Indian River County Decedent Interest in Homestead Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Sonya B.

January 8th, 2022

Easy to order what I needed.

Thank you!

Dennis H.

June 26th, 2019

Thank you for this program. It will help in the future. Dennis Holt

Thank you!

Della M.

July 7th, 2019

Very easy to purchase with immediate use of all of the forms that you need for probate of property. My parents had died and left equal shares of their home to my 2 brothers and I.

Thank you!

Stephen K.

April 1st, 2023

this 5-star rating is well-deserved.

Thank you!

BAHMAN B.

April 20th, 2020

Very good experience.

Thank you!

vickie w.

February 22nd, 2020

easy & convenience .good service

Thank you for your feedback. We really appreciate it. Have a great day!

Emery N.

May 16th, 2019

Thank you for your service,,you have a very good site,,easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Richard A.

June 24th, 2020

Great product. It would be better if the document files were not embedded within other files. It made downloading a little confusing. The titles of the forms did not match exactly word for word, which required a lot of back and forth to make sure I had downloaded the proper document. What would be great is if once you download a document, the hyperlink changed color, or somehow denoted the document had been downloaded. Just a suggestion. You have my email address if you have questions. STILL! Five stars for you guys. I would not let that hiccup dissuade me from buying any form package from you guys. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Charles C.

January 30th, 2019

Using an I pad and cannot type on form that was downloaded. I do not have a computer Charles

Thank you for your feedback Charles. You might want to make sure you have the Adobe app on your Ipad: https://itunes.apple.com/us/app/adobe-fill-sign/id950099951?mt=8

Thomas E.

December 18th, 2018

Great, immediate access to everything I needed to assist my client! This is truly a great resource for a Notary Public! I will surely keep my account open, and will refer others as well!

Thank you for the Kind words Thomas. We really appreciate you! Have a great day.

Cheryl C.

February 23rd, 2023

my only problem is the cost of the form I downloaded. A bit cheaper would be nice

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

January 17th, 2020

Very fast service

Thank you!

Thomas M.

August 24th, 2021

Great Service. I had to record 13 deeds in various Oregon counties, with o previous experience, and the process was straightforward with excellent instruction. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Herman B.

May 19th, 2022

Special Warranty Deed I can't seem to type all my info in the blank spaces. It won't allow me to type any more. Maybe you should consider either allowing typists to type more (leaving more space) or allowing more room to type more.

Thank you!

Feng T.

November 11th, 2021

Professional product, with clear instructions that gave me high confidence in the accuracy my document. The sample form was super useful. I highly recommend and will reuse Deed.com

Thank you for your feedback. We really appreciate it. Have a great day!