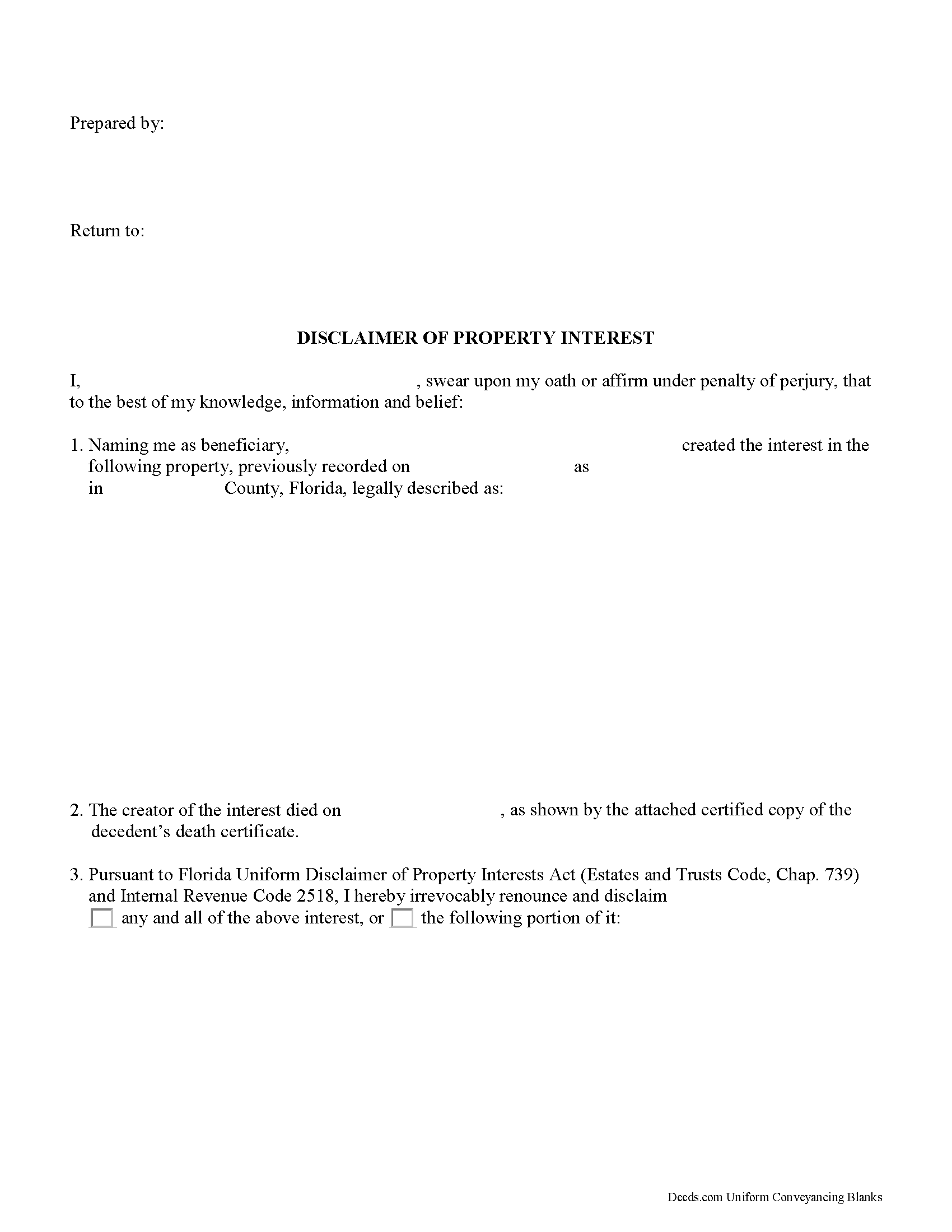

Indian River County Disclaimer of Interest Form

Indian River County Disclaimer of Interest Form

Fill in the blank Disclaimer of Interest form formatted to comply with all Florida recording and content requirements.

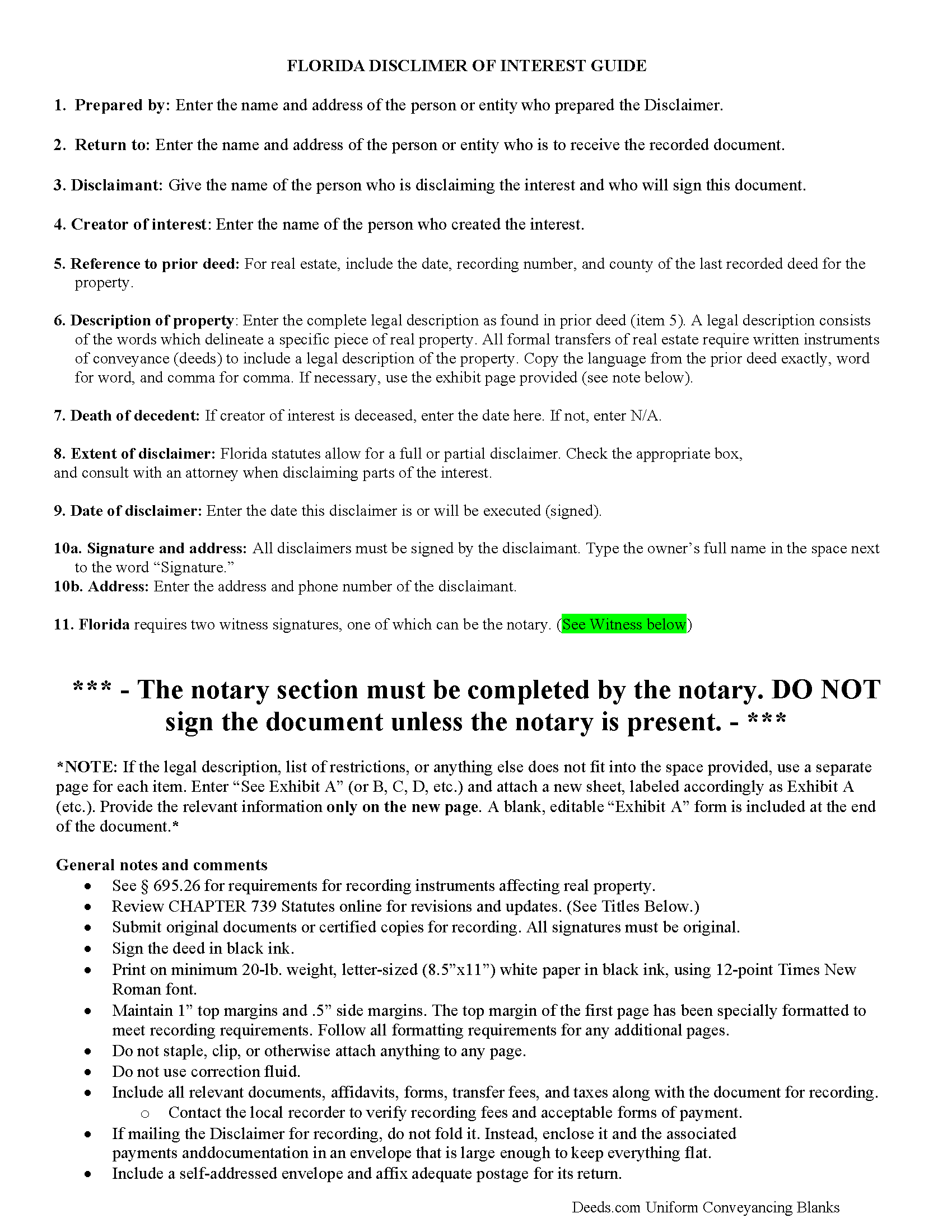

Indian River County Disclaimer of Interest Guide

Line by line guide explaining every blank on the Disclaimer of Interest form.

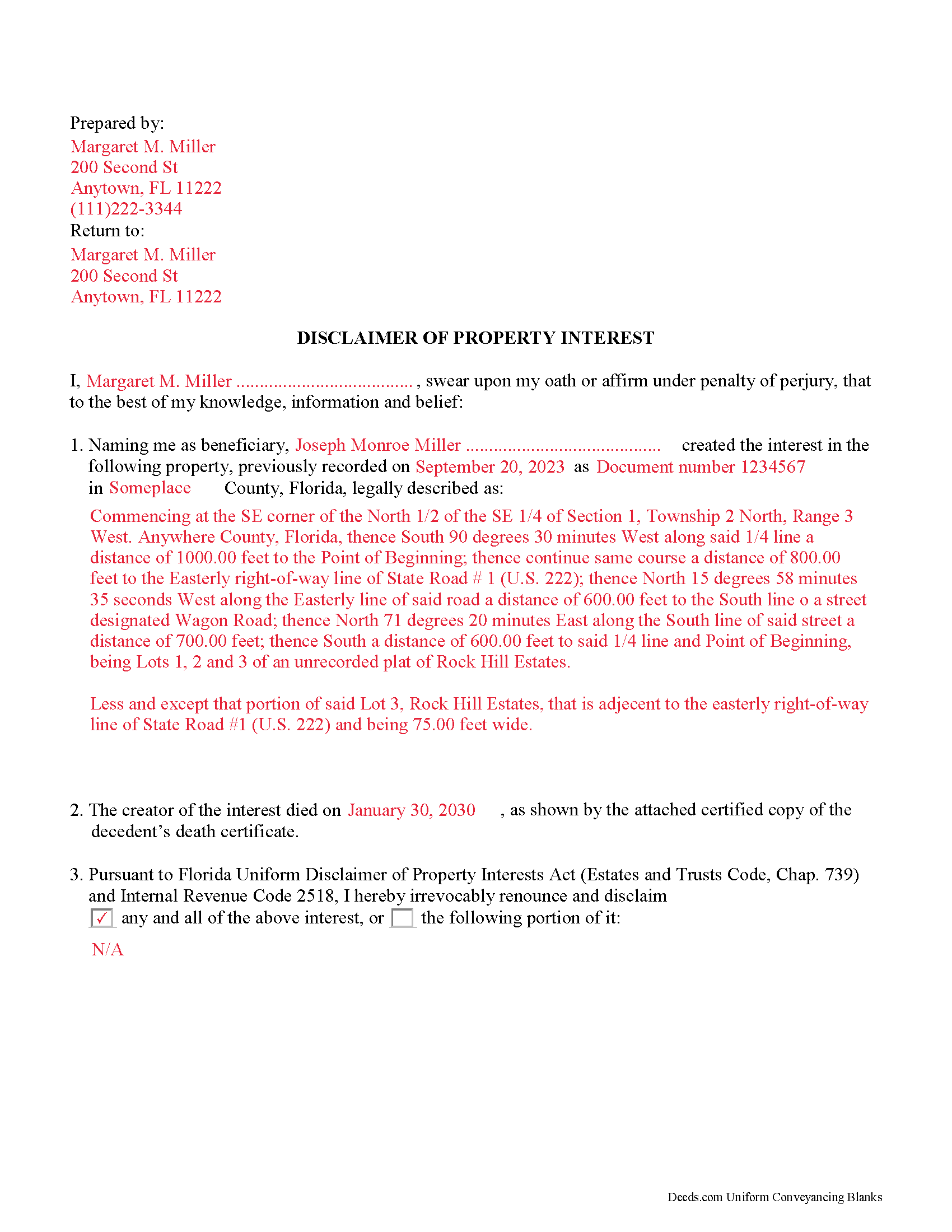

Indian River County Completed Example of the Disclaimer of Interest Document

Example of a properly completed Florida Disclaimer of Interest document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Indian River County documents included at no extra charge:

Where to Record Your Documents

Recording - County Courthouse

Vero Beach, Florida 32960

Hours: 8:30am to 4:30pm M-F

Phone: (772) 770-5185, Ext 3175 and 3135

Recording Tips for Indian River County:

- Documents must be on 8.5 x 11 inch white paper

- White-out or correction fluid may cause rejection

- Ask if they accept credit cards - many offices are cash/check only

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Indian River County

Properties in any of these areas use Indian River County forms:

- Fellsmere

- Roseland

- Sebastian

- Vero Beach

- Wabasso

- Winter Beach

Hours, fees, requirements, and more for Indian River County

How do I get my forms?

Forms are available for immediate download after payment. The Indian River County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Indian River County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Indian River County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Indian River County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Indian River County?

Recording fees in Indian River County vary. Contact the recorder's office at (772) 770-5185, Ext 3175 and 3135 for current fees.

Questions answered? Let's get started!

A beneficiary of an interest in property in Florida can disclaim all or part of a bequeathed interest in or power over property according to the Florida Uniform Disclaimer of Property Interests Act (Estates and Trusts Code, Chapter 739). This document must be in writing, declared a disclaimer, signed by the beneficiary or a legally authorized representative, and witnessed and acknowledged like a deed (739.104).

The disclaimant must record the disclaimer with the clerk of the court in the county where the property is located, as well as deliver it to the legal representative of the decedent, the fiduciary or administrator of the estate, or to the person to whom title to the property will pass (739.601).

Once effective, the disclaimer is irrevocable and the disclaimed interest "passes according to any provision in the instrument creating the interest providing explicitly for the disposition of the interest" (739.201). Be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property.

(Florida Disclaimer of Interest Package includes form, guidelines, and completed example)

Important: Your property must be located in Indian River County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Indian River County.

Our Promise

The documents you receive here will meet, or exceed, the Indian River County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Indian River County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Bobbie N.

February 24th, 2022

Thank you so much for making the site so easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Karen C.

November 22nd, 2019

Quick and easy download. Got everything I needed. I would recommend deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lorraine J.

April 6th, 2023

Thank-you.

Thank you!

Brenda R.

December 21st, 2020

This site was a great help to us. It was worth the money to get it right!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn R.

May 21st, 2020

Definitely 5 stars. Everything was taken care of well within 24 hours. If our law firm needs to record a single document in a different county again, we will use your service. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

James B.

July 31st, 2019

Your website is very easy to use. No problem downloading the forms.

Thank you!

Logan S.

April 27th, 2020

Wonderful experience. Was preapred to wait days, recording was finished in less than an hour.

Thank you!

Galina K.

June 9th, 2023

Was fast and easy to get the forms with instructions on how to fill them out.

Thank you for the kind words Galina. We appreciate you. Have an amazing day!

Chad S.

April 1st, 2019

GREAT SERVICE. A MUST HAVE FOR EVERY REAL ESTATE TRANSACTION!!THANK YOU FOR PROVIDING SUCH A CONVIENIENT EASY TO UNDERSTAND SERVICE.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

L. Candace H.

April 29th, 2021

So far it's been good & informative. I have not chosen forms for download but I like the site. Thanks

Thank you!

Stuart P.

May 14th, 2021

Easy and fast. I'll use this service for all my recordings

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah P.

May 14th, 2020

Great site. Official. Easy to use. Less expensive than those other sites as well. Saved me approximately $20! My records were available immediately. I highly recommend this site.

Thank you!

David M.

August 9th, 2023

A real boon to those of us who are not attorneys but wish to protect our assets and avoid probate court issues. Thank you for a great service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith F.

October 15th, 2021

Easy to understand and use!

Thank you!

William M.

May 22nd, 2021

On multiple tries, I could not get validation mail through my Yahoo email address. I tried Gmail, worked the first time. The rest of the process was super easy and fast.

Thank you!